Section 7 of the RBI Act empowers the government to consult & instruct the governor to act on issues that it considers to be in the public interest.

Mumbai: India sought to defuse growing tensions with its central bank following reports that the government had cited a never-used legal provision in trying to resolve disagreements with the monetary authority.

The Finance Ministry said in a statement on Wednesday it respects the autonomy of the Reserve Bank of India. That was after news broke that government officials had written letters to Governor Urjit Patel citing special powers the state has over the central bank, which if invoked, could lead to the government directing the RBI to do its bidding.

In the correspondence with the RBI, the government had sought Patel’s views on issues including the central bank’s handling of weak state-run lenders, tight liquidity in the market, and resolving bad loans at power generators, according to people familiar with the matter, who asked not to be identified because they aren’t authorized to talk to the media. The law cited by the government is Section 7 (1) of the Reserve Bank of India Act, according to the people.

The Finance Ministry said on Wednesday the central bank’s autonomy was “an essential and accepted governance requirement” and that it will continue to consult with the RBI. Making no reference to its Section 7 powers, the ministry said the government and the central bank “have to be guided by public interest” and the requirements of the Indian economy. Representatives at the Reserve Bank weren’t immediately available to comment.

The rupee pared losses after the government’s comments, dropping 0.4 per cent to 73.9413 against the dollar as of 1:40 p.m. in Mumbai.

Section 7 of the Reserve Bank of India Act: (1) The Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider necessary in the public interest.(2) Subject to any such directions, the general superintendence and direction of the affairs and business of the Bank shall be entrusted to a Central Board of Directors which may exercise all powers and do all acts and things which may be exercised or done by the Bank.For more, click here.

Section 7 of the law empowers the government to consult and give instructions to the governor to act on certain issues that the state considers to be in the public interest. The letters prompted Deputy Governor Viral Acharya’s hard-hitting speech on Friday, in which he warned that toying with the central bank’s independence could lead to dire consequences, the people said. Why India’s Government and Central Bank Are Feuding: QuickTake

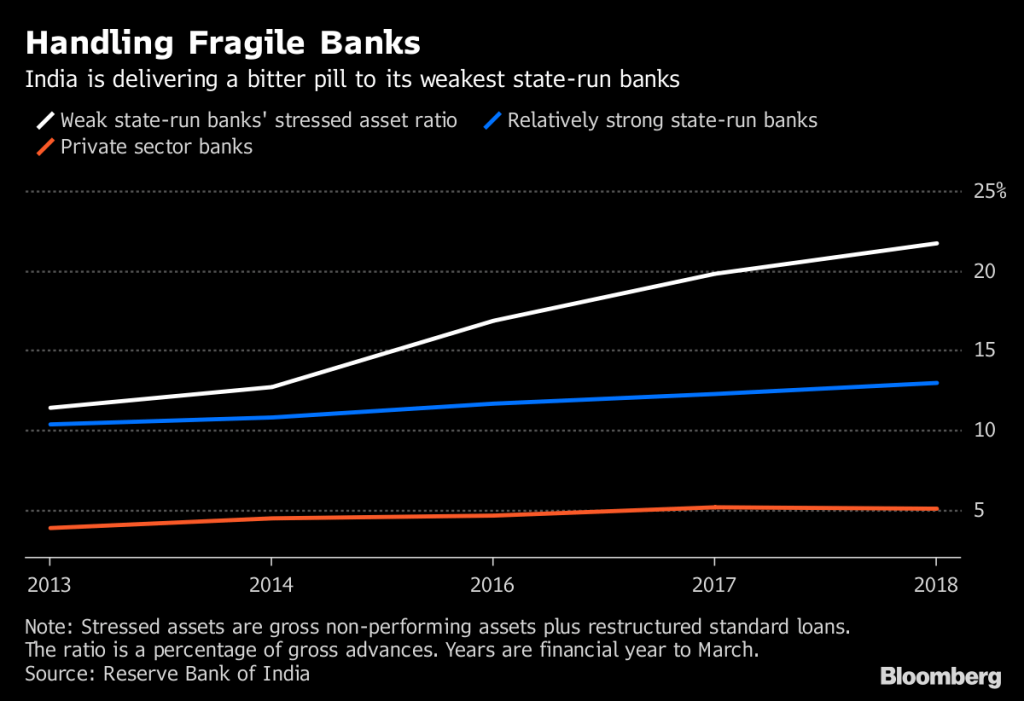

The letters are the latest flare-up in a dispute between the central bank and the government. The RBI under Patel has been pushing for more powers to clean up a banking system saddled with bad debts. The RBI has put lending curbs on some weak state-run banks, while the government — facing an election early next year — wants to ensure banks continue to lend to boost economic growth.

“India cannot afford these mistakes,” Sonal Varma, chief India economist at Nomura Inc., told Bloomberg Television. “The last thing India needs is to spoil the macro picture with this rift.”

Central banks around the world are facing heat from political leaders. US President Donald Trump expressed his unhappiness with the Federal Reserve’s pace of tightening while Turkey’s leader Recep Tayyip Erdogan attacked his country’s central bank for rate hikes.

Open Rift

The dispute between India’s central bank and the government has been simmering for a few months now. It comes at a time when the economy — currently the world’s fastest-expanding major one — is facing risks from elevated oil prices, a weak currency and a crisis in the shadow banking sector.

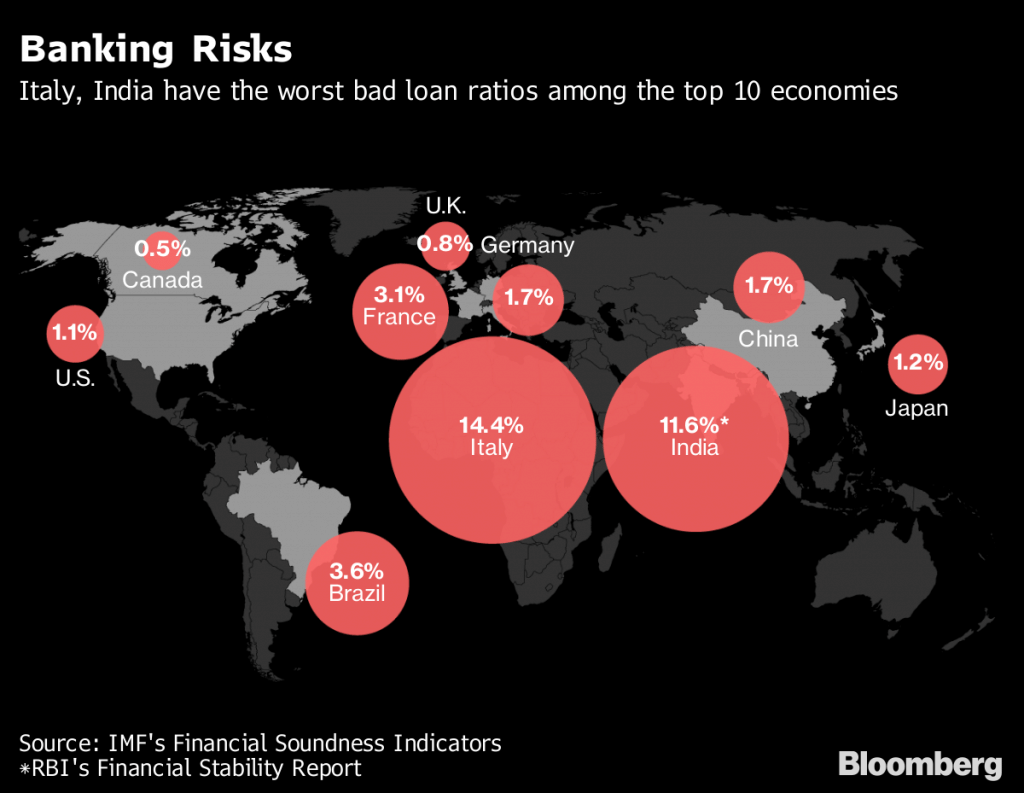

On Tuesday, Finance Minister Arun Jaitley blamed the RBI for India’s huge bad debt pile up, saying it “looked the other way” while banks were allowed to lend indiscriminately in the aftermath of the global financial crisis.

Acharya, a former professor of finance at New York University’s Stern School of Business, said his speech was inspired by Governor Patel’s encouragement to explore the theme of central bank independence.

ET Now, a local television station, said on Wednesday that if the Reserve Bank refused to act on liquidity constraints, the government will not shy away from taking steps against it. The channel didn’t identify the people for the information.

Patel took the helm of the central bank in 2016 following Raghuram Rajan’s exit. The governor was seen as being more supportive of Prime Minister Narendra Modi’s policies compared with outspoken Rajan.

“I am not expecting the rift between the RBI and the government to widen, though prolonged tensions cannot be fully ruled out considering the political angle to it in the run up to the general elections,” said Prakash Sakpal, an economist at ING Bank NV in Singapore. –Bloomberg