Earlier this week, Indian stock markets plummeted, mirroring the global trends after the weak jobs data in the United States reignited fears of a recession. Interest rate hike by the Bank of Japan and escalating tensions in the Middle East also spooked market sentiments. China and Europe are already grappling with slowdown. Going forward, while Indian markets are in a relatively better position, near-term volatility cannot be ruled out.

Slowdown in US labour market

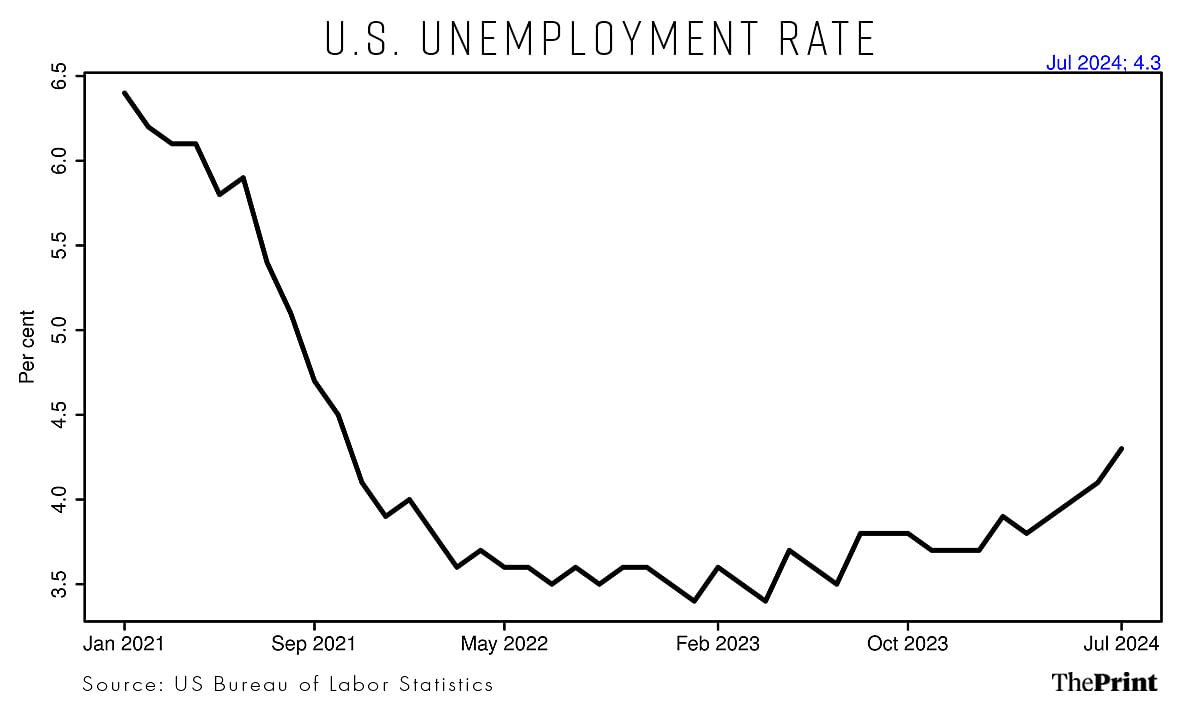

Despite a tight monetary policy, the US jobs market has shown resilience in the last two years, with the unemployment rate ranging between 3.5-3.8 percent. But recent data on the jobs front point to weakness in the US economy.

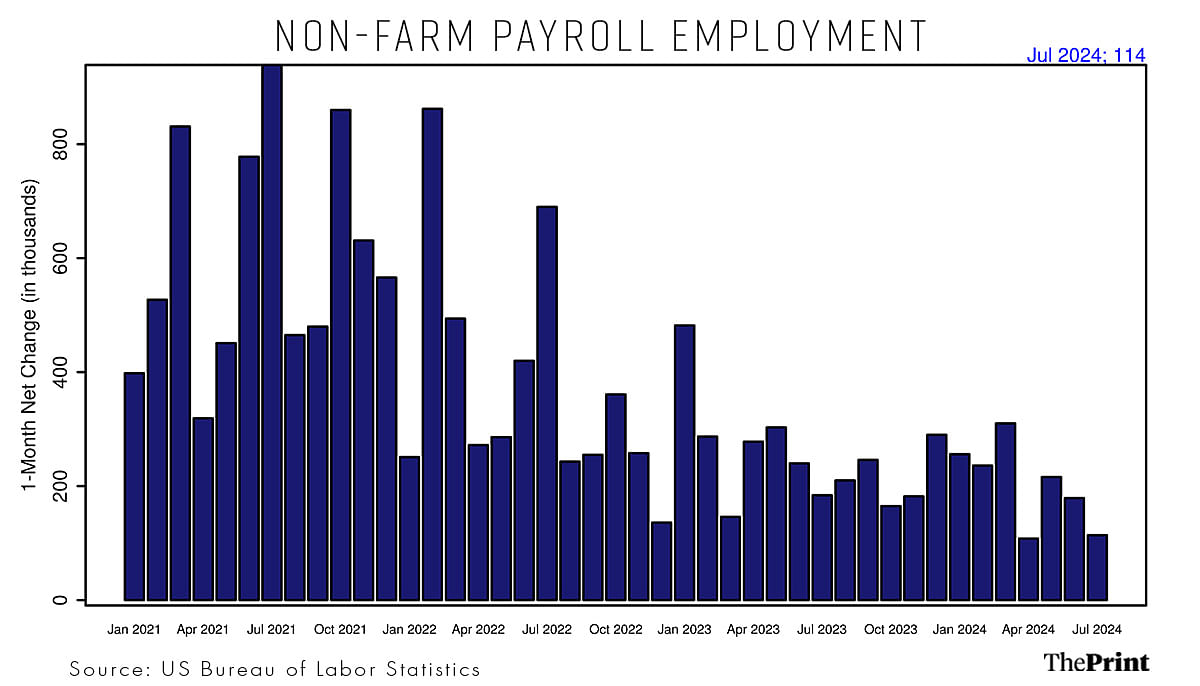

Job growth measured by the US non-farm payroll employment grew by just 114,000 in July, much below the average of 215,000 over the past 12 months. Alongside weak employment generation, the unemployment rate also edged higher to 4.3 percent in July from 3.5 percent a year earlier.

The number of unemployed rose to 7.2 million, up from 5.9 million in July 2023. The number of people employed part-time, due in part to the non-availability of full-time jobs, also increased in July.

The recent state of the jobs market has brought into focus the famous Sahm Rule Recession Indicator. The Sahm Rule signals the onset of a recession, when the current three-month moving average in the unemployment rate is half a percentage point or more above the low of the past 12 months.

The July reading of the indicator at 0.53 shows that the US economy is in recession. While it may be premature to conclude that the US is in recession purely on the basis of high unemployment rate, there are definite signs of a slowdown.

Beyond the macro picture, the muted quarterly financial performance of the technology companies amid a wave of layoffs could exacerbate the weakness in the labour market. Weak employment outlook and concerns that the US central bank may be behind the curve in ensuring a soft landing has triggered caution in global and domestic markets.

Interest rate hike in Japan & unwinding of carry trade

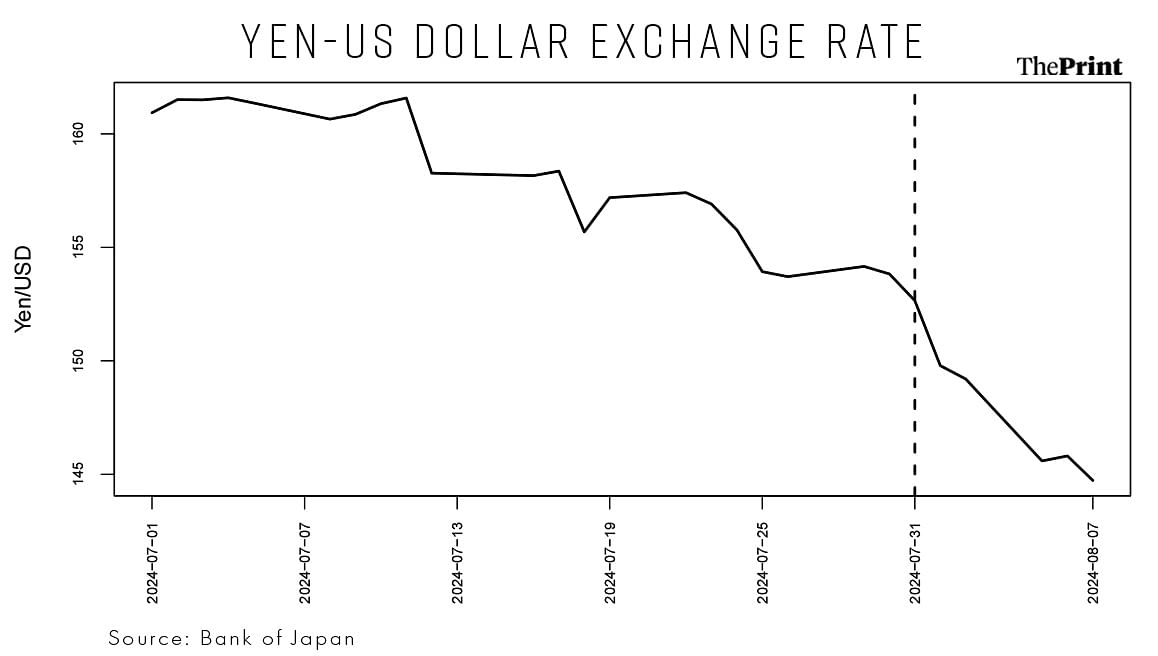

Last week, the Bank of Japan raised its short-term policy rate to 0.25 percent and unveiled a plan to taper its massive bond buying. This is the second interest rate hike this year following the one in March, when the bank ended its negative interest rate regime. The rate hike was in response to inflation risks, which is projected at 2.1 percent for the current year and 1.9 percent for the next year.

A shift from ultra-loose monetary policy led to the strengthening of the Japanese currency against the US dollar. While the decision to raise interest rate is beneficial for Japan’s economy, it had an adverse impact on Yen-funded carry trade, leading to disruptions in global markets.

Carry trade is a strategy that involves borrowing in a currency with low interest rate and investing in currencies and assets that offer higher returns. But when interest rates in the base currency start rising, the profit margins associated with the strategy tend to shrink.

With near zero interest rates in Japan till the end of July, investors were borrowing in yen and investing the borrowed amount in relatively higher yielding assets, such as Indian government bonds. The strategy was profitable even after accounting for exchange rate conversion (from yen to dollar and from dollar to rupee) and hedging costs.

The implication of the recent rate hike by the Bank of Japan on carry trade is twofold. First, a rise in interest rate makes borrowing in yen costly and lowers the overall profits. Hike in interest rate lowers the yield differential between yen and other high yielding currencies.

Secondly, a rise in interest rate could fuel foreign capital inflows, further strengthening the Japanese yen. The rise in interest rate and strengthening of the yen has led to losses for those engaged in carry trades with yen. With possibility of further rate hikes in Japan and rate cuts in the US amid recession fears, investors would be prompted to evaluate their risk-return strategy, leading to volatility in markets.

Another potential channel through which the appreciation of yen could possibly impact India is through yen-denominated borrowings. Some of the infrastructure projects are funded through yen-denominated loans. The cost of servicing yen-denominated debt may inch up in the event of a sustained appreciation of yen.

RBI holding rates a prudent move

Amid uncertainty in the global economic landscape, the Reserve Bank of India has rightly maintained a status quo on the policy rate and stance. Major global central banks have started cutting interest rates or are likely to do so in the coming months.

The Bank of England last week cut the policy rate by 25 basis points to 5 percent. The US Federal Reserve voted to keep its benchmark rate unchanged in its last meeting, but is likely to announce a cut next month, given the weakness in the labour market.

Escalation of tensions in the Middle East has led to volatility in oil prices. The weather remains another source of uncertainty. While rainfall is expected to be above normal, there are concerns about the spatial distribution, leading to an upward pressure on food prices.

India’s core inflation may have bottomed out and is likely to register an uptick. In this backdrop, it is prudent to wait for more clarity on the drivers of inflation and the evolving global environment.

Radhika Pandey is associate professor and Madhur Mehta is a research fellow at National Institute of Public Finance and Policy (NIPFP). Views are personal.