Washington: The International Monetary Fund warned that global economic risks have risen as central banks reduce borrowing costs and that stronger oversight is needed to ease threats to an already shaky expansion.

“While easier financial conditions have supported economic growth and helped contain downside risks to the outlook in the near term, they have also encouraged more financial risk-taking and a further buildup of financial vulnerabilities, putting medium-term growth at risk,” the IMF said Wednesday in its latest Global Financial Stability Report.

The policy easing that has helped support global growth has also fueled a further increase of financial risks, and threats to global growth and financial stability remain “firmly skewed to the downside,” the fund said. It added that policy makers “urgently need to take action to tackle financial vulnerabilities that could exacerbate the next economic downturn.”

The latest warnings come a day after the fund said global growth is on pace for the weakest expansion since 2009, when the world economy shrank, as trade wars cloud the outlook. Those disputes have whipsawed global markets and weighed on business sentiment, though central bank easing has helped alleviate concerns about a deeper economic slowdown, the report said.

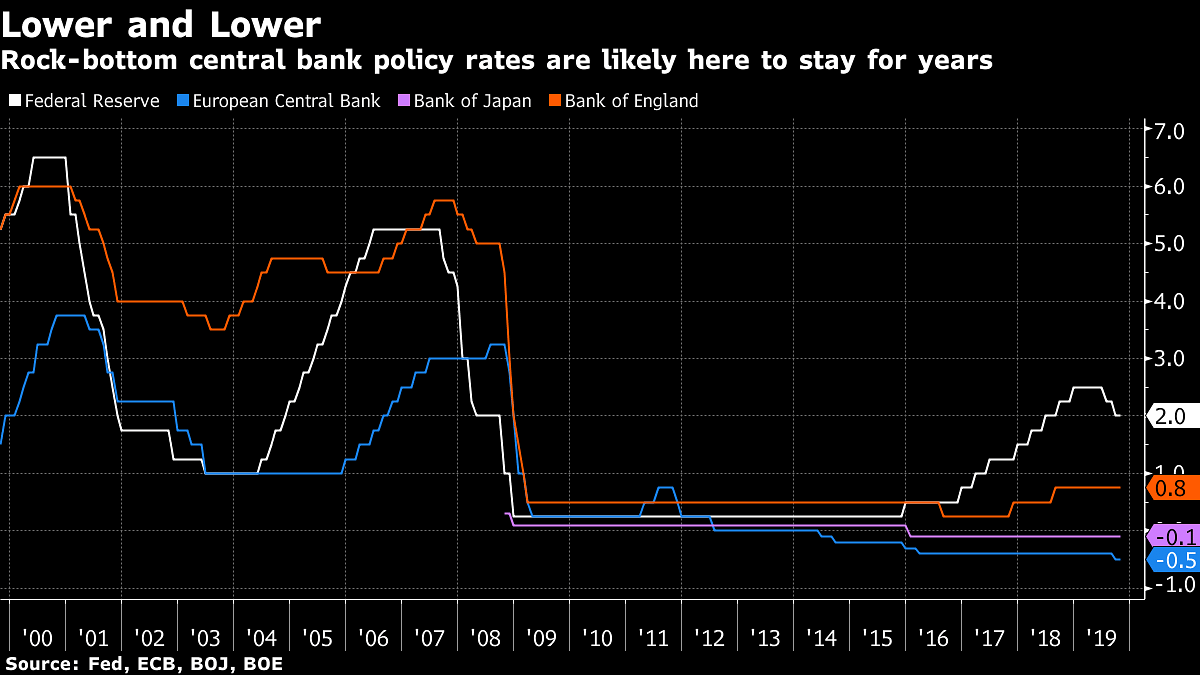

The fund said lower yields are spurring investors such as insurance companies and pension funds “to invest in riskier and less liquid securities” and that pricing in financial markets signals interest rates will remain lower for longer than anticipated at the start of this year. About $15 trillion of debt worldwide has negative yields, it said.

“Vulnerabilities have continued to intensify, putting growth at risk,” Tobias Adrian, director of the Monetary and Capital Markets Department, told reporters at a briefing on Wednesday, adding that policy makers need to prevent a rollback of regulatory reforms.

While there’s been significant progress on banking regulations, capital standards and liquidity levels since the crisis, trade policy is a new threat for stability, he said.

Trade tensions have fueled pessimism in markets, creating uncertainty and repeatedly causing “downside risks,” Adrian said. “So we urge policy makers around the world to work together to resolve those trade tensions.”

Officials emphasized that companies are taking on more debt and their ability to service that debt is deteriorating.

“There are quite a few weak non-financial firms in these economies that are still able to roll over debt and continue to accumulate debt because of very low interest rates” Anna Ilyina, a division chief in the Monetary and Capital Markets Department, told reporters at the briefing.

Also read: How close the world is to its first recession since 2009

‘Under Pressure’

“The concern is that in an economic downturn these firms may come under pressure and may experience difficulty servicing the debt, and they have to deleverage, and when they do they cut back on investment and employment and that exacerbates the recession,” she said.

The report said risks in China remain elevated due to high debt levels for investment vehicles, and said the authorities taking over one regional bank this year and injecting capital into another underscore the risks to the financial system in the world’s second-largest economy.

Vulnerability among non-bank institutions is elevated in 80% of nations with large financial sectors, a share similar to the depths of the global financial crisis, the fund said. In an economic slowdown scenario half as severe, corporate debt owed by firms unable to cover their interest payments with earnings could rise to $19 trillion, or nearly 40% of company debt in major economies.

“The search for yield in a prolonged low-interest-rate environment has led to stretched valuations in risky asset markets around the globe, raising the possibility of sharp, sudden adjustments in financial conditions,” the fund said. “Such sharp tightening could have significant macroeconomic implications, especially in countries with elevated financial vulnerabilities.”

Economic Outlook

IMF Chief Economist Gita Gopinath pointed to rising financial stability risks on Tuesday after releasing the World Economic Outlook.

“While monetary easing has supported growth, it is essential that effective macroprudential regulation be deployed today to prevent mispricing of risk and excessive buildup of financial vulnerabilities,” she told reporters in Washington.

The world economy will grow 3% this year, down from 3.2% seen in July, with the 2020 estimate lowered to 3.4% from 3.5%, the fund said Tuesday in its World Economic Outlook.

The projected 2020 rebound is likely to prove too optimistic, said Ben May, director of global macro research at Oxford Economics. He forecasts 2.5% growth this year and next.

“We think the worst effects of the industrial and trade sector weakness is yet to pass and are more circumspect than the IMF about the likely boost to global growth from recent monetary policy loosening,” May wrote in a report Wednesday.

“We also expect the uncertainty created by U.S.-China trade tensions and other geopolitical factors will prompt caution from firms over new capital outlays and new job hires.”

Also read: IMF pushes down global growth rate to 3% amid economic slowdown in India, China