China’s foreign direct investment has fallen by 11.7 per cent. As per the Ministry of Commerce, China’s FDI inflows declined by $111.8 billion between January and July 2023, followed by another $11.8 billion drop from July to September. This marks the first time such a massive deficit has been recorded since China began keeping records in the late 1990s. These developments exacerbate the ongoing downward trend in foreign business engagement and investments in China observed over the past two to three years. Factors such as the Covid-19 pandemic and China’s insular policies have primarily driven this downturn.

A major shift is the plummeting of Taiwanese investments in China to their lowest level in 20 years. In 2023, only 11 per cent of Taiwan’s total outbound investment went to China, a sharp decline from 34 per cent the previous year. Currently, Taiwan is redirecting a significant portion of its outbound investments toward South Asia (mainly India) and Southeast Asia. This shift is primarily due to strained cross-Strait relations, China’s weaponisation of trade, frequent economic coercion tactics, and Taiwan’s implementation of the New Southbound Policy to diversify its economic links.

However, this situation does not spell a doomsday scenario for China. Beijing remains the world’s second-largest FDI recipient after the US. Still, declining investments signify a slowdown in China’s economy and the additional challenge of foreign businesses moving out.

Waning business confidence

The trend of foreign firms relocating away from China is complex rather than binary, driven by dissatisfaction with government control, regulatory challenges, economic slowdown, and low-interest rates. Moreover, China’s strategic manipulation of global supply chains prompts companies to seek alternative locations. Europe’s de-risking strategy, the US’ ‘friend-shoring’ policy, and escalating China-US rivalry also compel many firms to relocate.

The 2023 European Union Chamber of Commerce’s Business Confidence Survey in China underscored waning business confidence. Of the 570 companies surveyed, 36 per cent cited China’s economic slowdown as the primary concern. Two-thirds reported increased difficulty operating in China, a notable uptick from pre-pandemic levels. Additionally, three-fifths perceive the business environment as increasingly politicised.

One significant development is Apple shifting its supply chain from China to India. Taiwan’s Foxconn, Apple’s main manufacturer of iPhones, is rapidly expanding operations in India. This decision is driven by China’s zero-Covid strategy and disruptions caused by stringent lockdowns in the country, which resulted in estimated losses of $1 billion per week for Apple. According to reports, Apple now aims to manufacture one out of every four iPhones in India,reducing over-reliance on China.

As China grapples with declining foreign direct investment, it is crucial to consider the broader implications of these trends on regional economies. The situation in India is particularly telling, as foreign firms are increasingly taking their money out, reflecting a growing concern among investors about the stability and attractiveness of the Indian market.

Despite government acknowledgment of declining foreign investments, China state media often portrays a contrasting positive outlook. For example, while reporting the 11.7 per cent FDI drop, Xinhua emphasised China’s actual FDI inflow—$15.86 billion—in January this year. However, focusing solely on monthly data can provide skewed perspectives, as monthly figures fluctuate and may not accurately reflect long-term trends and challenges.

Similarly, state broadcaster China Global Television Network (CGTN) has highlighted China’s efforts to streamline entry for foreign nationals from a select few countries from Europe and Southeast Asia engaged in business, education, and tourism through relaxed visa policies and improved visa services.

Also read: What can countries with high transaction cost on remittance do? Adopt an Indian method

Economic priority

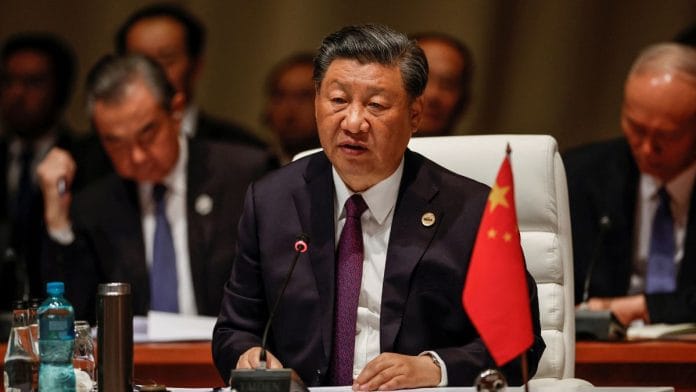

The decline in foreign investment is undoubtedly a significant concern for the Chinese leadership. Premier Li Qiang recently chaired a State Council meeting to formulate strategies to attract foreign capital, underscoring this as a core economic priority. In August 2023, the State Council introduced 24 new measures to boost foreign investment.

However, China’s strategy to relax visa policies won’t be enough to attract foreign businesses. While streamlined economic policies help, the critical challenge lies in delineating politics from economics. The weaponisation of economic ties and trade coercion tactics, combined with China’s global economic dominance, significantly sway relocation decisions amid China-US rivalry and cross-Strait tensions. Additionally, many countries aim to de-risk and diversify dependencies away from China, which will further challenge Beijing.

China’s failure to sincerely address the concerns of businesses and improve relations with key trade partners such as the US, India, and Australia could impede its efforts to contain the decline in foreign investments.

Sana Hashmi, PhD, is a fellow at the Taiwan-Asia Exchange Foundation and George HW Bush Foundation for US-China Relations. She tweets @sanahashmi1. Views are personal.

(Edited by Ratan Priya)