New Delhi: Earlier this week, the Supreme Court was witness to a very unusual development — the Union government putting forth arguments against its own premier investigating agency, the Central Bureau of Investigation (CBI).

On Monday, the court was hearing an application filed by the Department of Investment and Public Asset Management (DIPAM), Ministry of Finance. The application demanded the recall or modification of a November 2021 Supreme Court judgment on the 2002 initial stake sale of Hindustan Zinc Limited (HZL) to the Anil Agarwal-run Sterlite Opportunities and Ventures Limited (SOVL).

The November judgment had directed the CBI to register a case over the disinvestment process through which the central government, under then Prime Minister Atal Bihari Vajpayee, offloaded a 26 per cent stake in the mining and resources firm.

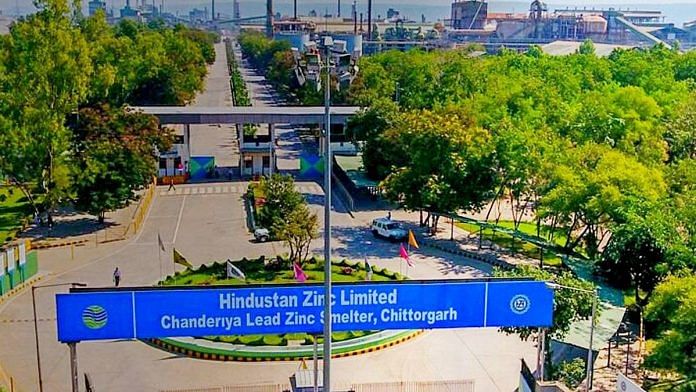

The company is now owned by Sterlite Industries, which has a 64.9 per cent stake, while the Government of India retains a 29.54 per cent. In November, the Supreme Court had permitted the current government to go ahead with the disinvestment of this residual stake.

Monday’s hearing saw Solicitor General Tushar Mehta — who had also represented the CBI in the earlier case — argue on behalf of the central government.

Mehta told a bench led by Justice D.Y. Chandrachud that — while it was unfortunate for the Centre to say that the foundational facts presented by the CBI to the court were factually incorrect — he could “show each and every line in the CBI’s report that is incorrect”.

DIPAM’s application, filed last month, had similarly highlighted several “factual inaccuracies” in the CBI’s submissions, which formed the basis of the Supreme Court judgment.

While this recall application has now been withdrawn, the Centre is expected to file a review petition on similar grounds against the Supreme Court’s November judgment.

What Centre’s application said

In its application filed last month, DIPAM claimed that the CBI had initiated a preliminary inquiry into the allegations at the time of disinvestment, and closed this inquiry after a thorough and elaborate investigation.

DIPAM alleged that the CBI had not placed this fact before the court, and that the department “had no occasion to know that the CBI had not placed the complete facts”.

It further claimed that the file notings and documents submitted in the court by the CBI, which formed the basis of the Supreme Court judgment, were “not correct”.

The application said that any disinvestment process “takes place at a global level”, and therefore, any direction by the Supreme Court “to commence a criminal investigation after about 20 years of disinvestment, in the absence of true facts being brought before it, would severely deter global players from participating in the process of disinvestment in future, which will not be in public interest”.

It claimed that the disinvestment decision was being “put under the scanner of a criminal investigation on mere surmises which appear to have been drawn by certain officials of the CBI”.

The application asserted that the decision to disinvest 26 per cent of HZL was taken “for valid justification and after deliberations at various levels”.

Also read: Govt sold 45% of Hindustan Zinc for Rs 769 cr in 2002. Its 30% stake is now worth Rs 27,000 cr

How the divestment happened

HZL was incorporated as a public-sector firm in 1966.

The central government took the first steps for disinvestment of HZL in 1991-92, when it divested 24.08 per cent of its equity in the domestic market. As a result, the government was left with a 75.92 per cent stake.

The second tranche was sold off in 2002, with the government’s decision to disinvest a further stake to a ‘strategic partner’ — Sterlite Opportunities and Ventures Ltd (SOVL). Arun Shourie was the Union disinvestment minister in 2002.

Under the shareholders’ agreement and share purchase agreement executed in April 2002, the Centre disinvested 26 per cent of equity in HZL in favour of SOVL, leaving the government with an equity holding of 49.92 per cent and it was no longer the majority shareholder.

The same month, SOVL acquired another 20 per cent of equity in HZL from the open market. As a consequence of this acquisition, SOVL’s stake in HZL rose to 46 per cent.

In November 2002, the government also sold a 1.47 per cent stake to HZL’s employees, further bringing down its holding to 48.45 per cent.

Further, as part of the “call option” part of the deal with SOVL, the government further divested a 19 per cent stake to the firm in November 2003. Through this two-phase transaction, the government sold a 45 per cent stake in HZL for around Rs 769 crore, and SOVL became the majority shareholder with a 64.92 per cent stake in HZL.

In 2012, the Centre announced its decision to disinvest its residuary shareholding of 29.54 per cent in HZL.

Following this, in November 2013, the CBI — on the basis of “confidential source information”, as quoted in the 2021 judgment — initiated a preliminary inquiry into suspected irregularities in the course of the disinvestment of the 26 per cent stake to SOVL in 2002.

Also read: SC says no recall of Hindustan Zinc divestment probe order, govt blames CBI’s ‘incorrect facts’

What the Supreme Court said

The disinvestment came under judicial scrutiny when the National Confederation of Officers’ Associations of Central Public Sector Enterprises moved the Supreme Court in 2014 demanding a CBI probe into the deal.

Ruling on this petition in November 2021, the Supreme Court highlighted several irregularities in the decision-making process, bidding and valuation of the 26 per cent stake.

“There is sufficient material for registration of a regular case in relation to the 26 per cent disinvestment of HZL by the Union Government in 2002. The CBI is directed to register a regular case and proceed in accordance with law,” the court observed.

Also read: Privatisation of PSU banks will create jobs, not take them away, says DIPAM secretary

Centre’s response to CBI’s claims

In response to this ruling, the DIPAM application filed last month annexed documents and minutes of meetings that took place regarding the disinvestment decision.

The Supreme Court had pointed out irregularities in the valuation of the 26 per cent equity. For example, it noted that while French international banking group BNP Paribas had been appointed as the ‘global adviser’ for the HZL disinvestment, during the preliminary inquiry, the CBI was allegedly unable to trace the officials representing the global adviser.

However, the DIPAM application said that “it is unfortunate that such a conclusion is drawn by certain officials of the CBI and placed before this Hon’ble Court”. It informed the court that the global adviser had been selected after competitive global bidding.

It asserted that the CBI had incorrectly told the court that BNP Paribas was appointed in January 2002, when it was actually appointed in November 2000. It also said that the “Union Government then was definitely not dealing with an impostor who was using the name of M/s BNP Paribas” and that there is detailed correspondence between the government and the firm through David Trafford, then director, BNP Paribas, corporate finance (oil & gas group).

The Supreme Court had also observed that R.B .Shah Associates was appointed as an ‘asset valuer’ for the valuation of the fixed assets, without issuing a competitive or limited bidding advertisement, which was allegedly against the Union government’s policy.

However, the department’s application now told the court that on this point, the CBI “seem to have not collected and not placed full details and true contemporaneous facts found in the official record of the government”.

“This lack of collecting facts by certain officials of the CBI obviously created an unwarranted impression about the alleged arbitrary selection of the asset valuer,” it said.

It explained that HZL had obtained a list of registered and approved valuers maintained with the Income Tax Department, and quotations were received from this list of five valuers.

“After scrutinising and evaluating the bids, M/s R.B. Shah Associates, Jaipur, was selected… this process was completely in tune with the Union Government’s policy,” the application said.

‘Serious miscarriage of justice’

At the time of the preliminary inquiry in 2013-14, several CBI officials — the special prosecutor, CBI head office, New Delhi, the director of prosecution, and the special director — had submitted reasons for recommending closure without registering a regular case.

However, other functionaries had recommended that the inquiry be converted into a regular case against certain named officials, under Section 120B read with Section 420 (cheating) of the Indian Penal Code, 1860, and Sections 13(2) and 13(1)(d) of the Prevention of Corruption Act, 1988, which talks about criminal misconduct by a public servant.

According to the application, then CBI director Ranjit Sinha had dissented against the inquiry’s closure. However, Sinha’s tenure ended in December 2014 before the matter could be referred to the attorney general — and the new director, Anil Sinha, concurred with the view of the director (prosecution), in favour of closure.

According to the CBI Crime Manual, in cases where the CBI director disagrees with the advice of the director of prosecution, the matter is to be referred to the attorney general for his views.

DIPAM’s application also asserted that the disinvestment in question is 20 years old, and that several officers who participated in the process would have “either died or must be in the last phase of their lives”.

Therefore, it argued, “it would be serious miscarriage of justice if all concerned are required to undergo the agony of criminal investigation after two decades and at the fag end of their lives, merely based upon some inter-departmental views expressed by few of the officers of the CBI which are apparently in ignorance of the above referred facts involving intricate commercial decision-making.”

(Edited by Rohan Manoj)

Also read: Antrix-Devas case: What was the dispute & why SC upheld NCLAT order to wind up Devas for fraud