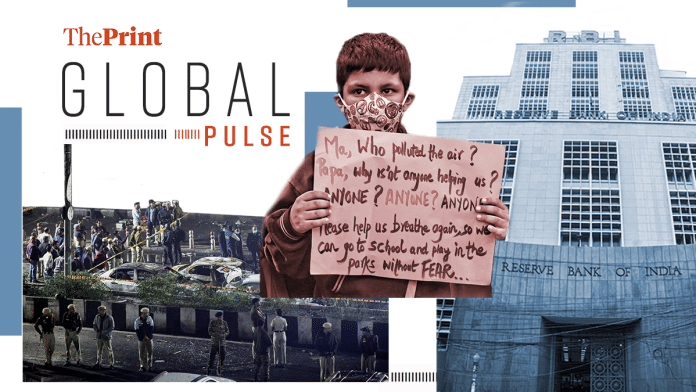

New Delhi: The Capital is grappling with a dual haze of smog and a lack of clarity on AQI data. In The Financial Times, Andres Schipani, Jyotsna Singh, and Krishn Kaushik report on the crisis, focusing on a long-running case regarding the effects of pollution that was recently heard in the Supreme Court.

“It also referred to the recent government practice of spraying water near pollution monitoring stations, which many residents believe is designed to influence pollution readings. India’s chief justice B.R. Gavai said that the city’s air quality has continued to worsen and that ‘a long-term solution needs to be worked out’,” says the FT report.

There is also confusion regarding how the air quality index is being calculated.

“While India’s Central Pollution Control Board says Delhi’s 24-hour average AQI since Diwali has been 400 at worst, Swiss group IQAir—whose app is also used by many city residents—often records higher readings,” the FT report adds.

Every country has its own air quality index and its own standards, Gufran Beig, a meteorologist with the National Institute of Advanced Studies, who founded Safar, the government’s air monitoring system, is quoted as saying in the FT report.

The article also quotes activists and civil society members, many of whom are enraged at the “perceived manipulation” of AQI data.

“All attempts right now are to minimise the problem, to fudge the data, to normalise an AQI of whatever number. Every attempt right now is to mislead, misrepresent and minimise,” Jai Dhar Gupta, leader of the activist group My Right to Breathe, tells the FT.

After the Pahalgam terror attack, Prime Minister Narendra Modi announced that any future terrorist attack would be treated as “an act of war.” However, following the Red Fort blast that killed 13, the official response has been “muted”, Pranshu Verma and Supriya Kumar report in The Washington Post.

Most tellingly, they write, India hasn’t declared Pakistan responsible.

“Though Indian media has reported that suspects in the Red Fort blast could have ties to a Pakistani militant group, the Modi administration has been careful in its language, attributing the attack more generally to ‘anti-nationalist’ forces,” says the WaPo report. “The government’s restrained reaction, according to political analysts, reveals its recognition that there is little international appetite for another exchange of strikes with Pakistan. It also highlights that India’s new military credo announced in May—which it said had ‘eliminated the false distinction between terrorists and their state sponsors’— would be difficult to adhere to as a matter of policy.”

The WaPo report highlights that blaming Pakistan has been a “reflexive response”. But this time around, it’s a geopolitical minefield that’s dictating India’s relatively tepid reaction, according to the report.

“India’s decision to launch ‘Operation Sindoor’, without presenting robust evidence linking the Kashmir attack to Islamabad, wound up eating away at its international support,” Michael Kugelman, a nonresident senior fellow at the Asia Pacific Foundation of Canada, has been quoted as saying.

“As the violence escalated, the United States, Britain, Russia and other global powers urged diplomacy and de-escalation,” the report says.

“India really got burned,” Kugelman further tells The Washington Post. Now, “India wants to ensure that it maintains the sympathy and the support that it has from the international community”.

Financial Times reports global banks are “buying up stakes” in Indian banks.

“Since the start of the year, India’s financial sector has had $8bn worth of deals from foreign companies, up from $2.3bn last year and $1.4bn in 2023, according to Dealogic data,” says the FT report. “They come as officials have laid out ambitions to consolidate the sector, with finance minister Nirmala Sitharaman this month saying the government wanted to create more ‘big banks’.”

The FT report also says that foreign banks are “casting a keener eye” owing to India’s economic growth.

(Edited by Madhurita Goswami)