Loan waivers will only make rich farmers richer. Quasi-universal basic rural income guarantees basic income for the poorest of farmers.

Crisis also begets opportunity. And years of agrarian distress have done just that. As agricultural incomes have been buffeted, first by droughts and then (ironically) also by surpluses, politicians are trying old and new ways of propping up incomes.

Proposal: We propose an alternative to build a new rural India where a basic income, regardless of agricultural vagaries, will be guaranteed.

There would be a direct cash transfer to rural households. Although the crisis is agrarian, the rural economy is depressed, justifying the broader, rural focus. Second, the transfer would not cover all rural households but all except the demonstrably well-off based on the rural Socio-Economic Caste Census (SECC). Third, even with broad coverage (of say 75 percent) the transfer would be meaningful enough to make it “basic.” Combining these three features yields a quasi-universal basic rural income, hence QUBRI.

Current schemes are highly regressive, helping the poorest very little. Loan waivers would benefit rich farmers because very few poor farmers (less than 15 per cent) borrow from official sources, and on average, rich farmers borrow four times as much as poorer ones (Rs 140,000 per household versus Rs 40,000).

Telangana’s Rythu Bandhu, is a laudable initiative, but suffers from similar regressivity. Our analysis for Bihar suggests that it would exclude nearly 98 per cent of the poorest farmers, and the benefits to the richest farmers would be 15 times that for the poorest (the companion longer paper has more detailed calculations). This regressivity is a feature of all farmer-oriented interventions such as MSP, fertiliser, interest and power subsidies.

QUBRI would be progressive and cover all the deserving poor as Odisha’s Kalia scheme does but would go further in including non-farm, rural households.

The other big advantage of QUBRI over Kalia (and Rythu Bandhu) is implementation. Under these two schemes, all farmers – landed, tenants and workers – would have to be identified. This could be a nightmare. The QUBRI would use the SECC not to target and include beneficiaries but to exclude non-beneficiaries, those that, by way of owning certain assets, are clearly non-poor.

Cash transfers would be sent to the remaining rural households. Many or most of these have bank accounts (which are being used for transfers of pensions and MNREGA payments). Latest data show that there are 64 crore bank accounts which should encompass most rural households.

Also read: India’s growth not leading to jobs, farm loan waivers don’t help poor – Raghuram Rajan

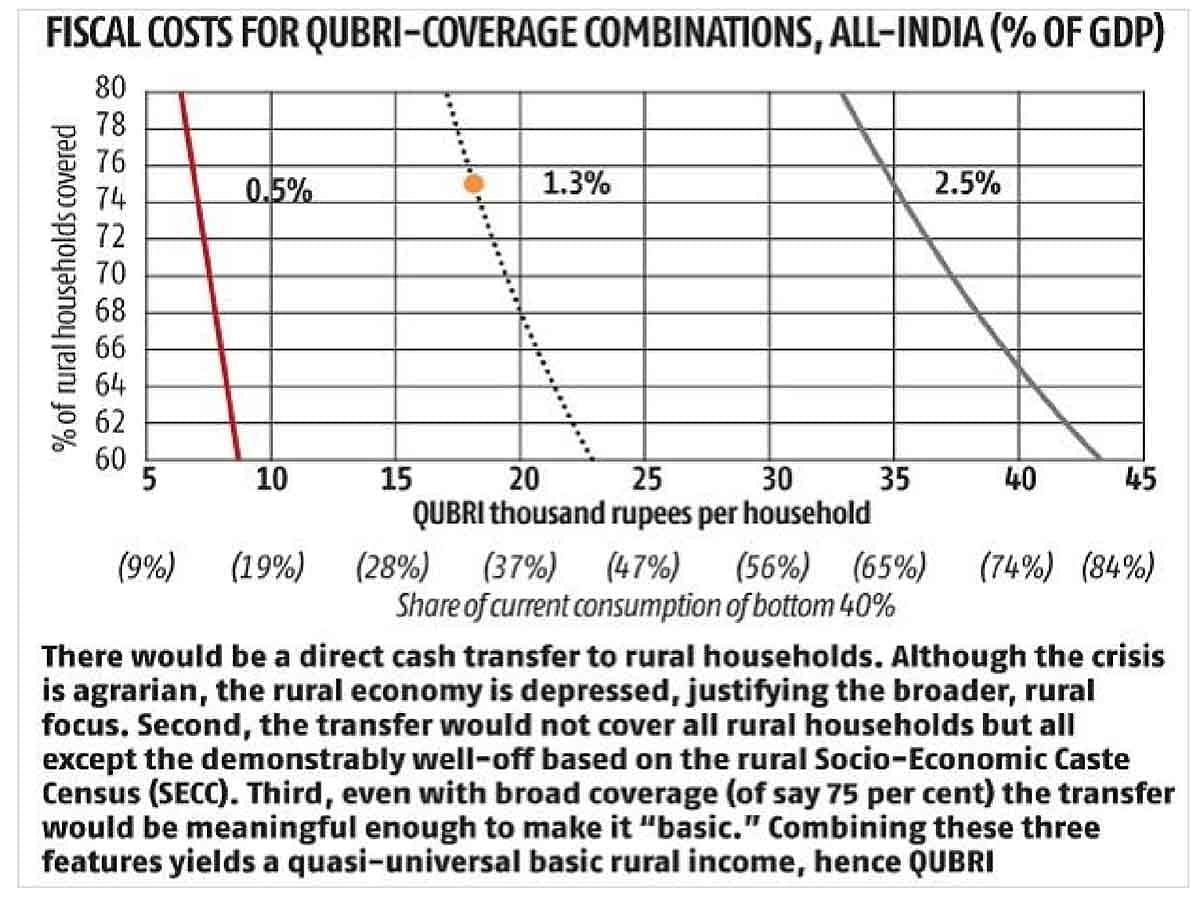

Costs, benefits: Under QUBRI, politicians will confront three choice variables: the amount of the QUBRI (i.e. the transfer per household), the coverage (number of households), and the aggregate fiscal cost. The greater the QUBRI and coverage, the greater the cost. Trade-offs will have to be made between these three variables. We show some illustrative calculations, using Census-based estimates which suggest a figure of 20 crore rural households in India in 2019-20.

The figure, on the x-axis, shows the QUBRI as an annual per household amount. It is also expressed as a percentage of notional rural consumption of the bottom four deciles, which we estimate at Rs 54,000 crore (in 2019-20). If this percentage is small, household consumption or income will not be augmented enough to be a meaningful cushion against crises.

The y-axis shows potential coverage between 60 per cent and 80 per cent of all rural households. Analysis of the SECC data suggests that below 60 per cent a lot of the deserving poor may be excluded; and above 80 per cent the pool of the less poor can be substantial.

The lines show combinations of coverage and QUBRI that result in the same fiscal cost. It is downward sloping because if coverage increases, benefits will have to decline (and vice versa) to maintain the same fiscal cost. We show these lines for three levels of fiscal costs: 0.5 per cent, 1.3 per cent, and 2.5 per cent of GDP.

Strikingly, our proposed QUBRI is not recklessly expensive. For example, our preferred combination (the dot in the Figure) would be a transfer amounting to 1/3rd of the current consumption of the poorest 40 per cent. This is a meaningful enough transfer to make it “Basic” and provide additional income. This yields a per household annual transfer of about Rs 18,000 or Rs 1,500 per month. With this QUBRI, 75 per cent of the rural population of India can be covered at a total fiscal cost of about 1.3 percent of GDP Rs 2.64 lakh crore in 2019-20 prices).

Of course, the underlying arithmetic will vary across states. In a poor and overwhelmingly rural state such as Bihar, the fiscal costs of attaining the coverage and QUBRI discussed above would be substantially greater. Conversely, costs would be substantially lower in Tamil Nadu. This will pose political challenges for financing and “burden-sharing” to which we now turn.

Cooperative Federalist Financing: The central government, at the appropriate time, should convene a meeting of all the states to discuss QUBRI because it must be discussed, financed and implemented within a cooperative federalism framework. The Center is necessary because it can provide resources more easily than the states all of which are close to their fiscal limits, especially the poorer ones. Equally, the Center cannot do it alone because the states will have to play a critical role in implementing the scheme (for example, updating the SECC). By coming together, financing and implementation will be strengthened.

Moreover, QUBRI must involve fair burden sharing between the Center and the states. If the center finances the entire amount, there would be serious moral hazard and lack of effort on the part of some states: they must have some skin-in-the-game. If the states were to finance most of it that could be unfair to the poorer states. That is why we propose a 50-50 burden-sharing rule below which seems a reasonable trade-off between equity and incentives.

There are many ways in which financing can be structured. No one solution will be politically acceptable to all.

But QUBRI should not be financed:

- from RBI resources not least because they are one-time and cannot finance a permanent QUBRI entitlement;

- by the states or center breaching their existing fiscal commitments.

Targeting a QUBRI of Rs 18,000 per household (inflation-adjusted to preserve real value over time), the Center should offer to finance one-third of it or Rs 6,000 upfront and without conditions. It should then offer to finance another Rs 3,000 in the form of untying existing grants given to finance Centrally Sponsored Schemes. That way, the Centre’s total contribution would be half of the targeted QUBRI. This offer by the Center would be equitable since it would result in greater transfers to poorer, and more populous and rural states such as Bihar. And untying is inherently desirable to provide states greater freedom in shaping expenditure priorities.

The center’s Rs 6000 per household contribution would entail an expenditure of Rs 84,000 crore. Where will this come from? Currently, we have schemes when agriculture does badly (Fasal Bima Yojana, FBY) and when agriculture does too well (MSP and price deficiency). They are a deadly combination of being demanding, duplicative, and dysfunctional (state insurance of agricultural incomes is desirable but its current avatar, FBY, has proved ineffective). They should be abolished to finance a QUBRI which would provide guaranteed income, irrespective of agricultural conditions.

As a starting suggestion, the following agricultural schemes should be eliminated or phased out: interest rate subsidy for crop loans (Rs 15,000 crore); FBY (Rs 11,000 crore); Additional MSP/price deficiency scheme (Rs 10,000 crore); fertiliser subsidy (Rs 70,000 crore). The entire fertiliser subsidy would not be abolished in one go. Instead, the domestic price of fertiliser should be increased by about Rs 150-200 per quintal every month so that the subsidy is eliminated over three years (the diesel and petrol subsidies were abolished through such creative incrementalism).

The feasibility of the Center financing the additional Rs 3000 QUBRI is illustrated by comparing its cost of Rs 42,000 crore with the aggregate CSS expenditures of Rs 3 lakh crore. In effect, the Center and states will need to prune about 15 per cent of the overall CSS budget.

What about the states? The states would then have to find the additional resources to top up the Center’s QUBRI of Rs 6000 (plus Rs 3000). If QUBRI is politically attractive, states should be able to find the means and political will to to do so. They will have to cut subsidies (power and water) and other wasteful schemes. Competitive federalism pressures will exert itself on the lagging states to find the means to match the efforts of states that do more.

Also read: Indian farmers need a new deal and not just loan waivers

Conclusions: The agrarian crisis has created an opportunity to initiate discussions on a real social safety net for rural India, a QUBRI. It should not be a substitute for government efforts to improve human capital (health and education) nor should it replace existing elements of the social safety net such as old age pensions and maternity benefits. QUBRI should also be monitored for its potential dis-incentivising impact on urbanisation, rural-urban migration and agricultural land consolidation.

The correct way to think about QUBRI is as help to rural India instead of and replacing other interventions such as loan waivers, and Rythu Bandhu and Kalia, and ideally, also the fertiliser, interest, power and water subsidies whose benefit/cost ratios have been non-compelling.

Technology is enabling the possibility of converting inefficient, regressive, producer-based, redistribution to better targeted, income and consumer-based support. And now agricultural crisis is offering the political opening to facilitate this transformational shift.

The time and opportunity are now.

The authors are respectively, Former Economic Adviser, Govt of India, Visiting Lecturer, Harvard Kennedy School and Senior Fellow, PIIE; Director of JH Consulting; Economist, World Bank; and Ph.D. student, Harvard University

This article was originally published on Business Standard. You can read the original article here.

But the farmers used to all subsidies want UBI too in addition to existing subsidies. No body can dare cutting any thing. It will be a political harakiri. The farmers are well united and have immense vote bank clout. Also every political party has diverse view on this specially before election to find fault with any body’s scheme and encash it for votes. So do not cut any thing and finance it by taxing rich businesses as RaGa says or by cutting goverment administrative expensesx and salary hikes. .