New Delhi: When one of India’s largest microfinance lenders, Spandana Sphoorty Financial Ltd (SSPL), announced its second-quarter results, the numbers were startling.

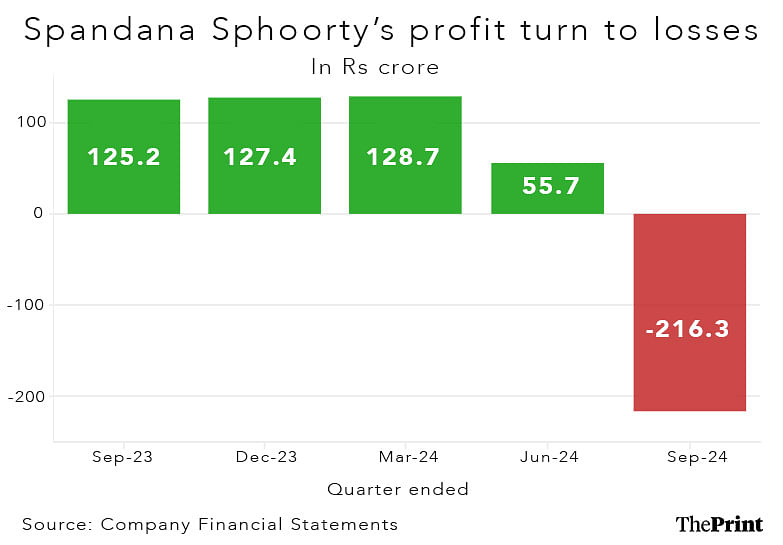

The two-decade-old micro-credit company posted a massive Rs 216 crore loss in the second quarter of 2024-25 ending September after turning a profit of Rs 125 crore in the same period last year.

What happened? How did the company go from making a profit to being in the red in a year?

There isn’t any single reason. The Hyderabad-based Spandana Sphoorty’s financial fortunes turned because of various factors affecting the entire microfinance industry: High attrition, weather-related challenges such as heat waves and heavy rainfall, and a slow pace of loan recovery.

Shalabh Saxena, CEO and Managing Director of SSPL, told ThePrint the results were definitely underwhelming, but Spandana Sphoorty wasn’t the only one in the business to be hit.

“The microfinance sector has been facing multiple headwinds over the last two quarters. Q1 was the first quarter where we saw signs of weakness in the environment when the sector was impacted due to the long-drawn elections, intense heat waves and the high attrition in a few states,” said Saxena.

These disruptions resulted in a huge loss in the second quarter despite a small profit of Rs 56 crore in the previous three months.

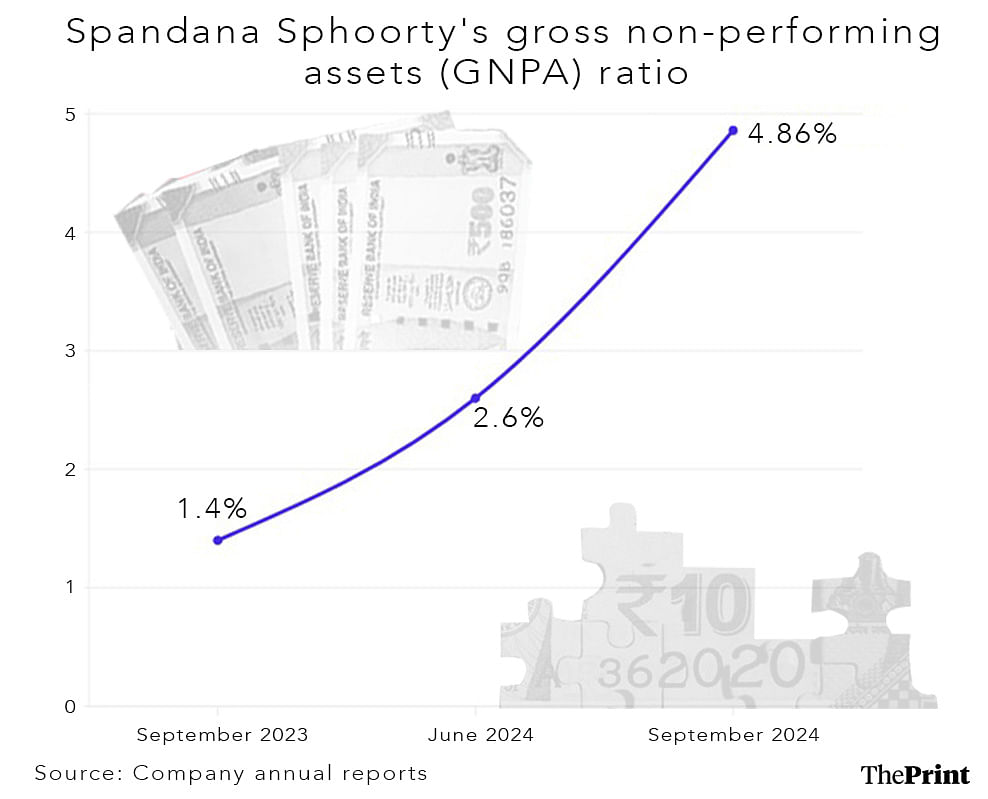

Also, the micro-credit company with a presence across the country saw its gross non-performing assets (GNPA) ratio climb to 4.86 percent in September 2024 from 2.6 percent in June 2024 and 1.4 percent in September 2023.

Saxena said business was disrupted in some areas because of climatic factors such as heavy rainfall and floods in the second quarter.

“We have taken all steps to ensure the quality of the portfolio and brought it back to pre-COVID levels,” he told ThePrint.

Spandana Sphoorty—a rural-focused non-banking financial company and a microfinance lender (NBFC-MFI)—has over 1,720 branches across India employing more than 17,000 people.

According to its website, it gives money to 33 lakh borrowers across 20 states providing collateral-free loans through the Joint Liability Group (JLG) model.

The company, which derives its name from the Sanskrit word spandan or response, had total assets under management (AUM) of Rs 10,537 crore in the second quarter of 2024-25.

“The loans that are given are income-generating loans… What we are trying to do is to ensure last-mile delivery,” said Saxena.

Also read: Individuals, businesses are increasingly defaulting on microloans. Both lenders & borrowers at fault

Scaling up

India’s microfinance industry has a long history. Inspired largely by the pioneer of microfinance from Bangladesh, Muhammad Yunus, it has grown rapidly over the years.

“India has kind of adopted it and we have scaled it up,” said Saxena.

Today, India has 14.9 crore active loan accounts managed in around 234 microfinance entities with a portfolio of over Rs 4.24 lakh crore and around 8 crore borrowers.

Almost 99 percent of microfinance loans in India are provided to women from low-income households.

However, the sector has been in trouble in recent months largely because of delayed repayments by individual and small business borrowers.

Last month, the Reserve Bank of India (RBI) barred some microfinance institutions due to irregularities in the regulatory framework.

Spandana Sphoorty isn’t immune to the problems ailing the sector.

“There are cases where there has been some over-borrowing from a customer point of view and over-lending from a financial point of view, resulting in the challenge in the portfolio quality,” said Saxena.

Banking experts said the company’s poor performance was a result of bad loans, which the company hadn’t been able to recover.

“Some of the loans have been overleveraged. High interest rates and poor regulations on the recovery of microfinance loans have also been the reason,” said Sharad Kohli, an economist and banking expert.

“So unless there is a drastic change in the company’s policy or a drastic regulatory change or the company makes some extraordinary efforts to recover the loans, or at least not give any future loans, I think the performance of the company can be under question in the times to come,” Kohli added.

Spandana Sphoorty’s poor financial performance has hit its share price.

Kohli said its shares have fallen more than 60 percent in the last year, with an over 7 percent tumble in just the last five trading days.

High attrition and the ground challenge

The situation on the ground is also challenging.

Sumit Kumar Pandey, a 28-year-old branch manager with Spandana Sphoorty in Bihar’s Barauli town in Gopalganj district, has worked for the company for five years. He said the last year has been one of the toughest for him and his 10-member team.

“The response to microfinance on the ground is quite good. We give this loan mostly to the poor and working class, especially to women’s groups,” said Pandey.

“But in the past few years, it has become difficult to recover the loan amount because people are not able to repay the loan on time due to lack of business, which is leading to NPAs,” he added.

Pandey’s branch has 2,200 customers and Spandana Sphoorty has more than 400 branches in Bihar.

Pandey said pressure from the company to recover the money forced many people to leave the job.

He said most of these loans were in the Rs 40,000 to Rs 80,000 bracket with an interest rate of 25 percent. He said the company gave larger loans to older customers compared to newer ones.

“If a customer has been with us for the last six years, seven years, eight years, 10 years, then obviously, they deserve differential pricing from somebody who I acquired only yesterday or maybe less than a year ago,” said Saxena.

Saxena said the company had to put more people on the ground to explain to customers the ramifications of not repaying loan instalments on time.

“It broadly means there is an impact on the credit scores which will prohibit borrowing in the future from any company,” he said.

Saxena told an earnings conference call in July the company had been hit by unusually high attrition in five key states—Madhya Pradesh, Rajasthan, Gujarat, Maharashtra and Telangana.

The cumulative assets under management of these states account for 32 percent of the company’s total portfolio in the country.

“High attrition in some states is due to workload and recovery pressures,” said Saxena.

He acknowledged there was some stress and an increase in working hours for staff on the ground. To mitigate these challenges, the company was giving better incentives, increasing local engagement as well as providing monetary support and recognition.

“So, we have recognised and are cognizant of this,” Saxena said. “We put in more people so that the workload of a field officer or a loan officer level is reduced.”

Saxena said the sector has been hit by local debt relief movements like the Karza Mukti Abhiyan to waive off the loans of farmers and economically weak people as well as increasing leverage of borrowers.

“Spandana has not been immune to any of these challenges,” he said.

A sector in trouble

ThePrint has previously reported on the troubles facing the microfinance industry, due in large part to higher delinquencies by individual as well as small business borrowers.

The share of microfinance loans overdue by between 91 and 180 days grew in the first quarter of this financial year compared to the same quarter of last year, snapping a two-year declining streak, according to data from Sa-Dhan, a microfinance self-regulatory body.

As of June 2024, an additional 9.1 percent of microfinance loans were overdue for more than 180 days.

This 90-day threshold is significant because, as per RBI rules, loans where the principal amount is overdue for more than 90 days are to be classified as non-performing assets.

In addition, rating agencies such as India Ratings and Research (Ind-Ra) fear the troubles will likely continue for some time.

“Ind-Ra has earlier highlighted rising overleveraging across MFI borrowers not limited to MFI loans, but other loans as well such as Kisan Credit Card loans, gold loans, state government loans and fintech loans which is adding to the overall distress for the borrowers,” Ind-Ra said in a note published last week.

“With a further rise in the inflationary pressure, as seen from food inflation numbers, the agency believes borrower cash flows would be under pressure impacting their repayment ability,” it added.

Also read: Individuals, businesses are increasingly defaulting on microloans. Both lenders & borrowers at fault

‘Business is a marathon’

With many challenges facing the microfinance sector in general and Spandana Sphoorty in particular, Saxena is working on multiple fronts to return to normalcy.

Spandana Sphoorty has adopted cautious lending policies, including risk-based pricing for loyal customers, to ensure transparency and sustainability.

“We are being slightly more cautious both in terms of lending and collection,” said Saxena.

The caution is reflected in the numbers: Spandana Sphoorty’s loan disbursements in the second quarter fell 40 percent from a year ago to Rs 1,514 crore.

But Saxena said there’s always scope for improvement. So, where does he see the company’s business in the next few quarters? According to him, any business is a “marathon”.

“It’s not a T20 or these are not the slog overs of a match. You have to continue doing what is right for the customer,” he said.

He refrained from predicting the company’s third-quarter performance but affirmed its focus on customer-centric policies and processes.

Saxena was optimistic about the sector, saying the industry was crucial for strengthening 60 percent of the population of the country that lives in villages.

“Microfinance as an industry is a very resilient industry. Customers and the industry bounce back very fast, which is evident from the past crises, be it COVID or demonetisation or the Andhra crisis,” he told ThePrint.

(Edited by Sugita Katyal)