Melbourne: Hawkish expectations in Asia’s emerging markets are piling up as traders become increasingly convinced that central banks in the region can’t ignore the threat of domestic inflation any longer.

Goldman Sachs Group Inc. is one of the latest banks to now see an “imminent” lift-off in rates in several Asian markets. The region’s shorter-maturity bonds, which are more sensitive to rate expectations, have spiked this quarter amid doubts about the dovish rhetoric from policy makers. Malaysia’s central bank surprised with a rate hike on Wednesday, after signaling patience in April.

An about-face from more central bankers will deepen the selloff in emerging-Asia bonds, which have already suffered losses of 7% this year, surpassing even those seen during the 2013 taper tantrum. The securities are already feeling the pain from runaway inflation and the fact that policy makers in the region are lagging behind some developed countries in raising rates isn’t helping.

The following four charts show how rate expectations have been increasing:

1. Malaysia

Bank Negara Malaysia surprised investors by raising rates 25 basis points on Wednesday, after indicating in late April that tightening policy due to supply-side shocks has limited effectiveness. Six-month ringgit interest-rate swaps are now pricing in more than three quarter-percentage-point increases over the next six months. Three-year yields have jumped by more than 100 basis points this quarter, the most on record in data going back to 2000.

2. Thailand

Thailand’s one-year non-deliverable interest-rate swaps have been climbing since April, and are now pricing in at least two 25-basis-point hikes over the next 12 months. That’s despite dovish comments from the central bank, with the governor maintaining that monetary policy can look through a short-term inflation spike. The first increase is likely to come in September, Goldman Sachs said in a note Monday. That’s well ahead of the median forecasts of economists for the first quarter of 2023.

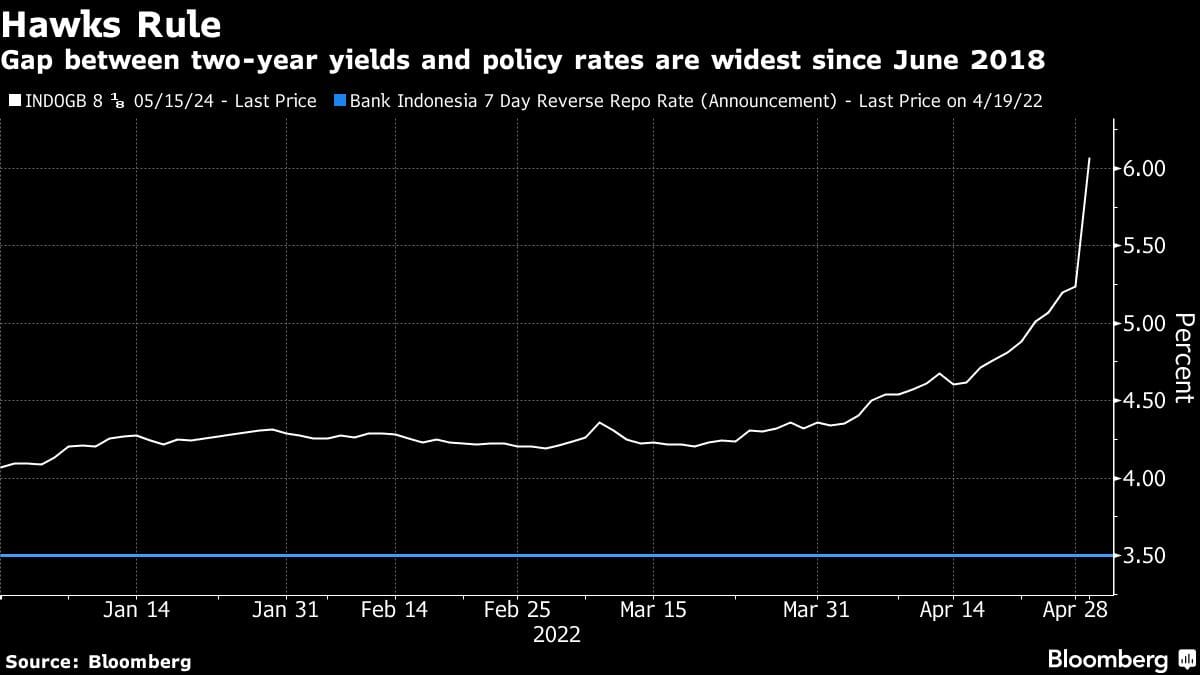

3. Indonesia

A surge in Indonesia’s two-year yields since April has increased their premium over the policy rate to more than 270 basis points, the most since June 2018, when the central bank was in the middle of its previous hiking cycle. Headline inflation quickened to 3.47% in April, the fastest pace since December 2017, though still within Bank Indonesia’s 2%-to-4% target.

There’s a good chance the first quarter-point hike will come at the May 24 meeting, as a pre-emptive move would show policy makers are committed to tackling inflation, Wellian Wiranto, an economist at Oversea-Chinese Banking Corp. in Singapore, wrote in a note Monday.

4. India

The Reserve Bank of India’s surprise 40 basis-point hike at an out-of-cycle policy meeting on May 4 triggered a jump in hawkish bets. Onshore overnight index swaps are now pricing in more than 100 basis points of tightening over a six-month horizon. The central bank was preaching patience as recently as February, but said retail inflation remaining stubbornly above the 2-6% target for three straight months drove it to act. —Bloomberg

Also read: Google joins Amazon to mull a bid for Indian Premier League