At the end of the last year, the outlook for the US economy was strong with no major signs of slowdown going into 2025. The last few months have, however, witnessed a significant change in the underlying growth momentum. The economic uncertainty, rise in prices and weaker growth outlook in the US are challenging the exceptionalism narrative that was the major driver of global markets in the last 2 years.

The economy seems to be on track to record a significant slowdown or possibly a contraction over the previous quarter. The latest reading of the Federal Reserve Bank of Atlanta’s nowcast of real GDP growth suggests a contraction of 2.4 percent in the first quarter (January-March) of 2025. Just a month ago, the nowcast model showed growth at 4 percent for the same period. This latest nowcast is also a sharp decline from the 2.3 percent growth recorded in the fourth quarter of 2024 (October-December).

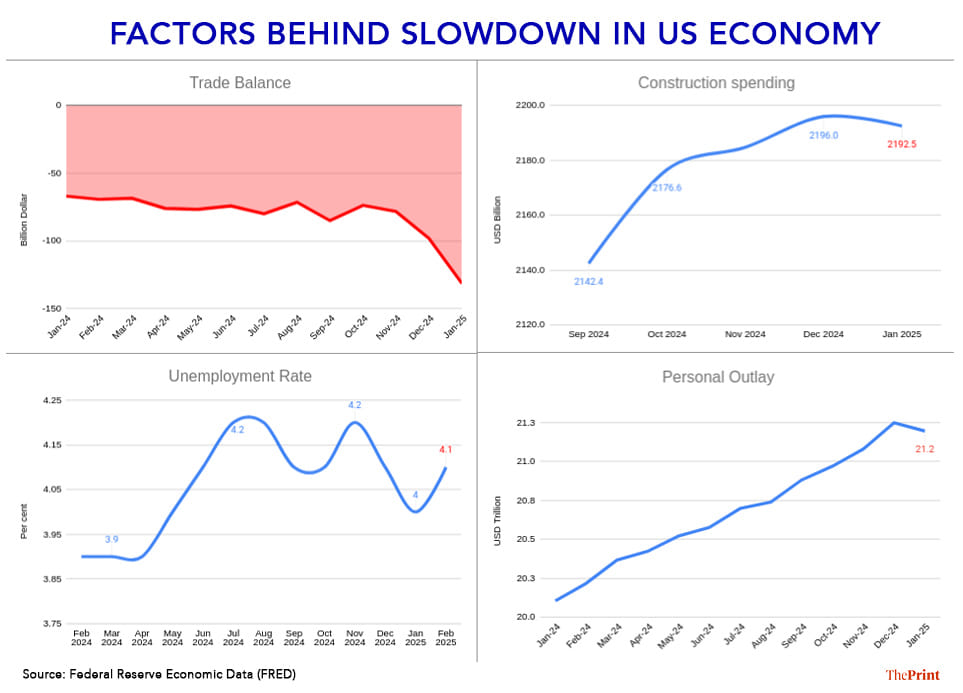

The key driver of the contraction is the sharp surge in imports, which has made the contribution of net exports to GDP considerably negative. This is likely driven by front-loading of imports before the multiple tariffs kick in. Subdued manufacturing sector and construction sector activity also led to downward revision in the nowcast reading.

Also read: India’s cautious approach to cryptos is in stark contrast to Trump’s open arms to digital assets

Record surge in trade deficit

The monthly US trade deficit in goods and services jumped by 33.9 percent in January ahead of the potential imposition of a slew of tariffs. Imports of pharmaceuticals, finished metals and computers witnessed a jump from December to January. While exports rose marginally in January, they are likely to be hit by weaker growth and potential retaliation by trading partners.

Consumers brace for higher inflation

Consumers are also worried about the inflationary impact of tariffs. The University of Michigan’s Consumer Sentiment Index in February at 64.7, slid nearly 10 percent from January. Both the Index of current economic conditions and index of consumer expectations plummeted in February as compared to the previous months. The efforts to shrink the federal workforce and the uncertain ability of the private sector to absorb those workers is likely to impinge on consumer spending.

Reflecting that price pressures are imminent from tariff increases, consumers’ expected path of inflation witnessed a substantial jump in February. Year-ahead inflation expectations jumped up from 3.3 percent in January to 4.3 percent in February, the highest reading since November 2023. Consumers expect inflation to remain elevated as the long-run inflation expectations also edged up from 3.2 percent in January to 3.5 percent in February.

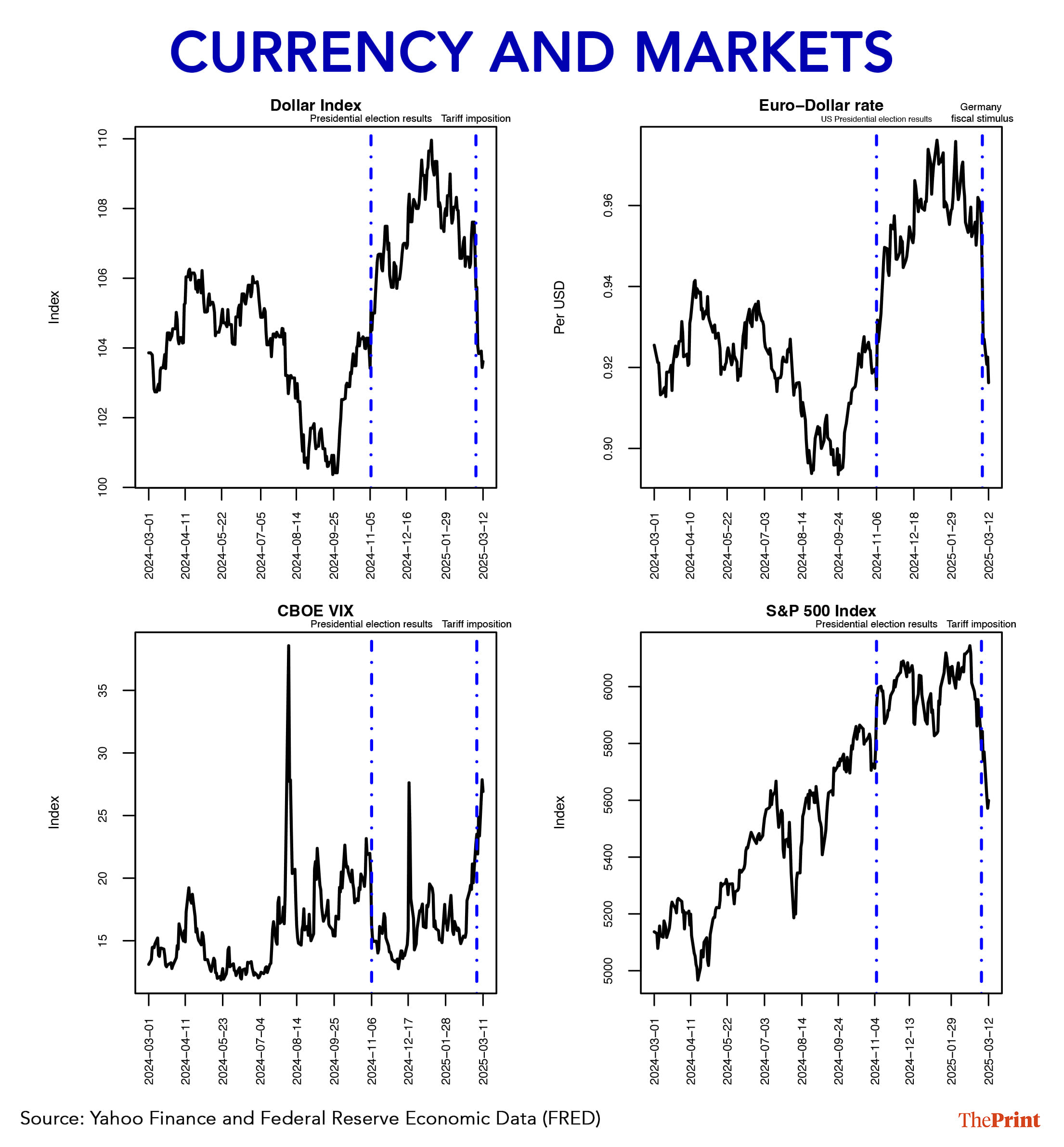

Weakness in dollar index

Fears of slowdown, uncertain policies and prospect of a trade war have weighed on the dollar index as well. The dollar index, a gauge of the dollar’s strength against a basket of currencies, has slumped to its lowest level since October 2024.

While the dollar is languishing, the euro hit a new high in early March. A shift in Germany’s fiscal stance from strict adherence to fiscal rules to a tolerance towards deficit through increase in defence and infrastructure spending has propelled the euro, at least in the short-term. To the extent the additional expenditure on defence and infrastructure is directed towards domestic producers, it will lift demand in the German economy. In contrast, if the additional spending is sourced through imports, it will be beneficial for Germany’s trading partners. In both cases, the shift towards fiscal easing has imparted strength to the euro and weakened the dollar.

Markets have turned jittery

Markets initially cheered Trump’s policy agenda hoping that it will rev up growth, but since the middle of February, Trump’s multiple tariff salvos have spooked the markets. Concerns over inflation, growth slowdown and geopolitical tensions are weighing on the markets. The possibility of escalating trade disputes amid the back-and-forth tariff moves have deepened the sell-off in the US equity markets and created uncertainty for businesses and investors. The CBOE volatility index, which measures the expected volatility over the next 30 days has spiked more than 50-60 percent since the week of Trump’s inauguration.

With markets turning nervous, the demand for safe haven US government debt has increased. Yields on the US 10-year bonds are down by nearly 60 basis points since the middle of January. Similar to the gauge of equity market volatility, the ‘MOVE’ index of implied volatility in the US treasury market is also the highest in 4 months. Additionally, credit spreads, an important measure of risk across US markers have widened over the past few weeks.

From trade war to debt war

The federal budget deficit surged to USD 1.1 trillion in the first 5 months of fiscal year 2025. The deficit is roughly 38 percent higher than the same period in 2024. The current administration’s priority of making the tax cuts permanent could increase the debt further. The outstanding debt has ballooned to USD 36.2 trillion, and approximately USD 9.2 trillion of existing debt will either mature or will need refinancing during 2025.

Of deeper concern is the possibility that the escalating trade war could spiral into a debt war. The retaliation from the US trading partners may not only come in the form of counter-tariffs, they may also respond by reducing their stock of US treasury holdings. The selling pressure could lead to rise in bond yields and push up borrowing costs across the board for the US, posing problems for debt sustainability.

Radhika Pandey is an associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Big GDP data revisions can impact policy-making. Method behind advance estimates needs improvement