The government has set out with an ambitious fiscal deficit target of 4.4 percent for the current year. This is, however, contingent on strong tax collections, disinvestment revenue and large dividend from the Reserve Bank of India and other central Public Sector Undertakings.

In the financial year that just concluded, India’s direct tax collections in gross terms posted a robust growth of 15.59 percent, reaching Rs 27.02 lakh crore. After accounting for refunds, the net direct tax collections at Rs 22.26 lakh crore grew by 13.57 percent in the same period. This year, however, tax collections growth could come under pressure owing to mounting global challenges.

Corporate tax collections are likely to slow down due to tariff-induced uncertainty and volatile global conditions. Export dependent sectors, in particular, could see a hit to their margins, affecting the budgeted corporate tax collections. Collections from income tax are also likely to be uncertain as the Rs 1 lakh crore tax relief announced in the budget could weigh on revenues.

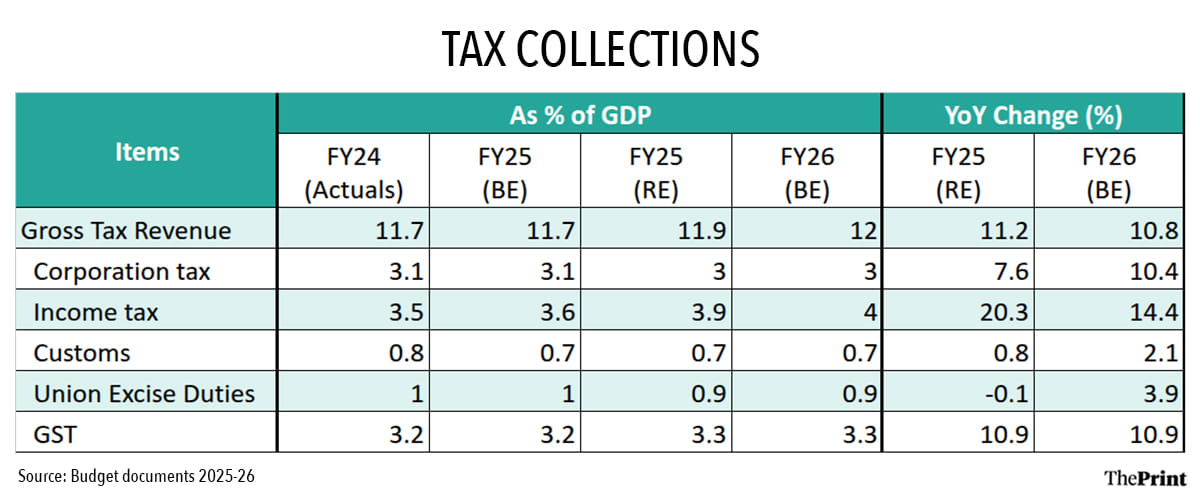

The budget has assumed nominal GDP growth of 10.1 percent, growth of gross tax revenues at 10.8 percent. Income-tax collection is estimated to grow 14.3 percent, while corporation tax collection is projected to grow 10.4 percent in the current financial year.

All these projections will need to be recalibrated in light of the uncertain global environment. On the positive side, the ongoing trade negotiations between India and the US could brighten up export prospects and cushion the impact to the fisc.

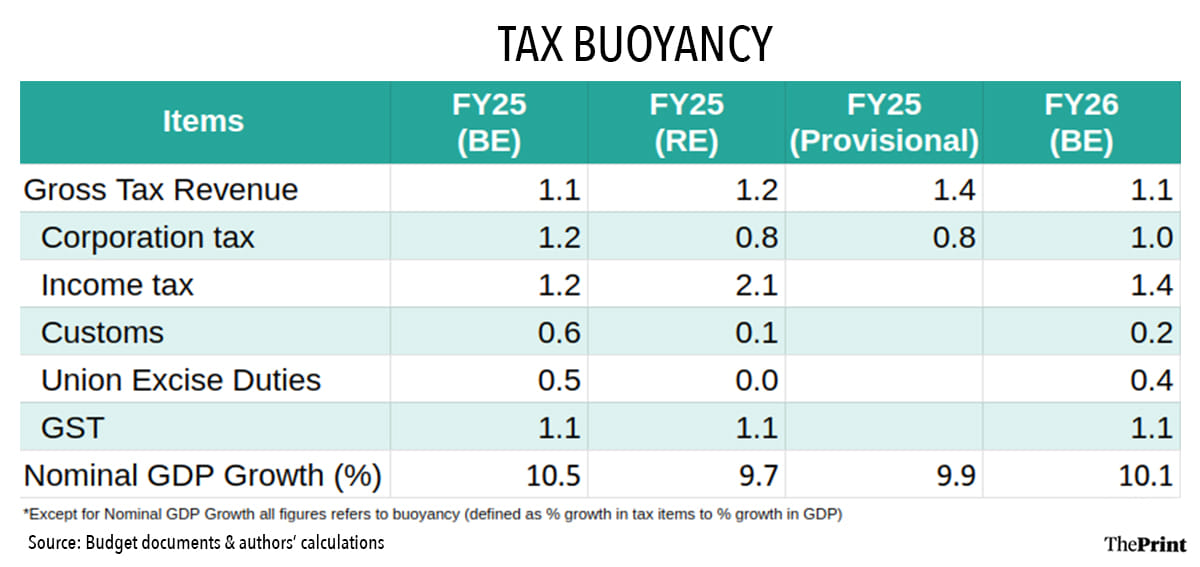

Tax buoyancy likely to come under pressure

The data from the Central Board of Direct Taxes shows that corporate tax collections net of refunds grew by 8.3 percent in FY25, better than the revised estimate of 7.6 percent.

With an estimated GDP growth of 9.9 percent for FY25, the corporate tax buoyancy comes to be less than 1 for the previous year. Thus, even before factoring in the impact of tariff-induced uncertainty, the corporate tax buoyancy is seen to be under pressure, implying that corporate tax collections are not rising in tandem with the size of the economy.

The current year’s budget estimates assume corporate tax buoyancy to be more than 1. Achieving a corporate tax buoyancy of 1 or higher would require corporate tax collections to grow as fast as nominal GDP.

The ongoing global trade war is likely to lead to significant supply chain reconfiguration, resulting in higher overall costs for firms and lower profit margins. In this backdrop, the corporate tax buoyancy is likely to be much lower.

Likely slowdown in real GDP to impact taxes

GDP growth for the current year is projected at 6.5 percent. India’s GDP could take a direct 0.38-04 percentage point tariff-led hit this year. The recent sustained moderation in commodity prices is likely to keep the wholesale price index based inflation range-bound.

Given the likely moderation in real GDP growth and the benign outlook on inflation, the projected nominal GDP growth of 10.1 percent for the current year appears optimistic and could see a dip to nearly 9 percent. A fall in nominal GDP could hurt tax collections and challenge the overall fiscal math for FY26.

Customs duty collections could taper further

The government has budgeted customs duty to grow by a modest 2 percent—well below the nominal GDP growth, in view of the cuts in custom duty announced in the budget.

The import tariff on Harley-Davidson motorcycles was previously brought down from 50 percent to 40 percent, while Bourbon whiskey saw a cut from 150 percent to 100 percent.

India and the US are engaged in discussions for further tariff reductions to boost bilateral trade. Consequently, even moderate decline in customs collections could impact fiscal calculations.

Non-tax revenues subject to uncertainty

In the current year, the government expects to receive Rs 2.6 lakh crore as dividend from RBI, nationalised banks and financial institutions. This is higher than the Rs 2.3 lakh crore that it expected to receive in FY25. A prominent part of this category is the dividend (surplus) transfer from the RBI to the government.

The income of the RBI after netting expenditure is transferred to the government. This year, the surplus distribution flow from the RBI is subject to various sources of uncertainties. The income of the RBI could come under pressure on account of softening yields on US treasury securities.

From September to December 2024, the US Federal Reserve cut its policy rate thrice by a total of 100 basis points. After three consecutive rate reductions, while the Federal Reserve announced a pause in January and March to assess the potential impacts on inflation and growth from recent policy shifts, they do expect a gradual easing of interest rates later this year.

While the income of the RBI could moderate, expenditure could increase on account of the need for enhanced provisioning. The need for enhanced provisioning could stem from volatility in gold prices and interest rates, reducing the surplus transfer to the government.

In addition to the non-tax revenues, the government’s disinvestment receipts are also likely to be much lower than budgeted. The frequent bouts of volatility in markets is likely to impact the investor appetite for disinvestment.

Expenditure commitments can rise, but capacity constraints exist

The uncertainty is likely to dent the private sector’s investment intentions. The findings of the forward-looking survey on private sector capex investment intentions signal a moderation in capital investment plans in FY26. The private sector intends to spend Rs 4.88 lakh crore in FY26, compared to Rs 6.56 lakh crore in the previous year.

Admittedly, the findings of the survey for FY26 need to be interpreted with caution as many companies expressed inhibition in declaring their capex intentions. Nevertheless, global uncertainties could delay private sector investments requiring the government to step up its own spending to mitigate the impact of private capex slowdown. However, the current trends suggest a slowdown in expenditure.

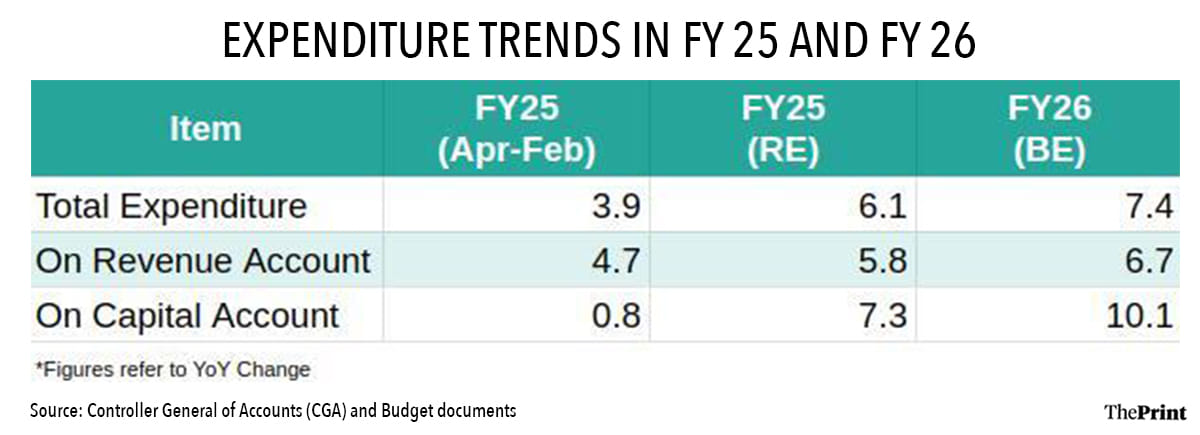

This year’s budget expects revenue expenditure to increase by 6.7 percent over the revised estimates, and capital expenditure to increase by 10.1 percent over the revised estimates.

In April-February of 2025, capital expenditure grew by a meagre 0.8 percent, accounting for 80 percent of the downwardly revised capex. Growth in revenue expenditure during this period is also lower than anticipated in the budget. The government’s ability to maintain the ambitious pace of spending will hinge on improved implementation capacity and the ability to maintain consistent spending patterns throughout the fiscal year.

Radhika Pandey is an associate professor and Pramod Sinha is a fellow at the National Institute of Public Finance and Policy.

Views are personal.