The feverish excitement over artificial intelligence has ignited a global capital expenditure cycle of unprecedented proportions. At the vanguard are the American technology titans. The latest chapter in this borrowing binge arrived last week with the announcement by Alphabet Inc. — best known as the parent company of Google, Android, Pixel, and YouTube — of a $32-billion debt raise.

American tech giants, generally known for their cash–generating capabilities and the ability to command high equity valuations, have been accessing the bond market at an increasingly rapid pace over the last 10-15 years. Yet Alphabet’s latest issue is unusual: bonds worth USD 1.25 billion in this issue or about 4 per cent of the total issue size carry a 100-year maturity. Investors in this slice of the bond issue will be repaid in full in 2126. Perhaps, even more uniquely, these 100–year bonds are denominated not in the US dollar, Euro, or Yen — the most liquid currencies in the global financial market — but in pound sterling.

By successfully placing this century bond, Alphabet has tested investor confidence in three fiercely debated bets: the adoption of AI, American technology companies’ capabilities to compete with DeepSeek-like open-source AI-models emerging in the future, and, we daresay, the pound sterling.

The uniqueness of Alphabet’s 100–year bond

Century bonds are usually issued by sovereigns or universities — institutions expected to exist a century from now. Even for nations, issuing a 100-year bond is a bold signalling move, with only a handful of countries having issued such bonds. The longest tenure US government bond is 30 years. The UK, which has one of the longest maturity curves among developed countries, has issued “very long term” bonds of 55 years.

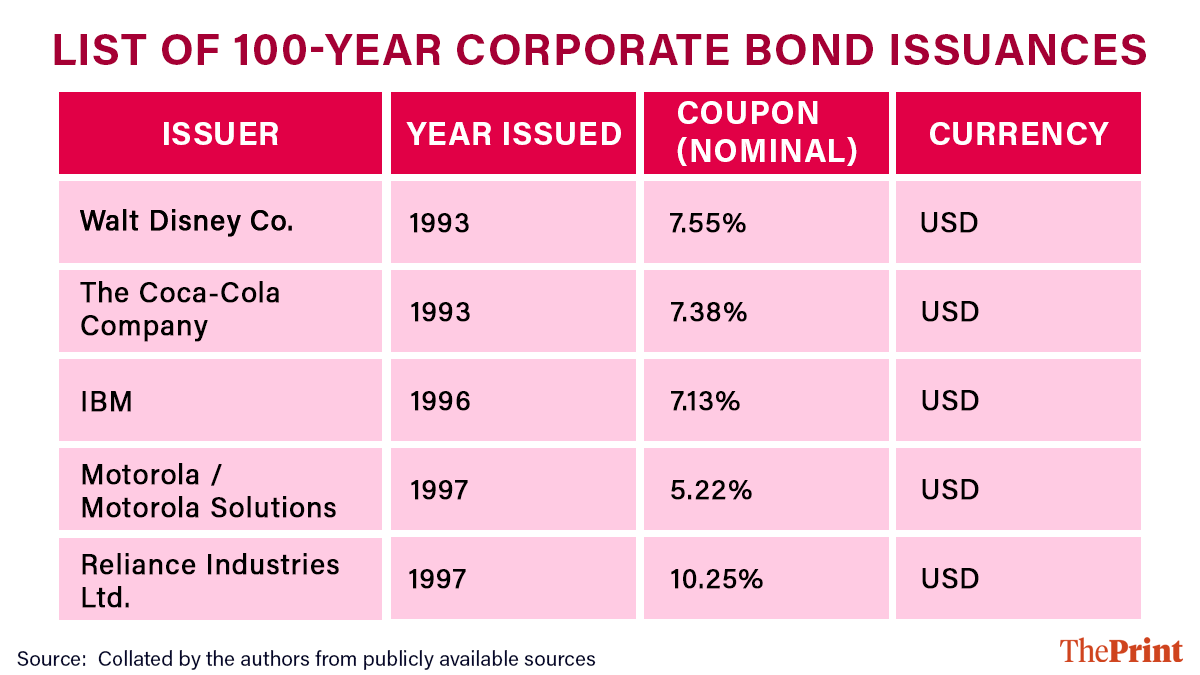

For a private corporation to issue century bonds is a rare feat, with even the most recent of such bond issuances made almost 30 years ago, during a period of, one might argue, relative global certainty. See Table 1.

The yield: The bond offers a nominal coupon of 6.12 per cent, which is 95 basis points over the 30-year US treasury yield and 120 basis points over the 50-year UK gilt bonds.

In the 1990s, when the last of the-100 year corporate bonds were issued, the US’s 30-year treasuries yield was between 6.60 per cent and 6.70 per cent. The bonds of the first three issuers mentioned in Table 1, thus, represented 50-90 basis points yield over the US treasuries. Motorola, on the other hand, appeared to have been issued at a discount, suggesting more credit worthiness than even the US government debt at the time. Reliance’s 100-year bond was issued at around 350 basis points premium over the US government debt. Despite today’s greater global uncertainty, investors have not demanded a significant premium from Alphabet.

Covenant-light: Despite the century-long horizon, market participants indicated that the terms are strikingly lean. Investors are afforded no minimum interest-rate coverage ratios nor guarantees from Alphabet’s cash-rich operating subsidiaries.

Asymmetric options: While Alphabet retains a “call” option to redeem the debt at its discretion, investors were granted no “put” option to exit their positions before the turn of the 22nd century.

Perhaps most curious is Alphabet’s choice of currency denomination jurisdiction. The denomination of the bond issuance may signal a temporary loss of confidence in USD. The US Dollar Index (DXY), which tracks the dollar against six major global currencies — euro, yen, pound, Canadian dollar, Swedish krona, and Swiss franc — and is commonly used to gauge dollar strength, weakened by almost 10 per cent in 2025 and continues to fall in 2026. In a similar vein, central banks have also been diversifying their reserves away from the US dollar, and countries have been trying to invoice their foreign trade in other currencies.

But then, why did Alphabet Inc. choose the UK as the jurisdiction for this issue and not some other relatively more stable jurisdiction such as Switzerland? Two factors might explain this decision. First, the tech giant likely sought the appetite of UK insurers and pension funds — institutions desperate to lock in yields to match their long-term liabilities. Second, this choice might be intended to signal Alphabet’s desire to diversify its funding sources, and demonstrate that US tech giants are capable of attracting funding from other jurisdictions, including those that appear more conservative with their approach to AI, compared to the US.

Also read: RBI is buying time by not cutting the repo rate. Past policy needs a breather to work

The fiscal mirage

Beyond the technicalities of the trade lies a more profound geopolitical shift. Global debt now scales a mountain of $350 trillion, dwarfing a global GDP of roughly $120 trillion. Across the West, public balance sheets are stretched. With debt-to-GDP ratios ranging from 105 per cent in the UK to a staggering 230 per cent in Japan, the sustainability of sovereign finance is being questioned by the very markets that once underpinned it.

In an era of polarised politics and fiscal inertia, the world’s most powerful democracies struggle to issue debt beyond 30 or 50 years. Yet, a private entity rated AA+ — one notch below the elusive AAA — has successfully convinced the market of its viability through the year 2126.

The corporate Leviathan

Alphabet Inc.’s issuance signals a shift in where investors place long-term trust. The investor community appears to be placing greater faith in the enduring utility of a search engine and an AI ecosystem than in the long-term solvency of the nation-state.

As we hurtle toward an AI-driven future, we must ask: are these technology behemoths replacing governments as the world’s most credible borrowers? For those holding Alphabet’s 100-year notes, the answer is clear. The bond market is no longer saluting the flag of the state; it is saluting the algorithm.

Bhargavi Zaveri-Shah is the co-founder and CEO of The Professeer. She tweets @bhargavizaveri. Harsh Vardhan is a management consultant and researcher based in Mumbai. Views are personal.

(Edited by Aamaan Alam Khan)