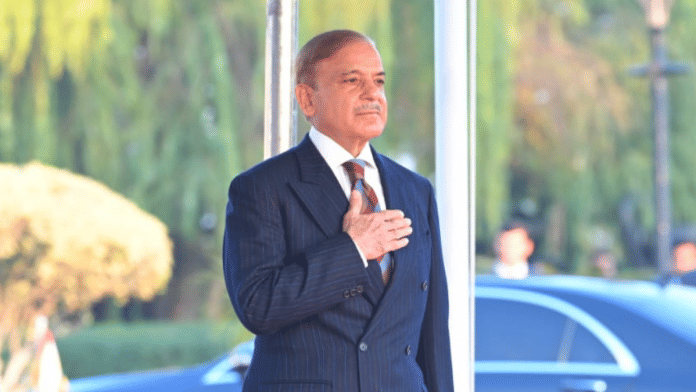

Greece leased and sold its islands when its economy was in the doldrums. Pakistan has no islands, but it has ‘diplomatic properties’ that it’s hoping to offload to fill its coffers. The Shehbaz Sharif government is exploring the option of selling one such building on R Street NW in Washington DC. Officials told Dawn that they would go through it only if it “benefitted Pakistan”.

Newspaper advertisements also sparked rumours that the Shehbaz government was selling its old embassy building, which underwent renovations that cost nearly seven million dollars. Embassy officials denied that the old building was up for sale or that they were struggling to pay diplomatic staff on time.

Not the first time

Earlier this month, Federal Minister of Information and Broadcasting Marriyum Aurangzeb said that the cabinet approved a proposal to auction one building in Washington owned by the Pakistan embassy. She further added that the previous bid of $4.5 million has been replaced by another amounting to $6.9 million.

Nosheen Saeed, member of the National Assembly of Pakistan, took to Twitter to share her views on the matter, claiming that this is not the first time the government put up an embassy for sale — the Sharifs have done it in Saudi Arabia and Europe too.

Who gives them the right to sell assets of Pakistan? They could have rented the building out and dealt with the loan. Sharifs have sold other embassy buildings in Saudi Arabia and Europe too. https://t.co/8CL6ZfNqCb

— Nosheen Saeed (@stickwithchick) December 13, 2022

The country’s debt has jumped to a record high of PKR 60 trillion. Former Pakistan Prime Minister Imran Khan had made promises to curb the debt while blaming his predecessors for throwing the country into the crisis. But the Pakistan Tehreek-e-Insaf (PTI) government ended up with the highest-ever debt in its 43-month rule. Within this context, the Pakistani government has been eyeing ways to make use of its idle properties.

In 2018, the diplomatic status of the R Street building was revoked as it had become non-functional, thereby becoming liable to local taxes. The cabinet agreed to the idea of selling the building in an auction because it was no longer appropriate for use due to incomplete renovations as well.

The current dilemma is whether to sell the building after renovation or in its current dilapidated condition, which, residents in the area claim, is a ‘security hazard’.

Qatar investments for Roosevelt Hotel

In August 2022, federal authorities drafted a plan to bring Qatari investments to the Roosevelt Hotel in New York with the purpose of improving foreign reserves of the country.

The hotel is owned by Pakistan International Airlines (PAI) through PIA-Investment Limited. The PIA acquired the 19-storey building in 1979 as a part of its diversification strategy. The hotel, located at a highly priced location, was closed in December 2020 as it was incurring massive financial losses.

PM Shehbaz Sharif decided to offer a 51 per cent stake in the Roosevelt Hotel and the PIA along with the management control to Qatar. The PIA law bars selling more than 49 per cent stakes and giving management control to any other organisation, so it was decided that the restricting clause must be done away with immediately. These plans were made ahead of Shehbaz Sharif’s visit to Qatar in August.

In August 2020, Pakistan’s National Accountability Bureau (NAB) filed a reference in court against Major General (Retd) Syed Mustafa Anwar, the country’s former ambassador to Indonesia, for illegally selling the embassy building in Jakarta at a ‘throwaway price’. He did it during his tenure in 2001-2002. The illegal sale resulted in a loss of $1.32 million to the exchequer.

Pakistanis on social media are well aware of such events, which only further their apprehensions about the sale of diplomatic properties in Washington.

That's nothing; even their envoys sell their embassy ??while on active duty. Bunty & Babli to a whole new level!https://t.co/r2oiep1Zyv

Sala embassy kaun bechta hai bey?

— Utkarsh "सूर्यवंशी" Rajanaka (@Saffronwing1) December 14, 2022