The Reserve Bank of India may keep policy rates unchanged on Friday after a bumper week in which the government boosted spending in its budget and President Donald Trump announced a surprise trade deal, raising the outlook for economic growth.

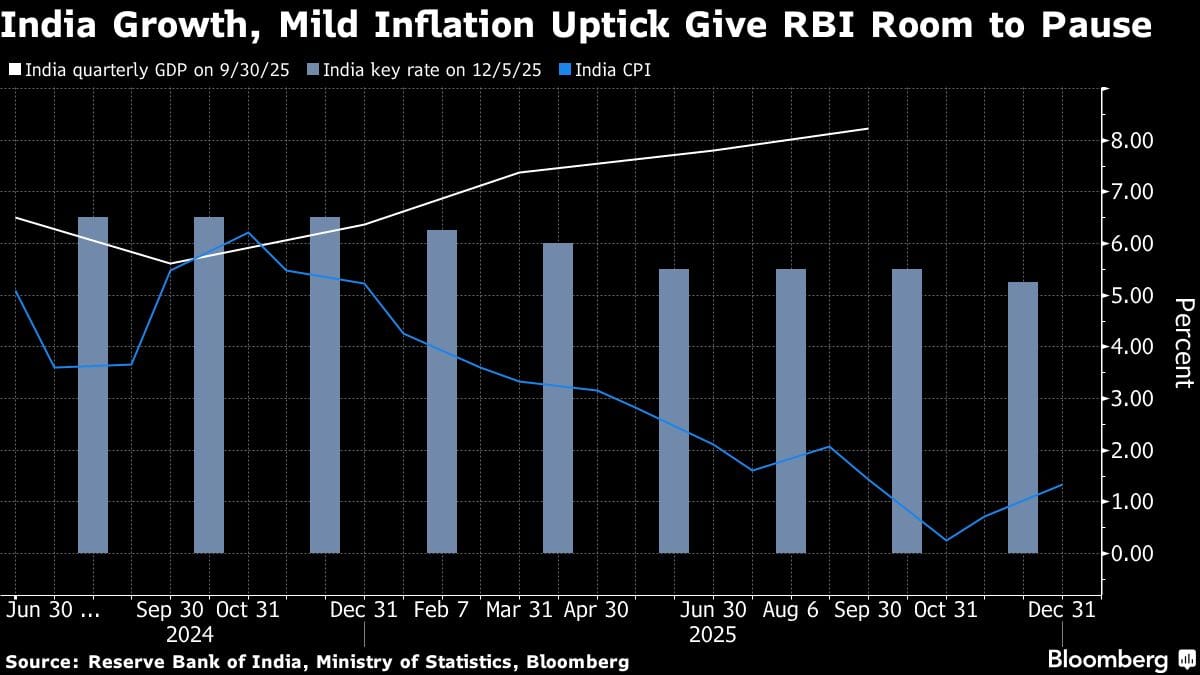

A majority of the 39 economists surveyed by Bloomberg expect the central bank to keep its benchmark repurchase rate unchanged at 5.25% on Friday. With the economy set to expand at over 7% for a second straight year beginning April and the rupee posting its biggest rally in seven years, some economists, such as Nomura Holdings’ Sonal Varma, expect the rate-cut cycle may even be over. Only five of those polled still expected a cut in this week’s policy meeting.

Bank of America economist Rahul Bajoria changed his rate-cut call to a hold after Trump lowered tariffs on India to 18% from 50% earlier under the trade deal. The “deal now would boost the growth certainty and the current momentum seen in high frequency indicators can continue to sustain,” he added.

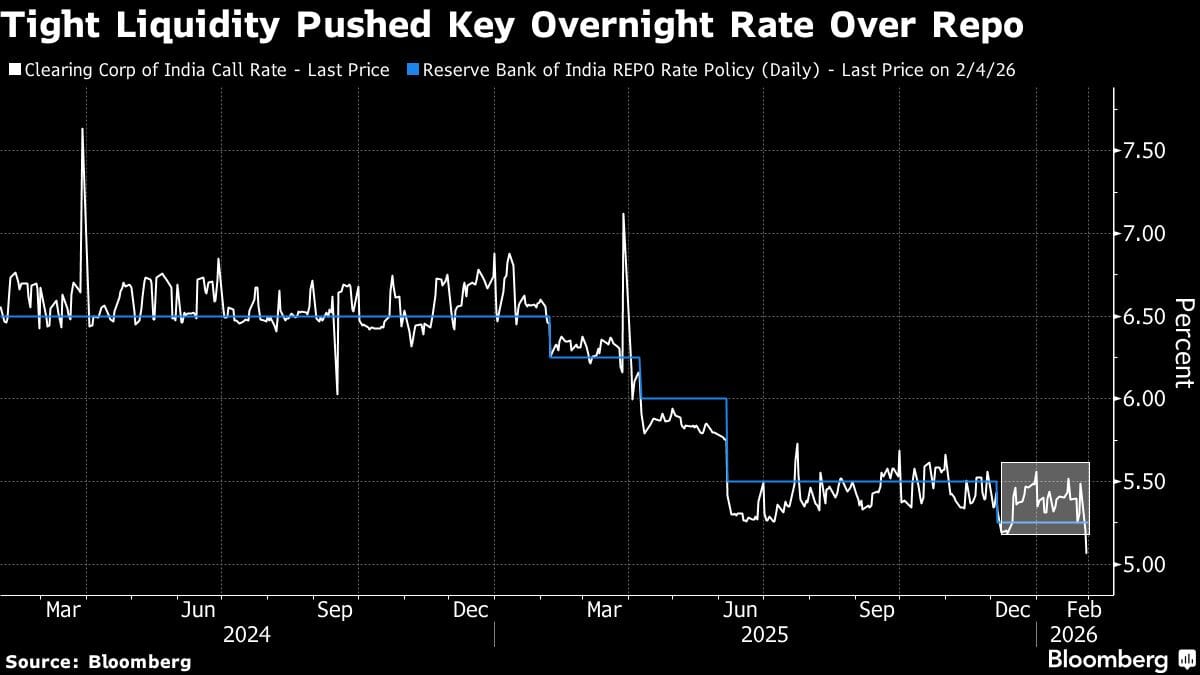

In the policy meeting, the RBI may need to explain how it plans to buy bonds from the market to add liquidity for investors such as banks, so that they have enough cash to participate in weekly bond auctions. This would help prevent interest rates from jumping because of heavy bond supply and could even bring borrowing costs down without the RBI having to cut its main policy rate.

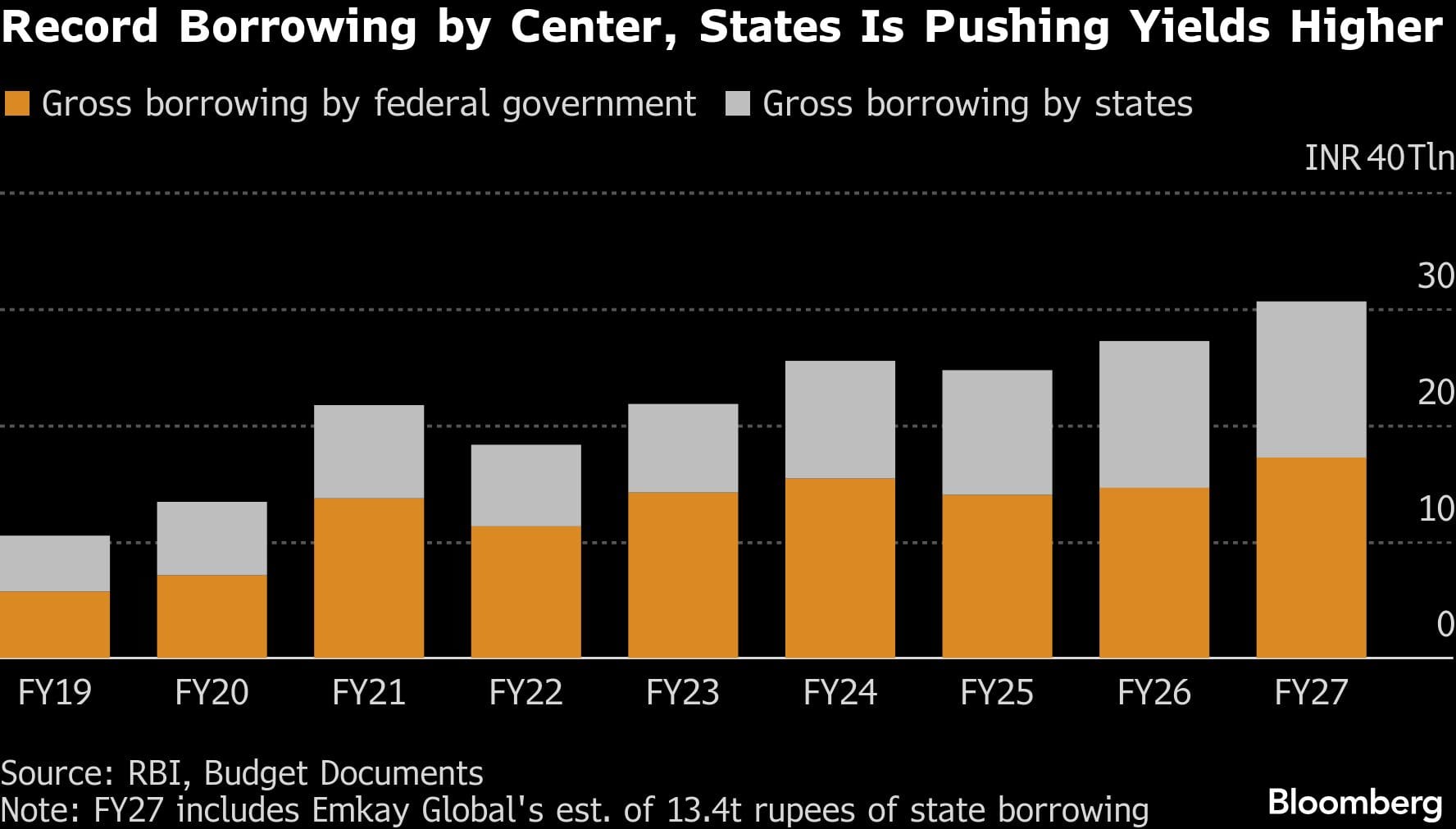

Bond markets were spooked, pushing up yields, after the government outlined plans to borrow 17.2 trillion rupees ($190 billion) in bonds in the next fiscal year, up 18% from this year.

The central bank has cut interest rates by 125 basis points since February last year, including a quarter point in December, and indicated that there was scope to cut more if inflation remains soft. However, from sub-1% levels seen in recent months, the RBI sees the retail inflation accelerating to near its 4% target in the first half of the next financial year starting April. A new inflation series due Feb. 12 may show inflation climbing slightly as the weight of food, which pulled down headline CPI last year, is reduced.

The central bank may still keep rate cut chances open as the global backdrop remains highly uncertain, according to Citigroup Inc. economists Samiran Chakraborty and Baqar Murtaza Zaidi. “Hence keeping some policy buffer might be a judicious option now,” they said.

Here are some of the key things to watch out for in Malhotra’s televised speech at 10 a.m. local time on Friday:

Forecasts

While the central bank awaits the new GDP series, it may still revise its growth forecasts given the boost from India-US trade deal, said CareEdge economists led by Rajani Sinha. The central bank projects the economy to grow 7.3% in the current year that ends in March, in line with the government’s 7.4% estimate.

Budget and Dividend

Governor Malhotra is likely to be asked about central bank’s plan to pay another round of record dividends as announced by Finance Minister Nirmala Sitharaman in the budget. The government expects to receive a record 3.16 trillion rupees in dividends from the RBI and state-owned financial institutions. Last year, the RBI transferred 2.69 trillion rupees to the government.

Economists say the payout is manageable, citing gains from RBI’s heavy intervention in the currency markets during the current fiscal year.

Markets

Bond traders are looking to the RBI for additional liquidity measures as it grapples with a record supply of debt.

State borrowing is also rising at a record pace as regional governments take populist measures ahead of elections. The supply surge comes as banks sell bonds to meet growing loan demand, while pension funds have increased allocation to equities. Interest rate swaps are pricing in benchmark policy rate remaining unchanged for the next one to two quarters, according to ITI Mutual Fund.

The demand-supply mismatch has made the central bank’s open market purchases critical in capping bond yields, which Nomura sees rising to 7% in the coming months. Tata Mutual Fund sees the RBI buying 8 trillion rupees of bonds by March, up from 6.6 trillion rupees currently planned.

As for the currency markets, the monetary authority may be at ease as the trade deal is expected to boost capital flows. The currency had been hitting a series of record lows in recent months due to punitive US tariffs and equity outflows.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.

Also read: Trade deal with US likely to lift Rupee & stocks, say investors