New Delhi, NCR: The festive season is well underway with Navratri concluding earlier this month, and Diwali soon to follow, but the usual bustle associated with this time of the year, is absent for the textile, interior designing and the advertising display sectors in the National Capital Region (NCR).

These sectors are still struggling with the double whammy of low demand and orders on one hand, and soaring prices of raw material, fuel and freight costs on the other. The impact of this gloom is seen throughout the economic ladder, but it is the workers of industries associated with these sectors who are the most hurt as they struggle to survive inflation with just a meagre or no increase in salary.

“We had no salary and work for many months during the lockdown; recently, our salary was hiked but even after that, it comes to just Rs 9,700 a month, which isn’t enough to manage household expenses amidst such soaring inflation. We can even cut down on our consumption but it’s difficult to manage children in these festivals,” Lakshmi, a migrant worker from Kanpur employed at the Modelama Textile Factory in the Udyog Vihar industrial hub of Gurgaon, told ThePrint.

She added that the economic situation not only ate away her savings, but also left her in debt.

“During the lockdown, we paid all our rent and ration through loans from the owner and shopkeepers. It was about Rs 30,000 to Rs 40,000 but we cannot repay it anytime soon as our current salary is just exhausted from hand to mouth,” Lakshmi said.

“The prices of everything is rising; cooking oil is beyond Rs 150-200/litre for both mustard and refined oil. Even sugar has become Rs 45-46/kg. After this, where do we have savings?”

Another textile worker in the same locality, 42-year-old Mohammad Shakil, shares a similar plight.

“Due to sluggish demand and work, the provision of overtime is also gone, taking away any scope for us to recoup losses and clear loans,” Shakil said.

“Whenever we ask for a hike, our manager says the company is also struggling with squeezed margins and fuel costs and hence can’t afford a hike. He says ‘you can leave and work wherever you please and get more money’.”

The festive season, which was expected to drive the economic recovery, with a demand hike leading to better prices and income surge, has proven a dud so far, thereby aggravating the crisis.

The management in these sectors say input costs have risen substantially, leaving them with little margins.

“Cotton prices have increased by 5-7 per cent in just this month. The price has increased from Rs 40,000/candy to Rs 47,000/candy in a month (1 candy = 356 kg of cotton). Even transportation costs have increased from Rs 1,500/box to Rs 2,300/box in the last four to six months,” said Ashish Singh, manager of Rama Garments in Udyog Vihar, Gurugram.

“Other costs like electricity, rent have increased. Despite all this, there’s no festive demand like in the years prior to Covid-19. It used to be Rs 20-25 lakh/week, which has dropped to Rs 7-8 lakh/week now,” Singh added.

“Due to this, product market prices are suppressed. We are fighting to survive and remain in the market. How can we pay more increments to workers in such stress?”

According to reports, cotton prices have soared to a record high in India on global trends as prices have soared to Rs 63,000/candy. On Intercontinental Exchange (ICE), New York, cotton prices have gained over 50 per cent year-on-year, rising to 108.67 cents a pound (Rs 66,025/candy).

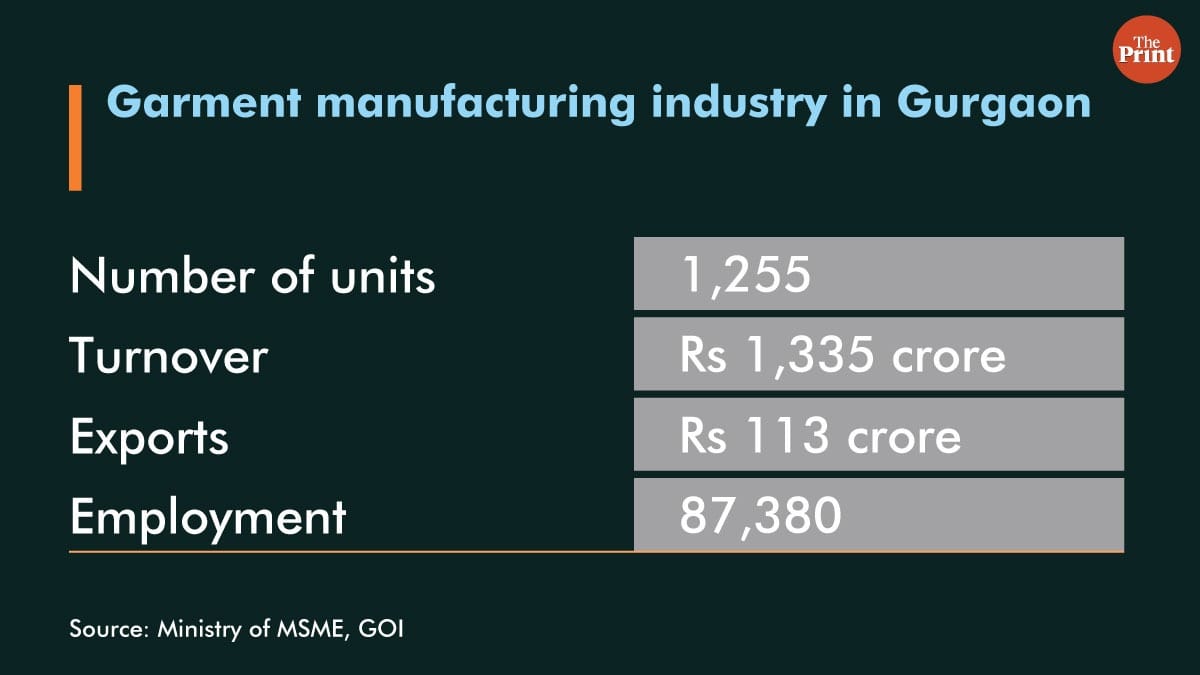

Gurugram is a textile manufacturing hub with thousands of workers employed in it (see box).

No festive orders for outdoor advertising

There’s similar stress in the once-thriving advertisement product industry, which makes advertising kiosks, sign boards premium metal and wooden carving carvings for interior decor and furniture among others. These are placed at malls, cinemas, airports and other places.

The festival season should have seen a surge in demand, given the increased advertising around these events, but, instead, the industry is facing severe headwinds.

Anil Khurana, owner of 3 Span Optimum Solutions LLP in Kapashera, Gurgaon, makes branding and display items for multiple corporate houses across India.

“We are fed up with explaining to our clients how input prices are increasing every few months due to the surge in raw material and other costs. They also have their budget and forward agreements,” he said.

“Metal has gone from Rs 47-48/kg to Rs 77-78/kg. Paint, MDF, ply, board, acrylic sheet price of everything has increased by at least 30-45 per cent,” Khurana added.

“To recoup from all non-operational costs and losses of lockdown, we need an increase in business but there’s still no business at all,” he said.

“It’ll take at least two years to normalise and recover, provided we keep getting orders. In markets and malls, footfall is still low. There’s little festive cheer, with a drop in orders by 20-25 per cent. There were products made prior to lockdown for a particular campaign or launch but those were rendered useless. Our annual turnover has declined by 20-23 per cent with margins reducing by 7-10 per cent.”

Another advertisement material manufacturer, Sushil Sharma, echoed similar concerns.

“Even the cheapest raw material prices have increased from 7-18 per cent. Acrylic sheet price surged by 15 per cent from Rs 2400/sheet to Rs 3200/sheet,” he said. “MDF sheet price has increased from Rs 900 to Rs 1,100. There’s similar sluggishness like lockdown in work despite festive months. All unproductive costs in lockdown like warehouse and office rent, bills and EMIs have led to losses of Rs 30-40 lakh.”

Also read: Shutdowns, debts, layoffs: Bengal tanners pushed to the edge say 3rd Covid wave will finish us

No cheer for miniature temple makers, furniture manufacturers

A small-scale industry exclusively linked to festivities makes miniature temples, idols or monuments using materials like artificial marble-like Corian. These industries, however, have witnessed a lower festive order this year despite a relaxation in Covid cases.

Further hurting them is surging transportation costs. It has also forced these industries to carry out massive layoffs.

“Earlier, I employed 10-12 people on a salary basis but due to low and infrequent orders, we now just hire 4-5 workers on daily wages to cut costs while continuing our operations. While the workers get money for 10-15 days in a month we also don’t spend unnecessary money on their salary,” said Farukh Saifi, owner of Alfalah Creations in Hindon, Ghaziabad.

“We took an order for a miniature temple from Patna a few months ago. Back then, its transportation cost was Rs 18-20,000, it has now increased to Rs 26-27,000,” he added. “This will be compensated from my end as we agreed for a particular cost and we have clients to maintain. I used to have a margin of Rs 15,000, which has now reduced to just Rs 7-8,000.”

Other industries around Delhi-NCR are witnessing similar stress with a delay as well as rising costs of raw material and freight.

Naveen Sethi, owner of Design and Detail in Dasna-Masoori, Ghaziabad, that manufactures modular kitchen and furniture for markets in India and abroad, said, “Profits have come down by upward of 50 per cent. From Rs 15-16 crore annually to Rs 5-6 crore. The major problem is we import many materials from China, Malaysia and Vietnam but containers are available at exorbitant costs with severe delays leading to cost overruns. I’ve shifted from wooden polymer to medium-density fibreboard (MDF).”

Industry stakeholders say the GST rules have further deepened their distress.

Lalit Kohli, owner, Unique International, which imports laser cutting, fabric and UV printing machines, said, “We pay a heavy 18 per cent GST as soon as we import. We need to keep some amount of stock ready though it gets sold at a later date. As a result, I haven’t been able to claim GST refund worth almost Rs 9 lakh for 2018-19.”

“We have to adjust GST at our end to avoid order cancellation and remain in the market as a majority of our clients are small players with no GST registrations,” he added.

Vineet Agarwal, President, Assocham, said, “Many companies witnessed demand sell-off, so they didn’t even open factories due to lack of economies of scale. Others were hurt by increasing raw materials prices. It’s perhaps the toughest time for MSMEs.

(Edited by Arun Prashanth)

Also read: ‘Process is punishment, govt loves paper’: MSMEs call out unease of doing business in India