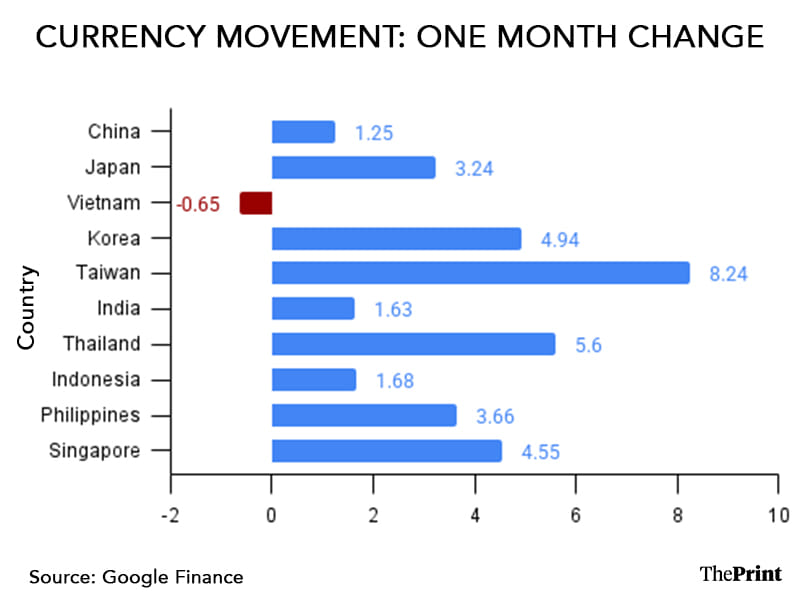

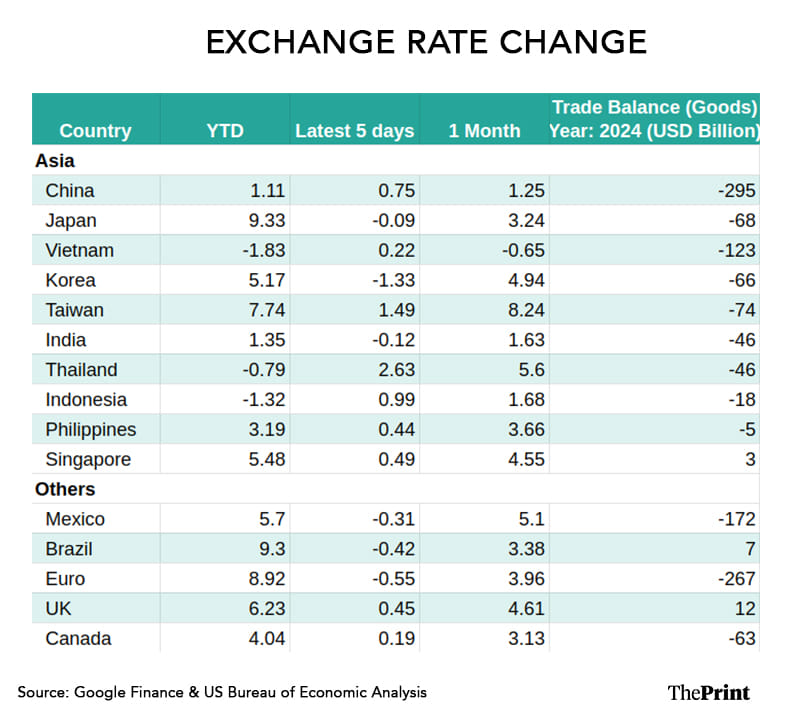

The latest fallout of the Trump tariff-induced uncertainties has been the sharp appreciation of Asian currencies. Led by Taiwan dollar, Asian currencies experienced record appreciation in the last few days as US President Donald Trump’s trade policies fuelled weakness of the US dollar.

Since the crisis of the mid-90s that led to capital flight and steep depreciation of Asian currencies, many economies in the continent, particularly export-oriented ones, have built large piles of dollars, and invested them in US treasury securities. But with the recent flip-flops on tariff policy, the trust in the dollar may be waning, leading to a wave of dollar-selling.

Allowing the domestic currency to strengthen as part of the trade negotiations with the US could also have triggered the rally in Asian currencies.

Taiwan dollar’s unprecedented surge

Taiwanese currency saw the strongest gain, nearly eight percent in the last month. In the last few years, Taiwan has strategically focused on forging strong trade and investment ties with the US, and enjoys a huge trade surplus with the US.

As a consequence, the exporters and investors have built large piles of dollar and dollar-backed assets. With the volatility in the dollar index, exporters and investors, including life insurers, concerned about the build-up of large stock of unhedged dollar holdings are reportedly offloading their stocks of dollars.

Other Asian currencies, such as the South Korean Won, Japanese Yen, Malaysian Ringgit, Singapore dollar and Indian rupee, have also appreciated against the dollar.

Whether the rally in Asian currencies is going to be sustained or is a temporary blip, hinges on several unknowns, but what is certain is that the next few weeks are likely to witness swings in the currency market. This could likely prompt some central banks to step up intervention to protect their currencies from a rapid appreciation.

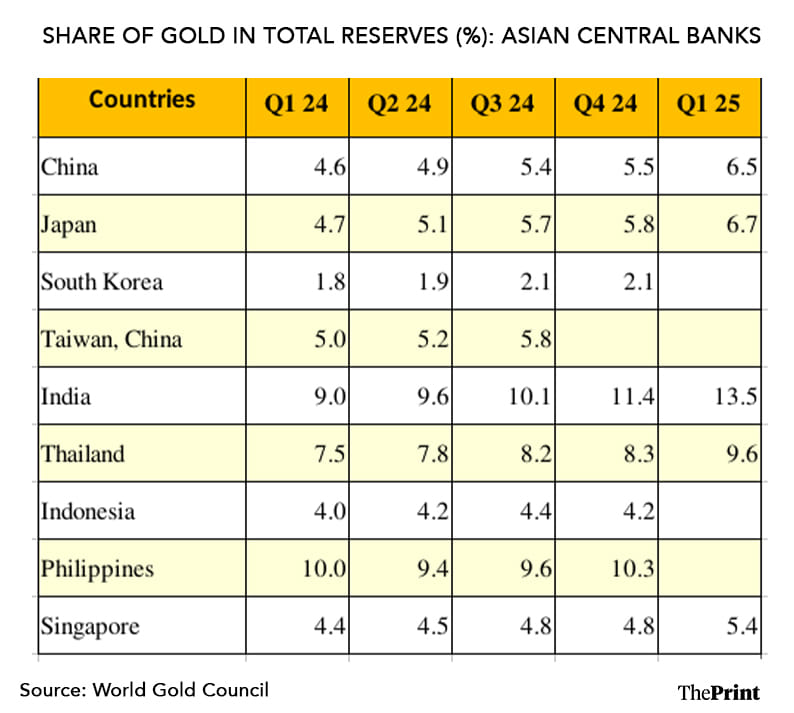

With the unwinding of dollar holdings, the move towards diversification of assets has gained impetus. Globally, investors and central banks are gradually diversifying their assets. Increasing the share of gold in total reserves by Asian central banks is also part of the diversification strategy.

Also Read: India’s 4.4% fiscal deficit target hinges on solid revenue. Global conditions pose a challenge

Role of Asia in US trade

The other possible explanation of the rapid surge in Asian currencies is that some central banks are allowing their currency to strengthen to cede their comparative advantage, in return for tariff concessions from the US.

While there is no certainty on this explanation, the direction and composition of US trade sheds light on why the US would indeed prefer stronger Asian currencies. Notably, the US has long complained that Asian countries have kept their currencies weak through intervention.

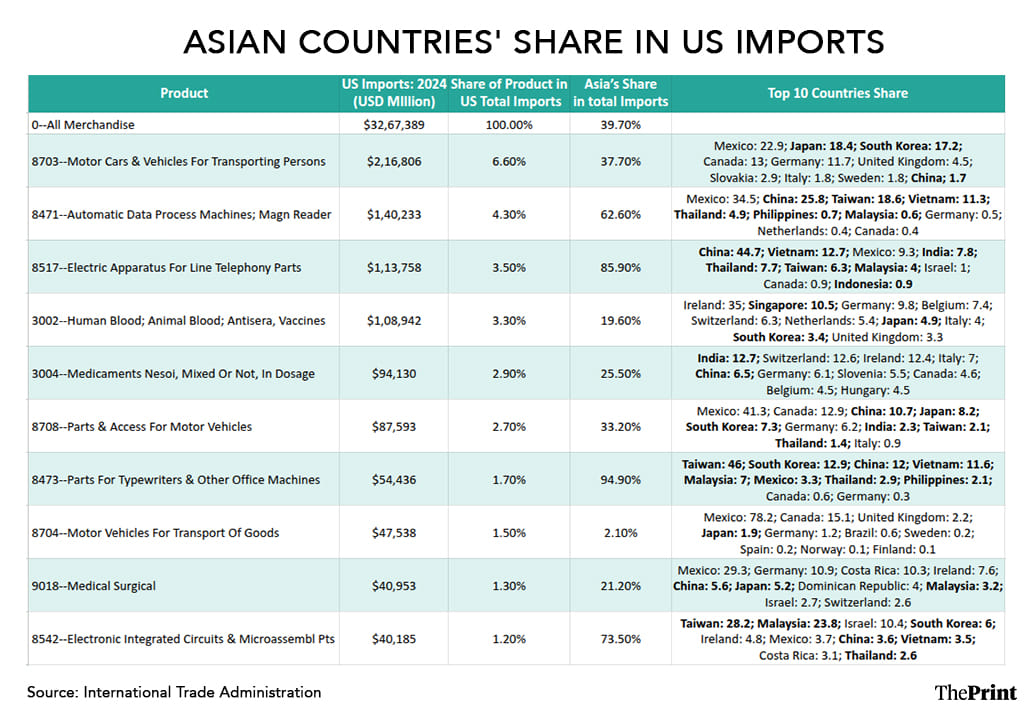

Latest data shows that almost 40 percent of US imports are sourced from Asia. The table below shows US’ top ten imports based on HS 4-digit classification. For the top ten US imports, Asian economies are the prominent suppliers.

For instance, automatic data process machines account for 4.3 percent of the total US imports. Of this, 62.6 percent of the imports are sourced from Asian economies. Similarly in other top US imports, Asian economies have a sizeable presence.

Stronger Asian currencies, and consequently a weaker dollar, would help address the trade imbalances with Asia. For instance with Taiwan, the US has a trade deficit of USD 74 billion in the calendar year 2024.

Rupee appreciation, oil decline & FPI flows

The rupee has also strengthened against the dollar since the second half of April, but driven by a mix of international and domestic factors. From Rs 86.76 to dollar, the rupee has appreciated to Rs 85.45, as of 2 May. The rupee was bolstered by strong foreign portfolio flows and a sharp decline in crude oil prices amid weakness in the US dollar.

Oil prices have fallen amid concerns of supply glut as OPEC (Organisation of the Petroleum Exporting Countries) and its allies have agreed to raise oil output by 411,000 barrels a day, starting June. Falling oil prices could cushion India’s import bill and support the rupee.

After being net sellers for three consecutive months, foreign portfolio investors turned net buyers of Indian equity in April. FPIs bought USD 510 million worth of equity. The positive sentiment of foreign investors was underpinned by weakening of the US dollar and optimism over a US-India trade deal.

While the intervention data comes with a lag of two months, there are indications that the Reserve Bank of India has been intervening sporadically to prevent a sharp appreciation of the rupee.

On the back of a weaker dollar, the RBI is likely cutting down its outstanding short dollar position in the forward market. RBI’s short dollar book position rose significantly in the last few months as it intervened in the onshore and offshore derivatives market to support the rupee, following a sharp dollar surge.

As of February 2025, RBI had a net short position of USD 88.8 billion—a sharp jump from net short position of USD 14.6 billion in September.

Amid an environment of weaker dollar, the RBI is likely opting to moderate its high net short position rather than rolling over the short position. While the cutting of short position could reduce its headline reserves, the impact could be mitigated due to valuation gains on account of rise in gold prices.

How much can Asian currencies strengthen is a challenge that Asian countries would have to grapple with in the wake of the global trade war.

Radhika Pandey is an associate professor and Pramod Sinha is a fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.