The Union Budget 2025-26 has been announced at a difficult time—slowing growth, global headwinds and slackness in private capex.

The budget has attempted to give a booster shot to growth with income tax cuts while sticking to fiscal prudence. However, the path to fiscal prudence is sought to be achieved through expenditure cuts rather than revenue augmentation.

Consumption stimulus via tax cut

Tax relief to the middle class is substantial. There will be no income tax for earnings up to Rs 12 lakh under the new tax regime. Including the standard deduction, the tax free limit rises to Rs 12.75 lakh.

The tax cut will increase the disposable income of the middle class and likely boost consumption. The extent of the boost will depend on factors, such as the marginal propensity to consume and financial liabilities of households.

Some portion of the rise in income will be used to build back household savings, which hit a record low of 5.2 percent of gross national disposable income in 2022-23. The country’s narrow tax base also raises questions on the extent of the impact on consumption.

Increase in allocations to rural sector schemes, such as Pradhan Mantri Awas Yojana (Gramin) and Pradhan Mantri Gram Sadak Yojana, sustained allocation to MNREGA, and marginal rise in allocation to the free food scheme, are likely to lift rural incomes.

Also Read: Why India’s liquidity management framework requires a thorough review

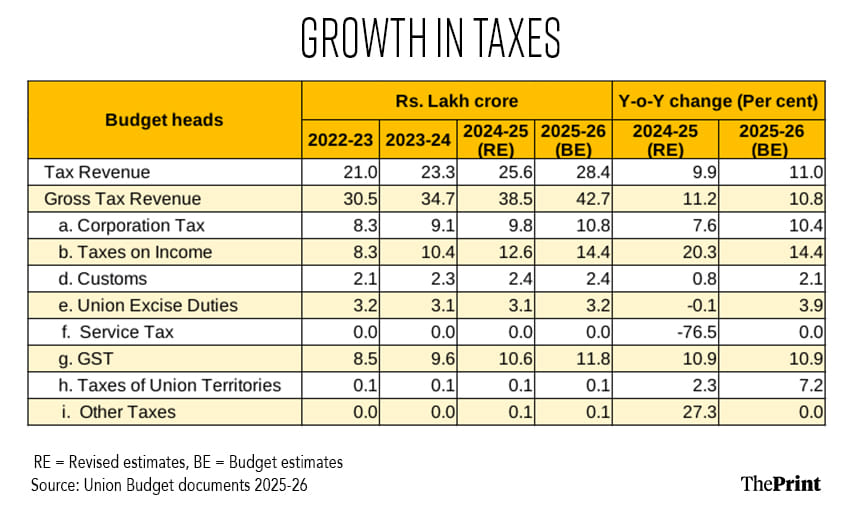

Shortfall in revenue receipts, optimistic growth projections for direct taxes

Revised estimates for the current year represent a shortfall in receipts. This is a departure from previous years, when revenue receipts, particularly tax receipts, exceeded budget estimates and were used to finance higher spending by the government.

According to the revised estimates, revenue receipts are lower by around Rs 41,000 crore, and tax revenues to the Centre are lower by Rs 26,000 crore this year.

For the current year, while gross tax revenues are projected to grow at a modest 10.8 percent, the projections for some of the taxes, in particular direct taxes, appear a tad optimistic. Despite cuts, income tax collections are projected to grow at 14.4 percent, much higher than the assumed growth in GDP at 10.1 percent.

Corporation taxes are expected to grow at 10.4 percent, higher than the revised growth of 7.6 percent for the current year. Amid global challenges, corporate profits are likely to remain under pressure. Hence, the projections for corporation tax appear optimistic.

Excise and custom duties are projected to grow between two and four percent. Custom duty projections reflect policy changes towards rate rationalisation amid global uncertainties.

Reliance on dividends from RBI & state-run banks

On the non-tax revenue front, the government expects another year of bumper dividend payout from the Reserve Bank of India and state-run banks. In the current year, the RBI dividend helped keep the fiscal deficit in check, despite a decline in nominal GDP growth and lower taxes.

The government expects to receive Rs 2.56 lakh crore from RBI and public sector banks next year, compared to Rs 2.34 lakh crore in the revised estimates of the current fiscal. Amid a decline in global interest rates and the possibility of higher provisioning to take into account the volatility in the currency market, the projections of dividend payout by RBI seem optimistic.

On the non-debt capital receipts front, there is disappointment. The government has moved away from setting a specific target for disinvestment, considering the muted appetite for privatisation. The government has set a target of Rs 47,000 crore for disinvestment and asset monetisation. This is despite a significant shortfall in the realisation from disinvestment in the current year. The government now expects to receive Rs 33,000 crore from disinvestment against the budgeted estimate of Rs 50,000 crore.

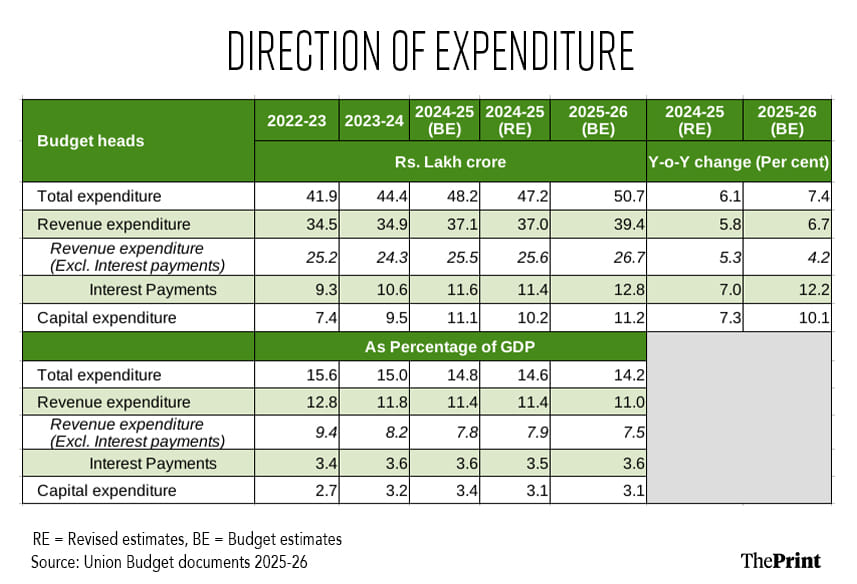

Thrust to capex non-trivial

There is a concern that capex outlay has not been increased substantially to give a fillip to the economy. Capex is pegged at Rs 11.21 lakh crore, marginally higher than the revised estimates of Rs 10.18 lakh crore for FY25. Notably, capex for FY25 has been revised downwards by almost Rs 0.9 lakh crore due to lower capex spending by the Ministry of Finance and Ministry of Defence.

The target for FY26 is non-trivial. It is important to first address the constraints towards the fuller utilisation of the budgeted capital outlay. The second phase of asset monetisation for 2025-30 will be crucial to garner resources for fresh capital outlay.

There are various models of asset monetisation and the challenges in these models should be addressed to ensure success of the asset monetisation plan.

Fiscal prudence via expenditure cuts

The government has done well to stick to the path of fiscal consolidation. Fiscal deficit is pegged at 4.4 percent of GDP for FY26, little below the mandated glidepath. This is sought to be achieved through a tight leash on revenue spending.

Revenue expenditure growth is pegged at 6.7 percent, amid a sharp 12.2 percent increase in interest payments. Net of interest payments, revenue expenditure is estimated to grow at a modest 4.3 percent over FY25 RE (revised estimate) versus five percent last year.

As a percentage of GDP, revenue expenditure, and notably revenue expenditure net of interest payments, has seen a significant compression in the last few years. From 10.2 percent of GDP in 2021-22, revenue expenditure net of interest payments is budgeted at 7.5 percent for FY 26.

It is unclear whether the sustained compression of revenue expenditure net of interest payments is the desired direction of the fiscal framework that the government would like to undertake in the coming years.

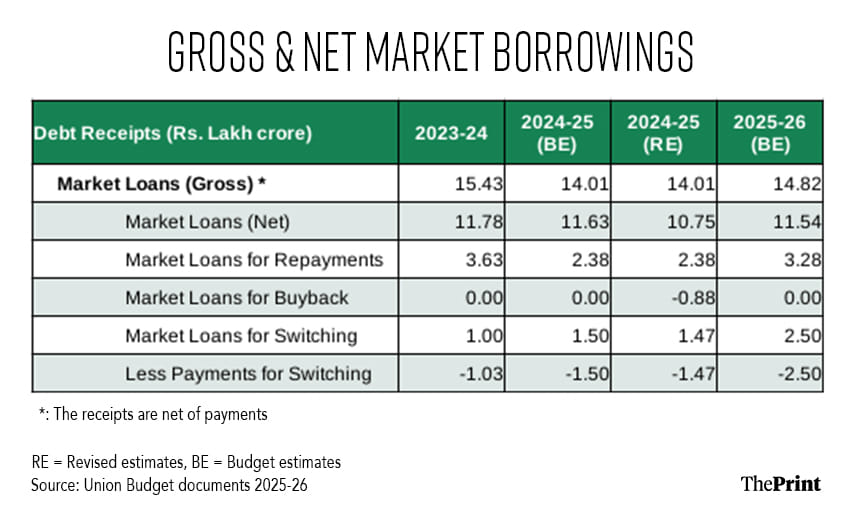

Govt’s borrowing plan & medium-term glidepath should augur well for bond yields

The government has estimated its gross market borrowing to increase to Rs 14.82 lakh crore, a 5.8 percent increase from the RE of FY25. However, due to higher redemptions lined up for FY26, the government’s net market borrowing is pegged lower at Rs 11.54 lakh crore, compared to Rs 11.63 lakh crore in the BE of FY 25. The decline in net market borrowings should lead to moderation in government bond yields.

The announcement of a new glidepath with debt-GDP as the fiscal anchor is also a positive move for the bond market. According to the medium term-glidepath, the government would endeavour to keep fiscal deficit in each year (from FY2027 till FY2031) such that the central government debt is on a declining path to attain a debt-to-GDP level of about 50 ±1% by March 31, 2031.

Radhika Pandey is an associate professor and Rachna Sharma is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Indian banks have solid asset quality & profitability for now, but risks are emerging on both counts

Shekhar Gupta is right in his assessment of the budget. It is a socialist budget with tax-cut lollipop for the middle class.

With this budget the BJP has made it clear that they are essentially socialists. As far as economics and finance is concerned, there is no difference between the BJP and the socialist political parties.

One reason might be that Modi thinks he has burnt all his political capital in pursuit of demonetisation, land reforms and agriculture reforms. The bitter experience from these genuinely reformist moves has made the BJP turn to socialism.

Why topple the cart and upset anyone?