New Delhi: Power distribution companies (discoms) in India have remained plagued with financial issues for over a decade now, and according to new data released by the Union power ministry, there seems to be no end to it.

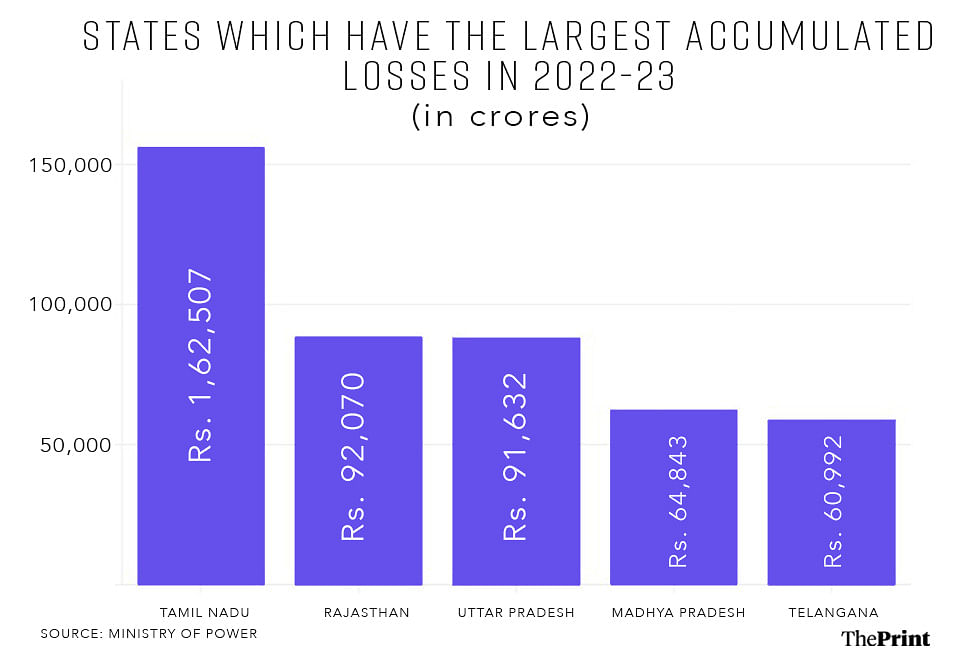

As of March 2023, Indian state-sector discoms had accumulated Rs 6,76,681 crore worth of losses and Rs 6,61,263 crore worth of debt, marking an 81 percent increase in losses and a 62 percent increase in debt since 2015-16.

There is, however, a significant disparity in discom debt among states.

Data the Union power ministry presented in the Rajya Sabha in response to a question revealed that the only discom in Tamil Nadu—the state-owned TANGEDO—was responsible for 23 percent of the total debt in the country as of March 2023.

Second in line is Rajasthan, whose three state-owned discoms account for 11 percent of the total debt. The list of the highest debt-incurring states is identical to the most loss-making ones, with Uttar Pradesh, Madhya Pradesh, and Telangana featuring after TN and Rajasthan.

Poor billing and collection, delays in tariff orders, no inflation adjustment in power purchase agreements, and expansive power subsidies are some of the main reasons why 68 state-run discoms are suffering losses, Shripad Naik, Union minister of state in the power ministry, said in his reply in the Rajya Sabha.

The data also showed that 14 private-sector discoms spread across Delhi, Gujarat, Odisha, UP, and West Bengal are faring much better in comparison. While the losses of the state-sector discoms increased from Rs 3.74 lakh crore in 2016 to Rs 6.76 lakh crore in 2023, the private-sector discoms went from Rs 2,048 crore losses as of March 2016 to Rs 28,769 crore profit of March 2023.

However, everything is not going smoothly in the private sector as well. The debt rose from Rs 12,146 crore in 2016 to Rs 23,116 crore in 2023.

Moreover, Ifri’s Energy and Climate Center reported in October that the state-sector discoms still supply nearly 90 percent of the power consumed in India, making them significantly more crucial than the private sector.

“The private sector has been able to figure out how to adjust their tariffs to reflect actual costs and accurately measure the consumption too,” said Vibhuti Garg, South Asia director of the Institute for Energy Economics and Financial Analysis (IEEFA). “It also has to do with where these private discoms are based. Delhi and Gujarat are not agri-intensive states and do not have heavy power subsidies.”

Transmission & commercial losses down

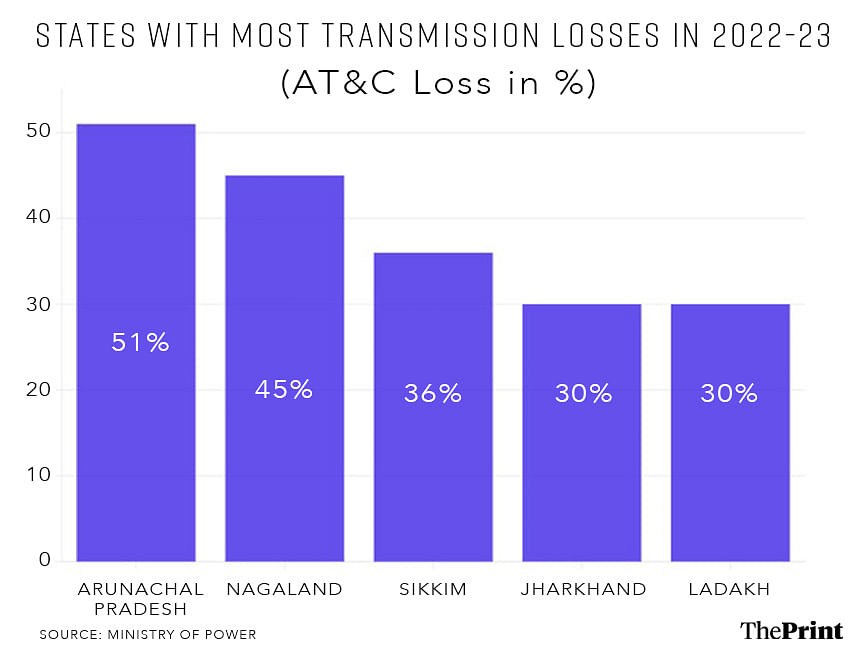

Shripad Naik also said that the Aggregate Technical and Commercial (AT&C) loss has come down in the last few years due to government interventions. The AT&C loss, which is the percentage of losses faced by distribution companies due to losses in transmission, electricity theft or unpaid bills, was down to 15 percent in 2022-23 from 23 percent in 2015-16.

However, the figures differ from state to state. Certain states, such as Arunachal Pradesh, still have a 51 percent AT&C loss, meaning the state discoms only get revenue for less than half of the total energy input.

Similarly, Nagaland, Sikkim, Jharkhand, and Ladakh all have higher than 30 percent AT&C losses.

In a press release in 2023, then-power minister R.K. Singh said that electricity theft and pilferage were one of the main reasons for high AT&C losses, and the government was looking to use smart meters and artificial intelligence to curb power theft.

“In the Northeast and Ladakh, transmission happens through long lines and low voltage, not to mention the challenging physical terrain,” said Rajasekhar Devaguptapu, a fellow at the Centre for Social and Economic Progress (CSEP). “This could explain the high transmission losses there.”

Even in the AT&C losses, the data showed that the private sector performed much better in 2022-23, recording only a 10 percent loss.

The private sector discoms registered a 24.6 percent AT&C loss in 2015-16—slightly higher than the level in state discoms—but then reduced it to 10 percent by 2022-23 while the state discoms could only bring it down to 15 percent.

Also Read: With 2 days left, new COP29 climate finance draft text is out—but the actual number is missing

Cost-revenue gap of distributing electricity

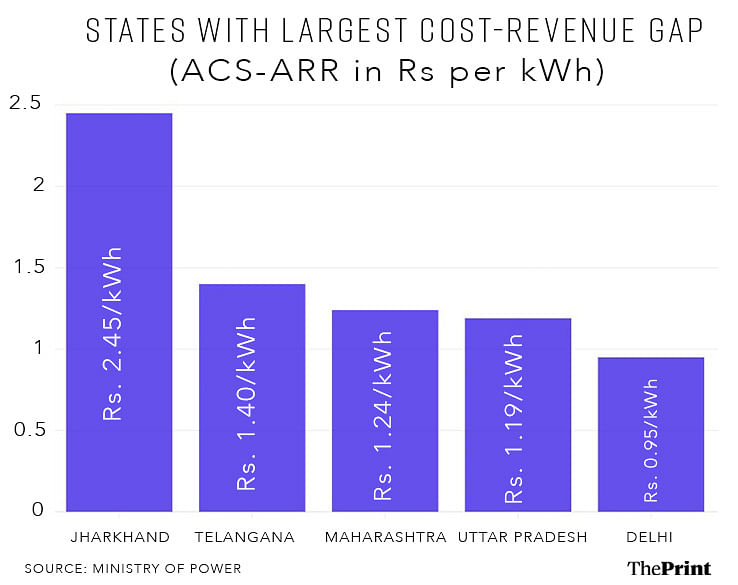

Another important indicator for the financial performance of discom is the gap between the Average Cost of Supply (ACS) and the Average Revenue Realised (ARR) per kilowatt/hour of energy or the ACS-ARR gap. The figure indicates the average profit or loss incurred by a discom in distributing one kilowatt of electricity.

When the ACS-ARR gap is positive, it shows that the cost of supply is higher than the revenue the discom generated, meaning that the discom is losing money. The ACS-ARR gap in India stood at Rs 0.45 per kWh as of March 2023. So, Indian discoms lost Rs 0.45 for every 1 kWh of power they distributed.

While Shripad Naik, in his response, flagged how this gap has reduced from Rs 0.54 per kWh in 2015, the current figure continues that distributing power is a loss-making endeavour for discoms in the country.

The ACS-ARR gap also varies across states. Jharkhand leads the pack, with its discoms having lost Rs 2.45 for every 1 kWh of electricity they distributed—the highest gap between supply and demand costs among all Indian states.

“They (discoms) must have tied up with quite expensive power purchase agreements,” says Garg. “Jharkhand is a state that produces its coal. So, the cost should ideally be low. It is a surprising figure.”

Telangana and Maharashtra follow Jharkhand. Both states have lost over Rs 1.2 for every 1 kWh distributed as of March 2023. According to Garg, the ACS-ARR gap would be higher in states with a high agricultural demand. Delhi is next on the list—its discoms incurred a Rs 0.95 loss to distribute every 1 kWh of power.

“When it is an agriculture-focused state, the discoms will need to give power subsidies to farmers and can not charge them too much. But they are still paying the same amount to power suppliers for the electricity, so they end up incurring huge losses,” said Garg.

Delayed subsidy payments & stagnant tariffs

In a decade when India plans to expand renewable energy to 500 GW by 2030, the discoms and their state remain a technical and economic challenge. A Centre for Social and Economic Progress (CSEP) paper in 2023 said, “Discoms are regulated entities, and shouldn’t be loss-making if they perform correctly.”

The losses aren’t a new phenomenon though. The analysis by CSEP showed that for the last 15 years, most discoms have had revenues lower than their costs.

Since 2001, there have been five major bailout plans for Indian discoms by the central government—which the CSEP paper describes as a “range of financial instruments” to fix the issue of recurring losses and increasing debt.

The authors at CSEP recognised and Garg reiterated that one of the reasons for debt and losses is the non-payment or slow payment of subsidies promised by the government.

“The government promises subsidies to certain citizens, but the actual funds reach discoms much later. Meanwhile, the companies run into debt in fulfilling the government’s promises,” said Garg.

Besides delayed subsidy payments, other issues are not collecting payments from customers and not revising power tariffs. Some state discoms have not changed their tariffs for over ten years, according to Ifri’s Energy and Climate Center. Inflation, meanwhile, has caused costs to skyrocket. However, consumers would face a challenge in case of any fix, said Devaguptapu.

(Edited by Madhurita Goswami)

Also Read: 31 cities under Centre’s National Clean Air Programme saw air quality worsen in last 5 years

Recall UDAY. 2. With more power now being generated by private firms, and increasingly renewables, where costs are falling, the long term solution lies in their selling directly to consumers, bulk ones to begin with. Using open access. Bypassing discoms with clogged arteries. The unreformed state of the power sector impacts the global competitiveness of Indian manufacturing.