In the next two weeks, the Union Budget and the monetary policy statement will be announced. These are going to be presented in the backdrop of moderating urban demand, uncertain private capex trajectory, potential tariff wars, stronger dollar and, overall, a difficult global environment.

Amidst the challenging landscape, the focus of the budget should be to support growth, while sticking to the path of fiscal consolidation. On the monetary policy front, the domestic growth-inflation dynamics rather than currency defence should be the prime focus.

Rationalising revenue expenditure

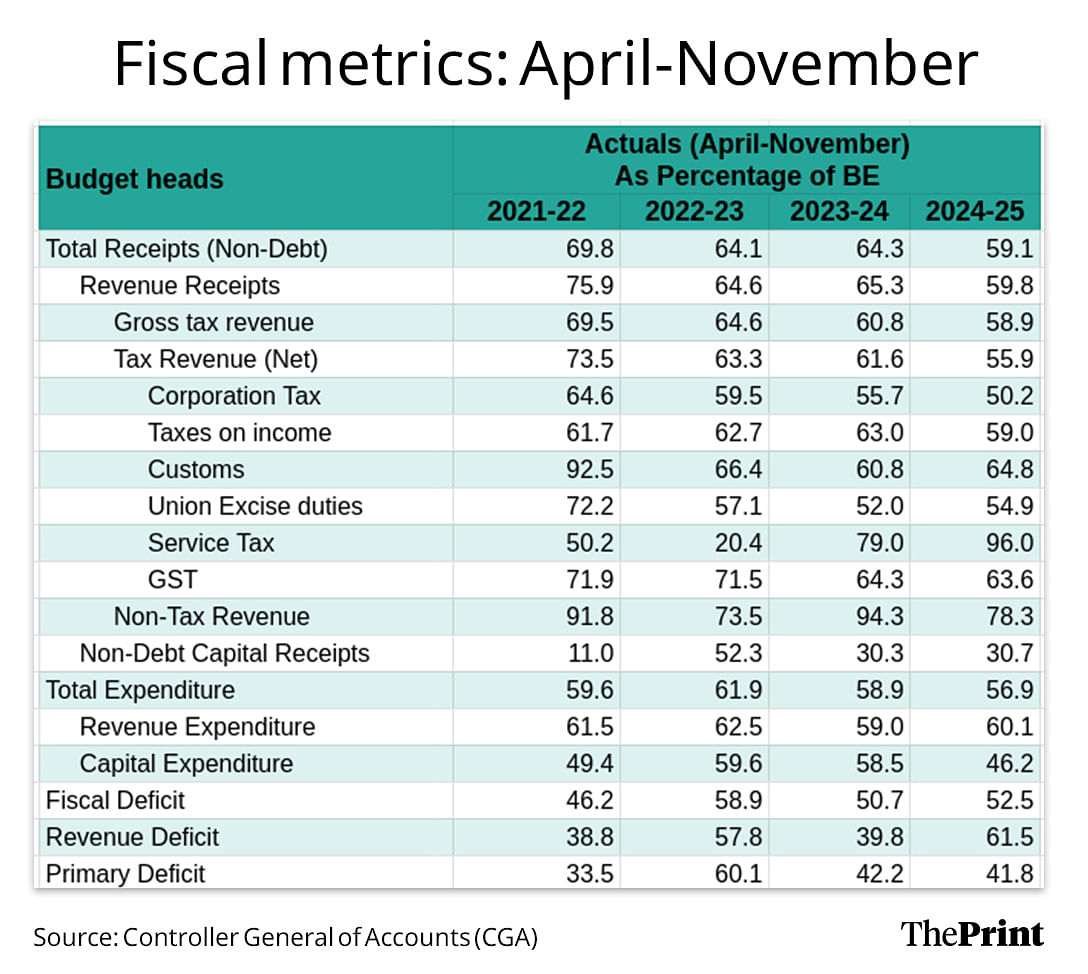

The budget should consider ways to rationalise revenue expenditure to create space for more productive spending. In the eight months of the current fiscal, 46 percent of the budgeted capex has been spent. In the corresponding period of the last two years, 58-59 percent of the budgeted capex was spent.

The expected pick-up in capex after the election-related uncertainty did not happen. In contrast, revenue expenditure has seen a material uptick. More than 60 percent of the budgeted revenue expenditure has been spent in the first eight months.

The major components of revenue expenditure—interest payments and subsidies—leave little room for expansion of spending in other areas. In particular, the allocation for food subsidy towards the free food grain programme needs to be revisited in light of the findings of the household consumer expenditure survey, which indicates a noticeable shift in the consumption patterns of households.

Tax relief to support consumption

Weakness in urban consumption is at the forefront of India’s growth slowdown. If unaddressed, it will further delay the revival of private capex. There is a growing demand to boost consumption through tax cuts. This is going to be a challenging task.

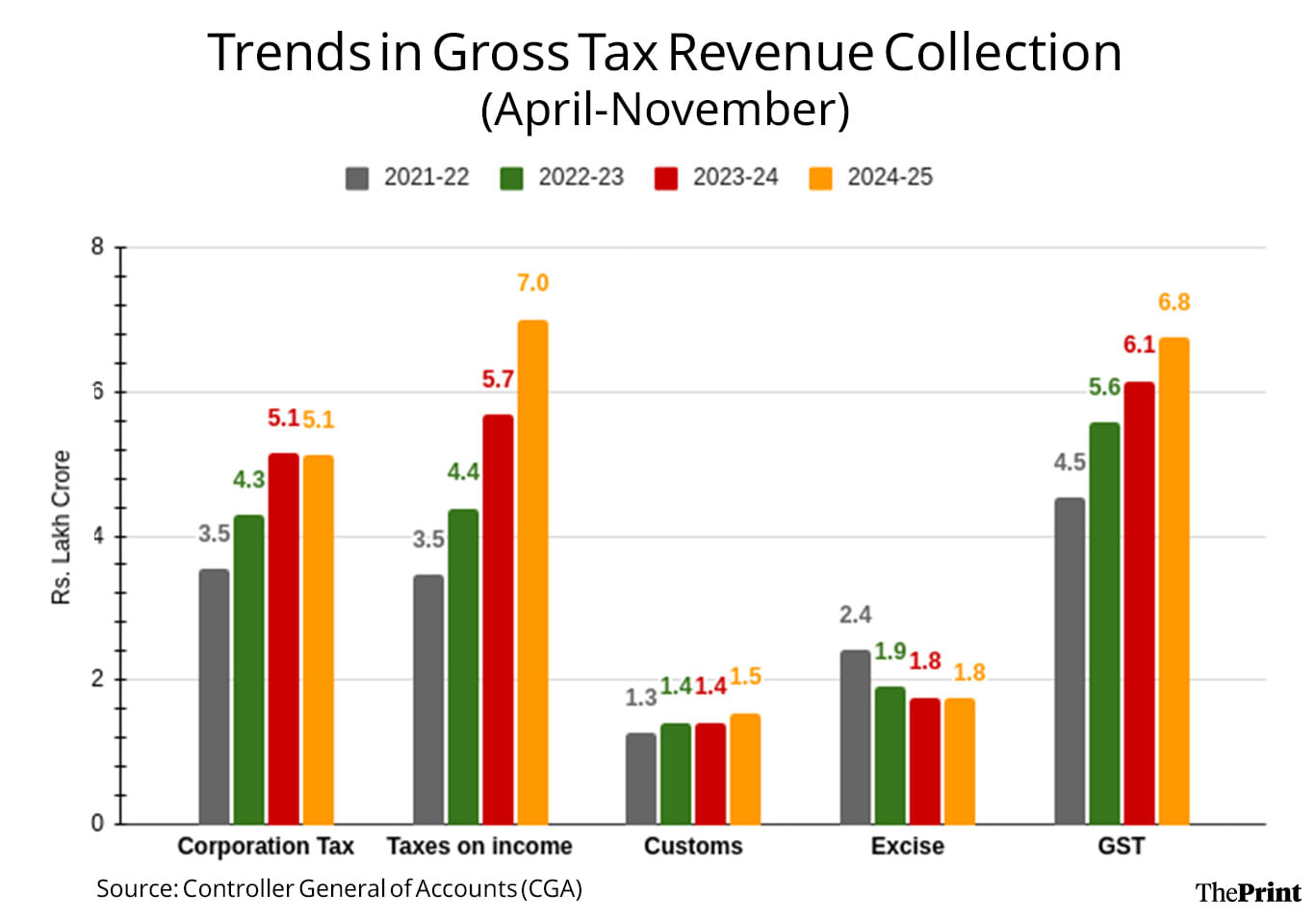

The trends of the first eight months of the current fiscal year show a slowdown in revenue collections, with the exception of income tax. Nominal GDP (Gross Domestic Product) is also expected to grow by 9.7 percent, as against the projected 10.5 percent for the current year.

With these constraints, a deeper fiscal stimulus to prop up consumption without deviating from the fiscal glidepath seems tricky. This could, however, be possible, if the spending on other heads are curtailed.

The revenue stream is unlikely to see a significant uptick in the coming year as well. The corporate tax growth could be budgeted a little lower than last year. But robust growth could be pencilled in for income tax.

The non-tax revenues in the form of dividend receipt from Reserve Bank of India is likely to be impacted by foreign exchange volatility and interventions in the forward market to stabilise the rupee.

Nevertheless, some rejig of tax slabs or tinkering of rates would be needed to uplift the sentiments of the middle class. However, to avoid potential revenue loss, efforts need to be made towards widening the tax base. Less than 7 percent of India’s population filed income tax returns in FY24, of which 60 percent reported zero taxable income. This points to the need for a more equitable tax design.

Setting realistic capex targets

While public capex support is warranted, the budget should avoid setting ambitious capex targets, which may risk implementation delays. In the first eight months of the current fiscal, capex on roads and defence contracted by almost 16 percent, respectively.

This is a concerning trend. The reasons for the contraction need to be examined—is the contraction on account of poor monitoring, or problems with project execution, or is the absorptive capacity the bottleneck? Based on a careful review of reasons, the capex target for the various sectors for the next fiscal should be fixed.

On track to achieve fiscal deficit target through capex shortfall

For the current fiscal, the government is likely to achieve the fiscal deficit target of 4.5 percent. The lower pace of capital spending would offset a possible undershooting of revenue projections and slower growth in nominal GDP.

Going forward, a significant development affecting the fiscal metrics is the announcement of the 8th Pay Commission. While this may not impact the fiscal maths for FY26, its potential implication would need to be factored in the medium-term fiscal roadmap.

In the July 2024 budget, the finance minister announced a shift from the current practice of fiscal deficit targeting. She announced that from FY27, fiscal deficit targets will be set such that the central government’s debt is on a declining path.

Some discussion on the implementation details of the proposed framework would be desirable. With the recent slowdown in growth, bringing debt levels to sustainable levels has become even more crucial.

Boosting manufacturing via rationalisation of custom duty

In the July 2024 budget, the Finance Minister proposed a comprehensive review of the custom duty structure with a view to ease trade, address duty inversion and reduce disputes. Any such rationalisation exercise would now have to factor in the persistent threat of trade tariffs.

To boost competitiveness, there is a need to review custom duty on intermediate goods, while increasing duty on imported steel to safeguard domestic industry. More importantly, there is a scope for simplification of custom tariff structure, wherein the number of duty rates need to be lowered to ease compliance and reduce disputes.

The budget should provide a thrust to affordable housing as it has the potential to drive growth through its multiplier effect on employment and income.

Focus on domestic growth-inflation dynamics

The Monetary Policy Committee under the chairmanship of the new RBI governor will meet for the first time, just a few days after the budget. While some will push for monetary policy to be directed towards defending the rupee, this will lead to tightening of monetary policy at a time when growth is weak.

Flexible inflation targeting requires the central bank to respond to the domestic growth-inflation dynamics. Food inflation is easing and its outlook appears favourable, while core inflation has remained in the range of 3-4 percent since November 2023. The policy rate and liquidity should be eased to support growth in the coming months.

Radhika Pandey is an associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy, New Delhi.

Views are personal.

Also Read: Govt estimates of GDP growth reveal several pain points. Budget 2025 should prioritise consumption