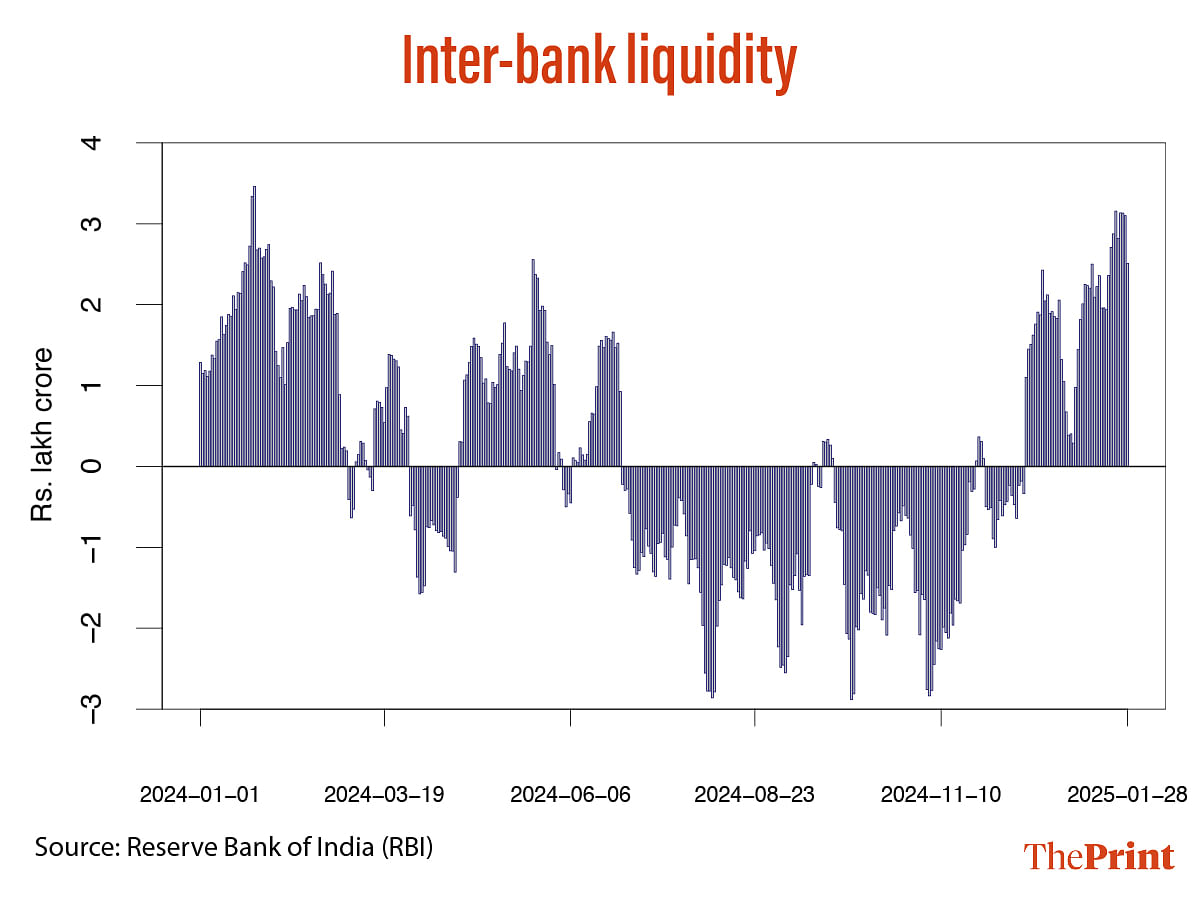

India’s banking system faced its deepest liquidity crunch in 15 years as the deficit rose to Rs 3.3 lakh crore in the last week of January. In response, on 27 January, 2025, the Reserve Bank of India (RBI) announced a raft of measures to increase liquidity. These include a Rs 60,000 crore purchase of government securities (G-Sec) via open market operations (OMO) to be conducted in three tranches, a 56-day variable rate repo auction for a notified amount of Rs 50,000 crore and USD/INR buy sell swap auctions of USD 5 billion for a tenor of 6 months. In the buy/sell swap, the RBI will buy USD 5 billion from banks and give them an equivalent amount of rupees. The swap will mature in 6 months. Cumulatively, these measures are expected to inject liquidity worth Rs 1.5 trillion.

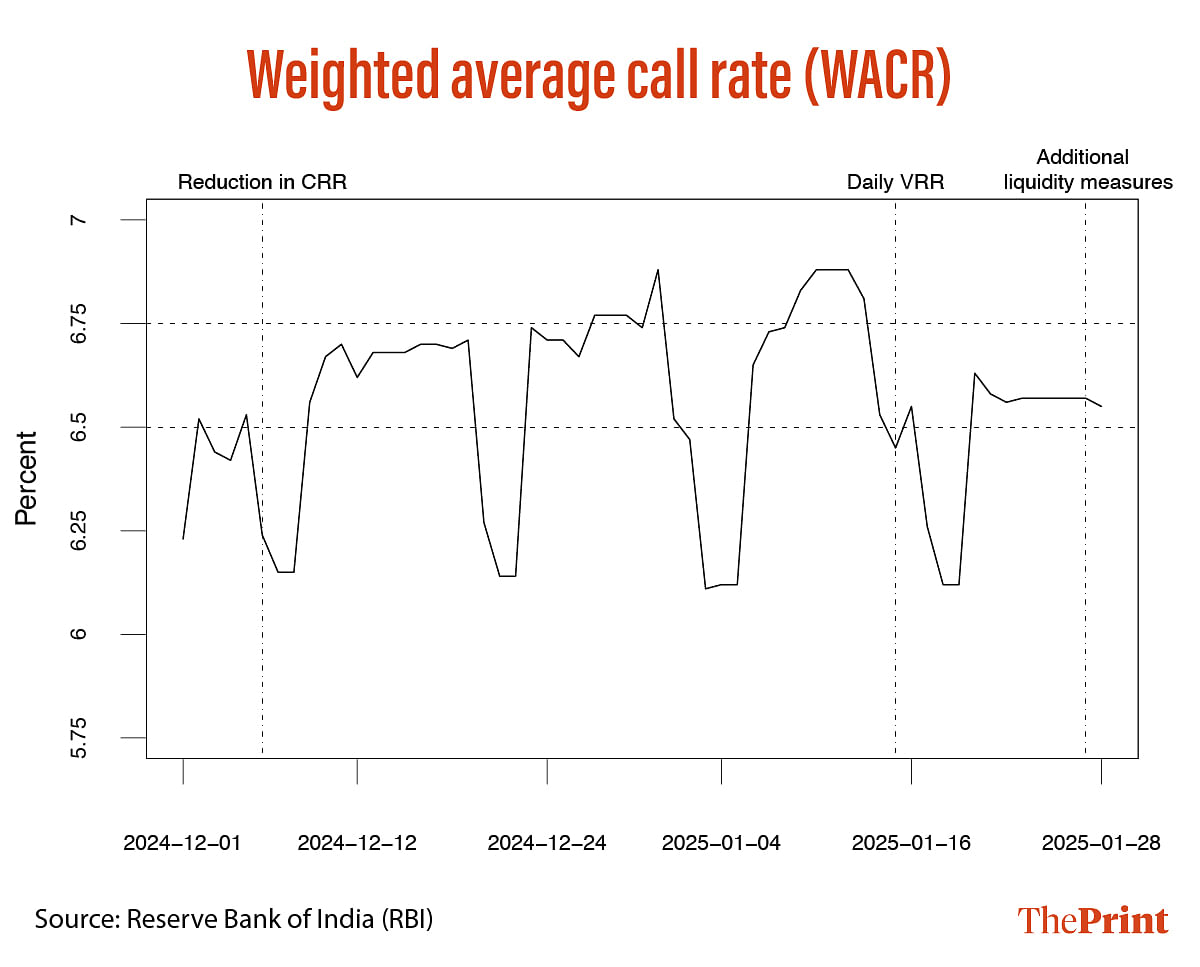

These are not the only measures that the RBI has introduced to ease the liquidity crunch. In the December monetary policy review, the RBI announced a 50 basis points cut in the Cash Reserve Ratio (CRR) (the percentage of deposits that banks must park with RBI) to 4 percent in two tranches. Additionally, from 15 January, 2025, the RBI has been conducting daily Variable Rate Repo Auctions to infuse liquidity in the banking system.

Interventions in the forex market to stem the rupee slide amid sustained dollar outflows through selling FPIs are the key reasons for the tight liquidity. While a series of measures have been announced, unless deposit growth picks up in a durable manner, liquidity tightness would likely remain a concern for the banking sector. The stricter liquidity coverage ratio norms which require banks to hold a higher proportion of high quality liquid assets (HQLA), could limit the effectiveness of the liquidity enhancing measures.

Dollar sales and liquidity tightness

The RBI’s continued dollar sales to curb rupee depreciation is one of the key reasons for the liquidity crunch. On a gross basis, the RBI sold USD 195 billion from April-November of the current year. Last year during the same period, it had sold USD 113 billion. RBI dollar sales imply that an equivalent amount of rupee liquidity goes out of the system.

On a net basis, RBI sold USD 20.2 billion in November. While the intervention data available is till November, the drop in foreign exchange reserves in December and January (till 17th) suggests that RBI has been intervening to stem the rupee volatility in the wake of the uncertain global environment following Donald Trump’s re-election as US President. Foreign exchange reserves have fallen from USD 700 billion in late September to USD 623 billion by mid of January.

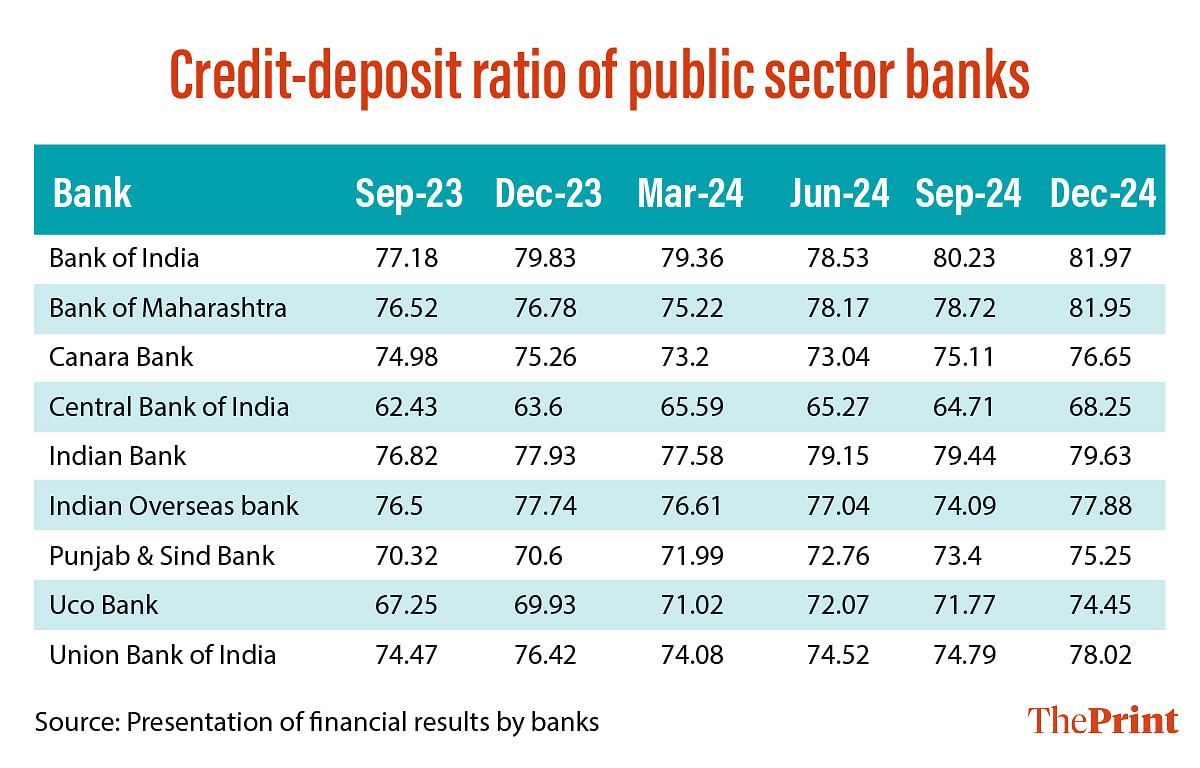

Rise in credit-deposit ratio

Liquidity has been a concern as banks have been grappling for stable deposits for months now. This is reflected in an increase in the credit-deposit ratio for individual banks. The 9 public sector banks that have announced their results for the December quarter show an increase in the credit-deposit ratio. For instance, Bank of Maharashtra’s credit-deposit ratio has increased from 78.72 in the September quarter to 81.95 in the December quarter. For Union Bank of India, the ratio has increased from 74.79 to 78.02 in the same period.

Amid a scramble for deposits in a tight liquidity environment, banks are increasingly relying on issuance of certificates of deposits (CDs). As of 10th January, 2025, the outstanding amount raised through CDs stood at Rs 4.9 lakh crore.

Just-in-time payment system and competition for deposits

An often under-discussed factor impinging upon the system level liquidity is the introduction of the new just-in-time payment mechanism to fund states for centrally sponsored schemes.

The government has introduced the new payment system to improve transparency in fund utilisation. In contrast to the earlier practice, funds for the schemes now no longer sit idle in state government accounts with public sector banks. Instead, they are routed directly to the scheme specific accounts. While the new system has improved the efficiency of fund utilisation, banks are facing repercussions. They get less idle stable deposits of state governments in their current accounts. Consequently, even the big banks are competing for higher deposits.

LCR norms and liquidity tightness

The draft liquidity coverage ratio norms propose an additional 5 percent “run off” factor for retail deposits enabled with internet and mobile banking facilities. Run off factor represents the percentage of deposits that are likely to be withdrawn in times of stress and need to be covered by readily available liquid assets.

While banks have been requesting relaxations in the proposed norms, if implemented in the current form, banks would have to substantially scale up their investment in government securities. This is where the effectiveness of the OMO purchases could be impacted. The conduct of OMO purchases by the RBI would require banks to tender their holdings of surplus G-Sec. The requirement to hold G-Sec to meet the requirements of the liquidity coverage norms would hinder their ability to participate in open market purchases of government bonds by the RBI.

More indicators needed to capture liquidity tightness

The weighted average call rate (WACR) is the operating target for the monetary policy framework. Ideally, changes in the money market should get reflected in the WACR. However, the recent episodes of steep liquidity tightness were not reflected in the WACR. WACR has largely remained range-bound, even in periods when liquidity deficit was above Rs 2 lakh crore. There is, therefore, a case to monitor additional variables such as the rate of interest on CDs and its spread with the policy rate, operations in the Tri-Party Repo, to capture the liquidity tightness in the system. In summary, the liquidity deficit should encourage a thorough review of the liquidity management framework.

Radhika Pandey is an associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy.

Views are personal.

Also read: Amid challenges, the upcoming budget & monetary policy must work in tandem to focus on growth