Hyderabad: In a just-bifurcated Andhra Pradesh in 2014, a pensive Chandrababu Naidu is said to have told a close huddle of bureaucrats in Vijayawada that “creating just one Hyderabad cost him dearly and he never wanted to make that mistake again”. The state, then, had no Capital, a massive debt, and emotional scars from the division of Telugu-speakers.

Naidu had just regained power after defeating the Congress government, which was in support of the bifurcation. With his team of officials, he made a quiet resolve—Andhra’s “coast, hills, and fertile lands” would be leveraged to create a Hyderabad in every region—an official, then a part of the discussion, told ThePrint on the condition of anonymity.

After all, Hyderabad was the jewel in Andhra Pradesh’s crown, with billions allocated to create world-class infrastructure in the city in the early 2000s. The city capitalised on the dotcom boom, with visiting dignitaries to the city including American presidents and US-based technocrats.

Post-bifurcation, Hyderabad was to serve as the shared, joint capital of Telangana and Andhra Pradesh for a transition period. It became Telangana’s Capital in 2024.

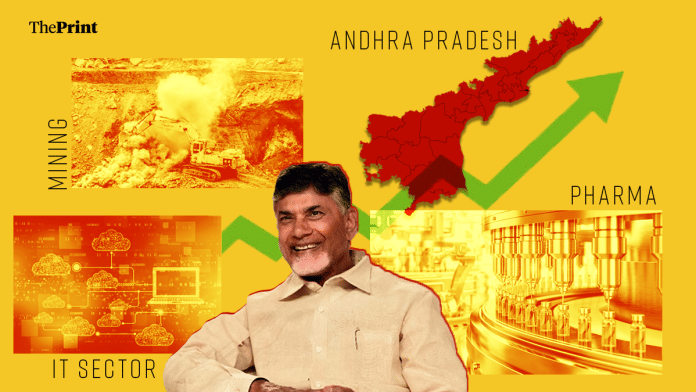

More than a decade after losing Hyderabad, Andhra Pradesh has engineered a calculated comeback—ditching the single-Capital growth model in favour of region-wise industrial hubs, fast-tracked clearances, customised sectoral policies, change in labour laws, and political alignment with the Centre.

This has led to a dramatic surge in domestic and global investment, with the state claiming over a quarter of India’s proposed investments in FY2025–26 based on a Bank of Baroda report earlier this year, positioning itself as a state outpacing traditional industrial heavyweights.

After coming back to power in 2024, Naidu and his officials began “a diversification of sectors, the decentralisation of investment, and the localisation of the employment policy,” the official who spoke to ThePrint has shared. What was central to this strategy was moving away from the over-reliance on Vijayawada and Amaravati, the administrative nodes of Andhra Pradesh, he emphasised.

The industries department swiftly mapped the four regions—Uttarandhra, Rayalaseema, Delta, and Southern Andhra—into economic zones based on resource availability and earmarked them into hubs to market them as specific sectoral spaces. To implement this, the planning and industries departments were put into service, and the first steps to reform policies led to the creation of the Andhra Pradesh Economic Development Board.

Unlike the existing nodal bodies under the industry department, such as the Andhra Pradesh Industrial Infrastructure Corporation Limited (APIIC) and the Andhra Pradesh Industrial Development Corporation (APIDC), which act as investment facilitators, the Andhra Pradesh Economic Development Board (APEDB) was set up in 2016 with a specific charter.

“Our goal was not just investment creation, but also investment redirection and fructification. This new reform had to be perfected almost as a vocal statecraft if all regions of the state had to benefit,” a senior official of the APEDB told The Print about the APIDC, which created a single point of contact for investments.

Policy reform was complemented by industry bodies, which were structured, along with over a dozen sectoral bodies, under the already-existing Andhra Pradesh Chambers of Commerce.

“The clock was set back by nearly 25 years because of the bifurcation of the state [during Congress rule], and there was a lot of catching up to do for every region and every sector. We reorganised ourselves because the only way to build momentum and accelerate the flow of investment was to plug the inter-regional disparities in industrial development,” the now-president of the chambers, Potluri Bhaskar Rao, said.

Before the state boundaries were redrawn, Visakhapatnam (Vizag) was known for its pharmaceutical, Business Process Outsourcing (BPO), and Information Technology Enabled Services (ITeS) units. Vizag’s pharma-landscape was characterised by major drug manufacturers, such as Aurobindo Pharma, Laurus Labs, Natco Pharma, Eisai Pharmaceuticals, and Gland Pharma, housed in the Jawaharlal Nehru Pharma City, a park dedicated to manufacturing and exporting medicines.

With the post-2014 re-mapping of economic strengths in every region showing that Visakhapatnam remained a significant part of the economy, with its steel, pharmaceutical, and IT units, as well as data centres, it was championed as the next best investor destination after Hyderabad. Consequently, HSBC, IBM, Infosys, Tech Mahindra, TCS, among others, set up operations in the coastal city.

Meanwhile, the southern districts of Nellore, Prakasam, and Tirupati were earmarked for the flourishing of mining, electronics, and defence-related aerospace industries, along with Sriharikota, India’s primary spaceport for launching satellites in Nellore.

Northward from Nellore, the balmy coastal region—upwards from Kakinada to Srikakulam—was declared to be the PCPIR or Petroleum, Chemicals, and Petrochemicals Investment Region zone.

The delta regions of Krishna, Guntur and Godavari—once known as the ‘rice bowl of India’—were reserved for industries, depending on the clayey alluvial soil.

With Andhra being the top producer of tobacco and the top exporter of seafood, its aquaculture, agricultural, MSME, and food processing industries were to later call central Andhra Pradesh their home.

On the other hand, the arid Rayalaseema region, whose glory was producing eight CMs, was demarcated as a zone with 90 percent of India’s Baryte reserves—a weighting agent in oil and gas drilling muds that prevents blowouts—along with 48 different minerals.

The region, therefore, became a fertile ground for harnessing solar energy, with the Greenko Group setting up the Integrated Renewable Energy Storage Project at Pinnapuram in Kurnool district. Commissioned by late-2025, the project is now reportedly delivering nearly 20 GWh of energy daily.

Subsequently, South Korea’s Kia Automobiles chose to set up its first Indian car factory in Anantapur—officially inaugurated in December 2019 by then-CM Y. S. Jagan Mohan Reddy—the region became the capital for renewable energy and automobile sectors.

Also Read: In Telangana’s Karimnagar, BJP clinches first corporation win since state’s birth

A new mantra

The plan to decentralise investments became a definitive reference point for ambitious, big-ticket international investments to flow in in Naidu’s second term after his Telugu Desam Party (TDP) was dovetailed into the NDA government at the Centre, Narendra Saranam, Vice Chairman, Confederation of Indian Industries, told The Print.

“During the first term, Andhra was not in a position of strength, and the investments that came in seemed scattered because the state government was still creating sufficient infrastructure across the state for a revitalised investment scenario,” Saranam explained.

In 2024, when the Naidu-led Telugu Desam Party and the NDA won a thumping majority, winning 164 out of 175 seats in the Andhra assembly, CM Naidu made up his mind to turn the state into an industrial powerhouse, a colleague in his Cabinet told ThePrint on the condition of anonymity.

“In our very first Cabinet meeting, we were told that our goal was to turn Andhra’s potential into performance,” the colleague said, further quipping that Naidu’s pathway for development looked like he had taken a leaf out of Prime Minister Modi’s ‘reform, perform, transform’ model. But taking advantage of being an NDA ally meant more than mirroring the Centre’s Viksit Bharat vision, the colleague added.

Andhra came up with 22 sectoral policies with incentives being customised for every industry and all regions. Old acts, such as the Non-Agricultural Lands Assessment, were abolished, and the license fee for many businesses was reduced. A long-pending demand of the tourism sector to be recognised as an industry also passed muster, keeping the state’s temple and coastal tourism potential in mind.

With policies simplified and an investment tracker put in place for approvals to be granted within a month of MoU signing, a surprise amendment came in mid 2025.

Andhra amended its labour laws and increased the maximum working hours to 10 hours a day, with Information & Public Relations Minister K. Parthasarathy announcing the amendments to the labour law.

The minister later clarified that the amendment applied to private firms and factories, and that the overtime cap had been increased from 75 hours per quarter to 144 hours.

The amendments faced strong backlash from labour unions. On 9 July 2025, millions of workers across India participated in a massive nationwide general strike, or ‘Bharat Bandh’, to protest the NDA’s economic and labour policies, according to reports.

But while the workers’ protests did not carry to Amaravati, the industrialists’ applause did.

The new mantra echoing in corridors of power among industrialists, who sat at the reform table with Naidu, is not ease of business anymore; it is speed of business.

“Beyond land and incentives, industrialists today are looking for predictable business outcomes and a productive workforce. And reforms in labour codes are central to the rapid industrial growth resulting in economic and social transformation,” Murali Krishna Gannamani, Chairman and Managing Director of Fluentgrid, and Chairperson of Confederation of Indian Industry, told The Print.

The results? Domestic and foreign investment has climbed steadily, starting in June 2024, when Naidu’s second term commenced.

In early January 2026, citing a Bank of Baroda investment report, Andhra declared that it had netted 25.3 percent of India’s total proposed investments in the first nine months of the 2026 financial year—April to December 2025—making it India’s leading investment destination.

The data, compiled from the Centre for Monitoring Indian Economy (CMIE), showed investment intentions across India stood at Rs 26.62 lakh crore during the period.

While the BoB report does not quantify or map investments region-wise, data gleaned from Andhra’s industries departments has revealed that its policy experiment of decentralisation of investments worked.

‘Pulling ahead’

The Sri City industrial hub in Nellore (South), Visakhapatnam (North), and Anantapur (West) received the heavy load of capital, while eight other districts across the state’s geography had big names to boast, too.

In February 2026, Carrier announced a Rs 1,000 crore investment for a new manufacturing facility in Sri City, further cementing its position as a cooling hub.

More than 90 percent of the landed investments amounting to Rs 2.3 lakh crore came from the private sector. The largest share of these investments came from the power sector, metals and chemical industries.

According to the Bank of Baroda report, renewable energy topped the charts, accounting for 22.6 percent of total investment, followed by chemicals (21.8 percent) and metals (17.3 percent) .

If structure and strategy formed the foundational pillars for heavy-duty investments to follow, a closer huddle between the ruling BJP at the centre and the TDP in the state lent the investors political stability and certainty. Companies from across India flocked to AP.

Indosol Solar pledged Rs 15,000 crore for Phase-1 of its integrated solar manufacturing facility at Ramayapatnam, with plans to reach 10 GW capacity by 2026 . From Kolkata, Dalmia Group announced its intention to set up a cement manufacturing plant in Kadapa for Rs 2,883 crore. The Mayfair Group joined Taj and Marriott to help AP broaden its hospitality surge with a Rs 400 crore resort in Bhogapuram, a seaside town on the edge of Vizianagaram district.

Former AP bureaucrats spoke to The Print and explained that these investment wins were not because of offering more land and less tax liability, or the enviable drive of the CM. Andhra succeeded because it moved swiftly, recognising the strategic value of the investments more than just the quantum of it. While its old rivals Maharashtra and Tamil Nadu, and its new competitor Telangana, were relying on their intrinsic strengths and historical status of being celebrity investment destinations, Andhra displayed competitive engagement on multiple fronts.

This agility was complemented by what both BJP and TDP leaders describe as a “double-engine government” synergy. With the TDP being the largest ally in the NDA government with 16 Lok Sabha MPs, the Centre extended crucial support, from standing as an informal guarantor to bring Singapore back for Amaravati’s development, to sanctioning a semiconductor facility in Kurnool under India Semiconductor Mission 2.0 that some states, including Telangana, felt favoured AP over other contenders. The Union Budget 2024-25 had already signalled this partnership, allocating Rs 15,000 crore specifically for Amaravati’s development and Rs 12,157 crore for the Polavaram irrigation project.

Speaking to ThePrint, Surya Teja Mallavarapu, IAS, Managing Director of Andhra Pradesh Technology Services, added that companies appreciated the ecosystem created for each industry, confirming that Andhra’s hard-nosed bargaining and its willingness to expedite administrative bottlenecks helped in the district-wise consolidation of investments. He personally oversaw the processes when Google Inc’s largest AI Centre in India was announced in Andhra Pradesh, as well as assisted Tata Consultancy Services and Lulu Global International, when they pledged Rs 1,370 crore and Rs 1,500 crore, respectively, in the state.

Industrialists say the state’s multisectoral investment yields are a testimony to a successful recalibration and reimagination of regional integration, which is perhaps why the IT and HRD minister Nara Lokesh tweeted in January 2026, after the BoB report was released: “Andhra Pradesh isn’t catching up, it’s pulling ahead”.

(Edited by Madhurita Goswami)

Also Read: Govt planning regulatory sandboxes for pharma sector to fast-track approvals & drug development