Flight chaos triggered by India’s biggest airline IndiGo in the past few days has raised questions about how an industry came to be dominated by one company, and the risks faced in other key sectors controlled by a few, powerful conglomerates.

IndiGo controls two-thirds of India’s domestic aviation market, operating about 2,200 flights daily. The budget airline failed to prepare in time for new government rules giving pilots more resting time, resulting in a shortage of crew last week. That caused the airline to cancel about 3,000 flights in the span of a few days, impacting half a million travelers, and wiping out billions from the company’s stock value.

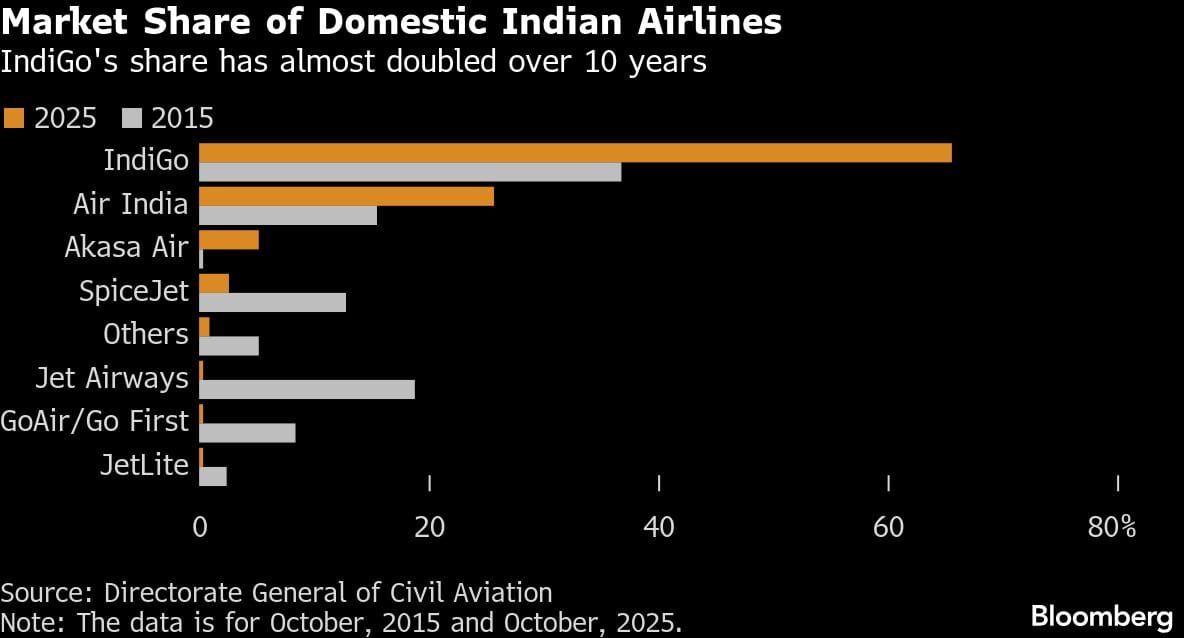

Opposition parties, industry experts and economists say IndiGo’s fiasco highlights a deeper problem in the aviation sector about the concentration of control. IndiGo, with 65.6% market share, and its closest rival Air India Group with 25.7%, mean the industry operates as a near-duopoly, they say. In any industry where competition is limited, consumers tend to lose out because of higher prices, poorer service and the risk of failure.

“There’s a huge consumer consequence to this, where the main people who suffer are ultimately the Indian consumers,” said Rohit Chandra, assistant professor of public policy at the Indian Institute of Technology in Delhi. “IndiGo brings that out front and center.”

Opposition parties say the IndiGo turmoil is a result of market concentration, and the government should take stronger action to combat that kind of dominance.

“Monopoly kills competition,” said Priyanka Chaturvedi, a lawmaker and member of Shiv Sena (UBT) party. “It has an unfair advantage. It takes away level playing fields for new entrants.”

India’s government acknowledges there’s a problem of concentration in the sector but has criticized opposition groups for politicizing the matter. On Tuesday, the Aviation Minister said it was using its policies to encourage more airlines to enter the market, without elaborating on what those measures are. The sector has room for at least five big airlines, he said.

The fast-expanding aviation industry has been hailed by Prime Minister Narendra Modi as a symbol of India’s growing economy and middle class. The number of airports in India has more than doubled since Modi came to power in 2014, with the number of air passengers growing 10-12% a year.

The domination of India’s two airlines is a far cry from a decade ago, when more than nine players shared the market. IndiGo led with just 36.8% at the time.

That all changed over time as several airlines collapsed because of over-ambitious growth plans and financial and supply-chain challenges. IndiGo’s growth was organic, while rivals Kingfisher Airlines, Jet Airways and GoAir all folded between 2012 and 2023. Financial troubles continue to dog India’s third-largest domestic airline, SpiceJet.

IndiGo didn’t respond to an email requesting further information. Chief Executive Officer Pieter Elbers said in a video message on Tuesday that the airline has stabilized operations and is working with the government on next steps.

Elsewhere in India’s economy, a handful of conglomerates dominate in key industries. Reliance Group’s Jio controlled 40.7% of the market share in telecommunications as of March 2025. The Adani Group controls more than 20% of India’s ports capacity, second only to the government, and is also the largest airport operator with a market share of 23% in passengers in 2024.

Viral Acharya, a former deputy governor at the Reserve Bank of India, estimated in a 2023 paper that the top five conglomerates — Reliance, Tata Group, Aditya Birla Group, Adani and Bharti Telecom — made up almost 18% of total assets in the non-financial sector in 2021. That’s up from 10% in 1991.

Brajesh Singh, a senior adviser at management consultancy Arthur D. Little, said it was common practice the world over for industries to consolidate, but it’s the responsibility of authorities to guard against market dominance.

“From the rules and regulations perspective, the government shouldn’t allow more than a sizable pie of the kitty,” he said. There has to be a “limitation that you can’t take more than 25-30% of the market share,” he added. “That has not happened.”

For now, consumers will continue to bear the brunt of the fallout from the IndiGo chaos. India’s aviation regulator on Tuesday ordered the airline to cut flights by 10% to stabilize its operations. The directive is part of a suite of actions by the government, including an investigation into the company that could result in penalties.

“The problem right now is that a lot of the national champions are being created at the cost of domestic consumers,” said Chandra. “Ultimately, the government can regulate its way out of these things by encouraging more entry.”

Reporting by Swati Gupta and Shruti Srivastava with assistance from Mihir Mishra and Danny Lee

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.