Indian Bank is the rare public sector bank with the least NPAs and consistent record of reporting profits.

New Delhi: For years, mid-sized and smaller public sector banks in the country faced one common problem — prospective candidates showed little interest in joining them.

They would, invariably, lose out on talent to the bigger lenders: State Bank of India, Punjab National Bank, Bank of Baroda and Canara Bank. Officials working in the bigger banks didn’t want to move to these banks even on promotion.

Not anymore.

Also read: In Narendra Modi govt’s final year, distressed assets and bad loans ail banking sector

When interviews were held recently for about 30 senior officials from public sector banks — many of them executive directors — to decide on their promotions, a majority wanted to move to the Chennai-based Indian Bank, where Padmaja Chundru has just taken over as managing director and CEO from Kishor Kharat.

The clamour to join Indian Bank comes with good reason.

In over two decades, the Chennai-based lender has transformed from once being deemed a ‘weak bank’, to one that has remained the least scathed by the current mess in the country’s state-run banking system.

Indian Bank, along with Vijaya Bank (now set to be merged with Bank of Baroda and Dena Bank), has the least non-performing assets (NPA) in the sector — while the gross NPAs in the country’s banking system rose to 11.6 per cent in March 2018, Indian Bank’s bad asset levels stood at 7.37 per cent.

Barring these two banks, all other public sector lenders have reported double-digit gross NPAs.

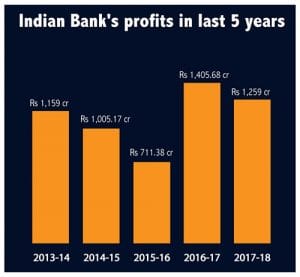

Apart from keeping the NPA levels in check, these two banks are also the only from among the 21 government-owned lenders, to register net profits. At Rs 1,259 crore, Indian Bank’s net profit is the highest for 2017-18 and it has consistently posted profits in the last five years (see graphic).

The turnaround has also made the bank more attractive to investors. Sources said that the government still owns 82 per cent of the bank, giving it huge elbow room to visit the market. And the government has taken note of the bank’s turnaround.

In August, speaking at the India Banking Conclave organised by the Centre for Economic Policy Research and Niti Aayog, Union minister Piyush Goyal, who was holding additional charge of the finance ministry in the absence of Arun Jaitley, praised the mid-sized bank for being able to withstand the banking crisis. “The bank was considered a weak one but look at the way it has performed,” he said.

The two-decade resurgence

In the late 1990s, the M.S. Verma Committee which was reviewing poorly-performing banks and their restructuring plans, had categorised Indian Bank, Uco Bank and the United Bank of India as weak banks.

By 1995-96, reckless lending without due diligence had left Indian Bank with a loss of Rs 1,727 crore, impacting its capital base. Only a capital infusion from the government helped it survive.

Armed with the oxygen from the government, Indian Bank adopted a conservative banking strategy, leading to a drastic improvement in its financial health that culminated in a successful IPO in 2007.

A large chunk of the credit for steering it out of troubled waters, through a focus on prudent banking, goes to its former chairman and managing director Ranjana Kumar, the first woman to head a government bank. Analysts said that Kumar, who took over as chairperson and managing director in 2000, took up the responsibility of cleaning up the bank.

Also read: Dena, Vijaya, Bank of Baroda merger: Raising efficiency or burdening performing banks?

She was instrumental in revamping the bank’s loan books by focusing on the small retail and micro, small and medium enterprises (MSMEs). Lending, which had thinned due to a pile of NPAs, began picking up under her. Kumar also merged over 100 branches of the bank and even managed to cut down on staff strength by granting employees a voluntary retirement scheme.

Her successor, T.M. Bhasin, continued on the same path and initiated the much famed SWOT (strength, weakness, opportunity and threat) analysis — typically used by the private sector — for its employees and the organisation.

Bhasin said he felt that the bank was focused on the top line, particularly high-cost deposits and large corporate loans. “We realised that we needed to change our strategy and we shifted the focus on profit maximisation by going aggressively after retail lending, recovery, revenue augmentation, and review of performance on a daily basis,” Bhasin said.

The bank also issued a directive to its staff barring them from sanctioning loans without proper securities. Intermediaries and loan touts were strictly kept out of bounds.

Simultaneously, the bank also introduced a new practice of daily review meetings of the top management at 9.30 am. “All loans of Rs 1 crore and above were reviewed initially. Later we increased it to Rs 5 crore and then finally Rs 10 crore,” Bhasin added.

Nowadays, the bank, former executive director A.S. Rajeev said, also focuses on the agriculture and the MSME sectors. “We have managed to keep the basics intact by focusing on reducing costs and taking up necessary organisational restructuring,” said Rajeev, who has just been promoted as MD and CEO of Bank of Maharashtra.

Ashvin Parekh, banking sector analyst and managing partner, APA Services, however, had a different view on the bank’s performance.

“It was not out of design that the bank outperformed its peers, I would say it was more out of default,” he said.

“From 2006 to around 2012, when most other banks expanded their lending portfolio rather aggressively and gave out big-ticket corporate loans, Indian Bank adopted a cautious approach mainly due to its past NPA problems…today, that cautious approach is paying dividends.”

Just as well.

I agree with Shri Prakash Joshi.

The contribution of Shri MBN rao as .E.D under MRS.Ranjan KUmar and thereafter as M.D.after great job done by Mrs..Ranjana Kumar is immense. Mr. K.C.Chakraborty had also given a right direction to the bank during his stint by in it’s 100th year by going public. The sacrifices of the then employees, hard work were enumerated in her book by Mrs.Ranjana Kumar. mr.S.RajGopal was more interested in bringing down the image of the Bank and its executives and referring cases to CBI the innocent executives for faults of one man. Scuh executives are still fighting their cases in courts for no fault of theirs. The tenure of T.M>Bhasin is a recent one and has no role in turnaround of Bank.

The report is partially correct till Mrs Ranjana Kumar’s’ contribution

She was exceptionally professional and humane

She was ably assisted by General Mangers and others led by Shri MBN Rao. They are architects of revival. Mr Bhasin took over in 2010 when Bank was very healthy

He also contributed

Mention of CMDs after Mrs Kumar was essential in continued revival

History should be correctly recorded

Whole-hearted devotion coupled with

sincerity by most of the officers/award

staff led by the intelligent executives

have brought such a reputation to

the premier Swadeshi bank —

INDIAN BANK

The solid foundation for turn-around of the bank was laid by Sri.S.Rajagopal who headed the bank for 3 years from end 1995 to 1998.He tightened the administration in such a way that the credit to deposit ratio was brought down from an alarming 75%to around 55%.The deposits grew substantially during his tenure.But he was.unpopular due to his frightening administration creating a scare among the executives and officers.The employees and officers unions fully cooperated by agreeing to forego many rightful benefits in the interest of the bank’s turn around. Smt. Ranjana Kumar built the edifice over the foundation laid by Sri.S.Rajagopal, with her characteristic flair of frequent communications with the staff of all cadre and by launching new structured loan products that clicked.

All because of dedicated efforts of staff and not MD and EDs.. Many lost their promotions for about decade paving way for juniors and inexperienced from other banks to come as MD and ED reaping fruits of our labour.. Today no one in Indian Bank is selected as MD or ED becoz BBB don’t know past history how bank turned around and sacrifices made.. Poor guys of Indian Bank who are always boss oriented