For most middle class Indians, N.R. Narayana Murthy is something of a hero. Until he came along, Indian industry was largely regarded as being a sloppy, corrupt place, full of black money and dodgy business practices. Murthy and Infosys, the company he founded with a few colleagues from his old job, changed all that. Not only was it one of India’s cleanest companies — no corruption, no bribing of politicians and officials, no off-the-book cash transactions, etc. — it was also a world-class operation. It was the global success of Infosys that made us more confident as we realised that India could do it. We could create products that the world valued and we could do it with honesty and integrity.

In the decades that have followed, Murthy and his co-founders have either moved away from Infosys or, at the very least, not been involved in its day-to-day functioning. But the company continues to prosper and its founders, having made more money than they ever imagined was possible, have moved on to other things. For instance, Nandan Nilekani, who succeeded Murthy as the CEO of Infosys, is now one of India’s leading public intellectuals and gives away hundreds of crores of rupees in his philanthropic initiatives.

So, it is startling for Indians to see a member of Narayana Murthy’s family accused of financial impropriety; especially when the charges are so clearly unfair.

Also read: Britain is suffering from a leadership crisis & its political parties are left with second 11

Akshata’s tax vs Sunak’s career

At the centre of the current storm is Murthy’s daughter, Akshata, who owns a little under one percent of Infosys. So enormous is the wealth that Murthy and his co-founders have created for shareholders that even such a relatively small shareholding is said to be worth around 700 million pounds sterling.

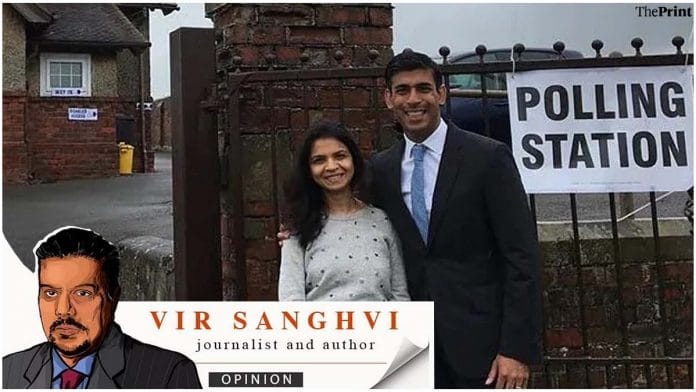

Akshata is an Indian citizen who went to America to study where she met Rishi Sunak. They fell in love, married and are resident in the UK where Sunak is a British citizen. Akshata, however, has not given up her Indian passport and it has been suggested that she might want to move back to Bengaluru sometime in the future to look after her parents as they grow old.

None of this would be of much consequence but for Sunak’s successful career. His parents came to the UK from East Africa (they are Punjabis), worked hard as immigrants often do (his father was a doctor, his mother ran a pharmacy), and invested in a good education for their son. Sunak became Head Boy of his public school, went to Oxford and then to business school in the US. He worked in the financial sector where he made quite a lot of money.

He then returned to England, joined politics, put his investments into a blind trust and rose to become the UK’s Chancellor of the Exchequer, a position roughly equivalent to our Finance Minister. His is the classic immigrant success story. The first member of his family to be born in the UK, he has risen to the top in one generation.

And that would be that — except for a row that has now broken out over Akshata’s Infosys shares. Like all Infosys shareholders, she gets dividends every year. Those dividends are subject to withholding tax in India and are taxed according to our laws. This is fair enough: the money is part of Infosys’s profits, which are earned by Indians working for an Indian company. It is only right that the Indian shareholders should pay Indian taxes.

But should Akshata be double-taxed? Should she also pay UK tax on the dividends? According to British law, you do not have to pay tax on your global earnings even if you live in the UK as long as you are regarded as a ‘non-dom’. Akshata pays British tax on everything she earns in Britain. And Indian tax on everything she earns in India.

This is not just because she is an Indian citizen, it is because of the way the UK law works. One-fifth of all top bankers in the UK are ‘non-doms’, that is to say, they pay tax in the UK on their UK income but not on their global income. Two-fifths of all those earning more than £5 million a year have claimed non-dom status and pay no UK tax on their global income.

Also read: Rishi Sunak to Priti Patel: Why British Indians wield more power than British Pakistanis

It was all legal, until it wasn’t

As a non-dom, Akshata is part of this group and her husband has made no secret of it. When he was appointed Chancellor, Sunak declared his wife’s non-dom status to the government and it was regarded as unremarkable because it was entirely legal.

Over the last month, however, Sunak has been consistently targeted with attacks that focus on his wife. The first controversy was over the charge that Infosys did business with Russia. Given that so much of Europe buys energy from Russia, it was hard to see why an Indian company should not do business with Russia. Besides, Narayana Murthy no longer runs Infosys so it was bizarre to suggest that his daughter was in some way responsible.

It turned out that Infosys was actually closing its Russia office so a new attack was launched. Now Akshata was attacked for not paying UK tax on her Infosys dividends. That this was entirely legal made no difference. It was, nevertheless, improper, the critics said.

But was it? The irony is that the non-dom category was originally invented, at least partly, to help those Brits who were plundering India and the other colonies. Two centuries ago, the British government created the non-dom exemption to help those rich Brits who had made money in the colonies. If, say, a British lord made a fortune exploiting Indians, there was no need for him to pay tax in Britain on his ill-gotten gains.

Ironically enough, if an Indian who now lives in the UK receives dividends from an entirely honest and honourable enterprise run by other Indians in her own country, then it is now considered improper.

Such was the uproar that ultimately Akshata surrendered to the critics. She agreed to pay UK tax on her Infosys dividends, even though she was not required to do so by law.

She issued a very dignified statement which read, in part, “Rishi has always respected the fact that I am Indian and as proud of my country as he is of his. He’s never asked me to abandon my Indian citizenship, ties to India or my business affairs, despite the ways in which such a move would have simplified things for him politically. He knows that my long-standing shareholding in Infosys is not just a financial investment but also testament to my father’s work, of which I am incredibly proud. My decision to pay UK tax on all my worldwide income will not change the fact that India remains the country of my birth, citizenship, parents’ home and place of domicile. But I love the UK too.”

1/ Since arriving in the UK, I have been made to feel more welcome than I ever could have imagined, in both London and our home in North Yorkshire.

This is a wonderful country.

— Akshata Murty (@anmurty) April 9, 2022

Also read: Not just Rishi Sunak, Indian-origin politicians are everywhere — Fiji to Portugal & Canada

Aspect that Indians can see

What are we to make of this? Most Indians I know are appalled. Partly it is the regard we have for Narayana Murthy and Infosys. But mostly, we find it grossly unfair that someone who did something entirely legal and made no secret of it, should be treated so badly.

It is possible to argue that the non-dom exemption is morally unjustifiable and should be abolished but a) as long as it exists, why pick on one person out of 75,000 or so British residents who are non-doms; and b) there is no suggestion that the category will be abolished now that the campaign against Sunak and his family has succeeded.

So what was behind it? Clearly, the campaign was manipulated to damage Sunak’s political career. He was being mentioned as a potential prime minister, a possibility that has now receded. The British press are notorious for going after the rich and famous, so that probably helped the campaign against Sunak.

But without wishing to turn this into a Meghan Markle moment, many UK Asians seem to think that there was a racial component to the attacks. In recent years, the UK has made many advances when it comes to the rise of Asians within the political system. Apart from Sunak, there are other East African Asians like Priti Patel who have done well as have the likes of Sajid Javid and Sadiq Khan.

This is creditable and encouraging. But for many Indians and others of South Asian origin in the UK, there remains a constant fear that when it comes to the crunch, white people will not hesitate to use your ethnic and social origins as a weapon. A rich, brown person is always an attractive target.

Perhaps I am over-emphasising the racial aspect; perhaps as a person of colour, I am over-sensitive about the racial component. But for any Indian who knows what Murthy and Infosys have stood for, there will always be the lingering suspicion that this was no more than a lynching of a high-flying brown person.

It does the UK no credit at all; at least in Indian eyes.

The author is an Indian print and television journalist and talk show host. He tweets at @virsanghvi. Views are personal.

(Edited by Prashant)

Disclosure: Infosys co-founder N.R. Narayana Murthy is among the distinguished founder-investors of ThePrint. Please click here for details on investors.