The micro, small, and medium enterprise or MSME sector has long been recognised as a crucial pillar of the Indian economy. Known for its ability to create employment with minimal capital and drive inclusive growth, the sector contributes significantly to local livelihoods and national development.

Assam, like many other states, has witnessed a quiet but notable shift in MSMEs, particularly in the adoption of digital payment systems. From small roadside vendors to urban retail shops, the signs of digital transformation are now visible across the state. QR codes and UPI-based payments are no longer rare. They are part of the new normal.

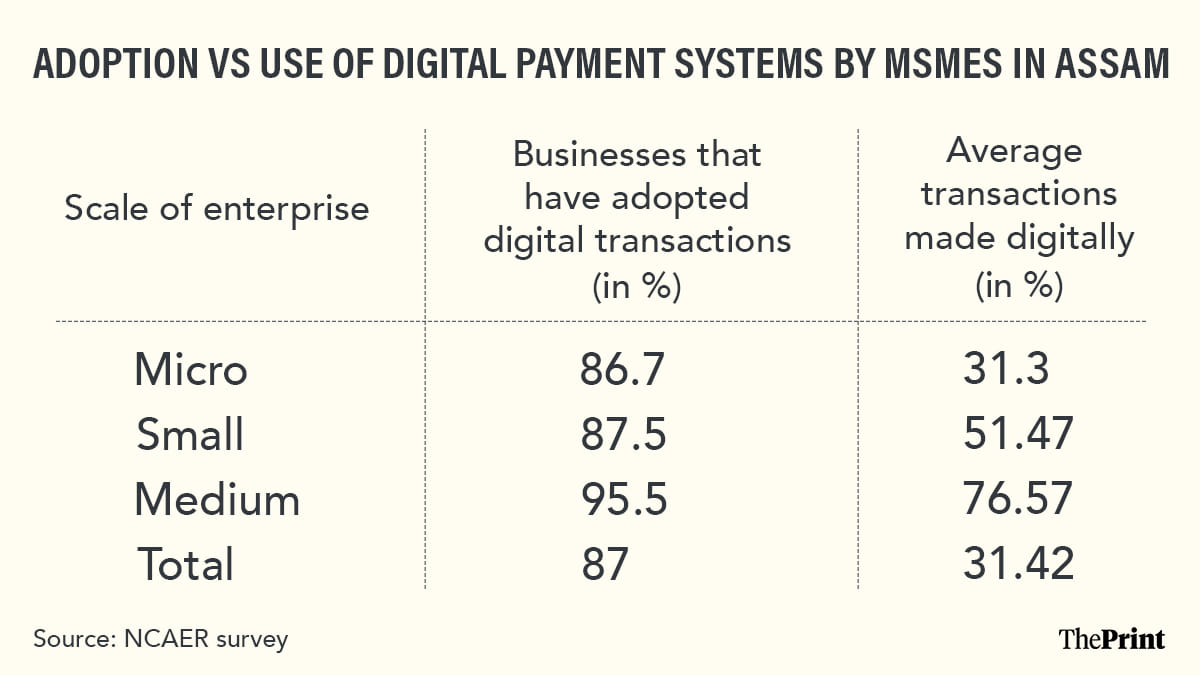

According to a recent survey conducted by the National Council of Applied Economic Research (NCAER) for the Directorate of Economics and Statistics (DES), Assam, nearly 87 per cent of MSMEs in the state have adopted at least one form of digital payment. This is promising.

Among medium enterprises, the adoption rate stands at an impressive 95.5 per cent. Small enterprises report an adoption rate of 87.5 per cent, while micro enterprises follow closely at 86.7 per cent. These figures signal a high level of digital readiness and a willingness among entrepreneurs to embrace change.

However, a closer examination of transaction data reveals a paradox. While the adoption is high, actual use of digital modes of payment remains relatively low. The NCAER survey shows that only about 31.3 per cent of total transactions for micro enterprises are conducted digitally. Small enterprises fare better, with 51.47 per cent of total transactions being digital, and medium enterprises lead with 76.57 per cent. This wide gap between the adoption and active use of digital payment systems tells a larger story—one where the missing link is not the business owner, but the customer.

Why customers don’t pay digitally

The reality on the ground is that even though MSMEs have installed digital infrastructure, a significant share of their customers still prefer to pay in cash. Whether it is a local grocery store, a tea stall, or a tailoring shop, the digital payment option is often available but rarely used. This reluctance among customers stems from a combination of behavioural, technological, and cultural factors.

For many people, particularly in tier-3 towns and rural areas, cash remains a deeply embedded mode of payment. It feels more tangible and trustworthy than a digital transaction that takes place on a screen.

Another important barrier is digital literacy. Many customers, especially the elderly or those with limited education, find mobile payment apps difficult to navigate. Others fear fraud or worry that if something goes wrong with the transaction, there is no clear route for recovery. In some cases, customers believe that using cash gives them more flexibility or helps them manage their spending better.

This gap between the availability of digital options and their actual use is not just a technological issue. It has far-reaching implications for the MSME ecosystem. Digital payments create financial records that are crucial for accessing credit, applying for government schemes, or building business credibility. Without a strong history of digital transactions, many small businesses remain outside the formal financial system. This makes it harder for them to grow, scale up, or survive during economic shocks. In a region like Assam, where MSMEs are central to employment and income generation, this disconnect could hold back broader development.

Also read: Maruti, Kia to Hyundai – why automakers are turning to trains to transport cars

Bring MSMEs in digital mainstream

It is also worth noting that the Northeast has been identified as a key focus area for India’s future growth. Described by Prime Minister Modi as the “Ashta Lakshmi”—a potential source for the country’s eightfold prosperity—the region is expected to play an important role in national progress. For this vision to become a reality, the MSME sector in Assam and neighbouring states must be brought fully into the digital mainstream. This will not happen if digital readiness is limited to business owners alone. Customers must also become active participants in the digital economy.

So far, most policy interventions have focused on the supply side—on helping MSMEs adopt digital tools, install QR codes, and attend training sessions. These efforts have delivered encouraging results. But the next phase must address the demand side. There is a need to invest in customer awareness, trust-building, and habit formation.

People must be shown that digital payments can be easy, safe, and rewarding. Campaigns in local languages, community-based outreach, and visible grievance redressal systems can all help build public confidence. Above all, digital financial literacy must be treated as a public good—something that empowers citizens and strengthens the economy.

MSMEs in Assam have taken an important step toward a digital future. They have embraced technology and demonstrated their willingness to evolve. But unless customers also make this shift, the benefits of digital transformation will remain limited.

A truly digital economy cannot be built by businesses alone. It requires customers who are informed, confident, and willing to adopt new behaviours. Every stakeholder—from governments and banks to fintech companies and civil society—must focus on turning digital payments into a habit.

The groundwork has been laid, and the opportunity is clear. It is only a matter of bringing the customer on board.

Palash Baruah is a fellow at the National Council of Applied Economic Research (NCAER), Delhi. He tweets @DrPalashBaruah.

Poonam Munjal is a professor at NCAER. She tweets @poonam_munjal.

Views are personal.

(Edited by Prasanna Bachchhav)