The focus of banking sector reforms in India has been public sector banks. But recent media reports suggest that some of India’s private sector banks may be in trouble.

With limited supervisory capacity, no resolution capability, and old laws, the only solution the Reserve Bank of India may have to the problem is to make a healthy public sector bank like SBI acquire them. This will not be good news.

How to judge the fragility of a private bank

As a member of the public, how is one to assess the soundness of a private bank? When a borrower does badly, the bank and the RBI work hard on covering it up. Most recent data is not available. But stock market speculators have strong incentives to peer inside the bank and understand the health of the lending portfolio.

The stock market deletes losses from the claims of the bank, including from the companies to which loans have been given. This influences share prices of banks. Hence, the key ratio to look at is the deposits of the bank divided by their market capitalisation.

As an example, consider Axis Bank. With deposits of about Rs 5 lakh crore, and equity market capitalisation of about Rs 2 lakh crore, this gives a ratio of deposits/Mcap of about 2.5. This is a reasonably healthy value.

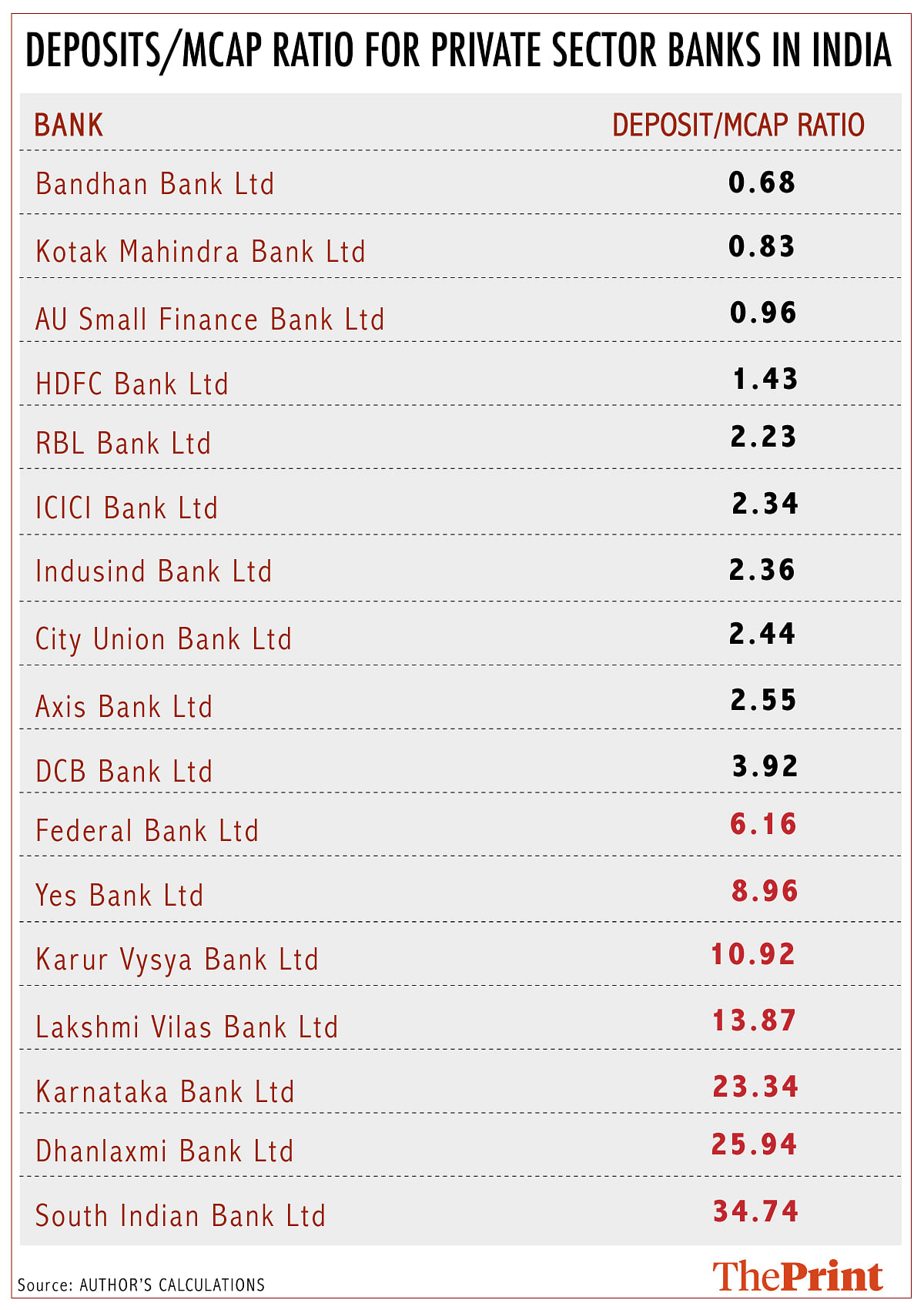

As a thumb rule, values of 4 or lower are a comfortable environment. The latest available data gives us the following ratio for private sector banks in India.

The table above shows all private Indian banks, sorted by the deposits/Mcap ratio (the latest deposit data is from June 2019). This throws up numerous names with values of worse than 4.

Let us pause to understand the meaning of a ratio of 10. This means that, in the eyes of the speculators on the stock market, for each Rs 10 of deposits from the public, the bank only has a buffer of Rs 1 of equity capital.

The table shows a weakness in seven banks: Federal Bank, Yes Bank, Karur Vysya Bank, Lakshmi Vilas Bank, Karnataka Bank, Dhanlaxmi Bank and South Indian Bank.

We now try to see if we can get a more recent estimate of these figures. If we use the September 2019 market cap numbers, we find that Yes Bank also shows weakness. Even assuming zero growth in deposits since June, the ratio of deposits to market cap is above 21. All the other banks remain in the same health as in June.

Also read: RBI has done its bit to boost India’s economic growth, now the govt needs to do its share

How regulation can fight the fragility of banks

How does banking regulation produce safety? A capable banking regulator does two things. First, it constantly forces the bank to do correct accounting of its assets. The assets must be counted at the prospective sale value. When a borrower comes under stress, this must be immediately recognised as loss. Second, the banking regulator must demand reduced leverage.

It is bad when unsophisticated households lose their bank deposits, when a private bank gets into trouble. This induces a loss of confidence in banking and, more generally, in the financial system. That is why everywhere in the world, policy makers have looked for a way to protect unsophisticated households. This is done through a financial ‘resolution corporation’ or RC.

The RC plays two roles. First, it watches over private banks, and moves in to execute a rapid bankruptcy process when the bank is in trouble, but before the bank is bankrupt. This imposes less turmoil upon the economy than would have been the case if a bank went to the Insolvency and Bankruptcy Code when it is unable to pay creditors.

Second, the RC pays out deposit insurance to unsophisticated households. In India, each individual is protected up to a total value of Rs 1 lakh held in all deposit accounts with a given bank, put together.

At present in India, we have a deposit insurance corporation, DICGC, which pays Rs 1 lakh to an individual, summing across all the accounts held with the bank. The trouble is the DICGC is a mere paybox. It plays no role in thinking about when to intervene in a bank, and in running a smooth bankruptcy process.

The Financial Sector Legislative Reforms Commission (FSLRC), which was led by Justice B.N. Srikrishna, designed the required new RC arrangement. It is essential to have this RC, if we are to have private banks and private insurance companies. The first Modi government had proposed but withdrawn an FRDI Bill, which used the law drafted by FSLRC.

Also read: The disruptive reform that’s responsible for India’s consumption slowdown

Revive FRDI Bill

It is essential to revive and enact the FRDI Bill, in addressing the foundations of the failure in Indian finance.

At the same time, we should be modest in our expectations. Building a complex institution like the RC is a multi-year job. We cannot expect to just hire a few people and rent an office and expect that it will work. Like all modern organisations, an RC involves complex issues of organisation design, process design, writing process manuals, building IT systems that encode process manuals, training the staff. It takes about three years to build a government agency.

As a consequence, even if the FRDI Bill is enacted tomorrow, for some years, there will be no capable RC. This means that the problems of fragile private banks in 2020 and 2021 will have to dealt with, without the benefit of a capable institutional mechanism for doing this. However, it is important to start the process now so that we have parallel supervisory capacity, in case the RBI remains deficient, and we have a resolution mechanism for those banks that fail.

In the meantime, the only provision in the law to deal with failing private banks is forced mergers.

Also read: Financial sector needs bold reform to fix slowdown. Modi govt has time & numbers to do it

The author is an economist and a professor at the National Institute of Public Finance and Policy. Views are personal.

inancialexpress.com/industry/banking-finance/deposit-mcap-ratio-wrong-way-to-gauge-banks-health-they-are-well-capitalised-as-per-this-ratio-cea/1892578/

The Print and the author may want to update this article in view of the RBI response on 8 Mar 2020 dismissing deposit/mcap ratio as a valid metric to assess the health of banks. Dr Patnaik does make the point in the article that weak RBI supervision and lack of data means that analysts will need to rely some metrics and the mcap ratio is one such. But in light of the RBI’s strong rebuttal, it would be good to have the author’s response.

Who propounded this ratio?

Any book in which this ratio is explained

Since neither The Print nor the author have responded to the RBI’s criticism of the analysis in the article, we should treat the article as alarmist and disregard it.

The RBI tweet of 8 Mar 20 said: “Concern has been raised in certain sections of the media about safety of deposits in certain banks. This concern is based on analysis which is flawed. Solvency of banks is internationally based on Capital to Risk Weighted Assets (CRAR) and not on market cap.”

Also, I couldn’t find any credible source or book that says bank deposits/mcap is an accepted metric to assess the health of a bank. Finally, I contacted some bankers for their view and all of them dismissed the ratio described in the article.

This proposed measure of safety in this article while merits a reading, assumes much.

It assumes that the market price is reflective of the true value of the stock. This may not be true and can go either ways. A stock may be overvalued- individually by operators or by virtue of market sentiment – skewing the ratio.

It assumes the market to have perfect knowledge – which is a tall order even in the most mature market as bankruptcies and regulatory action in recent times have proved.

I would like to go with Roshni’s view above and rely on the bank’s regulatory capital ratio which would be a true indicator devoid of fickle market sentiment.

Ms Patnaik, Your erudition notwithstanding you seem to have ignored that compliance in Indian banks include the statutory liquidity ratio. Second , a capital buffer of Rs one per per Rs 10 of means a CAR of 10 per cent which is what Narasimham Committee 1 criterion. Ideally the ratio applicable is leveraging ratio to common stock, Ma’am Patnaik !

All banks in India have to follow Basel III norms for computation and reporting of capital adequacy ratio. Federal bank has reported car of 14.14% as at mar-19. Incidentally the bank also reported its highest ever quarterly Net profit in excess of 400 crores for the second quarter ended sept 2019. The only weak and loss making Pvt sector banks in India currently are catholic Syrian bank and laxmi vilas bank

For providing comfort to the common customers, especially SB,FD,RD Account holders whose number runs into millions,it would be preferable to match liabilities under various groups and ensure the above three groups are secured by matching or exceeding assets, especially Deposit with RBI, Government of India Bonds etc

My suggestion is that banks should not be allowed to hide behind veil of secrecy. As any Mutual Fund Scheme is required to display its portfolio detailing investment in various companies, banks should also periodically publish the details of their top borrowers ( enjoying credit facilities of more than 1% of the total loan book of the bank) with their respective credit ratings. I recall that the Supreme Court has repeatedly asked the RBI to publish details of loan defaulters and yet RBI has not complied with it. The depositors must know the financial strength of a bank with whom they have entrusted their hard earned money. Sadly, many of the depositors of the failed PMC Bank had no inkling of a special relationship of this bank management with HDIL. This is sad. Secrecy must go and depositor should know where and to whom their hard money has been lent.

Do not worry about us. We The South Indian bank on the “right” track.. Our top management is capable to avert any disaster.