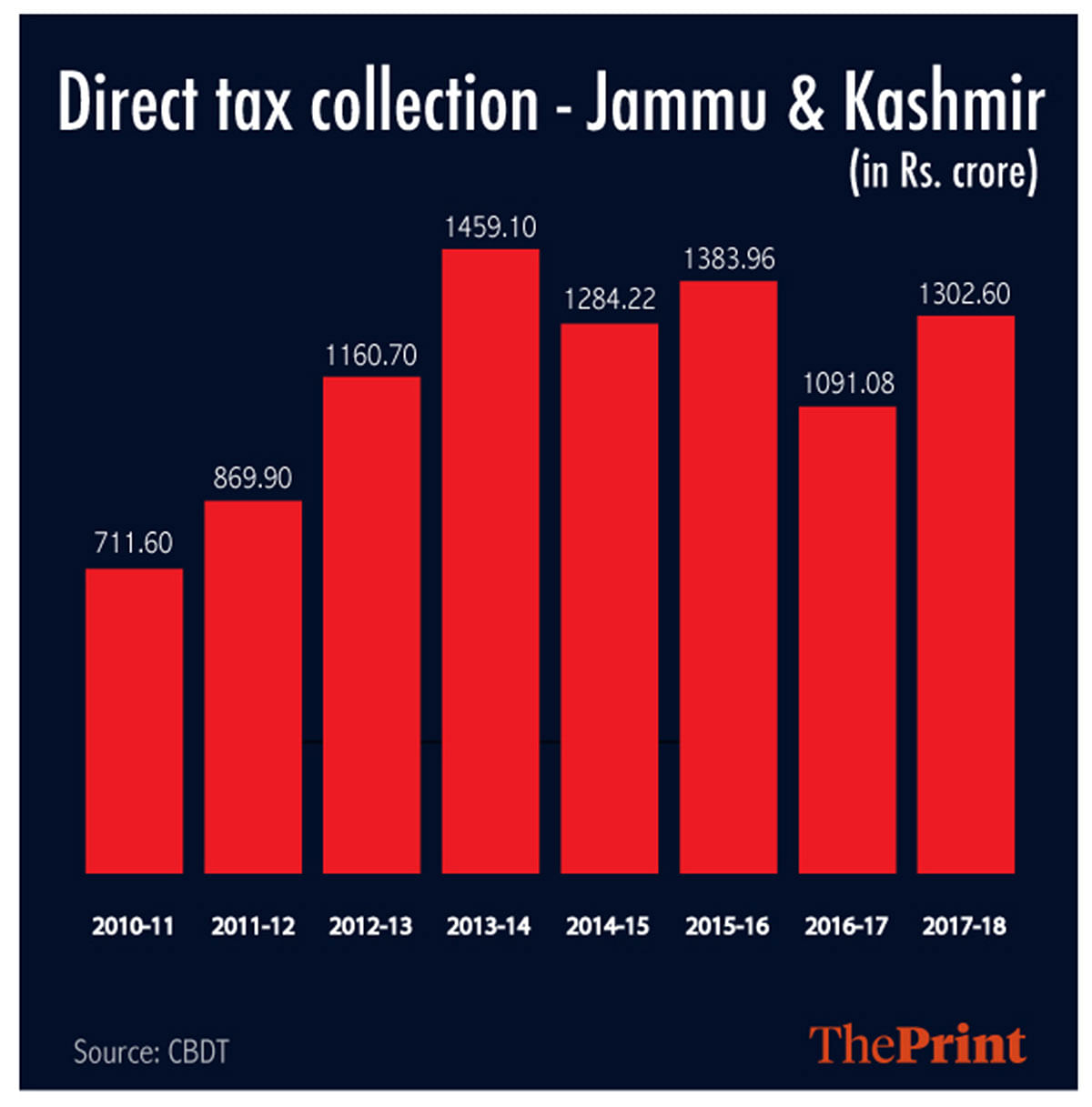

Direct tax collection in Jammu and Kashmir stood at Rs 1,302.60 crore in financial year 2018, up from Rs 1,091 crore from a year ago.

New Delhi: Direct tax collection in Jammu and Kashmir showed a healthy 19.3 per cent year-on-year growth in 2017-18 despite continuing political turmoil and the long shadow of terrorism in the state.

The Central Board of Direct Taxes (CBDT) data revealed direct tax collection in the state stood at Rs 1,302.60 crore in financial year 2018, up from Rs 1,091 crore from a year ago.

The state, though, has seen a topsy-turvy growth in tax collections for a major part of the last decade.

The FY18 collections are less than Rs 1,459.1 crore recorded in FY14 and Rs 1,384 crore in FY16. In FY15, the collection stood at Rs 1,284.22 crore. If the data is seen from 2010-11 onwards, however, the state has witnessed a healthy growth in tax collections of about 95 per cent.

Other states that have registered significant growth in collections in 2017-18 include Delhi, Maharashtra, Gujarat, Tamil Nadu, Andhra Pradesh and Karnataka, showed the CBDT data, released in October.

Also read: One solution governor Satya Pal Malik failed to consider in Jammu and Kashmir

Kashmir situation

Speaking to ThePrint, State Bank of India group chief economic adviser Soumya Kanti Ghosh said the growth in collections from Jammu and Kashmir is a “heartening development” and “shows that economic activity in the state is picking up and incomes for more and more people are increasing”.

“However, this could also mean that more people are voluntarily coming in the tax net now,” said Ghosh.

He also said that the only way to ensure peace and social development in the state is to push economic growth and boost employment.

A senior CII official said tourism along with other cottage industries form the backbone of Jammu and Kashmir’s economy.

“Besides these, there is limited activity in the state and the continuous political turmoil has been having an impact on the state’s economy. The situation in (relatively stable) Jammu is also not much different,” said the official.

However, when asked about the uneven growth pattern in the state, former Jammu and Kashmir finance minister Haseeb Drabu said that tax collections have typically slowed when floods have ravaged the valley.

The killing of Hizbul Mujahideen terrorist Burhan Wani too had an impact on the economic activity of the state in 2016, Drabu told ThePrint.

Last week, President’s Rule was imposed on Jammu and Kashmir after a six-month long Governor’s Rule.

Also read: Sexual exploitation of women is now a crime in Jammu and Kashmir — a first in India

Tax collections

CBDT has been under pressure to add fresh taxpayers with the aim of increasing the overall tax base in the country.

Earlier reports suggested that the department had directed taxmen to focus on states such as Himachal Pradesh, Punjab and Haryana, besides Jammu and Kashmir.

Income tax collection from states such as Rajasthan, Uttar Pradesh, Bihar, along with north-eastern states of Mizoram, Nagaland and Sikkim, among others, however, show a fall.

In October, the CBDT said there has been a constant growth in overall direct tax-GDP ratio over the last three years.

“There is a growth of more than 80 per cent in the number of returns filed in the last four financial years from 3.79 crore in 2013-14 to 6.85 crore in 2017-18,” an official statement had said.

The CBDT data also shows that there has been a growth of 19 per cent in the number of non-salaried individual taxpayers from 1.95 crore to 2.33 crore in 2017-18. The average non-salary income declared has increased 27 per cent from Rs 4.11 lakh in 2014-15 to Rs 5.23 lakh in 2017-18.

However, despite efforts from the government, a large chunk of collections still comes from 15 per cent of the top taxpayers.