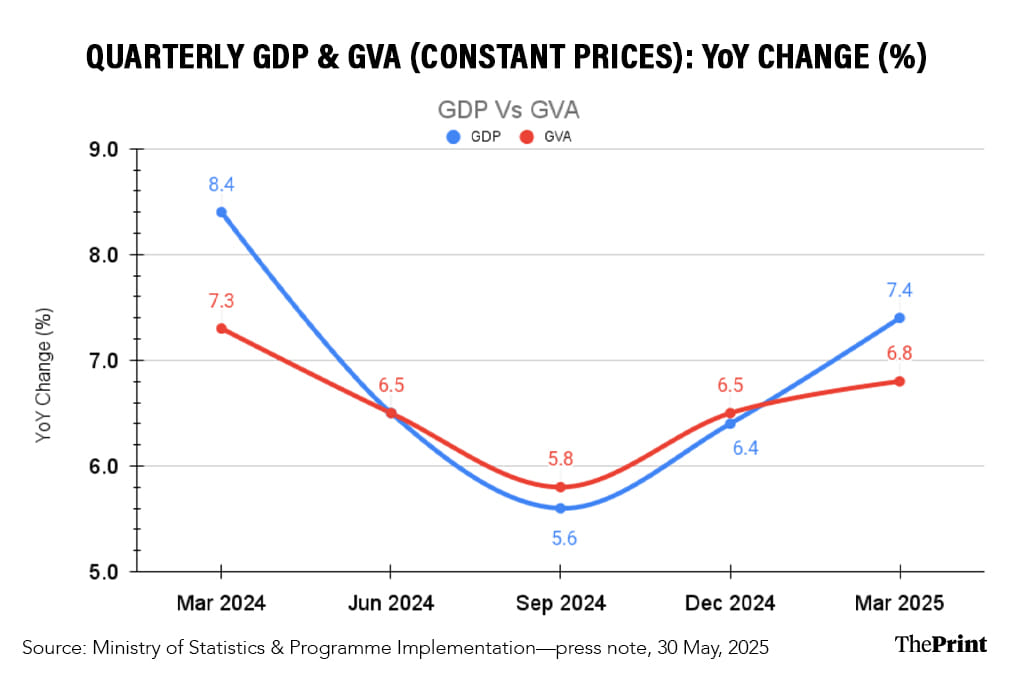

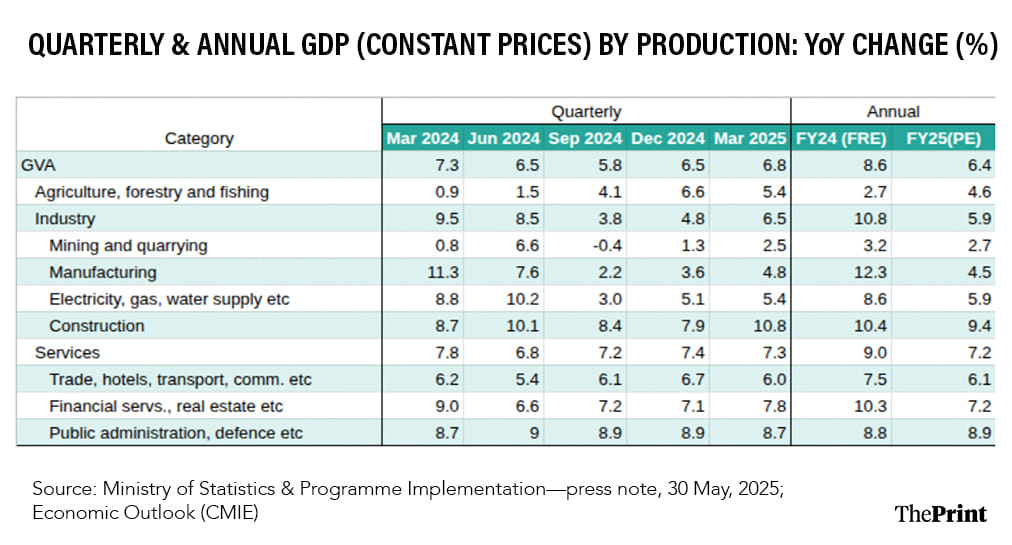

India’s economy wrapped up FY 2024-25 strongly, with the fourth quarter Gross Domestic Product (GDP) growing 7.4 percent year-on-year—the fastest in a year and above expectations. Gross Value Added (GVA) growth for the quarter came in at 6.8 percent.

The wedge between the GDP and GVA growth is explained by higher net taxes (up 12.7 percent), driven by higher collections and lower subsidies. The strong Q4 helped annual GDP growth for FY25 reach 6.5 percent, matching previous estimates.

Growth drivers in Q4

Robust momentum in investment

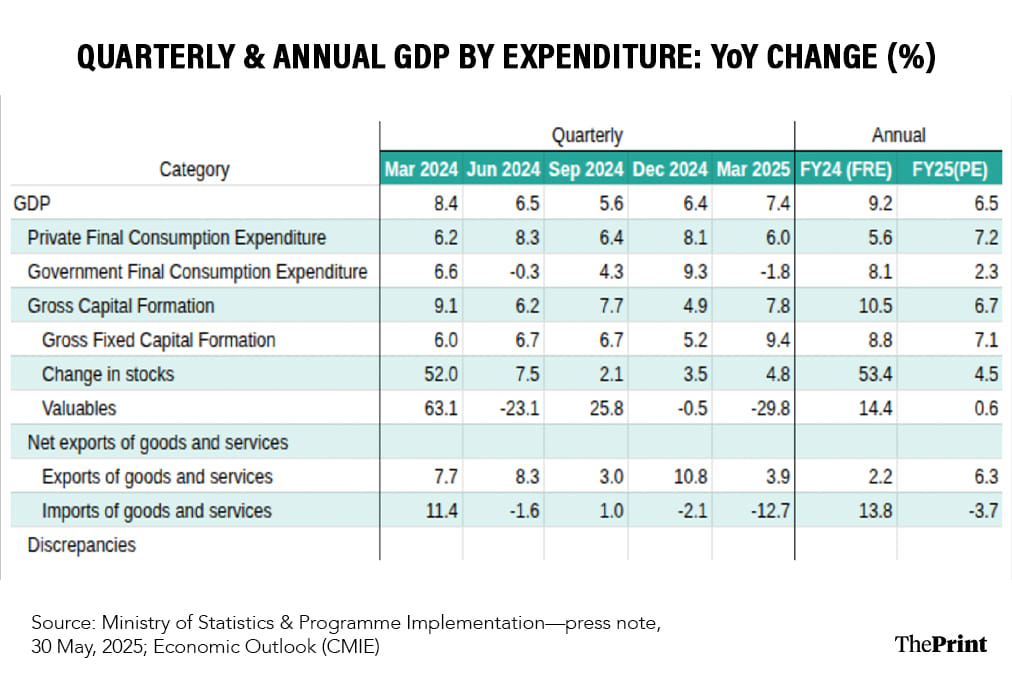

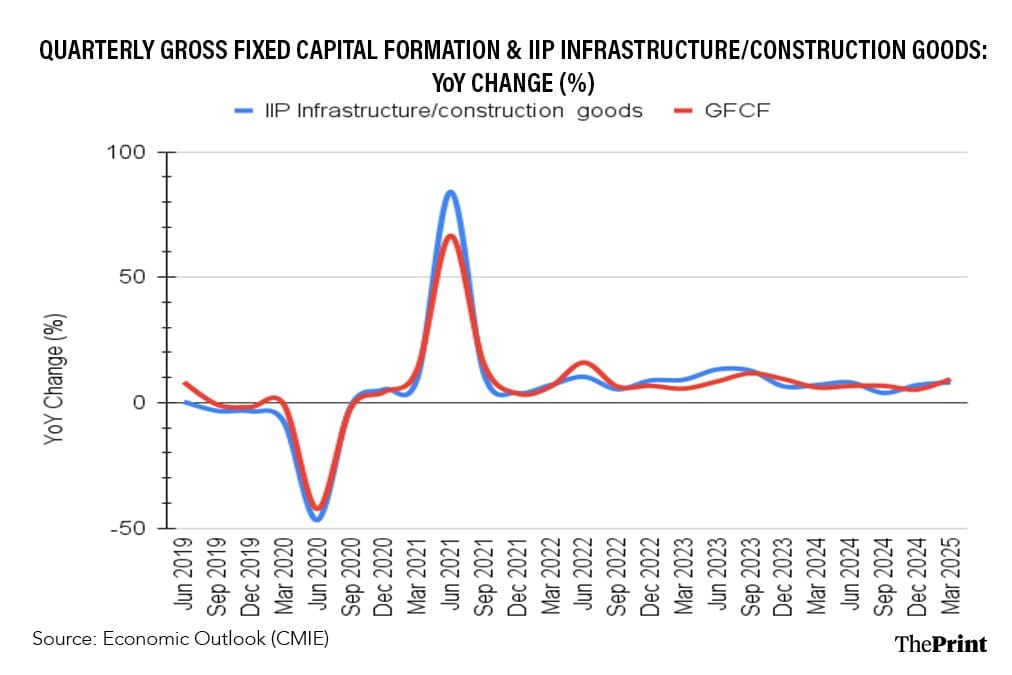

A key driver behind the recent growth surge has been the government’s strong focus on capital expenditure in the last quarter of FY 2024-25. Gross Fixed Capital Formation (GFCF) jumped by 9.4 percent in Q4—the fastest pace in six-quarters—highlighting sustained investments in infrastructure, such as roads, railways and urban development.

The construction sector mirrored this momentum, expanding by 10.8 percent in the quarter and 9.4 percent over the year. Furthermore, the substantial increase in central government capital expenditure in the second half of FY25—up 48 percent year-on-year in December 2024 and 33 percent in March 2025—significantly contributed to the overall improvement in investment growth during the year.

This investment-led growth is further corroborated by the Index of Industrial Production (IIP) for infrastructure and construction goods, which recorded an impressive 8 percent growth in Q4, underscoring the robust activity in construction and capital formation during the period.

Resilience of rural sector

Rural India continued to support growth in the absence of a broad-based revival in urban growth.

The primary sector, which includes agriculture, forestry, and fishing, expanded by 5.4 percent in Q4, up sharply from just 0.9 percent a year ago. This was supported by improved rabi crop output (4.5 percent growth in food grain output for FY25) and higher Minimum Support Prices (for example, Rice: 5 percent; Wheat: 7 percent for marketing season 2024-25), which boosted rural incomes and, in turn, private consumption.

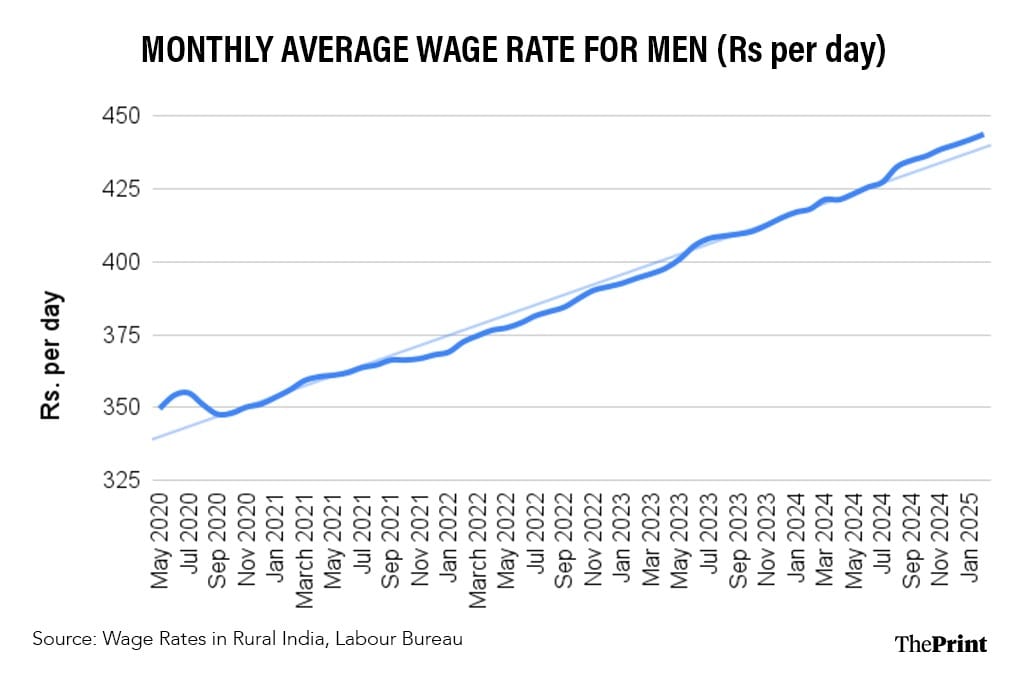

Average rural wages (men) rose by 6 percent in FY25 (April–February, compared to the same period last year), exceeding the trend and reinforcing signs of a rural revival.

Decent growth in services

Services continued to be the backbone of India’s growth, contributing 55 percent to Gross Value Added (constant prices) this year. The sector recorded 7 percent growth for the third straight quarter in Q4 FY25.

Financial, real estate and professional services etc. grew by 7.8 percent in Q4, while public administration and defence expanded by 8.7 percent, while trade, hotel, transport etc recorded 6 percent.

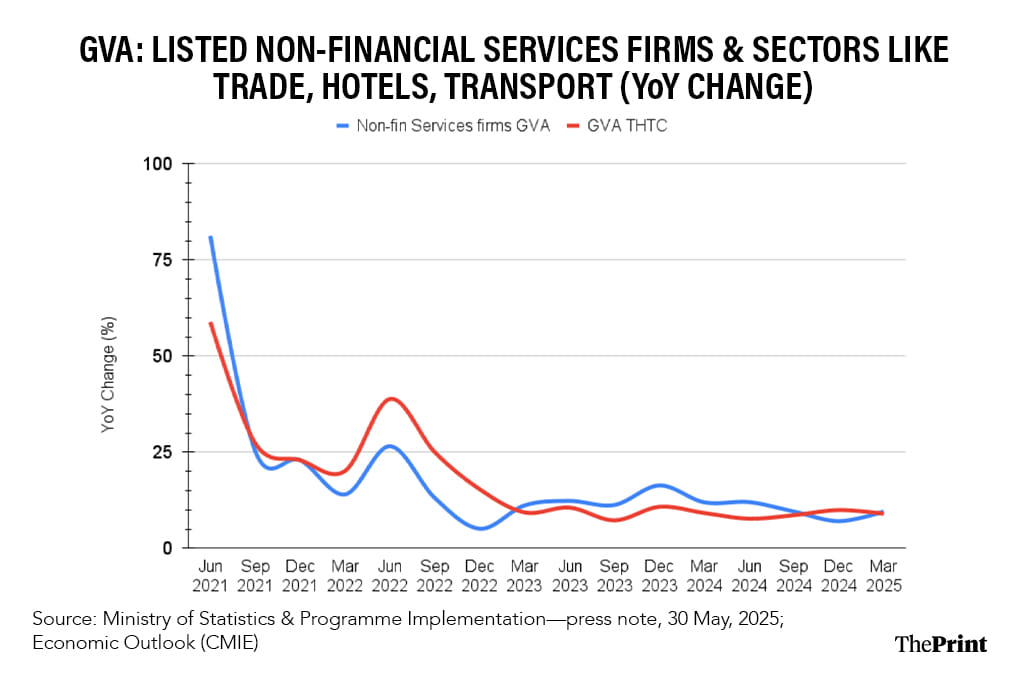

Interestingly, the firm data seems to align with the official figures. The Gross Value Added by listed non-financial services companies broadly corroborates the official growth estimates for sectors like trade, hotels, and transport etc.

FY25 Provisional Estimates

For the full financial year of 2024-2025, real GDP stood at Rs 187.9 lakh crore, reflecting a 6.5 percent growth, which is in line with the Second Advance Estimates. Sectoral growth estimates present a mixed picture, with investments and lower imports contributing positively to overall growth, and consumption remaining somewhat subdued.

It is important to note that these figures are derived using the benchmark method with the help of proxy indicators, and as such, the estimates are subject to revision, when actual source data becomes available.

While most sectors performed in line with expectations, the construction sector stood out, posting a growth of 9.4 percent for FY25 in the Provisional Estimates—higher than the 8.9 percent projected in the earlier Second Advance Estimates—highlighting its strong momentum within the overall economic landscape.

Agriculture saw a notable turnaround in FY25, with growth rising to 4.6 percent from 2.7 percent last year. The higher agriculture output is driven by rising foodgrain output in the year. The outlook remains positive, with above-normal monsoon projected for the current year as well.

Manufacturing’s share in GVA remained flat at 17 percent, and the sector grew by 4.5 percent in FY25, as against 12.3 percent in FY24. Manufacturing continued to face both structural and cyclical challenges, including global supply chain disruptions, trade uncertainties and soft urban demand. This underperformance is concerning, given the sector’s importance for exports and job creation.

While Gross Fixed Capital Formation share of GDP (constant prices) rose to 33.7 percent—the highest since FY14—it seems to reflect the outsized role of the public sector in driving investments. National Accounts Statistics 2025 suggests that private corporations investment remained flat at Rs 20.4 lakh crore in FY24, compared to Rs 20.3 lakh crore in FY23 at constant prices.

This stagnation reflects weak investment sentiment, which is likely to improve only as business confidence, capacity utilisation and global demand strengthen.

Private Final Consumption Expenditure grew by 7.2 percent in FY25, up from 5.6 percent last year, but remains below pre-pandemic levels, indicating a still-fragile recovery. Rural consumption has been more resilient, thanks to higher real wages and strong farm output.

Looking ahead, recent tax cuts, a likely normal monsoon and expected rate reductions by the Reserve Bank of India should help boost urban demand in FY26. However, the overall outlook for PFCE remains cautious, and will depend on continued policy support, and sustained recovery in both rural and urban consumption.

Exports lent strength to the GDP numbers with a growth of 6.3 percent growth in FY25, as against 2.2 percent in FY24. Buoyant services exports and contraction in imports (-3.8 percent) led to the growth. Looking ahead, export prospects face headwinds from global trade weakness, tariff shocks and softer IT demand, which could keep net exports under pressure in FY26.

India’s FY25 growth reflects resilience, driven by strong public investment and a vibrant services sector, though persistent manufacturing weakness highlights the need for structural reforms.

The outlook for FY26 remains positive. Rural consumption is expected to lead India’s economic recovery in FY26, supported by recent income tax reliefs, a forecasted normal monsoon, and anticipated 25-50 basis points of rate cuts by RBI—all of which should boost rural demand even as urban discretionary spending remains subdued.

Maintaining momentum will require labour reforms, climate-resilient agriculture and new trade agreements, alongside continued focus on infrastructure and digital investments. Despite global headwinds, India is projected to grow at 6.3–6.4 percent in FY26.

Radhika Pandey is associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Moody’s US credit rating downgrade may usher in a new era—waning investor interest in US govt bonds