Tariffs have emerged as the key policy instrument in the US to address multiple issues ranging from reducing trade deficit and protection of domestic manufacturing to curbing illegal immigration and raising government revenue.

After imposing an additional 10 percent tariff on Chinese imports (tariffs on Mexico and Canada have been paused), President Trump announced a 25 percent tariff on imported steel and aluminium from global producers. While Canada, Brazil and Mexico will likely bear the brunt of tariff, Indian metal producers will also be impacted.

The latest in the series of tariff announcements is the decision to impose reciprocal tariffs, implying that the US levy on imports will be the same as other countries’ levy of tariffs on US products.

Under the “Fair and Reciprocal Plan”, the US authorities will determine an equivalent of a reciprocal tariff taking into account the tariffs, non-tariff barriers including subsidies, exchange rate policies and any other practices that hinder market access for US products.

Also read: Budget tries to balance growth with fiscal prudence, but relies on spending cuts over revenue boost

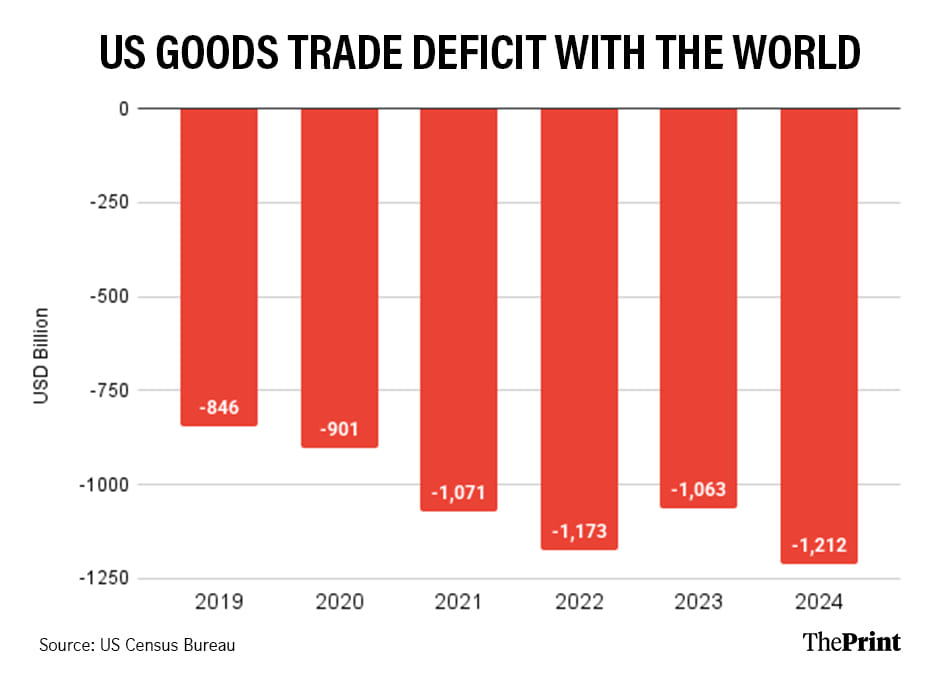

US trade deficit in goods

The use of tariffs stems from the urgency to curb the rising US trade imbalance. The US trade deficit in goods widened to USD 1.2 trillion in calendar year 2024 from USD 1.06 trillion in 2023. While exports of goods rose by 1.89 percent, imports jumped by 6 percent in 2024.

A look at the broad commodity category shows that the trade deficit is the highest in consumer goods at USD 547 billion, followed by capital goods at USD 320 billion in 2024. At a disaggregated level, the US trade deficit is the highest in “Machinery and Transport Equipment” which includes imports of road vehicles, electrical machinery and telecommunication equipment.

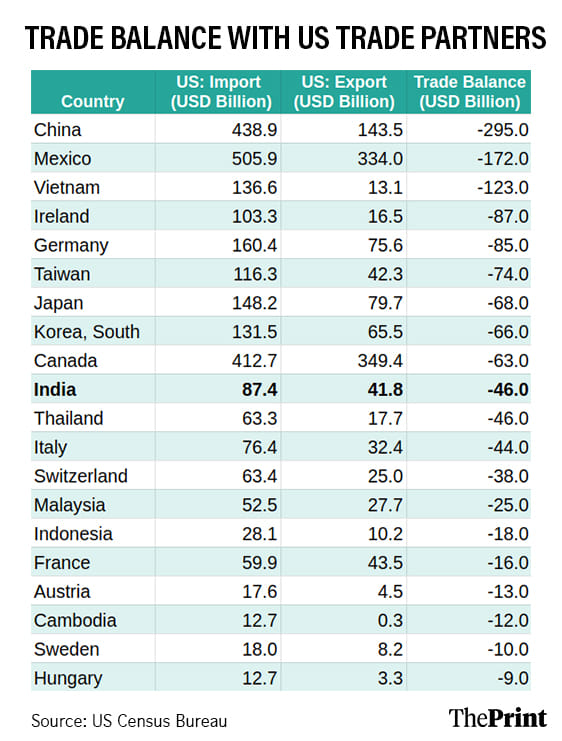

Region-wise, the US has the largest trade deficit at USD 510 billion with Pacific Rim countries including China, Japan, South Korea, Malaysia and Taiwan. With Europe, the US trade deficit is at USD 267 billion and with North America at USD 235 billion. Notably, with India and Thailand, US has a similar trade deficit at USD 45.6 billion, though the value of imports from India exceeds that from Thailand.

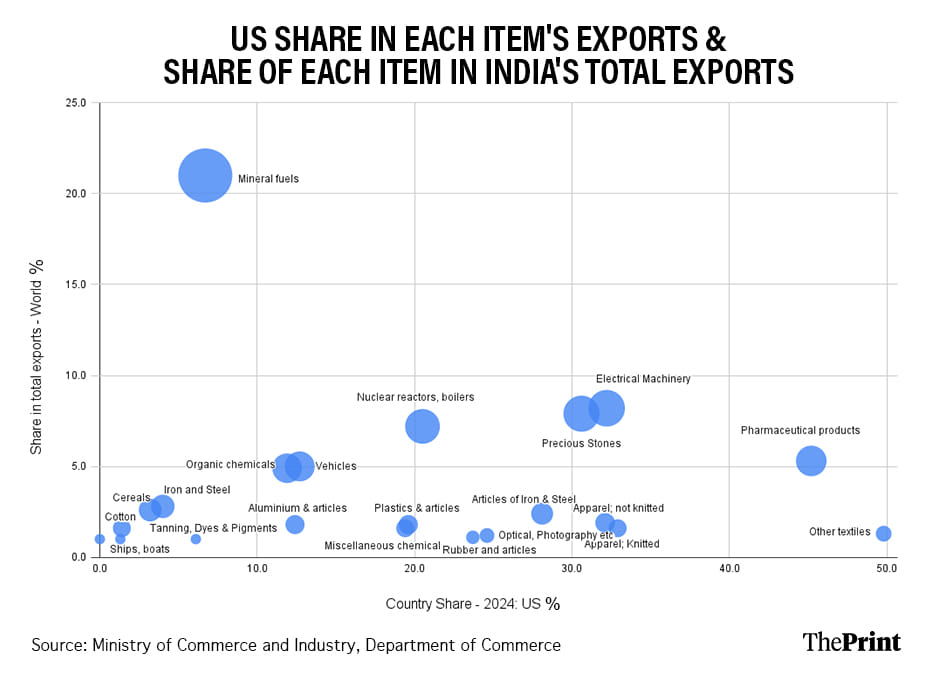

From India’s perspective, the US is the largest and growing export market. In FY 24, exports to the US accounted for 17.7 percent of the total goods exports. The share has risen to 18.65 percent for the current year. But there is interesting variation at the sectoral level. Exports of agricultural products to the US account for more than 10 percent of their overall exports. The US accounts for 23 percent of the overall exports of chemical products. It is the most dominant market for India’s pharmaceutical products accounting for 33 percent of the total exports. The country accounts for more than one-third of exports of electronic goods and readymade garments.

Vulnerability to tariffs

The risk to tariffs will depend on the extent of trade surplus a country enjoys with the US and the gap between local and US tariff rates.

The implications of the reciprocal tariffs are not yet clear and will depend on their design i.e. whether reciprocal tariffs target specific goods or sectors or are levied across the economy. Nevertheless, India will be impacted as among the US trading partners, India enjoys the 10th largest surplus, though this is much lower than China’s trade surplus at USD 295 billion for the calendar year 2024.

The US has, on multiple occasions, expressed displeasure on India’s high tariffs. The report of the US Trade Representative on Foreign Trade Barriers pointed out that India’s average Most-Favoured-Nation applied tariff rate at 18.1 percent in 2022 was the highest of any major economy.

The analysis by the Global Trade Alert database shows that India, Brazil and Malaysia stand out as large US export destinations where local tariffs exceed US import tariffs by a large margin. These countries would likely be the hardest hit by reciprocal tariffs.

To assess the sectors that may be vulnerable to tariffs, we look at the US’s export share in conjunction with the share of that sector in India’s export basket. We narrow down on the sectors where the share of the US in the total export basket is more than 20 percent (higher than the all-India average of 19 percent). Our analysis shows that for electrical machinery, precious stones, pharmaceuticals, apparels, nuclear reactors and articles of iron and steel, the US export share is much more than the all India average. Any action to restrict exports to the US market will likely impact these sectors as US serves as a major export destination. Notably, electrical machinery, precious stones and pharmaceuticals also occupy a pivotal share in India’s exports basket. By implication, a slowdown in exports in these sectors will have a bearing on the current account deficit.

Tariffs on metals could slowdown exports

On 10 February, US President Donald Trump expanded the scope of steel and aluminium tariffs that he had originally imposed in 2018. The recent action ends all country exemptions, raises the tariffs on aluminium from 10 percent to 25 percent and adds more downstream steel and aluminium products to the tariff’s coverage.

While India is a relatively small player in the US imports of aluminium and steel, from its standpoint, the US is a major export destination, particularly for aluminium.

Data from the International Trade Administration shows that India was the sixth-biggest supplier of aluminium to the US in 2024. It provided nearly 3 percent of US imports. In contrast, Canada provided 42 percent of aluminium to the US. On the steel front, India’s rank is much lower at 15. It provided nearly 1.5 percent of the total imports of steel by the US.

The US accounts for a sizable 12 percent of India’s aluminium exports. Imposition of tariffs could hinder India’s exports in one of its key markets and potentially increase the threat of dumping from other countries.

Response of US consumer prices to tariffs

While the US trade partners will likely bear the brunt of tariffs, the US economy is not likely to be immune to their impact. Recent estimates suggest that a 25 percent tariff on Canada and Mexico and 10 percent on China could push consumer inflation by 0.5-0.8 percentage point. This could delay monetary policy easing and may well lead to a rise in interest rates, leading to rise in cost of borrowings.

Radhika Pandey is associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.