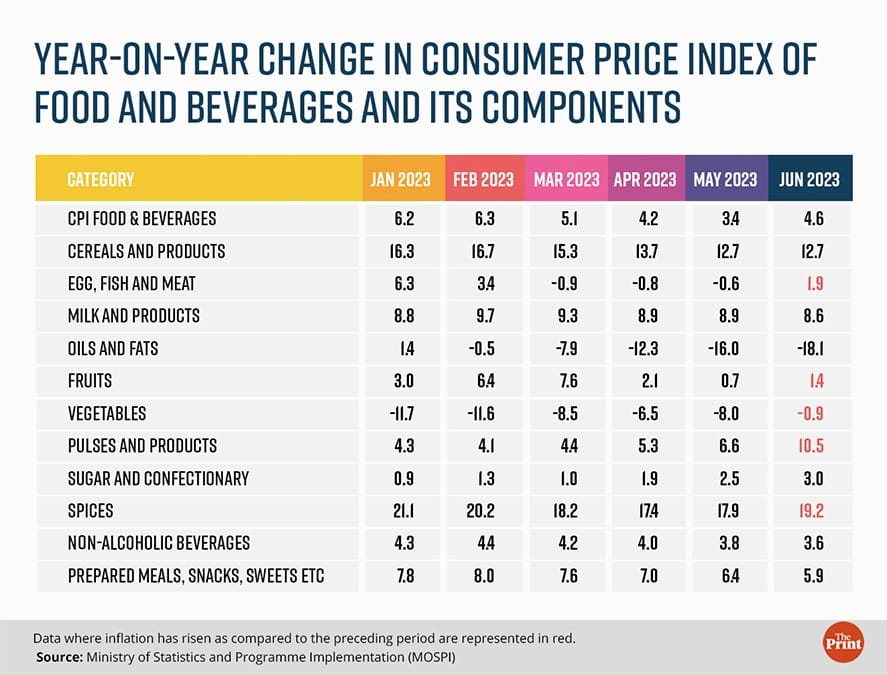

India’s consumer price index (CPI)-based inflation surged to 4.81 percent in June from 4.3 percent in May on the back of higher food inflation, while core inflation remained broadly stable. Food and beverages inflation jumped from 3.35 percent in May to 4.7 percent in June. Rise in food prices was driven by higher prices of vegetables, pulses and their products, spices, eggs, meat and fish. While the jump in vegetable prices was on expected lines, the worrying part is the inflation in cereals and their products.

On a year-on-year basis, inflation in cereals remained stable, but on a sequential basis, there was a reversal of three months of declining trend in cereal prices.

In addition to the seasonal uptick, weather-related disruptions have led to a jump in food inflation. Persistently high food inflation could force the Reserve Bank of India (RBI) to keep the rates on hold for longer.

On a positive note, however, the non-food prices eased owing to moderation in crude, commodity and raw material prices.

Drivers of food inflation

Pulses inflation jumped from 6.62 percent in May to 10.5 percent in June, driven by prices of arhar, moong and urad. While prices of pulses have surged due to the uneven monsoon that impacted sowing, policy interventions by the government such as the removal of the 40 percent cap on procurement could encourage farmers to increase the sowing area and reduce the spike in prices.

Cereals also showed a double-digit inflation at 12.7 percent (similar to the year-on-year change in May). The recent spike in cereal inflation is driven by rice. After grappling with a year of rise in wheat prices, the jump in rice prices — with wheat prices remaining firm — could pose a fresh set of challenges.

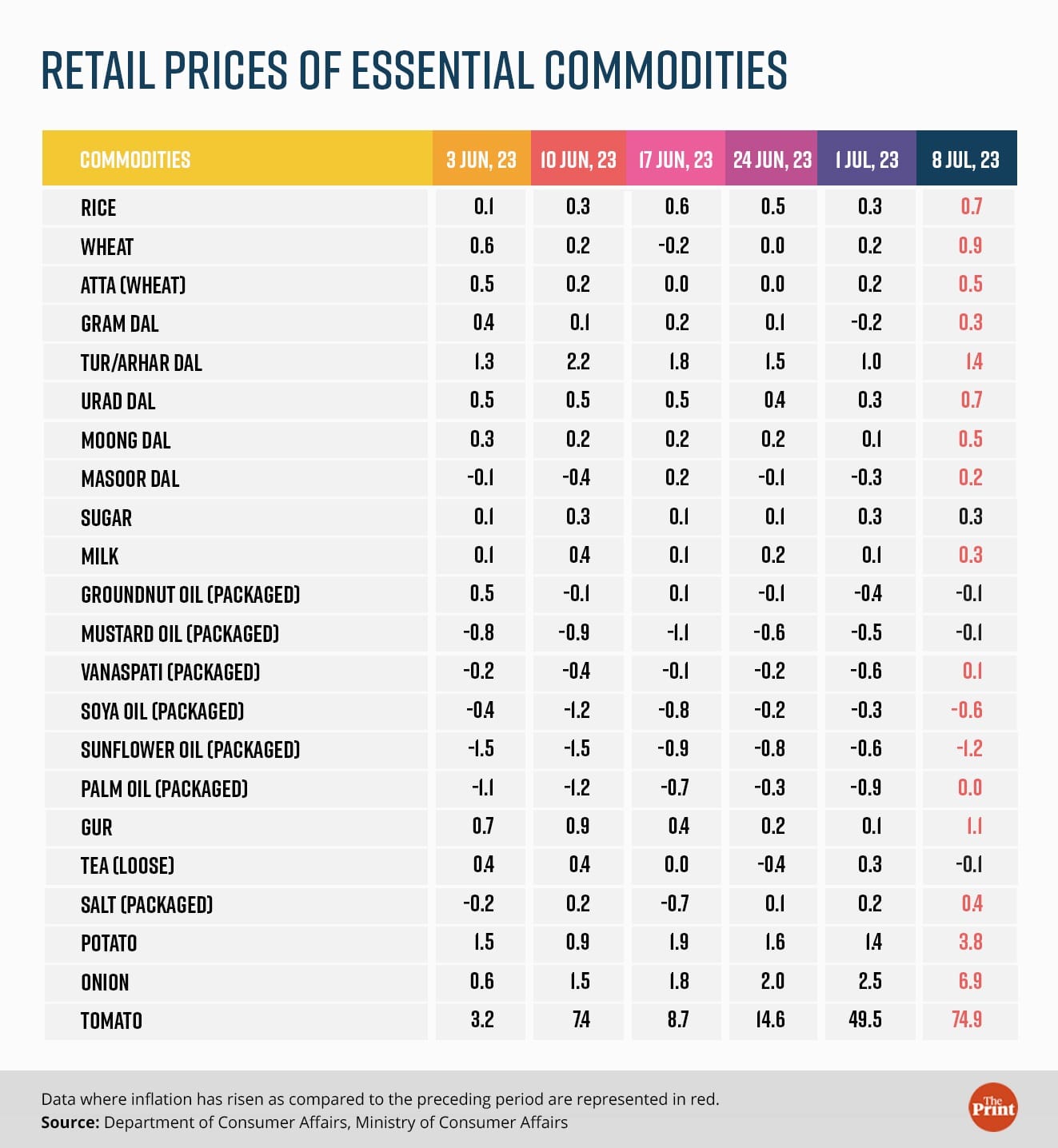

According to data released by the Department of Consumer Affairs (DCA), Ministry of Consumer Affairs, the retail price of rice has risen from Rs 39.4 per kg for the week that ended on 3 June to Rs 40.3 per kg for the week that ended on 8 July. During the same period the retail price of wheat remained broadly stable around Rs 39.1-Rs 39.4 per kg.

The recent increase in the minimum support price for paddy coupled with the progress on sowing will determine the trajectory of cereal prices in the coming months.

Vegetable prices remained in the contraction zone but the pace of contraction has moderated substantially in June. In June, vegetable prices were just 0.1 percent lower than a year ago as compared to 8 percent lower than a year ago in May.

Interestingly, tomato prices that have skyrocketed in the past few weeks are still lower than the corresponding month of last year, though the pace of contraction has moderated. Tomato prices saw a contraction of 53 percent in May. In June the disinflation narrowed to 35 percent.

Spices recorded a sharp 19.2 percent inflation in June, from 17.9 percent in May, due to a jump in jeera prices.

While milk inflation remained elevated at 8 percent, the prices of edible oils that had shot up in the wake of the ongoing Russia-Ukraine war, helped in offsetting the rise in food inflation. June was the third consecutive month of double-digit contraction in edible oils.

What lies ahead in July?

Early indications point to escalating price pressures in July.

Of the 22 commodities tracked by the DCA, the prices of 15 commodities have registered a week-on-week jump between 1 July and 8 July. The biggest jump is seen in tomato prices, with prices being 75 percent higher at the end of the week closing on 8 July than in the previous week.

Prices of rice, wheat and pulses have seen a surge in the week that ended 8 July as compared to the previous week.

However, a revival in rainfall in July could boost sowing and trigger a reversal in food prices.

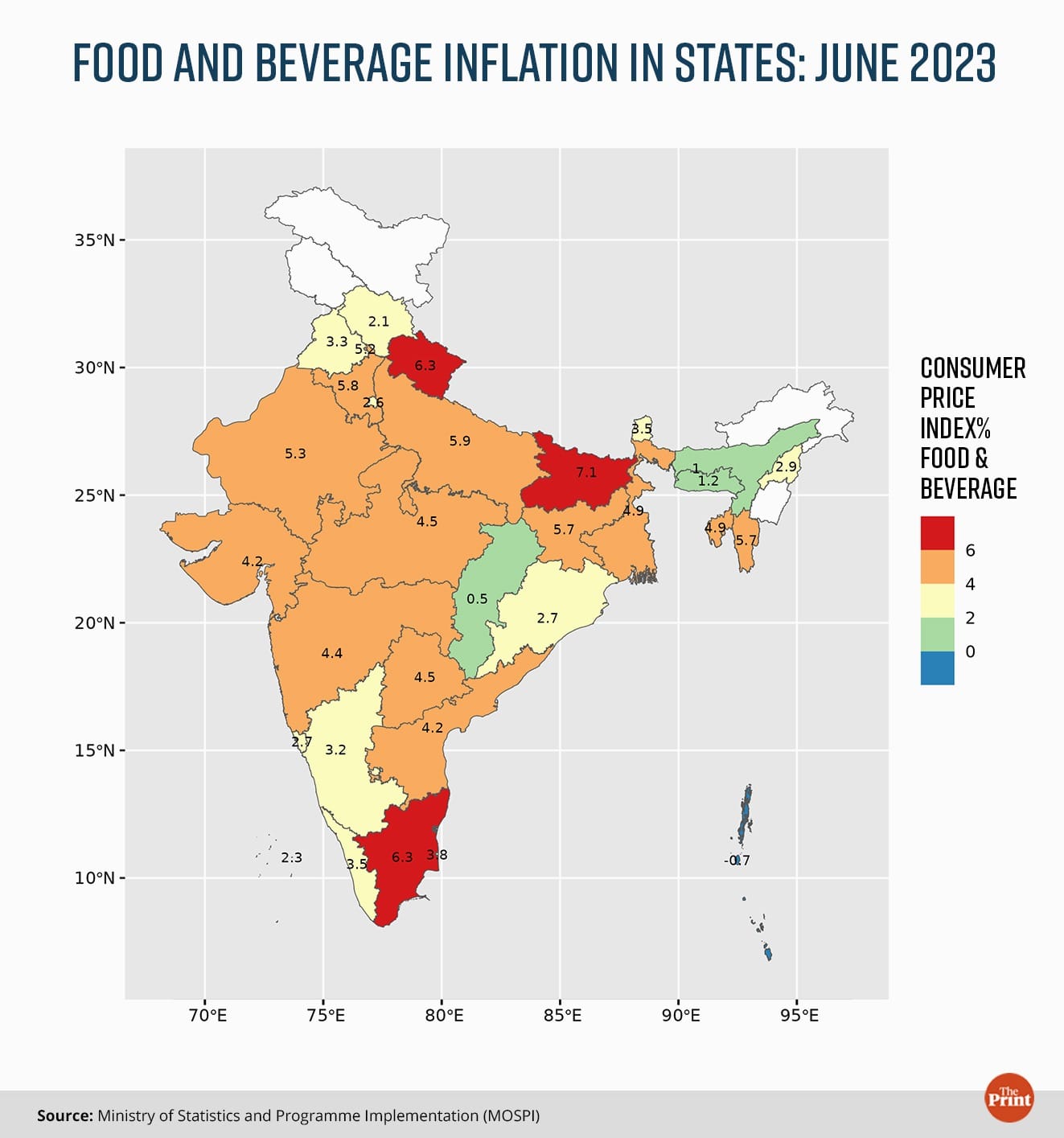

States inflation

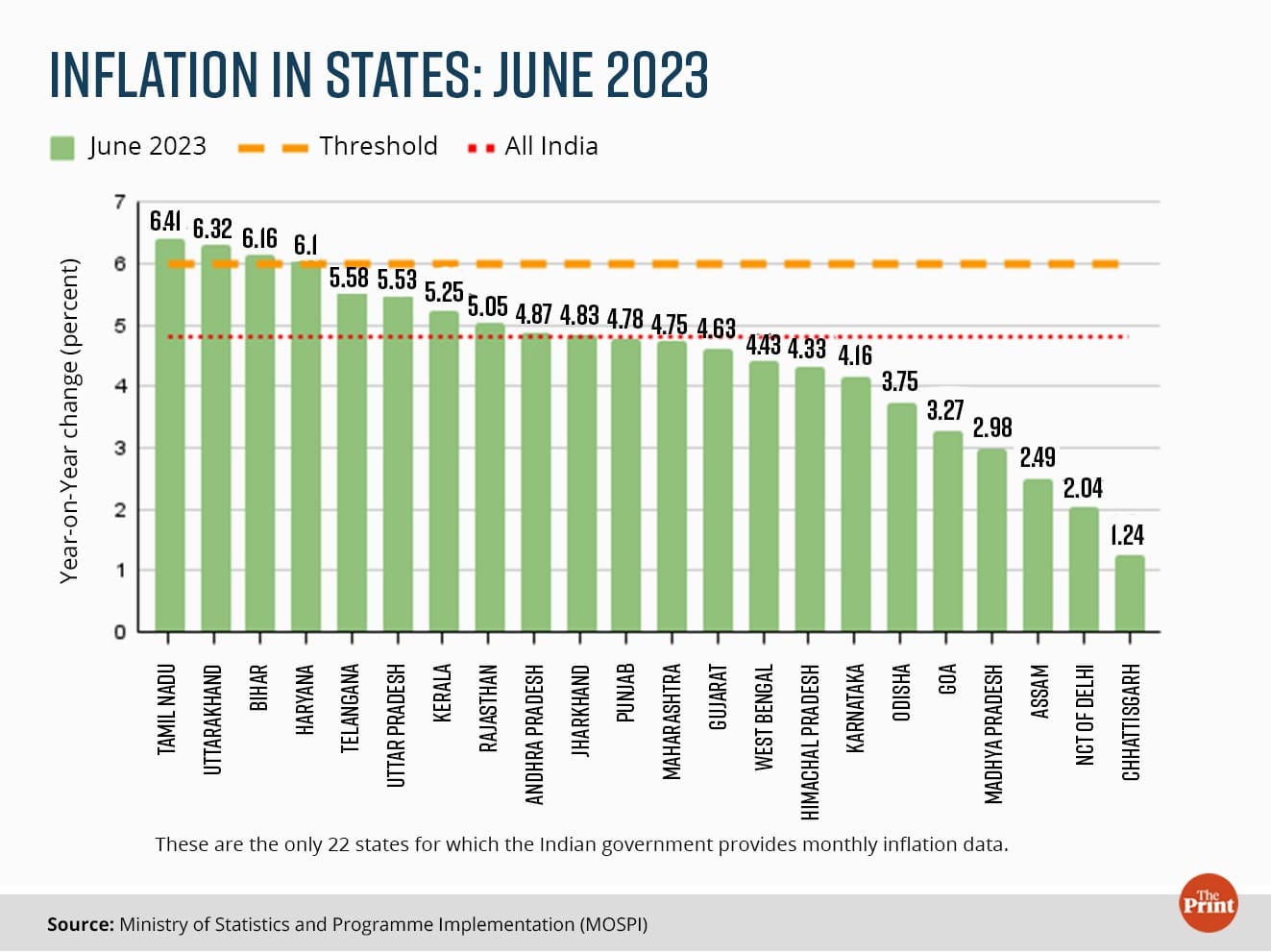

Inflation in 10 of the 22 major states was above the all-India average of 4.8 percent in June.

Among the major states, Bihar, Tamil Nadu, Uttarakhand and Haryana registered inflation of above 6 percent in June.

Of these four states, while rural inflation (at 7.11 percent) in Haryana outpaced urban inflation (4.89), in Uttarakhand, it was the urban inflation (at 7.75 percent) that led to a spike in the overall state inflation.

Food inflation in Bihar, at 7.13 percent, was the highest amongst all the states in June, due to increase in the prices of cereals, spices and vegetables.

US inflation rose at its slowest pace in more than 2 years, but tight monetary policy to continue

On a year-on-year basis, the US CPI inflation registered a growth of 3 percent in June. Core inflation also moderated from 5.3 percent in May to 4.8 percent in June.

While inflation has cooled significantly from the peak of 9 percent, it is still above the 2 percent target with core inflation still elevated at 4.8 percent.

In addition to the inflation print, the state of the labour market is also a crucial determinant of the interest rate decision of the US Federal Reserve. While non-farm payrolls, a crucial indicator of employment, increased by 209,000 (below the consensus estimate), the unemployment rate was 3.6 percent in June, down 0.1 percent from the previous month.

On the positive front, the moderation in inflation would lower the pressure on government bond yields as Indian bond yields are seen to closely mirror the US bond yields.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: India-US trade ties deepening, but Modi may need to commit to easing protectionist policies