Proliferation of the freebie culture has resulted in some states witnessing an acute fiscal crisis in recent months.

Himachal Pradesh and Punjab, in particular, are facing a significant surge in their outstanding debt burden. Freebies may be smart politics, but they are turning into bad economics, forcing states to withdraw poll promises.

Debt and deficit in Himachal Pradesh

Himachal Pradesh is facing a significant financial crunch, which can be attributed to a swelling wage and pension bill and rise in subsidy burden, leading to an increased reliance on borrowings, alongside limited sources of revenue generation. With the growing financial constraints, the state government has stepped in to enforce fiscal discipline through measures, such as rationalisation of existing subsidy schemes, adjusting the date of release of salaries and revoking the pension of disqualified legislators.

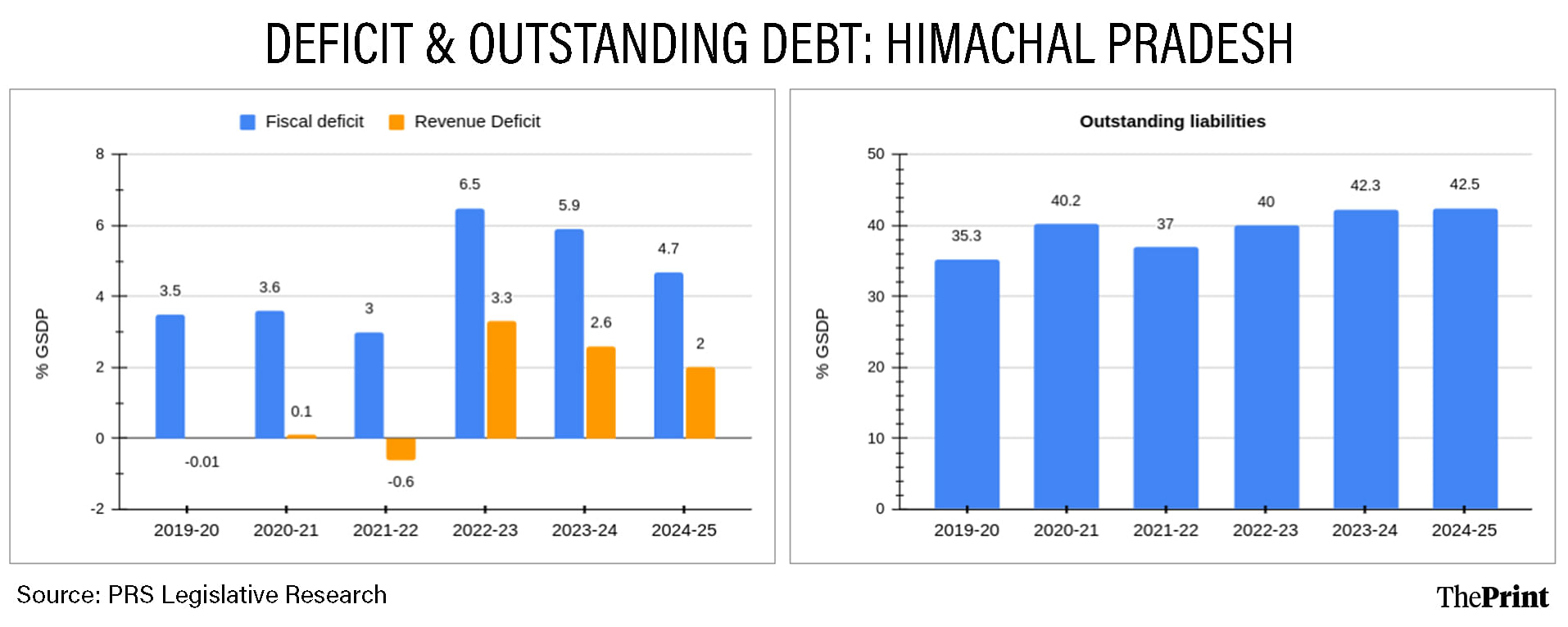

The state’s outstanding debt is projected to rise to almost Rs 97,000 crore in the current year from nearly Rs 88,000 crore last year. As a percentage of Gross State Domestic Product (GSDP), Himachal’s debt has risen to 42.3 percent in 2023-24 and is estimated at 42.5 percent for the current year. In 2019-20, the debt was 35.3 percent of the GSDP.

The state’s fiscal deficit, at 3.5 percent of GSDP in 2019-20, had jumped to 6.5 percent in 2022-23. Even in 2023-24, the deficit was revised up by 130 basis points to 5.9 percent. The rise in expenditure on salaries and pensions has contributed to a significant jump in the state’s spending.

Also Read: India saw slower growth in Q1, but consumption, non-govt investment, manufacturing were reassuring

Revenue-capital expenditure composition

During the last three years, more than 80 percent of the overall expenditure is accounted for by revenue expenditure: required for the day-to-day running of the state machinery. More than 60 percent of the expenditure is allocated towards payment of salaries, pensions and interest payments, which together constitute the committed expenditure.

Of these three components, the expenditure on pensions is estimated to jump by 10 percent in the current year from the revised estimates of the previous year. In fact, pension as a share of total expenditure is likely to account for 19 percent, up from 17 percent in the previous year.

The payouts on account of poll promises have led to higher spending on pensions. In the current year, the government has increased the pension for women from Rs 1,150 per month to Rs 1,500 per month. Similarly, salaries are projected to constitute 32 percent of the total expenditure in the current year, up from 30 percent in the previous year.

Last year, the government switched to the old pension scheme. While this may reduce pension expenditure in the short-run, from 2034, when the employees begin to retire, the costs on account of pensions will escalate.

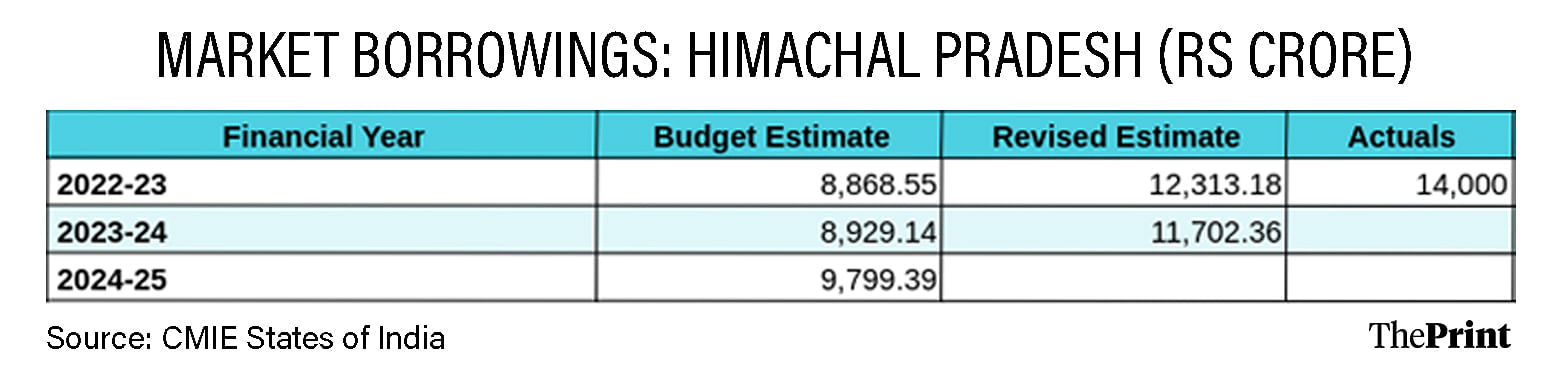

Another concerning feature of the state’s fisc is that for the last three years, the actual borrowings have surpassed the budgeted estimate by a significant margin. Consequently, the interest burden is picking up. In the current year, expenditure on interest payments is expected to jump 11 percent from the revised estimates of the previous year.

Concomitantly, the capital outlay for the current year is expected to be 8 percent lower than the revised estimates of the previous year.

Revenue deficit and tapering grants

Recent Finance Commissions have recommended grants to correct significant imbalances in the revenue account for some states that may remain after accounting for devolution of central taxes. The 15th Finance Commission recommended revenue deficit grants worth Rs 2.95 lakh crore for 17 states. Of this, Himachal Pradesh will get Rs 37,000 crore over the 15th FC’s award period. In each successive year, however, the magnitude of grant will taper.

Himachal Pradesh had a revenue surplus for most of the years between 2015-16 and 2021-22, but during the last three years, the state has been budgeting a revenue deficit after accounting for revenue deficit grants.

In the last financial year, the budgeted revenue deficit was 2.2 percent of GDP, but the revised estimates pegged the revenue deficit at 2.6 percent of GDP. In the current year, the state has budgeted a revenue deficit of two percent of GDP.

With the tapering of revenue deficit grants, the state will have to make efforts for augmentation of its own revenues to achieve compliance with the fiscal responsibility legislation. It also needs to minimise committed expenditure so that more funds are available for development expenditure.

Also Read: Guaranteed pensions may cause fiscal ambiguity. Govt may have to raise pension outlay for UPS

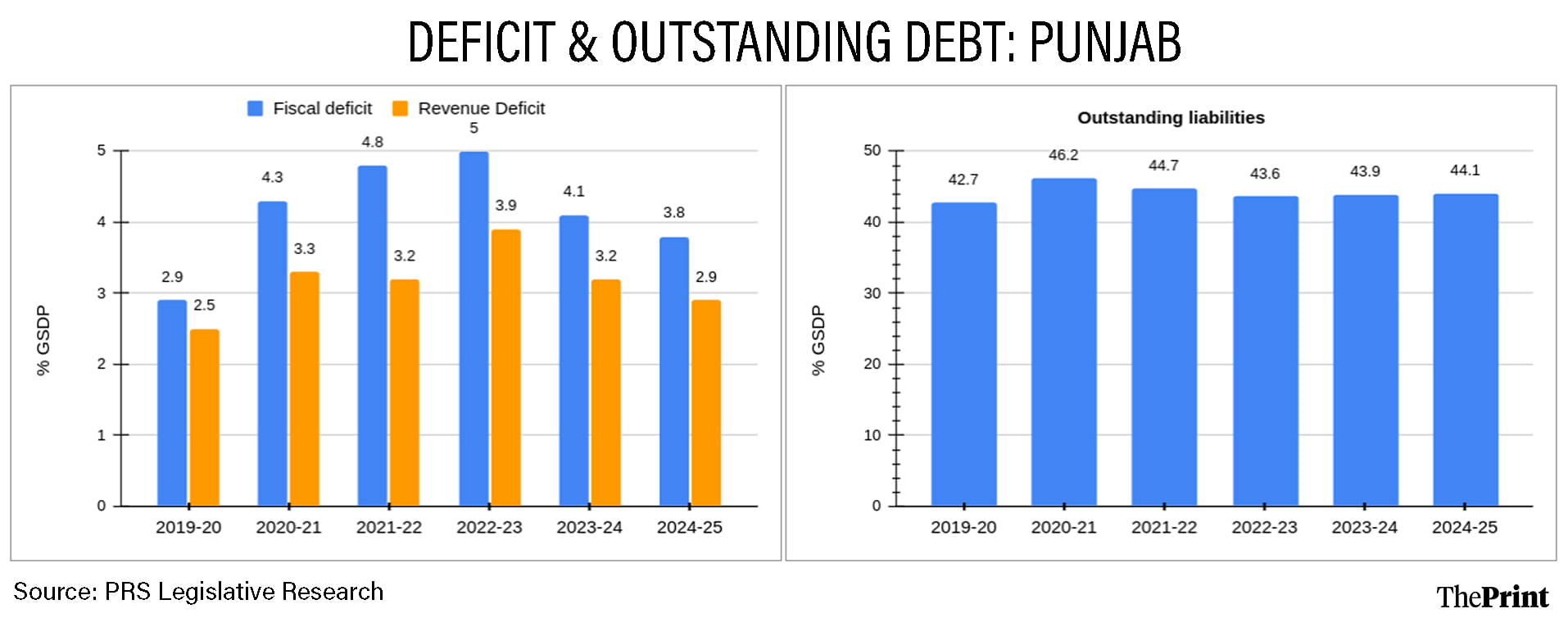

Financial crisis in Punjab

Punjab has been reeling under an acute financial crisis as freebies, subsidies, and rising salary and pension bills, have led to a burgeoning debt burden. In the current year, the outstanding debt as a percentage of GSDP is projected to be 44.1 percent, marginally higher than the revised estimates for 2023-24 at 43.9 percent.

Doling out subsidies, and rise in salaries and pensions, have led to swelling of revenue expenditure, which, in the current year, accounts for 94 percent of the total expenditure (excluding debt repayments). Of the projected revenue expenditure of Rs 1.27 lakh crore, Rs 35,000 crore is expected to be spent on salaries, another Rs 20,000 crore on pensions and Rs 24,000 crore on interest payments.

With the bulk of the expenditure oriented towards revenue spending, the state’s capex has been slashed by almost Rs 3,000 crore in the current year, compared to the budget estimate of the last year. Another big component of revenue spending is the power subsidy for agriculture and domestic use, which accounts for nearly 80 percent of the overall subsidy spending. In the last three years, the Punjab government has been spending Rs 20,000 crore on power subsidies.

Due to a rise in the revenue expenditure, the state has been observing a persistent revenue deficit since 2015-16. This is despite the state receiving a revenue deficit grant.

The 15th Finance Commission recommended grants worth Rs 25,968 crore over five years. The bulk of the grant has already been provided till 2023-24. The grant will reduce to zero in 2025-26, further deepening the financial woes of the state. Punjab’s revenue deficit was 3.2 percent of GSDP in 2023-24 and is expected to remain high at 2.9 percent of GSDP this year.

The state government has hiked the prices of petrol and diesel and has partially withdrawn subsidies for domestic consumers. Rationalisation of revenue expenditure, particularly agriculture subsidies, will help in improving the fiscal health of the state.

Radhika Pandey is associate professor and Madhur Mehta is a research fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Production, demand, non-food credit grew moderately in Q1. GDP report card likely to be a mixed bag