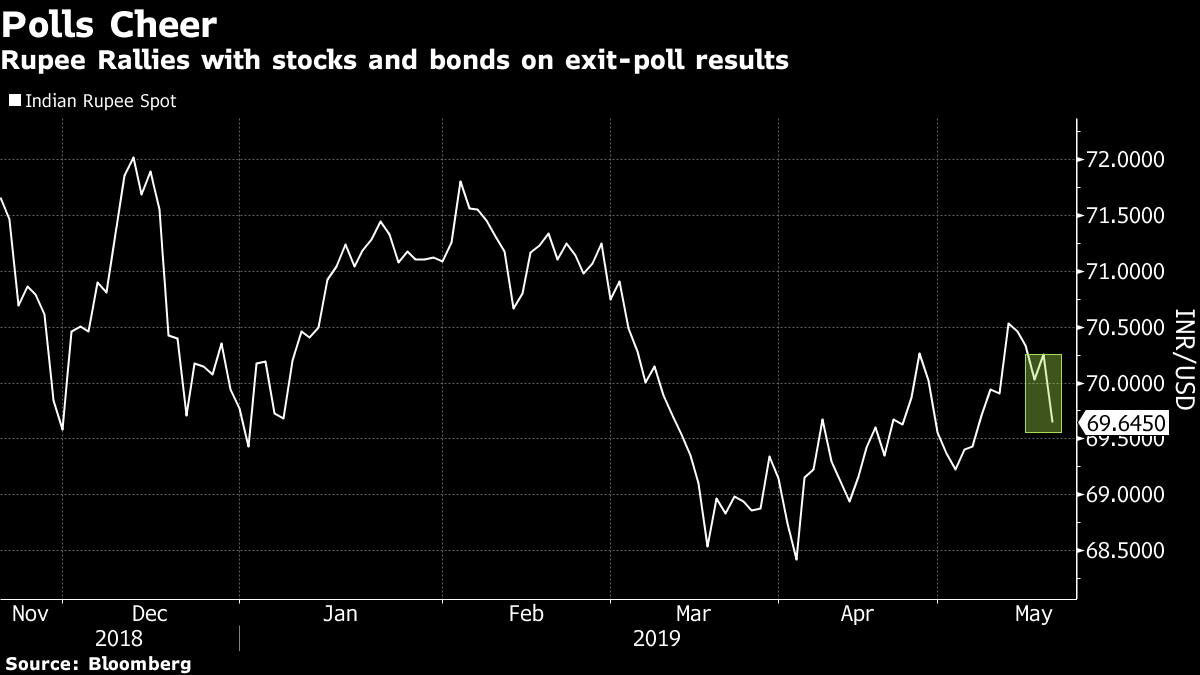

Mumbai: Indian stocks rallied the most in more than three years and the rupee and sovereign bonds climbed after exit polls signaled Prime Minister Narendra Modi’s ruling coalition is poised to retain power.

The S&P BSE Sensex climbed as much as 2.6%, the biggest advance since March 2016, and a gauge of volatility collapsed as exit polls predicted a comfortable majority for the Bharatiya Janata Party and its allies. The rupee rose the most since December, while the yield on benchmark 2029 bonds slid 6 basis points.

The predictions have comforted investors concerned by Modi’s ability to repeat his landslide 2014 win amid a resurgent opposition, farm distress and a job crisis. While a second term depends on the vote-counting day delivering a verdict similar to exit polls, the strength of the projected victory is reassuring, according to BNP Paribas Asset Management.

“The markets should see continuity and potential for reforms and foreigners are likely to be net buyers,” said Jean-Charles Sambor, deputy head of emerging-market debt at the money manager. “We see India as being under-owned.”

Sentiment has been fragile as overseas funds have pulled more than $650 million combined from local shares and bonds this month amid the political uncertainty and the risk off mood triggered by the U.S.-China trade standoff. The rupee, Asia’s top performer in March, has slid 1.6% this quarter, while the Sensex halted a nine-session losing streak last Tuesday before capping the best week since March.

“Exit poll results have put to rest any concerns about the present government not coming back,” said Paresh Nayar, Mumbai-based head of currency and money markets at FirstRand Ltd. “Financial markets are going to cheer these exit poll results.”

Also read: India has been a businessman’s dream and a citizen’s nightmare

Key Metrics:

Seventeen of the 19 sector indexes compiled by BSE Ltd. gained, paced by a gauge of energy stocks. The S&P BSE Information Technology Index — a group of software exporters — fell as the rupee strengthened. The NSE Volatility Index plunged as much 30%, the steepest decline since May 2014 when Modi swept to power with the biggest mandate in three decades. Rupee’s one-month volatility collapses 114 basis points, most May 2014

Strategic Views

Morgan Stanley ( Jonathan Garner, chief strategist for Asia and emerging markets)

Bullish on Indian equities and cautious about markets like China Economy is primed for re-acceleration after a series of shocks including GST and demonetization Earnings growth will accelerate from 2% on a trailing year basis to 20% and that’s a key driver of our Sensex target of 42,000 (from 38,691 currently). It is a better earnings story that we have going for India than we have for other EMs

CLSA India ( Mahesh Nandurkar and Abhinav Sinha, analysts)

Possible strong mandate for Modi means concerns on populist steps such as cash transfers and farm-loan waivers will probably decline, which is good news for government bonds A victory for BJP-led coalition, as signaled by exit polls, will bring back local fund flows to equities, which is good news for mid-cap stocks

Bank of America Merrill Lynch ( Jayesh Mehta, country treasurer)

Even though these are exit polls and we still need to wait until the actual results, this outcome will be taken positively by markets A government led by the BJP will ensure continuity in economic policy and investors like that

RBL Bank Ltd. ( Rajni Thakur, an economist)

The currency may gain as much as 60 paise Monday if the RBI doesn’t intervene to check the appreciation, and the rupee will immediately move to levels of 68/USD in next two-three days if this trend continues Equity markets will see momentum building up over the next two months if actual election results are in line with what exit polls show

TCG Advisory Pvt. ( Chakri Lokapriya, chief investment officer)

A Modi win will ensure that the economic reforms process that started with the goods and services tax and the bankruptcy code will continue. This will ensure economic recovery and growth We will advise investors to jump in as it is uptick time and Modi again. – Bloomberg

Also read: Modi’s second term needs to be bolder than his first

The market is hailing Alexander, saying, Sire, use your glittering sword to slice through the many Gordian knots that keep India from realising her true potential.