New Delhi: With Jet Airways undergoing liquidation and GoAir heading the same way, SpiceJet remains the last struggling carrier in India’s aviation sector. The low-cost carrier, which has been on the brink of collapse, had been raising funds in an effort to mount a comeback.

While these funds have already been deployed to clear much of its mounting dues and to re-operationalise parts of its grounded fleet, several questions remain about the sustainability of its most recent recovery effort.

As industry analysts have pointed out, SpiceJet has been close to collapse about six times since it began domestic operations in 2005. In a recent interview, SpiceJet Chairman and Managing Director Ajay Singh said, “People have said so many times that SpiceJet will not survive. This is an airline that refuses to die. We will not die and we will be a vibrant player in the Indian aviation space again.”

But despite the company’s confidence in a turnaround and in its target to be a 100-aircraft airline again, buoyed by the recent availability of funds, aviation experts are divided on its future.

New funds help address past dues

The low-cost carrier, which has been struggling with the availability of funds, received a lifeline in September after it raised Rs 3,000 crore through a Qualified Institutional Placement (QIP). The QIP attracted institutional investors and mutual funds, including Goldman Sachs (Singapore), Morgan Stanley Asia, BNP Paribas Financial Markets ODI, Nomura Singapore Ltd ODI, Tata Mutual Fund, and Discovery Global Opportunity Ltd, among others.

The fund inflow enabled the airline to settle several long-standing disputes with multiple lessors. In addition to the Rs 3,000 crore funding, SpiceJet will also receive an additional Rs 736 crore from a previous funding round. It intends to use the newly raised capital to operationalise grounded aircraft, acquire new planes, invest in technology, and expand into new markets.

Within the first week of raising new funds, the company was able to pay off its pending salary and Goods and Services Tax (GST) dues, deposit 10 months of Provident Fund contributions for its employees, and make headway on settling other outstanding liabilities.

In a high-profile settlement, the airline in September resolved its dispute with Engine Lease Finance Corporation (ELFC). ELFC had previously claimed $16.7 million in dues, but agreed to settle for an undisclosed amount lower than the initial claim.

“We are fully committed to restructuring our finances and restoring stability,” a SpiceJet spokesperson told ThePrint. “In the 40 days since our QIP, we have made substantial progress in addressing our financial obligations, injecting new momentum into our growth path.”

The spokesperson added that the company has so far resolved claims of around Rs 2,500 crore, significantly reducing outstanding liabilities and strengthening its financial position.

“Additionally, we have cleared over Rs 800 crore in pending dues, including TDS, outstanding salaries, GST, and PF contributions. A large amount has been allocated towards engineering, maintenance and ungrounding aircraft,” the spokesperson said.

Also Read: Resurgence in India’s air cargo expected to continue as Red Sea crisis crosses one-year mark

The start of the downward spiral

In 2015, the company was close to shutting down, facing the same headwinds that downed several of its peers, such as GoAir and Jet Airways.

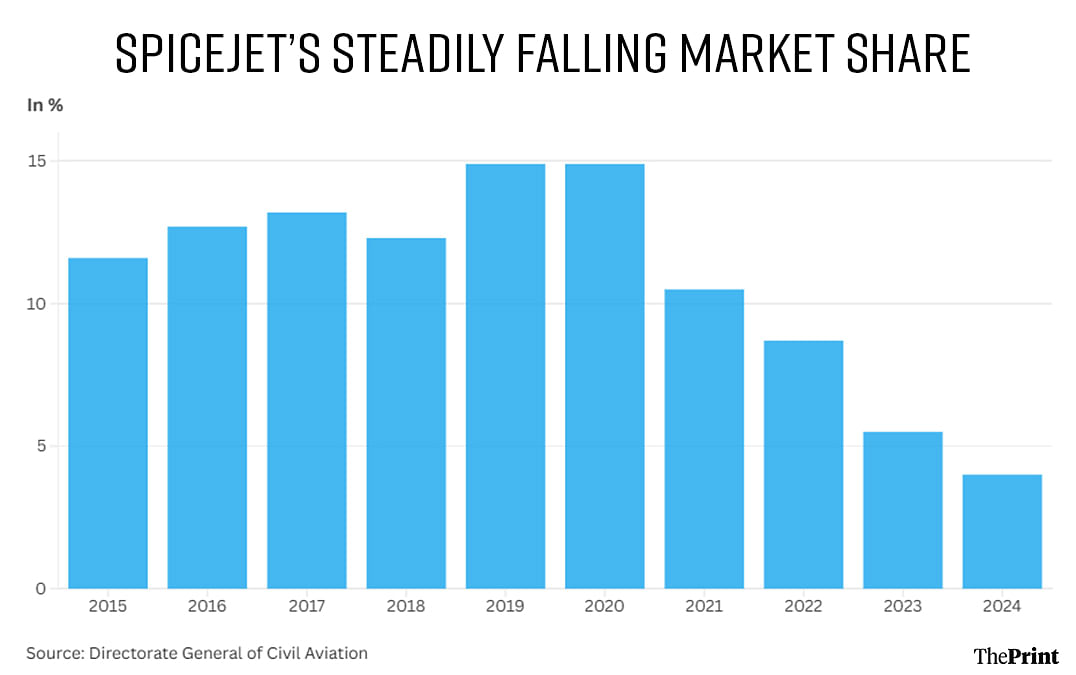

Unlike those other two airlines, SpiceJet managed to bounce back, posting profits in FY16, and becoming the second largest airline in FY20 with a 16 percent market share.

However, since then the company has been back in the red and its market share has declined to just 2 percent in September 2024.

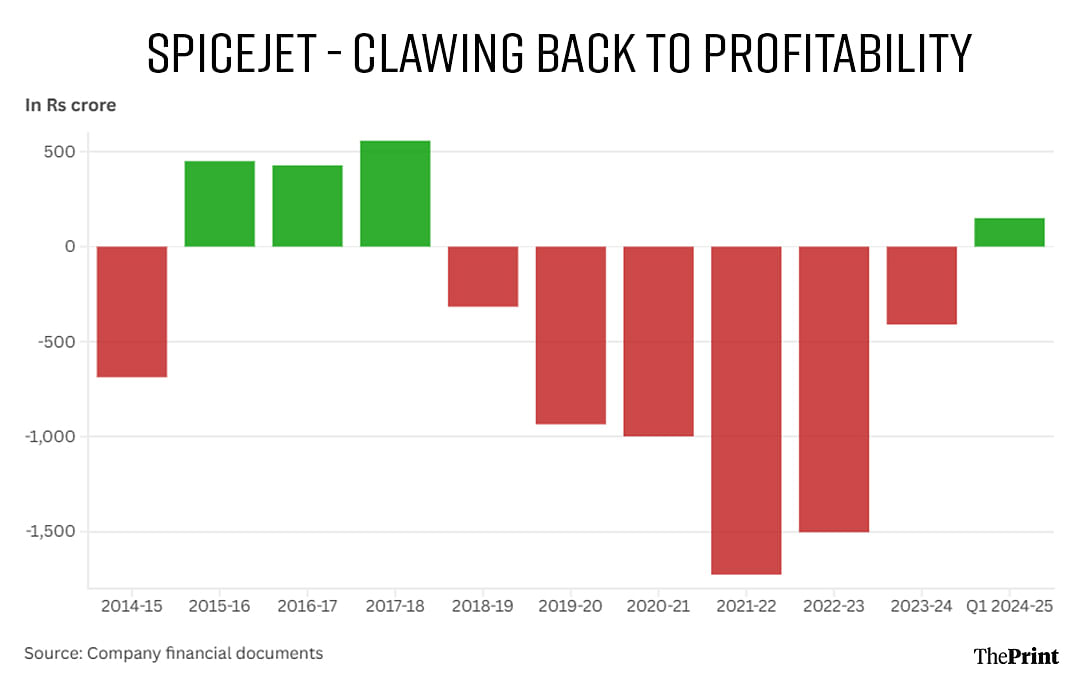

In 2020, the company posted a loss of Rs 934.76 crore, which ballooned to Rs 1,725.47 crore in 2022 and Rs 1,503.02 crore in 2023. In the financial year (FY) 2024, the company managed to pare its losses to Rs 409.44 crore.

According to Shantanu Gangakhedkar, senior Consultant (Aerospace & Defense) at Frost & Sullivan, like many other low-cost carriers globally that have also failed in the last 2-3 years, SpiceJet’s decline was also due to a combination of factors, ranging from a sudden decline of passengers in 2020-2022, increased costs, especially fuel costs, fleet issues and workforce shortages.

Few airlines crack LCC model

IndiGo’s ongoing success—with it single-handedly accounting for about 60 percent of passenger traffic currently—is an outlier in the low-cost carrier (LCC) sector where SpiceJet, Air Deccan, Air Asia and Go Air have struggled.

Globally, too, only a few airlines have been able to crack the LCC model.

Gangakhedkar said the aviation industry in India is highly complex and intensely competitive, adding that fuel prices in India are one of the highest globally, making it difficult for LCCs to operate with a strong profit.

“Globally also LLCs model is complex and very few have been able to run it profitably while many more have also been shut down,” he said. “For an LCC, it’s all about how the fixed and operating costs are managed, aimed to enhance profitability mainly through fleet and route strategy.”

Likewise, Kinjal Shah, the senior vice-president and co-group head (Corporate Ratings) at ICRA Ltd, added that, while the entry of low-cost carriers helped increase the market for air travel as it attracted a lot of passenger traffic from road and rail travel due to the competitive pricing, in India, there are no separate airports for full-service carriers and low-cost carriers.

This impacts the economics of the LCCs since while the airfares are much lower compared to full-service carriers, the costs are not proportionately lower.

“This has resulted in the failure of many low-cost carriers in India,” Shah said. “Further, the road and rail connectivity in India has also improved, making it more competitive against air travel.”

A brief bounce back

SpiceJet’s bounce back in FY16 was driven by a streamlining of its operations and focusing on key metrics, according to Rajarshi Maitra, Associate Director, InCred Research Services.

“Post losses of Rs 25 billion (FY12-15), in December 2014 SpiceJet was close to closure. Since then, SpiceJet bounced back, posting a profit of Rs 4.5 bn in FY16. The key was its focus on Passenger Load Factor (highest in the industry), achieved by eliminating unprofitable destinations,” Maitra told ThePrint. The Passenger Load Factor (PLF) is the percentage of available seating capacity filled with passengers.

Maitra added that the airline managed to carve a niche in Tier 2 towns, where competition between airlines is lower compared to the metro airports. This aided strong Revenue per Available Seat Kilometre (RASK) and PLF.

“These measures led to SpiceJet reaching a domestic market share of 16 percent in FY20,” he explained.

“COVID-19 put the company in severe financial stress. Their market share declined to just 2 percent in September 2024. Due to the financial stress, 55 percent of its fleet is grounded. However, a turnaround is expected soon as the company has successfully raised Rs 30 billion equity recently. This will significantly boost its net worth (-Rs 50 billion in June 2024).”

The blows keep coming

However, the first blow came before COVID-19 hit in 2020. In 2019, the grounding of Boeing 737 Max aircraft hit the airlines hard. In March 2019, the Directorate General of Civil Aviation (DGCA) ordered the grounding of these aircraft in India after two Boeing 737 Max crashed abroad within six months.

SpiceJet had about 12 of these aircraft in its fleet. The suspension lasted for over two years and was lifted only on 26 August, 2021.

The pandemic was a huge blow for the Indian aviation sector. According to global analytics company Crisil, it led to a massive Rs 1.1-1.3 lakh crore revenue loss for Indian airlines over the 2019-20 and 2021-2022 fiscal years.

“SpiceJet faced two major black swan events—the grounding of our Max aircraft in 2019 and the unprecedented COVID-19 crisis in 2020, both beyond our control,” the company’s spokesperson told ThePrint. “Despite these obstacles, we demonstrated resilience and determination, adapting to the situation at a time when much larger airlines struggled and shut down.”

The spokesperson added that the biggest challenge these past years for the airline was the availability of funds to unground its grounded aircraft. However, with the recent record fundraising, the company is now on a “solid financial footing”.

Questions over sustainability of turnaround

“SpiceJet has navigated the challenges of the Indian aviation market for 18-19 years with remarkable success, maintaining consistently high occupancy rates,” the spokesperson said.

“In 2015, we achieved a historic turnaround that took many by surprise. Today, with our established experience and infrastructure, we are poised to not only repeat but surpass that achievement. SpiceJet has the knowledge, resilience, and strategic plan to grow into a 100-aircraft airline once again.”

In August, when the company announced results for the April-June 2024 period, it recorded a net profit of Rs 158.2 crore, despite having ended the financial year 2023-2024 with a loss of Rs 409.4 crore. As of 30 June, 2024, the latest period for which there is data, the company had a negative net worth of Rs 2,397.7 crore, according to its financial documents.

Gangakhedkar said the company’s goal now will be to pay back the dues so that the not-in-service aircraft can be brought back to service so as to maximise fleet and route operations. This should help it generate enough cash and return to profitability.

“The airline will have to focus on fleet optimisation, route planning, workforce management with the key focus of keeping the costs down and increasing margins,” Gangakhedkar said.

“SpiceJet has a lot of aircraft parked for various reasons, so using these aircraft optimally to increase RPKs as well as working towards having higher load factors would help generate cash.”

Maitra, too, said he expected the company to quickly ramp up operations on all fronts, which would entail re-starting the grounded fleet, adding new slots at airports and increasing the number of flights.

“We expect the company to focus strongly on volume growth over the next 1-2 years and gain market share from competitors,” Maitra said. “The long-term mantra remains (a) focus on PLF and (b) focus on margin by establishing a presence in routes with low competition.”

A recovery far from certain

Not everyone is convinced that SpiceJet can effect a turnaround. In the company’s audited financial statements for the first quarter of this financial year, the auditor made specific mention of its doubt.

“Losses over the last few years have been primarily driven by adjustments on account of implementation of Ind AS 116 (India’s new accounting standards), adverse foreign exchange rates, operational disruption during COVID-19 followed by sub-optimal operations due to liquidity constraints faced by the Group,” the documents note.

This, the auditors of the company’s financial results said, “may create doubt about the company’s ability to continue as a going concern.”

Mark Martin, the founder and CEO of Martin Consulting and who worked as head of strategy at SpiceJet in 2009, attributing it to promoter and board issues, noted, “The airline has been close to shutting down multiple times. In 2007, 2013, 2015, 2019, and 2022 too they were in a mess… so they have been near closure. Investors such as Wilbur Ross, the Tatas, the Marans and private equity saved the airline. How many times will they go in and out of a financial crisis?”

He added that the story of SpiceJet was “a saga of mismanagement and promoters exiting and bad fiscal planning”.

“They have raised funds previously as well,” Martin said. “No airline has been able to raise so much funds. There is no end to this. SpiceJet will continue like this.”

He also added that several of the steps announced by the company seem like “gimmicks” to boost its stock price.

“They just announced the seaplane operations. But they have already done it in Gujarat and the service was inaugurated by Prime Minister Narendra Modi in 2020. Why were they sitting for so many years? Why didn’t they set it up? So most things SpiceJet does look like a gimmick to spike its stock price up. SpiceJet is talking about getting more aircraft, but with their payment record, who will give them the aircraft?” Martin asked.

SpiceJet, however, has ambitious fleet and route network expansion plans.

“We had around 28 grounded aircraft, out of which two have returned back to service,” the spokesperson said, adding that the company targets to operate 35-40 aircraft by the close of FY25 and to double that number to 75-80 by FY26.

“Our strategy is to drive swift expansion, similar to our successful approach in 2015,” the spokesperson said.

“By the end of November, we are adding 10 aircraft—seven on lease and three returning to service from our grounded fleet. As we scale up our fleet, we will be able to expand our route network and introduce more flights, significantly boosting our operational capabilities and market reach.”

(Edited by Sanya Mathur)