New Delhi: In a bid to increase health insurance coverage in India, the National Health Authority (NHA) is planning to launch three-year pilot projects with insurance companies under which they will be able to use the Pradhan Mantri Jan Arogya Yojana (PMJAY) platform for group insurance plans at PMJAY rates and packages.

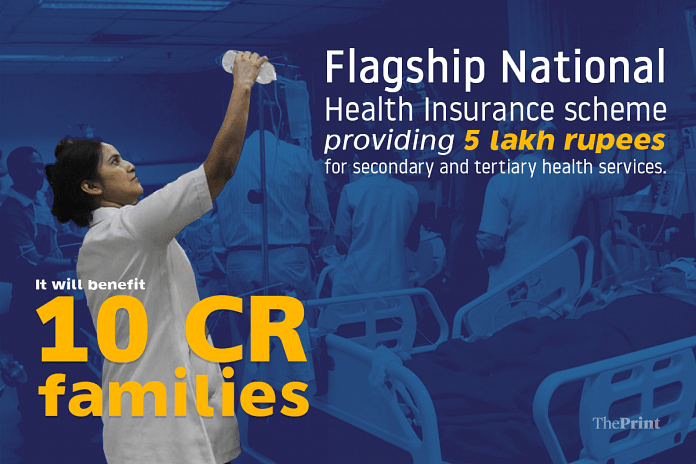

Every individual in every such group, however, will have to be without any existing health insurance. PMJAY is the secondary and tertiary care arm of Ayushman Bharat.

The initial back-of-the-envelope calculations are that for a cover of Rs 5 lakh per annum, each member of the group may need to pay a premium of Rs 300-600. There will be no subsidisation by the government, but just benefits associated with the economy of scale, officials explained.

The notice issued by the NHA inviting expressions of interest said: “It is thus proposed to carry out insurance pilots drawing upon AB PM-JAY framework, retaining the core features of AB PM-JAY benefits, processes, IT infrastructure, hospital network etc for similar economies and efficiencies for all stakeholders, resulting in affordable premium levels, product acceptance and uptake in large numbers by the end customer/communities. The insurance company shall offer coverage as above to the uncovered population on a self-pay basis, having liberty to innovate, to attract and to service as suitable for the profile of customers in this segment, their needs and aspiration etc.”

Also read: What is digital health ID? All about the 14-digit number and privacy concerns around it

‘Only for the uninsured’

The group insurance plan can pick any group but none of the members should have insurance.

“We have no problems provided it is a defined group — it could be the employees of one company, it could be sacked employees of another. It could be domestic workers in a particular locality who have been aggregated,” said an NHA official, explaining the principle behind the scheme. “Just that no person in the group should have an existing health insurance. We will do some checks to prevent something like that from happening.”

The idea is to extend the benefits of insurance to the lower and middle classes who are not eligible for PMJAY, whose salaries exceed Rs 22,000 per month, which is the eligibility for coverage by the Employees State Insurance Corporation (ESIC), and do not have the wherewithal to buy individual health insurance plans. A demographic, which the NHA calls the “missing middle”.

“NHA shall extend support as regards to AB PM-JAY framework — IT systems, hospital network, package pricing constructs and anonymised and aggregated actuarial data for the relevant state/territory where an insurance company intends to carry out pilots so that insurance company may rate the risk and determine actuarial premium levels,” said the EOI document. “NHA will not provide any financial support and/or other support not stated/not relevant for the said pilot programme. IT system support shall be extended to the extent feasible for both parties and agreed to by NHA at its discretion.”

The official quoted above added that in the initial stages of the pilot project, NHA is looking at 8-10 such groups and is also willing to make some changes in the existing packages keeping in mind the altered profile of the targeted clientele.

“For example, in our programme (PMJAY, under which families listed in the socio economic caste survey data as ‘deprived’ are being provided an insurance cover of Rs 5 lakh per family per year) there is no provision for single rooms but in this we can make some alterations to allow for a person to opt for that, may be with a slightly higher premium or may be a top up,” the NHA official explained.

Looking at NGOs

While it is for insurance companies to put together a group and approach the NHA, one of the probable partners that the NHA is looking at are NGOs, in a bid to reach out to rural populations that are not eligible for PMJAY.

The current economic climate of job losses has also spurred the proposal, officials said. The target population for the pilot projects are informal workers, self-employed persons and their dependents etc.

“Many such families may not be able to afford to pay the premium for commercial health insurance schemes and are highly vulnerable to the impact of catastrophic expenditure on hospitalisation caused. Sudden outbreak of Covid-19 pandemic along with already existing high ‘out of pocket expenditure’ has further increased the vulnerability of the uncovered population of the country. This segment of population is often referred to as ‘missing middle’ in the discussions on financial protection and Universal Health Coverage in India,” read the NHA document.

Also read: Covid testing, positivity trends since 13 August reassuring, but can’t get lax, says govt

Follow the TN model for health care