There is enough commentary on the Ram Mandir, the caste census, electoral bonds, and the arrests of two chief ministers. Perhaps it is time to get down to the dismal science of economics.

The Congress-led INDIA alliance, broadly speaking, seems to support the following ideas:

- Revamp of the Goods and Services Tax.

- Return to the Old Pension Scheme (OPS).

- Return to the old pattern of military recruitment.

- Guarantees for enormously high prices for most crops.

- Attacks on India’s rich entrepreneurs.

- Free electricity to all farmers and to most of India’s population.

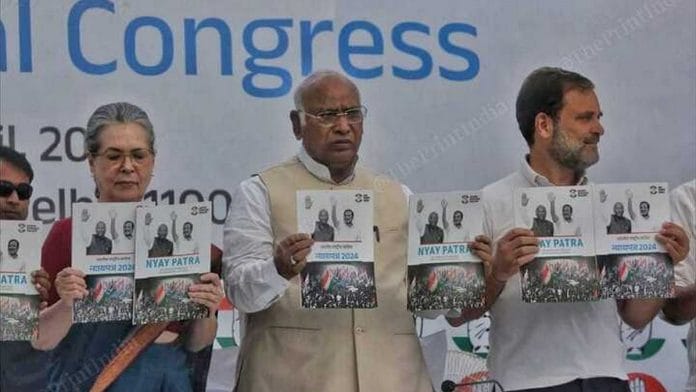

Now, not all of the aforementioned points have found their way into the Congress manifesto, released today. But vocal factions within the party and its allies have consistently championed these policies, and they are unlikely to disappear. For instance, while the OPS was missing from the document, manifesto panel head P Chidambaram made a telling statement to the media: “It’s not missing, it’s in our head.”

Therefore, this discussion primarily focuses on what has broadly been “in the head” of both the opposition and the BJP, as evidenced consistently through their actions and pronouncements.

Let us examine the opposition’s pet ideas, followed by an evaluation of what the BJP-led NDA is likely to focus on.

Also Read: Black money won’t disappear. But bad ideas like wealth & estate taxes will make it grow

INDIA’s vision, or lack thereof

Here is a look at the INDIA alliance’s key policy and rhetorical standpoints and how these will likely play out.

GST

The GST was first proposed by the UPA government. The primary objectives were to unify India into a single market and to prevent inflationary pressures from cascading indirect taxes. Everyone knew that the change would be painful, and it would take time to stabilise the new system. Manmohan Singh, Prime Minister at the time, conspicuously supported the introduction of GST.

It is nobody’s case that the GST is perfect. It is a tribute to the GST Council, which includes all state finance ministers, that they have not rigidly stuck to frozen formulas. They have made frequent changes. They have acknowledged software glitches and have tried to address them. They have acted against crooks who try to game the system. And recently, the government has also acted to control the oppressive officials at the lower levels in the GST hierarchy.

After the expected initial setbacks, GST has proved to be quite buoyant, with collection rates exceeding GDP growth rates.

Most sensible countries have instituted variants of GST. Even the Congress manifesto mentions not repealing GST but launching “GST 2.0”, which Chidambaram has also reiterated earlier. Despite this ‘official’ stance, however, several prominent opposition leaders have been telling their audiences that GST is anti-poor.

Do such leaders want to return to a fragmented market of 28 states? Do they want to reduce transport efficiency in the country? Do they want to reinstate corrupt octroi departments? It beats me. I wonder if they have bothered to consult with Manmohan Singh. He will doubtless elegantly convince them that going back on GST would definitely classify as being anti-national!

OPS

The vociferous demand to return to the Old Pension Scheme among some sections of the Congress is so reckless that one hardly knows where to begin. The Reserve Bank of India has estimated that if all state governments revert to the OPS, the cumulative fiscal burden could be as much as 4.5 times that of the current National Pension Scheme (NPS). Even if it’s not enshrined in their manifesto, the Congress has been talking about “forming a committee” to look into the matter, which means OPS as an idea has not been retired.

Again, Manmohan Singh must be horrified that his party has been sponsoring this position of gargantuan fiscal irresponsibility. No party that claims to act on behalf of the poor should give in to this irrational demand of government employees, forming a fraction of our population and immensely privileged. Moreover, there is no evidence that the beneficiaries will be worse off with the NPS. They might even be better off. It just does not involve the kind of overarching guarantee that lazy officials seem to want. The worst thing about returning to the OPS is that it would mean condemning the coming generations to inherit the legacy of a still-poor country that is also bankrupt.

Military recruitment

The new Agnipath military recruitment scheme is an imaginative effort to prevent our armed forces from becoming a gerontocracy and from draining the revenues of the country at the same time. Any new system will face glitches and the authorities have promised mid-course corrections. But the Congress has announced it will reinstate the old recruitment scheme if it returns to power.

To go back to a system which is two-and-a-half centuries old, inherited from the East India Company’s Madras Army, has to be one of the least creative responses possible. It is also fiscally irresponsible, although with defence issues that is always a secondary consideration. The Opposition’s stance is frankly baffling.

MSP

In 2010, it was the UPA government which stated in Parliament that an MSP calculated at 50 per cent more than the weighted average cost of production was unworkable. TTo change course, and even put this in the manifesto, is a sign of childish petulance. Eminent economists such as Ashok Gulati have pointed out that endless increases and guarantees of support prices are not the correct prescription for the woes of Indian agriculture. The MSP bugbear discourages crop diversification and is dramatically reducing the water table in parts of the country.

I have argued earlier that the MSP agitation is led not by poor farmers but by rich middlemen and landlords. There is no rational explanation for the Opposition endorsing this ruinous position.

Attacks on magnates

Launching verbal attacks on rich entrepreneurs is another dismal aspect of the Opposition’s campaign.

Let us consider two unnamed persons. One runs one of the most efficient petroleum refineries in the world. He has also made India one of the cheapest countries for data transmission, giving us an enormous competitive advantage. The other person runs some of the most efficient ports in the world. He also has the gumption to buy mines, build railroads, and acquire harbours in different countries, thus enhancing India’s strategic defence posture. Not a single coffee-drinker from JNU could have pulled off what these persons have done. What is the point in attacking persons who are national human capital assets?

In the 1950s, it was fashionable for our home-grown socialists to constantly target Tata and Birla. Contrast this with Meiji Japan championing Mitsubishi and Hitachi, or more recently, Korea supporting Samsung and Hyundai. If we had encouraged the Tatas and the Birlas in the 1950s, instead of throttling them, we too might have been a rich country by now. How can a country be prosperous if its businesses are not large, successful, world-class and profitable? Denigrating successful entrepreneurs will result in enduring poverty being our fate.

This does not mean that corporate illegalities should be overlooked. Japanese and Korean prosecutors can be quite ruthless when they pursue corporate wrongdoings. But they attack actions and prosecute individuals. They do not discredit their national flag bearers. We must support, not insult, our business leaders even as we implement our laws fairly and correctly.

Free power

The grant of free electricity to farmers in many states has resulted in excessive groundwater extraction, which is disastrous for the environment. It will lead to the eventual desertification of our fair land. Now, the INDIA alliance, or the Aam Aadmi Party’s Arvind Kejriwal specifically, has announced free electricity to all poor people as one of its six “guarantees”. Swaminathan Aiyar wrote recently that with the rapid adoption of electric vehicles, millions of truckers might soon be charging their batteries at the connections of these so-called farmers and ‘poor’. Given India’s success with Direct Benefit Transfers, why persist with manipulating prices through subsidies, leading to terrible unintended consequences? The Opposition has a lot of explaining to do.

Also Read: No left-right divide on economic issues among Indian masses. BJP’s welfarism played a role

What is the BJP offering?

The BJP is yet to come out with their official manifesto. But the broad contours of their economic thinking are evident to all. Let me attempt a summary, based less on their vision statements and more on their actions so far:

- Heavy focus on infrastructure.

- A commitment to industrial planning, special benefits for “favoured” sectors.

- Managed trade rather than free trade.

- High direct tax rates for individuals, with selective reductions for corporations.

- Fiscal restraint.

- No interest in substantive privatisation. Focus instead on making the public sector more “efficient”.

- Retreat from agricultural reform in the face of political issues.

- Focus on Direct Benefit Transfers for welfare programmes.

Some of these are highly promising, others less so.

Infra push

The focus on infrastructure, especially transportation (roads, railways, airports), has been overdue and welcome. However, there is a real danger of falling too much in love with infrastructure. For instance, a recent article in ThePrint highlighted that we may have gotten carried away with metro train systems. Let us not forget that China is burdened with ghost cities and unused airports. In general, with infrastructure, it is better for demand to exceed supply rather than create supply and wait for demand to fill it up. It’s better to have traffic congestion first and then build a road rather than the other way around.

Industrial planning & managed trade

This worries people like me the most. Complex tariff protections, subsidies, investment guidelines, and so on remind me of the socialist Industrial Policy Resolution of 1956 and our descent into a nightmare until 1991. These plans can be gamed and favoured industries can easily fall out of favour and we can be stuck with white elephants. A heartening difference from 1956 is that there is no obsession today with state control of key industries, which only led to sloth and unprofitability. Industrial policy today involves tie-ups and cooperation with the private sector. This should ensure a measure of economic sanity. Nevertheless, it’s a slippery slope, and we must be vigilant to ensure that industrial policy does not slip into waste and gaming.

For a purist like me, managed trade sounds like an oxymoron. Consider a simple product with, say, 18 components. Now, say, 12 are made in India, four come from a favoured Switzerland, and two from unfavoured Ruritania with a 100 per cent duty. How can our product be globally competitive? However, even the US, a bastion of free trade, has opted for industrial planning and managed trade. What are nations like ours to do? I don’t have an answer. All I can say is—the freer the better, the less management the better.

Taxes and tribunals

The 40 per cent marginal highest tax rate is really a disappointment. It is a clear signal that this government is wary of being labelled pro-rich, a favourite accusation of their opponents. This pusillanimity may be the one persistent fault of this government, and likely to be a recurring issue.

While tax rates capture the headlines, most complaints in India pertain to tax administration. Ours has to be one of the most adversarial in the world. To be fair, the government has been trying to improve it, but tinkering at the edges will not work. We must move beyond the obsession with cut-off dates and amounts. The government should simply state that if any party loses a case at the Income Tax Tribunal level, regardless of the date or amount involved, they will not appeal. The argument that tribunals can be fixed is both jejune and fatuous. This government talks about “sabka vishwas”. For God’s sake let us at least have vishwas in our tribunals. Will the BJP be imaginative enough to make this a part of their manifesto? I certainly hope so.

Fiscal restraint

Fiscal restraint is easily the one area where this government gets very high marks. I am so glad that Finance Minister Nirmala Sitharaman did not listen to vapid NRI economists who kept telling her during Covid-19, to throw money down from planes. She has also not succumbed to the temptation of over-spending based on the buoyancy of revenues. In addition, Sitharaman has been more transparent than her predecessors as she has brought off-balance-sheet items onto the books.

Low impetus to privatisation

With the exception of Air India, this dispensation has at best shown a desultory interest in disinvestment and privatisation. This has been a great disappointment. Our political masters should realise that the Appleby civil servants in every department have a vested interest in opposing disinvestment and privatisation. No one wants their empires to become smaller. They are also adept at crafting high-grade position papers about the “strategic value” of some PSU, or how one can be “easily” turned around. We must understand that state involvement in industry and commerce is inherently inefficient. Sooner or later every one of these enterprises will falter and the price will be paid by taxpayers, not by lenders and shareholders. The NDA leaders should re-read their Kautilya and follow his precepts.

Agri reform

The retreat from agricultural reform in the face of protests that seem to have been organised by a few middlemen and landlords has to be one of the greater disappointments of recent times. Without an increase in agricultural productivity, we are doomed to not become a developed society. One wonders if the NDA will find stealthy or roundabout ways to move forward in this area.

From a political perspective, the BJP must realise that the enormous labour force stuck in this low productivity sector will end up as an albatross holding the country back. Much needs to be done—monopolistic mandis have to go; incentive structures should automatically encourage crop diversification; mandates are not possible or needed; futures markets should be made robust so that farmers get the right signals to avoid over-planting or under-planting. But I suspect that an embarrassed BJP will not even mention agriculture in their manifesto. This, of course, will not and should not prevent their moving ahead if they are re-elected.

Direct Benefit Transfers

DBTs have been hailed as a significant achievement of this government. They vastly reduce skimming by intermediaries and petty ground level harassment, and also intelligently leverage the new digital infrastructure. They are a huge improvement over welfare schemes that distort relative prices through subsidies, cross-subsidies, and freebies. But there’s a danger of falling too much in love with DBT.

One of my worst nightmares is of two Indias: an urban, productive, and prosperous one, contrasted with a rural counterpart, content with subsistence-level food and paltry benefits. We must not forget the unintended consequences of good intentions. When western governments introduced welfare schemes for single mothers, they did not realise that they were simultaneously incentivising single parenthood. MNREGA, for instance, was supposed to provide employment. Is it in danger of becoming a dole? Grateful labharthis (beneficiaries) can be grateful voters. But a Ma-Baap Sarkar, patron-client relationship is inherently unhealthy. Net-net, I worry about the very success of DBT leading to unforeseen bad consequences. Will the BJP listen or will they be dismissive? Will their manifesto give us a clue? We cannot predict.

Having looked at the principal economic drivers of INDIA/Congress and of the BJP/NDA, the jury is clearly out. A vote for the former is a vote to drive this country into bankruptcy and enduring poverty. A vote for the latter is one for optimism, albeit tinged with caution.

Jaithirth Rao is an entrepreneur and a writer. Views are personal.

(Edited by Asavari Singh)

We must also make a distinction between Adanisation and privatisation.

We must also understand that before asking someone else (who has very less) to give up their dreams, we (who have very much) must sacrifice first. So asking village youth to give up secured military job or asking old men to adjust with lower pension, the MPs who almost always are already crorepatis must give up hefty salary raises and luxurious perks. And, of course, pension for mostly looting public wealth is absolutely slap on the poor’s face. So they should give up pension for just 5 years.

Also indirect tax should not be used to compensate for your economic mess/incompetence like demonetisation, swatch bharat sandas scheme which was foolishness by design, etc.

Electricity must not be free, but it should be subsidised for agriculture.

If you think that people work or earn money so that they could only eat and if they r given free food they will stop working then god help u. I believe people work to eat but they earn money to buy iPhone. Because otherwise most of us well off folks had no need to work any more, we could eat our wealth off while watching tv whole life and still have something left. Also thinking this way is very dishonourable our no so good doing fellow. This is cavalier attitude.

Providing food or social security to our people is like investing in/helping them, just like a parent support the child in their early life.

we must also understand that the logical end of capitalism is communism, because growth based economy or world cannot continue forever. But, yeah, that is still far away.

Also there must not be a new parliament or statue of unity when parliament never runs full, and old parliament is already gargantuan. When 85% of the population live in poverty.