The government’s fiscal deficit came in at 46.5 percent of the annual target in April-October of the current year. This is only marginally higher than the deficit in the same period of last year. However, challenges persist on the capital expenditure front as the government could spend just 42 percent of its annual target till October.

The unexpectedly weak GDP growth reported for the July-September quarter also has implications for the government’s fiscal targets. The nominal GDP grew at 8.9 percent in the first half of the current year as against the budgeted target of 10.5 percent. The economy must grow at over 12 percent in the second half to achieve the budgeted nominal GDP growth.

Typically, a slowdown in nominal GDP growth puts the government’s fiscal deficit target under pressure, but a slower growth in capex could help in bridging some part of the shortfall.

Spending challenges

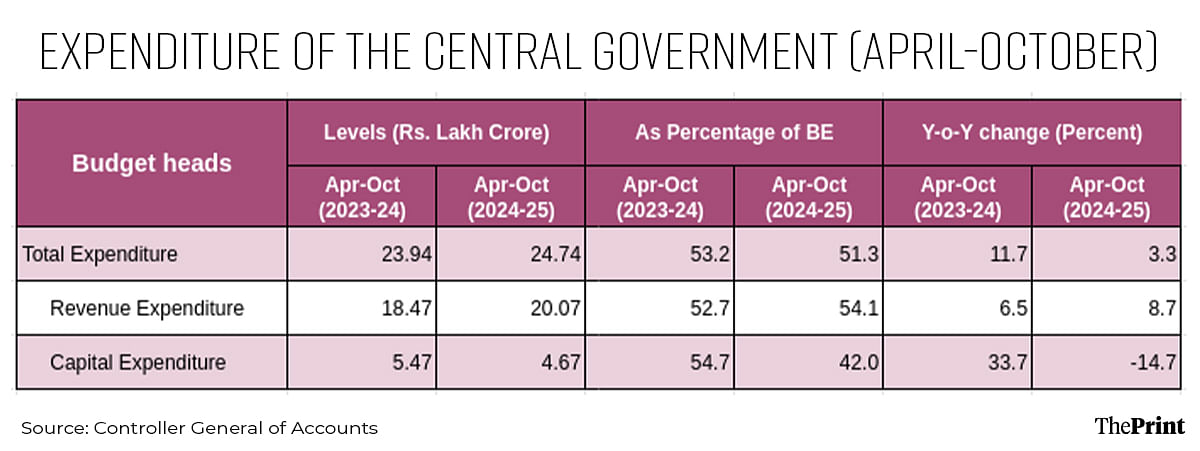

The capital expenditure of the government in the first 7 months of the current fiscal stands at 42 percent of the budgeted target. Last year, the government had spent 54.7 percent of the annual target. For the current year, the government had budgeted Rs 11.11 lakh crore for capital expenditure. It will be a challenge for the government to spend the remaining 58 percent in the 5 months. Put differently, the government would have to spend more than Rs 1.2 lakh crore in each of the remaining 5 months to achieve the budgeted target.

Capital expenditure declined by 14.7 percent during April-October of the current year. After election related restrictions, extended rains in the September quarter may have dented capex normalisation plans. While the government is nudging ministries and departments to speed up the pace of capex spending, there is likelihood that the government might undershoot its capex target by around Rs 1 lakh crore. The shortfall is likely to be seen in the central government’s own capex spending as well as in capex loans to states. According to the Finance Ministry, the central government has released Rs 50,671 crore to states up to September, to ramp up capital spending.

Reassuringly, however, the Ministry of Road Transport and the Ministry of Railways, that together account for almost 47 percent of the budgeted capex, have managed to maintain a steady pace with 53 percent and 61.9 percent of their budgeted capex spent till October.

Muted capex spending by central and state governments led to a sharp slowdown in Gross Fixed Capital Formation (GFCF) to 5.4 percent in the September quarter, down from 7.5 percent in the previous quarter. The weak performance of the GFCF was one of the key factors that dragged GDP growth to a seven-quarter low of 5.4 percent.

Given the implementation lags in capex plans and limitations in the ability to absorb capital investments, the government may have to reconsider its strategy of fixing successive ambitious capex targets.

Noticeably, October saw a reversal in total expenditure trends. While total expenditure contracted during the first half of the current fiscal, it surged by 31.7 percent in October. The jump is attributed to a 41.9 percent pick up in revenue expenditure, reversing the trend seen in the previous months. However capital expenditure contracted for three consecutive months (August-September), underscoring concerns on the quality of expenditure.

Revenue position bolstered by income tax collections

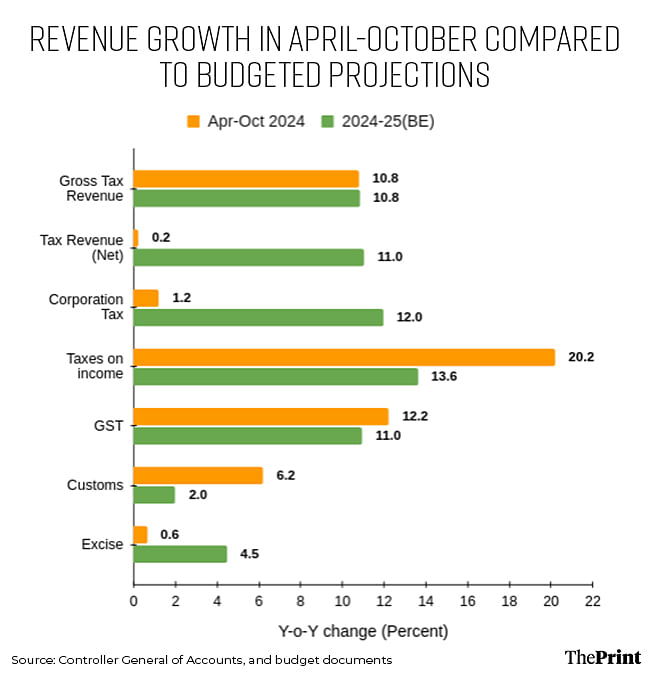

In the first 7 months of the current year, the government’s gross tax revenue grew by 10.8 percent but the net tax revenue posted a muted 0.2 percent growth, mainly on account of additional devolution of taxes. In October, the government released Rs 1.78 lakh crore to state governments. This includes one advance instalment in addition to the regular instalment due in October. While corporate tax collections rose by a meagre 1.2 percent in April-October owing to a slowdown in corporate profits, it is the income tax collections’ growth of 20.2 percent that helped bolster the overall revenue position of the government.

Another way to gauge the performance of tax collections is to compare the growth in the seven months with the budgeted growth for the full year. Looked at this way, income tax collections grew well above the budgeted growth of 13.6 percent. The government may well be able to achieve its budgeted gross tax collections due to the robust income tax collections.

To be sure, recent direct tax collections data does show a pick-up in corporate tax collections. Excise duty collections growth is lower than the budgeted growth due to lower consumption of taxed goods, particularly diesel due to excess rains. For customs duty, the government has budgeted a lower growth due to a re-calibration of customs duty including the sharp cut in duty on gold. Nevertheless, customs duty collections grew by 6.2 percent in the period till October.

On the other hand, non-tax revenues expanded by 50.2 percent, lifted by the Rs 2.11 lakh crore dividend from the RBI and other PSUs, as against the budget estimate of Rs 5.4 lakh crore

Concerns persist on the subdued non-debt capital receipts that have managed to cover just 24 percent of the budgeted target due to the lagging divestment of PSUs.

Deficit position

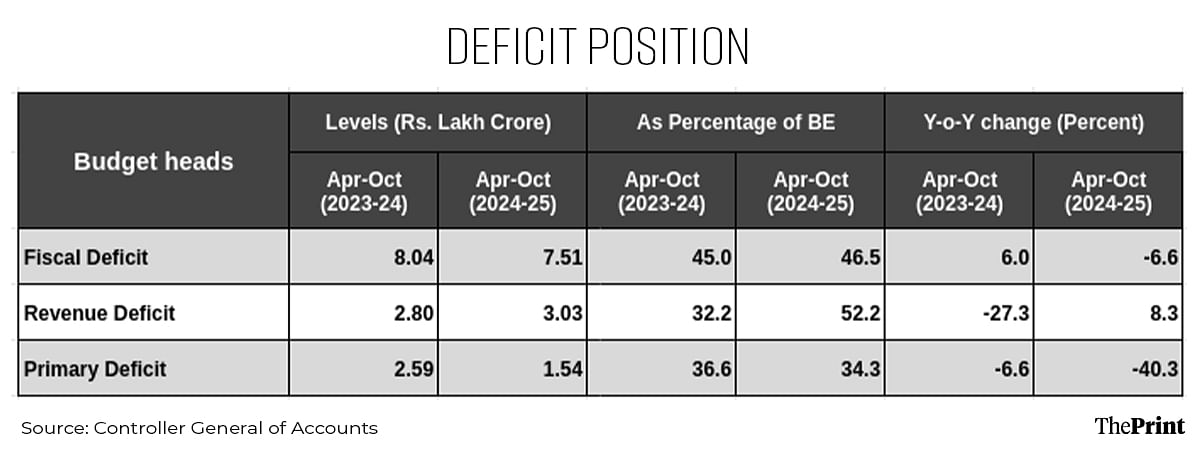

In the first 7 months of the current year, the fiscal deficit came in at 46.5 percent of the budgeted target, marginally higher than in the same period of last year. In absolute terms, the fiscal deficit at Rs 7.5 lakh crore was lower than Rs 8 lakh crore in the same period last year, due to higher dividend payments from the RBI and continued contraction in capex.

However, revenue deficit has reached 52.2 percent of the budgeted target in the same period, significantly higher than 32.2 percent of the budgeted target last year.

Going forward, maintaining fiscal discipline without compromising on the quality of expenditure would be a key challenge for the government.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.