The upcoming Goods and Services Tax Council meeting is being convened after a significant interval from the last one. Apart from the routine issues of clarifying tax liability on certain goods and services, and addressing retrospective taxation, the council needs to take up the issue of rate rationalisation and simplification.

Discussions need to also begin on examining the feasibility of bringing petroleum products within the GST ambit. The council could also consider allocating a proportion of GST revenues for the local bodies to bolster their resource base.

But first, a few words on the usefulness of GST collection data for policy purposes.

GST per person and consumption per person

GST, being a destination-based, tax reflects the consumption pattern within a state. The state-level GST collections show wide variations. Consumption in bigger and more populous states, such as Uttar Pradesh, tends to be more than the smaller states.

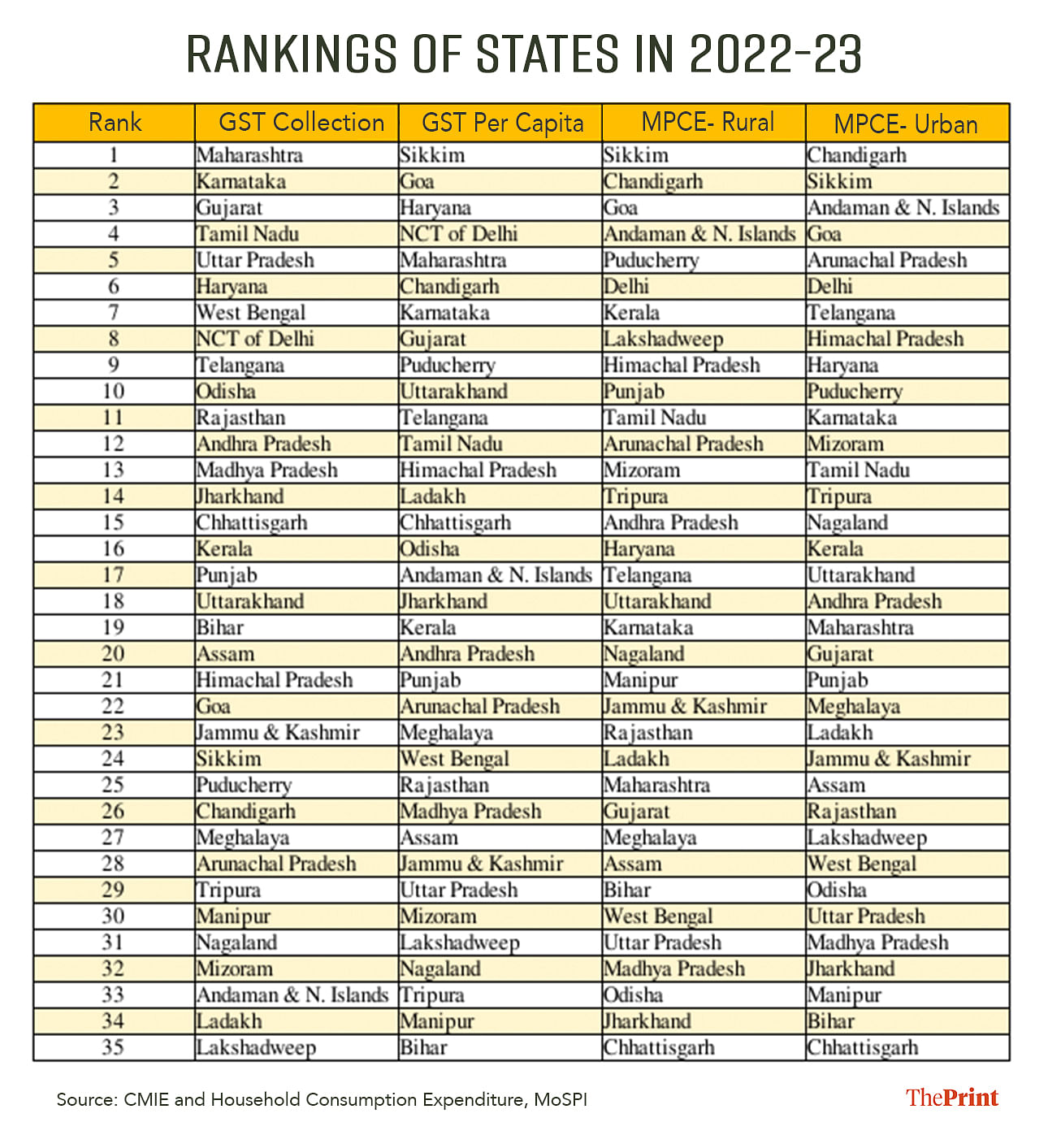

Hence, a useful proxy measure is to look at GST collections per capita to gauge the intensity of consumption in a state. Using this measure, Sikkim and Goa show higher consumption. Interestingly, a similar set of states have higher monthly per capita consumption expenditure as seen in the latest consumption expenditure survey.

Thus, looking at GST collections per capita and comparing them with monthly per capita consumption expenditure (MPCE) gives important insights on the state-level consumption.

While data on MPCE comes with a lag, the per capita state-level GST collections is a useful monitoring tool to gauge the level of consumption in states, and the variability therein.

GST simplification needed

While the creation of a single national market has been the most visible benefit of the roll-out of the Goods and Services Tax, the time is now appropriate to bring about the next level of transformation in the GST regime to reinvigorate economic activity and boost consumption. The key element of this transformation is the move towards rate rationalisation.

In most other countries, there is a single GST rate. In India, there are four tax slabs: five percent, 12 percent, 18 percent and a high rate of 28 percent. In addition, there are two special rates of three percent on gold and silver, and 0.25 percent on precious/semi-precious stones.

Besides the rates, some items of consumption, such as tobacco products, aerated water, pan masala, automobiles, etc, attract GST compensation cess.

The cess was introduced to compensate states for any revenue loss incurred due to the implementation of the Goods and Services Tax.

To compensate states for the shortfall in GST collections, the central government borrowed against their securities, and the borrowed amount was transferred to the states. While they were fully compensated for the revenue shortfall, the levy of compensation cess was extended beyond June 2022, and till March 2026, to retire the loans taken by the central government during the Covid period.

The multiplicity of taxes has led to complexity and interpretational challenges, leading to tax disputes. There are several layers of complexity introduced due to multiple tax rates, resulting in similar products being taxed differently. In some instances, similar products are taxed differently based on the nature of packaging. Some items of mass consumption, which were earlier tax exempt, have been brought under the ambit of GST, if they are “pre-packaged and labelled goods”.

Another case in point is the different GST slabs based on the specification of a commodity. Apparels with a price of Rs 1,000 attract a GST rate of 5 percent, and those above Rs 1000 attract a GST of 12 percent. Such price specific rates increase compliance and monitoring burden, and may be prone to tax leakage.

There should be a phased move towards a low single rate. A move towards a simplified tax regime will reduce the incentive for evasion. Classification related disputes will also be addressed with tax simplification.

Also Read: Shrinking gap between average rural & urban consumption spends good news, but inequality persists

Is the GST structure regressive?

While any move towards GST rationalisation and simplification is desirable, it should be informed by an empirical analysis of the distribution of tax burden across different income groups of consumers.

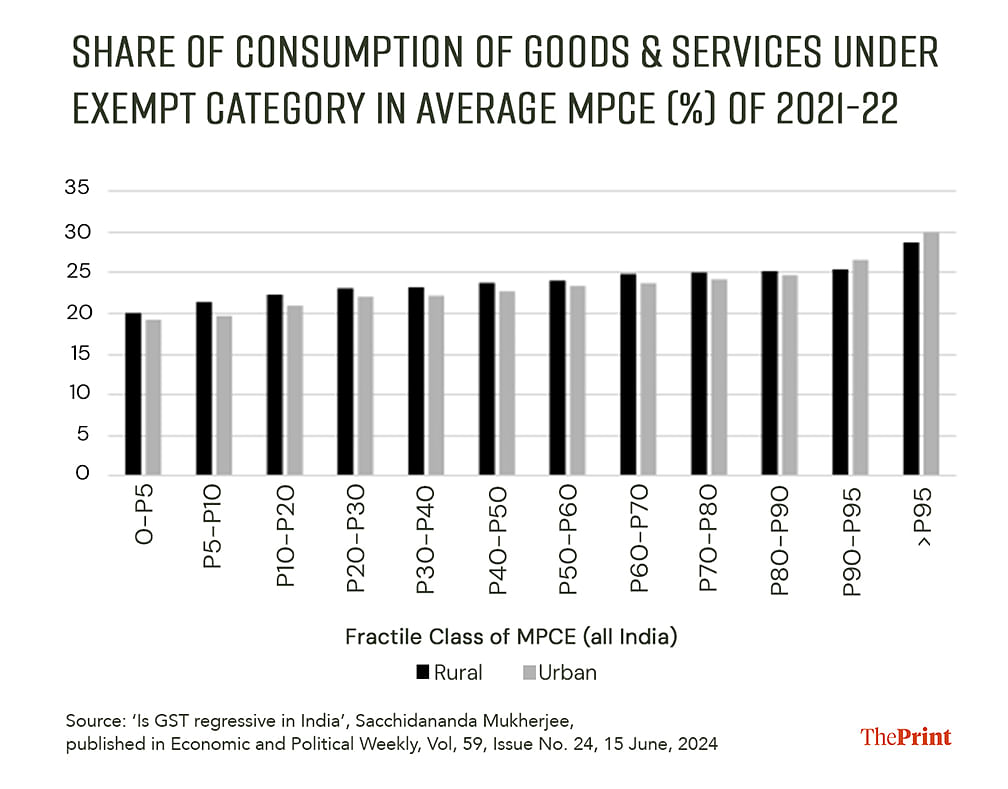

This is a critical gap in the Indian public finance literature, which a recent paper by Professor Sacchidananda Mukherjee attempts to fill. The author categorises items of consumption based on their tax liability and divides consumers into fractile classes based on monthly per capita consumption expenditure.

The author then analyses the share of consumption of goods and services under different tax brackets across fractile classes. This analysis sheds light on the burden of tax on the different strata of consumers in both rural and urban regions.

The study finds that the 5 percent tax rate is progressive, i.e., the share of consumption on items falling under the 5 percent category is more for the lower strata of consumers as compared to the upper strata.

However, the concerning aspect is that the lower strata of consumers bear the burden of 12-18 percent tax rate more than the upper strata. This is based on the finding that the share of consumption of items falling under the 12-18 percent tax bracket is more for lower income groups.

Another telling finding from the analysis is that consumers with higher consumption expenditure benefit the most from GST exemptions. This finding is contrary to the perception that tax exemption benefits consumers at the lower end of the pyramid. It also underscores the fact that removing exemptions may not necessarily be regressive.

Share a percentage of GST with local bodies

The third tier of government is woefully short of fiscal resources needed to augment the local infrastructure. The merging of taxes within the GST has further exacerbated this resource crunch. The GST Council could consider allocating a proportion of the GST to support the resource base of the urban local bodies.

Examine inclusion of petro products in GST ambit

While the government has indicated that it will make efforts towards bringing petrol, diesel, aviation turbine fuel and natural gas under GST, the council will have to take a call on this.

Currently, each state sets its own value-added tax (VAT) for petrol and diesel. If these are brought under GST, there will most likely be a maximum tax of 28 percent. The substantial reduction in tax burden will benefit the consumers, but could have a negative impact on state government revenues. With GST revenues growing at a strong pace, there is scope for initiating a discussion on this difficult issue.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.