New Delhi: The Jammu & Kashmir administration is set to levy property tax on those under the jurisdiction of urban local bodies (ULBs) beginning 1 April. The Housing and Urban Development department issued a notification to the effect Tuesday, a copy of which is available with ThePrint.

The decision comes after over two years of speculation surrounding the initiative, and the Bharatiya Janata Party (BJP) was among the political parties that expressed concern at the time.

Property tax is a tax collected by local bodies, in this case municipalities and municipal councils, from the owner of a particular property. It does not apply on sale or purchase of property.

Before 5 August 2019, when Article 370 — a constitutional provision that, along with Article 35A, gave special status to J&K — was nullified, there was no provision for property tax in the erstwhile state. However, this changed after 2019 and over 100 central laws were extended to the newly carved Union Territory of J&K.

In October 2020, the central government amended various laws under the J&K Reorganisation (Adaptation of State Laws) order, 2020, including the J&K Municipal Act, 2000, and the J&K Municipal Corporation Act, 2000.

The amended municipal Act said property tax will be levied on all lands and buildings or vacant lands or both situated within the municipal area, drawing flak from political parties.

“The property tax shall be levied at such a percentage not exceeding fifteen per cent of the taxable annual value of land and building or vacant land or both, as the government may, by notification, from time to time specify,” said the amended Act.

The property tax will now be implemented as 5 per cent of taxable annual value (TAV) on residential property and 6 per cent of TAV on commercial property, according to the notification, issued under the Jammu and Kashmir Property Tax (Other Municipalities) Rules, 2023.

Property tax determined on 1 April 2023 will remain in force till 31 March 2026, marking the first block of three years. Any new building coming up during the period will be taxed according to the first day of the block and tax will be charged proportionate to the number of months for the year, in case the building came up in the middle of the year, said the notification.

TAV is the product of nine variables — type of municipality, built area, land value in line with the J&K Preparation and Revision of Market Value Guidelines Rules, 2011, as on the first day of the block, the number of floors, usage type, construction type, age of the property, given slab of the area, and the occupancy status.

The slab factor for an area of up to 1,000 sq ft is zero, which would result in no tax for property measuring as much.

While the opposition has hit out at the tax, and members of the Srinagar Municipal Corporation have criticised the move as well, local tax and economy experts are split on the merit of the initiative.

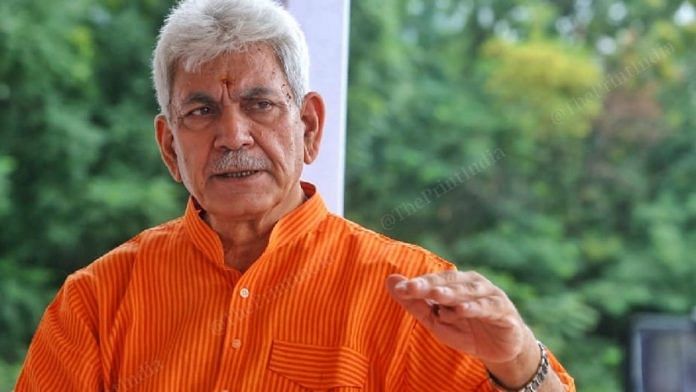

ThePrint reached J&K Lieutenant-Governor (LG) Manoj Sinha’s office and Department of Information and Public Relations through messages and emails. However, there was no response from either until the time of publishing this report.

Also read: Why changing Ladakh L-G may not be enough to cool agitation — ‘feeding uncertainty’

What is exempt

According to the notification, “places of worship, including temples, masjids, gurudwaras, churches, ziarats, etc. and cremation and burial grounds shall be exempted from payment of property tax”. “All properties” owned by the Government of India, and the J&K government and municipalities have been exempted as well.

Vacant land where construction/development is disallowed due to a master plan in force or vacant lands put to agricultural use in keeping with the six-monthly cropping surveys of the revenue department is also in the exempt category.

Delay in filing the return will attract a penalty of Rs 100 or 1 per cent of property tax per month (whichever is higher), up to Rs 1,000.

Among local stakeholders, the notification has led to some concern.

Falendra K. Sudan, former head of department, economics, at the University of Jammu, said the tax is being imposed in order to raise funds for municipalities because “they have no funds of their own”.

“With these funds, they can develop smart city projects and infrastructure. I think this is the intention of the government.”

Even so, Sudan said the tax will “lead to resentment”. “There are taxes to be paid at the time of construction, on top of that, this tax… it will naturally lead to resentment. When tax is charged initially, after the building is constructed, people will pay it happily as they are also in a hurry. But if it is an annual feature, it will be a burden on people,” he said.

Vikram Garg, a J&K-based senior chartered accountant, described the decision as smacking of a “bit of dictatorship”.

“We became a UT in October 2019 and, barely 3.5 years later, including two years of Covid, we are still coping with all the central laws that have become applicable to us and the transition phase thereof.

“And now (there is) another new tax law which ideally — if at all — should have been implemented by the elected government and not by the UT administration, which is not a popular government. This action shows a bit of dictatorship.”

Garg said provisions regarding inspection of property in order to determine the taxable value might lead to ‘inspector raj’, and added that residential property should have been exempted.

“Property tax returns have to be filed, leading to compliance cost, like the cost of filing the return (which could mean hiring a chartered accountant), an additional pinch to the middle class,” he added. “It will be a fixed cost to the owner, whether he or she is earning from that property or not and therefore, may be unjustified.”

About the possibility of investment from outside the state also being affected by the tax, Sudan said it is already “very meagre”. Investors will have to be given tax incentives and exemptions in order to bring them to the UT, he said.

However, Deepankar Sengupta, a J&K-based economics professor, said investors are not likely to be affected by this tax.

“Investors pay these taxes in other states as well. Nobody comes to J&K because there is no property tax here. You come to invest because there is scope to make money. There will be no negative impact on the economy,” he said to ThePrint. He said only those who have earned properties through “illegitimate means” would be affected.

“For a normal householder, this tax is not likely (to be) too much. But things are different for those who have several houses. People who have acquired property through illegitimate means will be hard-pressed,” he said. “I don’t think there will be a lot of financial pressure. It will be one more tax. That’s all.”

Sengupta said that in an “urbanising society like ours”, it is important to give necessary funds to local governments for development. “If you don’t give necessary funds to these (local) governments, you are not going to see orderly urban growth. If you want improvement in urban governance, then they should have the funds to do so.”

Also read: Before Art 370, Nehru was ‘irritated’ by Sheikh Abdullah’s Kashmir interview

Opposition hits out

In 2020, when the likelihood of the tax arose for the first time, Lieutenant-Governor Manoj Sinha had assured residents that there will be no property tax.

In December 2022, the then newly elected BJP mayor for Jammu, Rajinder Sharma, also announced in the municipal corporation, “There will be no property tax in Jammu.”

With the tax announcement, political parties have lashed out at the BJP.

Former J&K chief minister and National Conference vice-president Omar Abdullah said Tuesday, “No taxation without representation.”

“No Taxation Without Representation”. Why should people in J&K pay state taxes including the proposed property tax when we have no say in how our government is run & no say in the decision making of J&K. We are expected to be mute spectators to all unjust decisions by Raj Bhavan.

— Omar Abdullah (@OmarAbdullah) February 21, 2023

The Congress called the move a “new tool of stealing money from pockets of JKians”.

Property tax new tool of stealing money from pockets of JKians.

BJP controlled LG adminstration is responsible for sufferings of common people.

— J&K Congress (@INCJammuKashmir) February 21, 2023

J&K Congress chief Vikar Rasool “strongly denounced” the move in a Twitter post.

I strongly denounced the levying of property tax on our people who are unable to run their homes due to the high rate of inflation, immense unemployment rate and zero business activity.

This is BJP lead Centre Government Amrit Kaal and LG administration Naya Jammu Kashmir…

— Vikar Rasool Wani (@vikar_rasool) February 21, 2023

Criticism from Srinagar Municipal Corporation

Members of Srinagar Municipal Corporation (SMC) have also hit out at the administration over the “arbitrary” move, saying it is “violative of municipal empowerment”.

“Imposition of property tax in J&K is ironically violative of municipal empowerment as this has neither been deliberated upon, nor approved by elected ULBs (urban local bodies),” tweeted Junaid Matoo, mayor of Srinagar and head of its municipal corporation.

Imposition of Property Tax in J&K is ironically violative of municipal empowerment as this has neither been deliberated upon, nor approved by elected ULBs.

While SMC will explore ways to contest this arbitrary move, I am writing to the Hon’ble LG seeking a withdrawal of the SO.

— Junaid Azim Mattu (@Junaid_Mattu) February 21, 2023

Deputy mayor Parvaiz Ahmad Qadri said “people should not get panicked”.

The people need to understand that imposition of property Tax is only SO of Govt & before implementation that has to be first passed by SMC; We are rejecting proposal even at its arrival & it won’t get consent of corporators to get it passed by SMC. People should not get panicked pic.twitter.com/aA1iobWoid

— Parvaiz Ahmad Qadri (@Parvaiz_Qadri) February 21, 2023

Meanwhile, J&K BJP chief Ravinder Raina said the provisions and modalities of tax collection will be decided by the general house of the ULBs.

(Edited by Smriti Sinha)

Also read: 9,400 more personnel, new operational base for ITBP — how India plans to strengthen hold on LAC