With general elections 2024 around the corner, an important factor on the minds of policy makers would be how optimistic the general public is feeling about the economy, the price situation, and their own income, spending and employment prospects. This article takes a closer look at some of the indicators capturing the economic situation and sentiments of the general public.

Latest survey results show that households expect inflation to gradually ease in the coming months. They seem to be more confident about the state of the economy, and their income and employment prospects.

On the flip side, household debt has risen. While households’ net financial savings has declined, there seems to be a greater preference towards physical assets. There is good news on the headline employment numbers but there has been an increase in the share of low-productive jobs.

Also read: Private sector green shoots & strong manufacturing, but elevated inflation: India’s FY24 report card

Households’ expectation on inflation has edged down

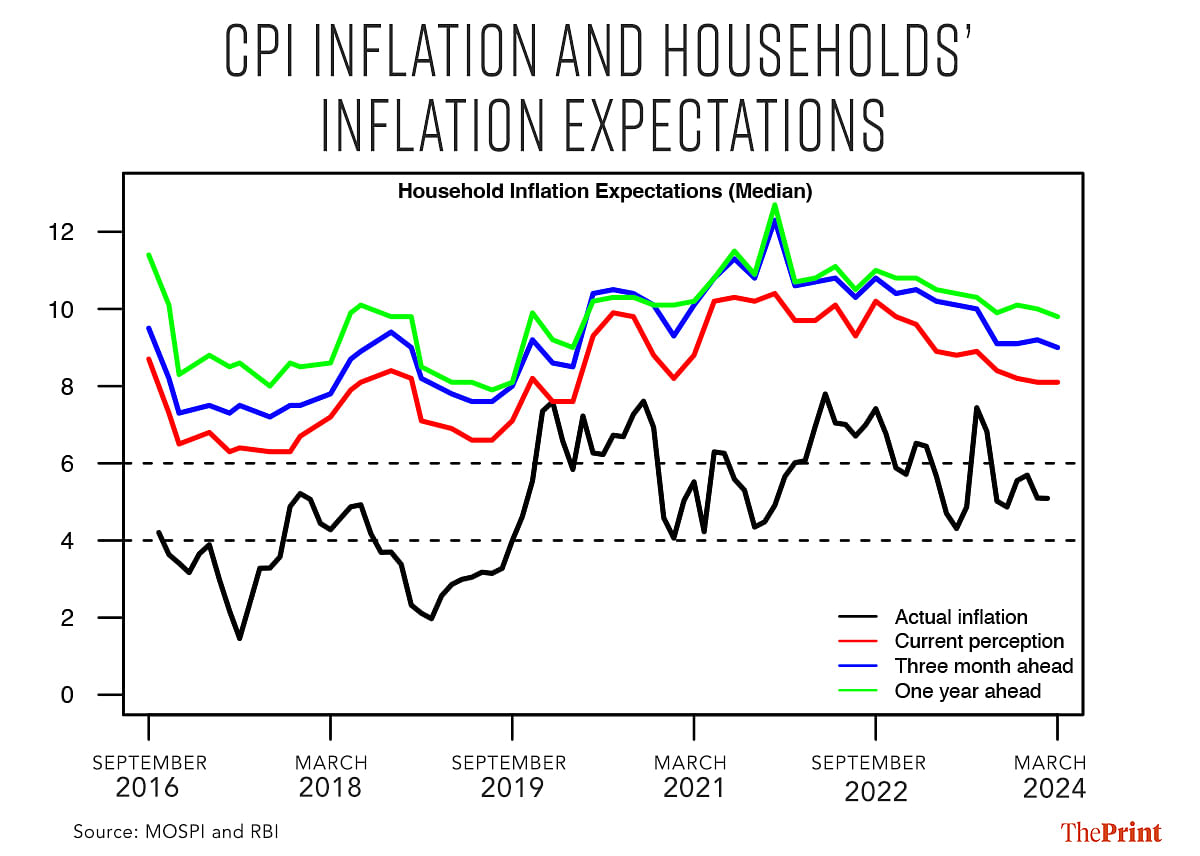

A key objective of the inflation targeting regime is to actively anchor households’ inflation expectations. The RBI periodically conducts the Households’ Inflation Expectations Survey, which captures responses on current perception on inflation, expectations on three-month ahead and one-year ahead inflation rates. The survey also seeks qualitative responses from households on price changes in the coming three months as well as in the next one year.

Despite challenges such as food and oil supply shocks, households expect inflation to ease in the coming months. The latest survey conducted in March shows that households inflation expectations for both three month and one year ahead moderated by 20 basis points to 9 percent and 9.8 percent, respectively.

While the households perception on current inflation remained unchanged at 8.1 percent as compared to the January round, it has come down since the July 2023 round of the survey, when it was 8.9 percent.

Further, the share of households expecting prices and inflation to increase over the next three months and one year has come down for the overall price level and for most of the product groups, compared to the previous survey.

Confidence about the state of the economy

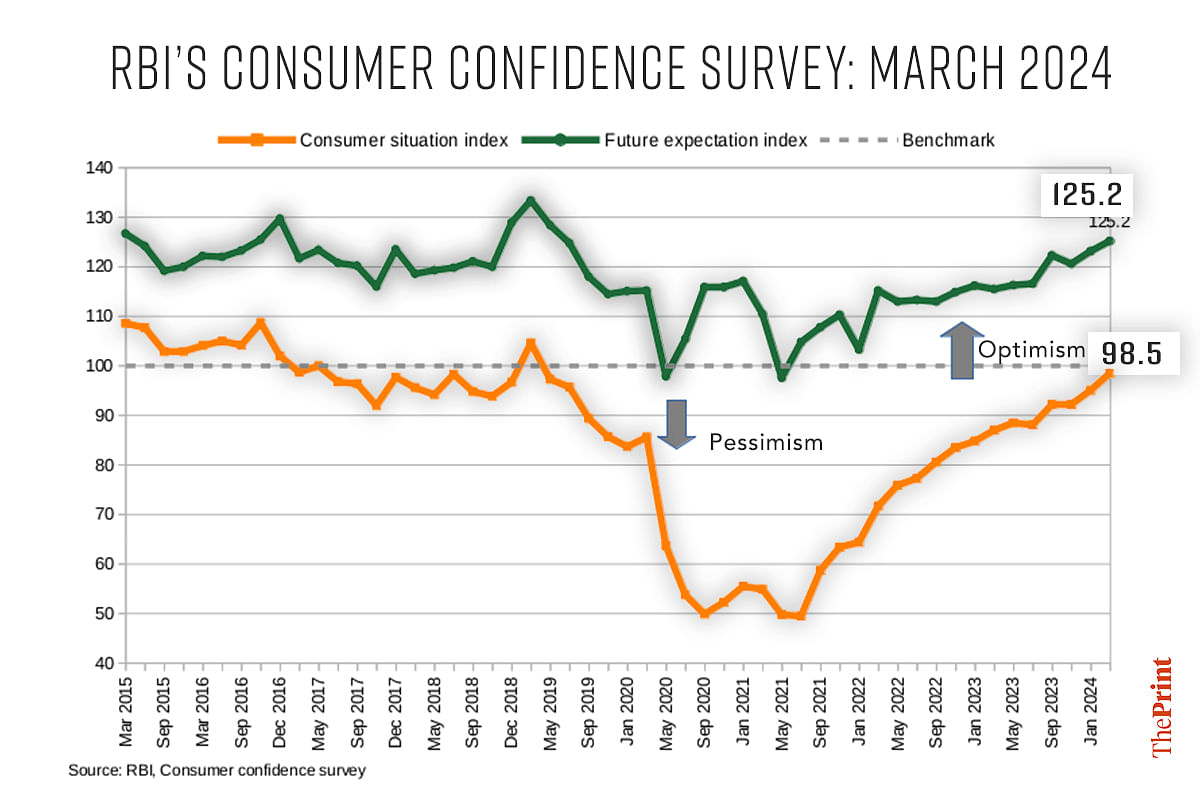

Households seem to have become more optimistic about the state of the economy. The RBI’s bi-monthly consumer confidence survey tracks households’ current perception and one-year ahead expectation of general economic situation, employment scenario, overall price situation and income and spending.

The survey conducted in March, 2024 shows that the consumer confidence for the current period, captured through the Current Situation Index at 98.5, is the highest since mid-2019.

The index capturing the year ahead consumer confidence, referred to as the Future Expectation Index, also improved and touched its highest level since mid-2019. As compared to the January 2024 survey, households reported notable improvements in their economic situation and employment both for the current period and the year ahead.

The picture on consumer sentiments presented by the CMIE is not that bright. The Index of Consumer Sentiments reported a marginal rise of 0.9 percent in March after two months of decline.

The Index of Consumer Sentiments peaked in December. March was the third consecutive month when consumer sentiments were weaker compared to December.

Overall, the index of consumer sentiments for rural households has picked up while for urban households has seen a dip. The pick-up in rural consumer sentiments is driven by optimism about the future rather than the current conditions.

Household borrowings remain elevated, savings shifting towards physical assets

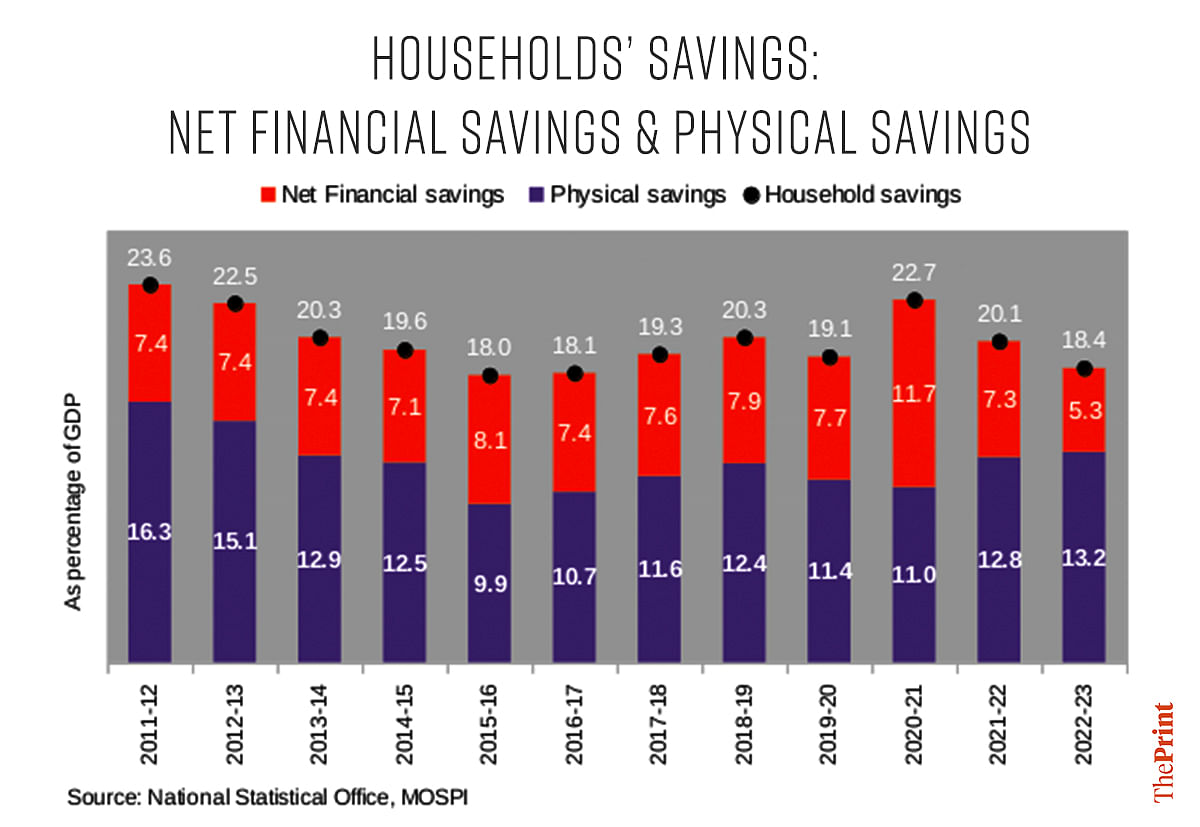

The first revised estimates published by the Central Statistics Office showed that the net financial savings of households declined to 5.3 percent of GDP in FY 2023 as compared to 7.3 percent of GDP in FY 2022.

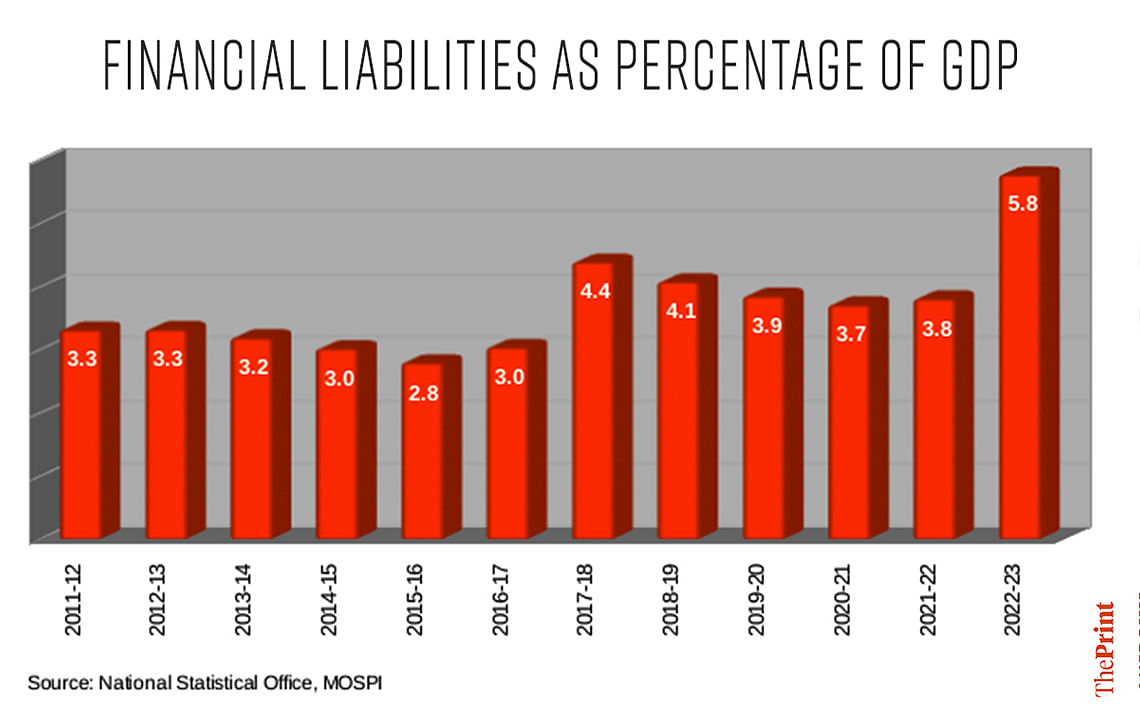

Households net financial savings, a function of gross financial savings and financial liabilities, have fallen due to a rise in households’ financial liabilities. The Revised Estimates show that the households financial liabilities surged to 5.8 percent of GDP in FY 2023, compared to an average of 4 percent of GDP in the past few years.

The stock of household debt rose to 38 percent of GDP in FY 23, second only to 39 percent of GDP in FY 21

The fall in households net financial savings has been offset by a higher household physical savings in FY 2023. Households savings in physical assets rose to 13.2 percent of GDP in FY 2023. It had ranged between 11-12 percent of GDP in the previous five years.

The phenomenon of decline in financial savings, rise in borrowings and a shift towards physical savings seems to have continued in FY 2024 as well. In the year, overall bank loans outpaced deposits — a trend that has now continued for three years in a row. Particularly, loans to households had the largest share in bank loans in FY 24.

In April, 2023, the share of personal loans in the total bank credit was 29.7 percent, by February, the share rose to 32.5 percent. Loans to households witnessed a growth of 20-30 percent in the three quarters of FY 24. It is likely therefore that households’ financial liabilities as a share of GDP will remain elevated in FY 24 as well. However, the share of unsecured personal loans could see a decline post a series of measures taken by the RBI to restrict such loans.

The shift from financial to physical savings is likely to have continued in 2023. This is evident through the record 31 percent surge in housing sales in 2023. The housing demand is likely to remain undeterred in 2024.

Unemployment rate has declined but quality of employment needs improvement

The reports of the Periodic Labour Force surveys put out by the government show a consistent improvement in the headline employment indicators.

The government’s recent report on Key Unemployment Statistics for 2023 shows that the unemployment rate across the country came down to 3.1 percent in 2023 from 3.6 percent in 2022 and 4.2 percent in 2021. There has also been an increase in the labour force participation rate from 56 percent in 2022 to 59.8 percent in 2023.

The improvement in the labour force participation rate is almost entirely driven by a rise in the female labour force participation rate.

However, there are concerns about the quality of jobs. The latest quarterly bulletin of the PLFS shows that the share of regular wage/salaried employees has remained stagnant at around 48 percent for all persons from October-December 2022 to October-December 2023.

The stagnancy in regular wage employment has led to an increase in self-employment. And, the increase in the share of self-employed is primarily seen for female workers.

In summary, while households are increasingly turning confident about their economic prospects, the quality of employment and the trajectory of financial savings of households need to be monitored.

Radhika Pandey is associate professor at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Merchandise & services exports soar, trade deficit shrinks — how India’s exports have rebounded