An analysis of the finances for 23 states for the first half of the current year shows that there has been a significant improvement in the expenditure quality of states. Capital expenditure of states grew by a significant 52 percent over the same period last year. Growth in revenue expenditure is modest at 9.7 percent.

While taxes have increased by 15 percent, states’ performance differs considerably on the deficit front. The timely release of tax devolution to states and a pick up in the 50-year interest free loans for capex by states will support their finances, the discontinuation of the GST compensation and the tapering of grants are likely to exert pressure on some states’ fiscal performance in the coming months.

Improvement in quality of expenditure but variations persist

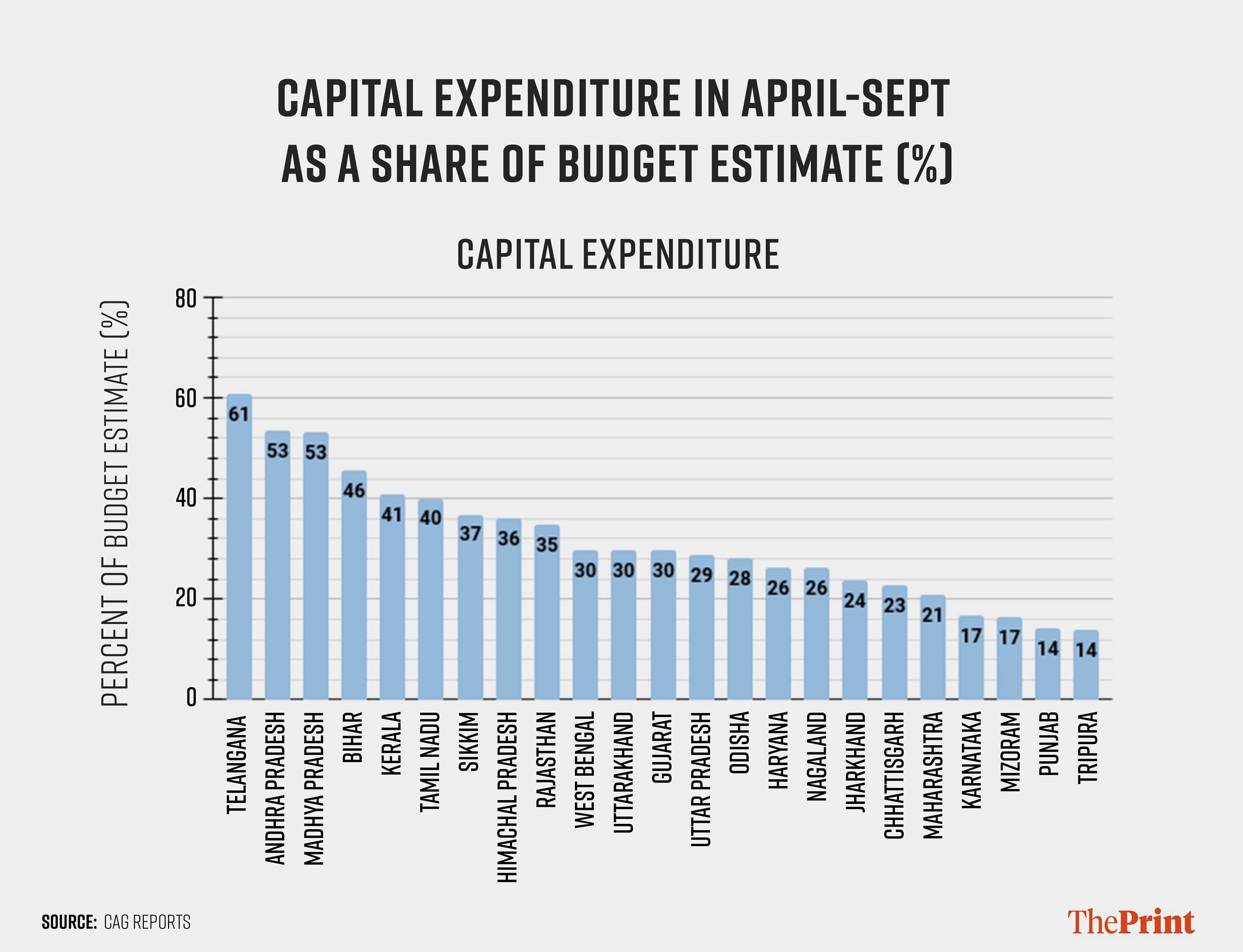

In the current fiscal, states have budgeted Rs 8.14 lakh crore towards capital expenditure. Of this, Rs 2.63 lakh crore has been spent in the first half, up 52 percent from the corresponding period a year ago.

In the first half of the last financial year, states had spent Rs 1.72 lakh crore. While states are prioritising capital spending, the support from the central government in the form of the 50-year interest-free loans is also helping states maintain their momentum on capex.

On an aggregate basis, states have spent more than 32 percent of the budgeted expenditure in the first half of the year. But there are considerable variations among states. Andhra Pradesh, Madhya Pradesh and Telangana have spent more than 50 percent of their budgeted capex in the first half.

Bihar, Kerala and Tamil Nadu have also spent more than 40 percent of their budgeted capital expenditure in the first half. In contrast, Punjab and Karnataka are clear laggards whose actual capex spending is less than 20 percent of their budgeted estimate during April-September. The bulk of the expenditure incurred by these two states is in the nature of revenue expenditure in this period.

Notably, Telangana, Andhra Pradesh and Uttarakhand have seen a triple digit growth in capital expenditure in the first half of the financial year.

Most of the states have reported a double-digit growth in capital expenditure, however in Punjab, Karnataka, Kerala and Himachal Pradesh, capital expenditure this year has declined as compared to last year.

Another metric to assess the quality of expenditure of states is the share of budgeted capital expenditure to the budgeted total expenditure. While for most of the states, capital expenditure accounts for 12 to 20 percent of the overall expenditure, in Gujarat, Odisha and Uttar Pradesh, capital expenditure accounts for more than 20 percent of the budgeted expenditure.

Among the smaller states, Nagaland has budgeted almost 35 percent of the expenditure in the form of capital spending.

Deficit position: Fiscal surplus in some states, overshooting of budgetary targets by others

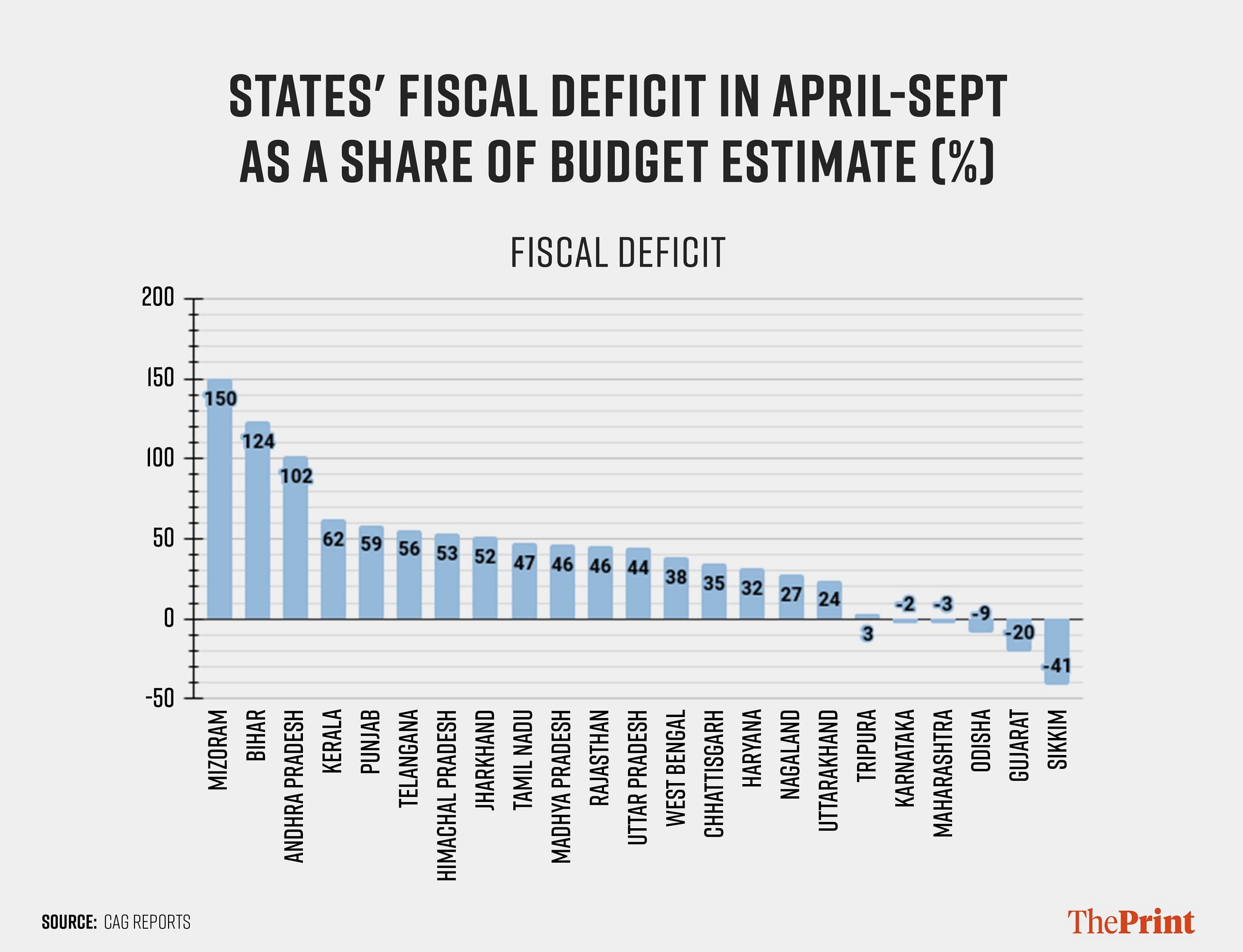

For the current year, the fiscal deficit of states is budgeted at Rs 9.6 lakh crore.

In the first six months, the states’ fiscal deficit at Rs 3.5 lakh crore accounted for almost 37 percent of the budgeted target. Again, there are wide variations in the fiscal performance of states.

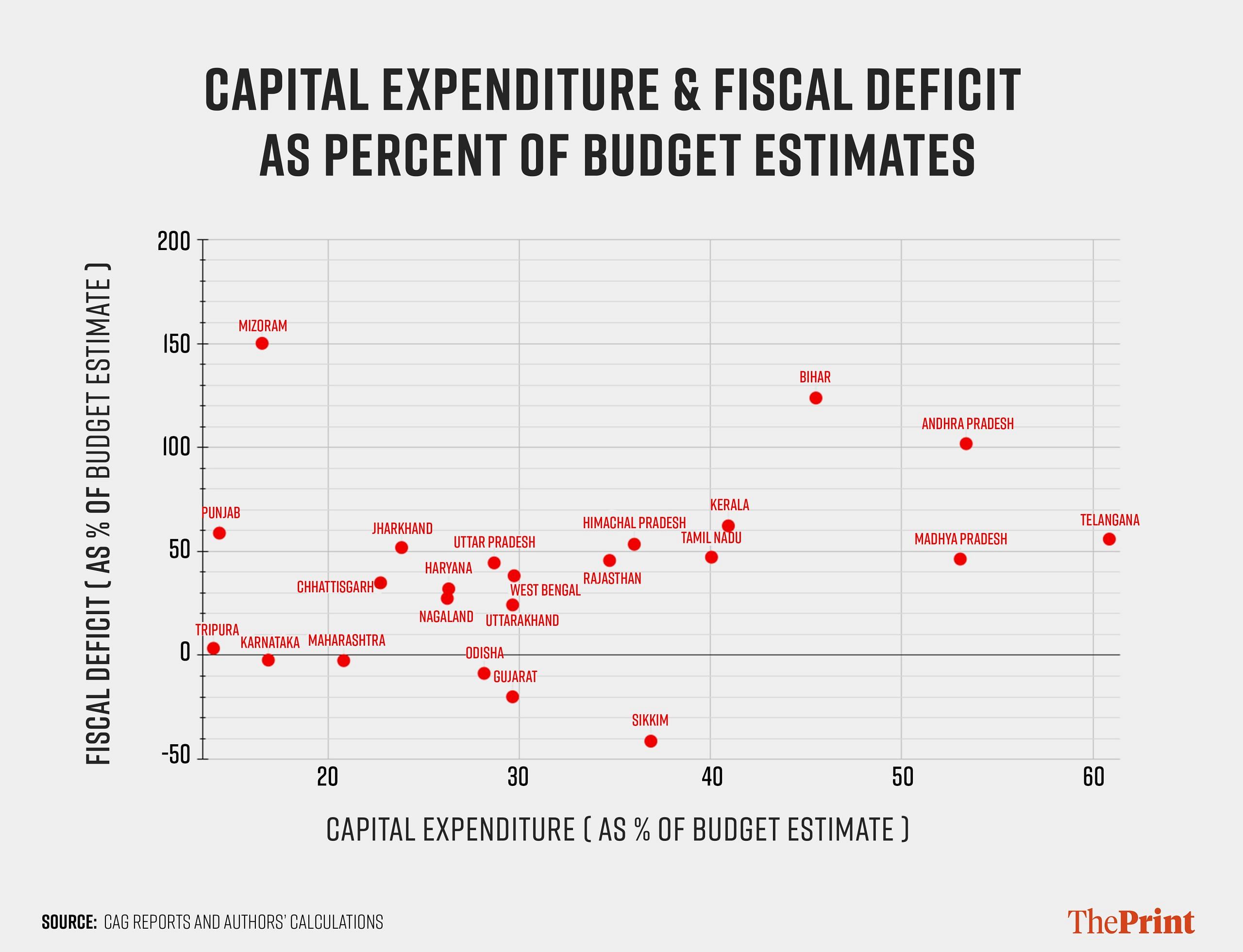

Gujarat, Maharashtra, Odisha and Karnataka have managed to achieve a fiscal surplus in the first half of the financial year. These states had a surplus on their revenue account as well.

Notably in Karnataka, while revenue expenditure in the first half was strong: amounting to 42 percent of the budgeted expenditure, the reduction in fiscal deficit has been mainly due to a reduction in capital expenditure. Only 16.8 percent of the budgeted capex has been spent this year as compared to more than 33 percent incurred in the corresponding period of the last year.

On the other end of the spectrum are states like Andhra Pradesh and Bihar that have already exceeded their budgeted fiscal deficit targets. Among the poll-bound states, Mizoram has exceeded its budgeted fiscal deficit target for this year. Telangana has also incurred 56 percent of its budgeted target in the first half of the financial year but has a higher capital spending.

States that have reported revenue deficits or have substantially overshot their budgeted fiscal deficits will need to address their fiscal imbalances in the coming months.

Recent Finance Commissions have recommended grants to states to eliminate their revenue deficit.

The Fifteenth Finance Commission recommended Rs 2.9 lakh crore as post devolution revenue deficit grants to 17 states for the period 2021-22 to 2025-26. A substantial part of the grants has been awarded in the first three years of the award period. These grants will taper off in the next two years. Thus, without the cushion provided by these grants, states will have to augment their revenues or cut expenditure to achieve a surplus on their revenue account.

Revenue position

On the revenue front, of the 23 states, 14 states have managed to achieve more than 40 percent of their budgeted revenue receipts in the first half, with Gujarat being the top performer. While most of the states have registered a growth in revenue receipts in the April-September period as compared to the same period last year, three states-Punjab, Tamil Nadu and Kerala have seen a contraction in their revenue receipts.

Among the big poll-bound states, Telangana, Madhya Pradesh and Chhattisgarh have seen more than 10 percent increase in revenue receipts, while Rajasthan’s revenue receipts grew by 6.5 percent in the first half of the current year.

Revenue receipts of states typically comprise of tax revenues, non-tax revenues and grants-in-aids. Most of the states have seen a double-digit growth in taxes except for Kerala and Tamil Nadu.

While Gujarat has achieved more than 50 percent of its revenue receipts in the first half, a major contributor towards this stellar performance has been the category of grants-in-aid.

Gujarat has exhausted more than 98 percent of the budgeted grant-in-aid in the first half. This implies that the state has to now rely on its own taxes and non-tax revenue to achieve the budgeted target for revenue receipts. In Telangana also, grants-in-aids have played a crucial role in pushing up the revenue receipts.

Summing up

On a comparative perspective, states that have incurred more than 50 percent of their budgeted fiscal deficit but have also registered decent capital spending are better placed as compared to states that have reported higher deficits but lower capital spending.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.