The outcome of the general elections has taken a surprising turn, differing from both exit poll predictions and market expectations. However, the agenda for the incoming government remains steadfast.

Among many things, it must focus on accelerating growth, addressing rural distress, creating employment opportunities in manufacturing and services, spurring consumption and private investment, and tackling sector-specific challenges to boost exports.

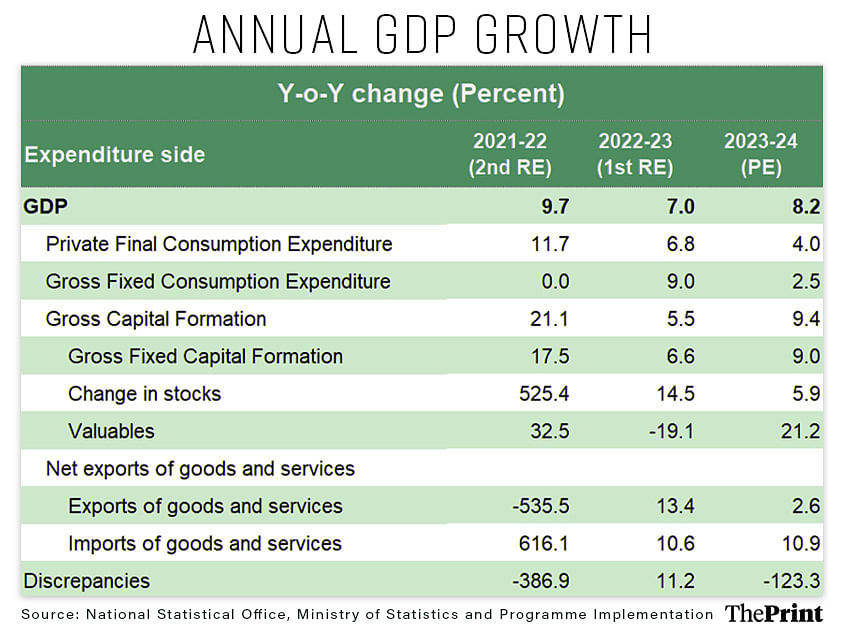

The new government has inherited an economy showing brisk growth. The Gross Domestic Product (GDP) figures, released just before the election results, continued to surprise on the upside, surpassing earlier estimates and market expectations.

To be sure, GDP got a boost due to sharp growth in net taxes (due to higher taxes and lower subsidy outgo). Even going by the cleaner metric of Gross Value Added (GVA), India posted a decent 7.2 percent growth in 2023-24.

Aggressive capex push by the government, healthy balance sheet of the banking sector propelling credit growth, and buoyant services exports underpinned by the growth of Global Capability Centres, have provided impetus to growth in recent years. But sustaining this high growth momentum requires addressing some persistent pain points in the economy.

Stimulating growth in private consumption

While the 2023-24 GDP logged a robust growth of 8.2 percent, this growth is not broad-based. Private consumption — the mainstay of the economy — grew by a meagre 4 percent.

Demand for items of mass consumption has remained weak, possibly due to high inflation and lower wage growth. Rural demand has also been weak due to poor monsoons last year, and subdued performance of the agriculture sector.

Initial signs of recovery are visible in rural demand, as reflected in FMCG sales growth, but these need to be sustained. Spatial distribution of rainfall and durable signs of easing of food inflation will be critical for demand to pick up.

What can the government do to boost consumption? Typically, lower demand is addressed through expansionary fiscal and monetary policies. If the government chooses to stick to the path of fiscal consolidation, along with a thrust on capital expenditure, a steeper cut in taxes may be difficult.

Government is still some distance away from attaining its medium-term fiscal deficit target of 4.5 percent by 2025-26. However, a review of the GST rates could be considered as it will help in rationalisation of taxes and reduction in tax burden.

Focus on employment generation

Policy intervention to boost employment is critical for a pick-up in consumption. Government’s survey data indicates that while the labour force participation rate has improved, roughly 50 percent of the working age population is still out of the labour force.

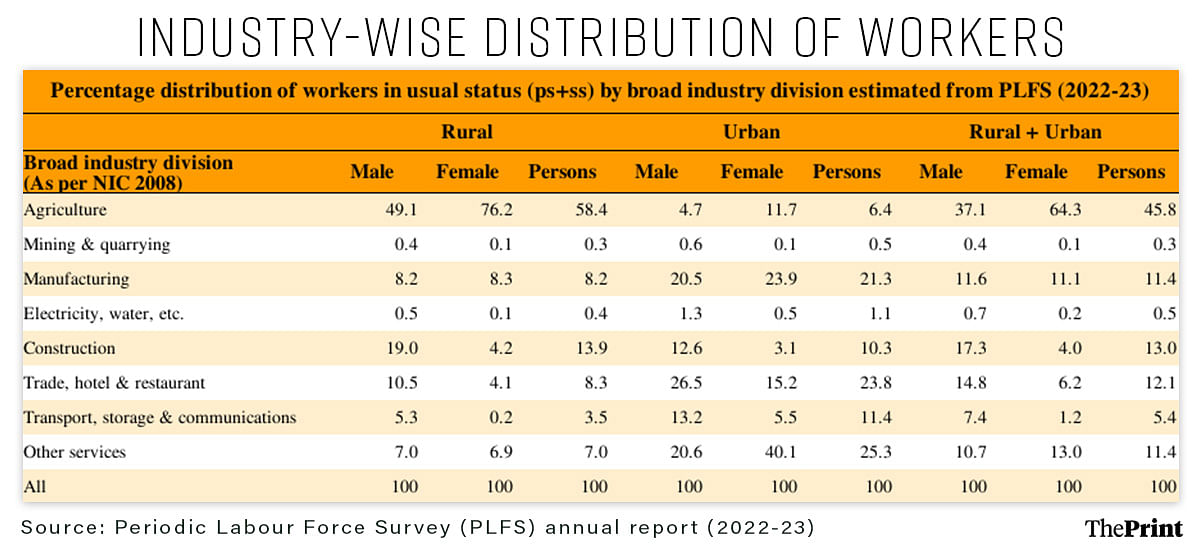

Female labour force participation is even lower. The quality of jobs is also a concern. Almost 46 percent of the workers are employed in agriculture. The share of regular wage/salaried employees is stagnant.

Manufacturing sector employs only 11 percent of the workers. Broad-based and sustained growth in the labour intensive segments and incentivising the smaller firms to grow is crucial for generating gainful employment.

To reap the benefits of demographic dividend, India needs a skilled workforce. The education landscape needs a fresh look so that the demand for skills in emerging areas can be met.

Private investment needs a sustained pick-up

The imperatives of fiscal consolidation imply that the public sector cannot continue to do the heavy lifting with regards to investment. With deleveraged balance sheets of companies and healthy financial sector, the private sector is well-positioned to kick start a fresh cycle of investment.

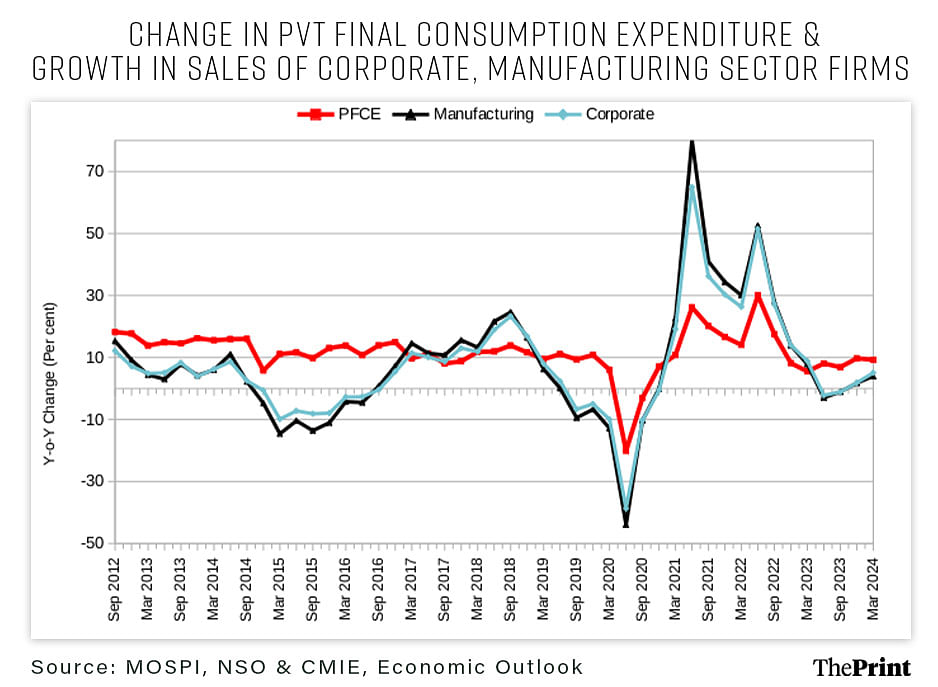

However, weak consumption may be holding back private investment. A clear manifestation of this is the weak growth in nominal sales of non-financial firms. Since March 2023, the nominal sales of firms in the non-financial sector have witnessed weak growth. Broad-based growth in consumption demand could lead to a revival in private investment.

Year-on-year change in private final consumption expenditure and growth in sales of corporate and manufacturing sector firms

Boosting exports

The US-China trade tensions have prompted many companies to shift their production bases away from China. India, with its large domestic market and lower labour cost, appears to be a fit case to benefit from this shift. But three years on, benefits from the China-plus-one strategy have been marginal. India’s share in global exports has increased from 1.5 percent in 2020 to 1.8 percent in 2023.

Impetus on skilling to harness India’s comparative advantage in services exports, and addressing roadblocks to boosting merchandise exports, is required. Measures, such as reduction in tariffs, avoiding knee-jerk reactions through imposition of trade restrictions, a review of Free Trade Agreements to address structural imbalances, and improving logistics, will foster export growth.

Focus on agriculture exports and horticulture can help in augmenting farmers’ income. Policy push to labour-intensive exports will support employment generation. One sector that holds potential in this regard is our exports of readymade garments. Review of reasons constraining exports of readymade garments would help in improving our export outlook.

As MSMEs contribute 40 percent of exports, their voices must be heard and pain points be addressed.

Glidepath for debt reduction & fiscal consolidation

The government has ended its second term with an overall public debt in excess of 80 percent of GDP. The Centre’s own debt is projected to fall only marginally to 57.2 percent of GDP from 58.1 percent of GDP in 2023-24.

In absolute terms, the outstanding internal and external debt, and other liabilities of the government at the end of 2024-25, are estimated to be Rs 183.67 lakh crore (trillion) as against Rs 168.72 lakh crore (trillion) at the end of 2023-24. While it may seem as an unpopular proposition, the government needs to trim its debt burden.

Accumulation of debt increases the share of interest payments in overall expenditure and limits the space for productive expenditure. Particularly in light of excess dividend and S&P ratings outlook change, markets and investors would like the government to come up with a roadmap for fiscal consolidation and reduction of debt. This will impart transparency and predictability to the government’s fiscal policy framework.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Indian banking sector’s boom continues, but low deposit rates for some banks point to future risks