Mumbai: A rally in Indian sovereign bonds may come in the second half of the year as the central bank is likely to cut policy rates twice more, according to a two-decade veteran of the debt market.

“Given that we have a governor whose take is that the Reserve Bank of India should work toward bringing back growth,” rate cuts are possible as early as April, said Neeraj Gambhir, former head of fixed income at the local unit of Nomura Holdings Inc. He expects the yield on the most-traded 2028 bonds to drop as low as 7 percent by year-end, a level last seen in November 2017.

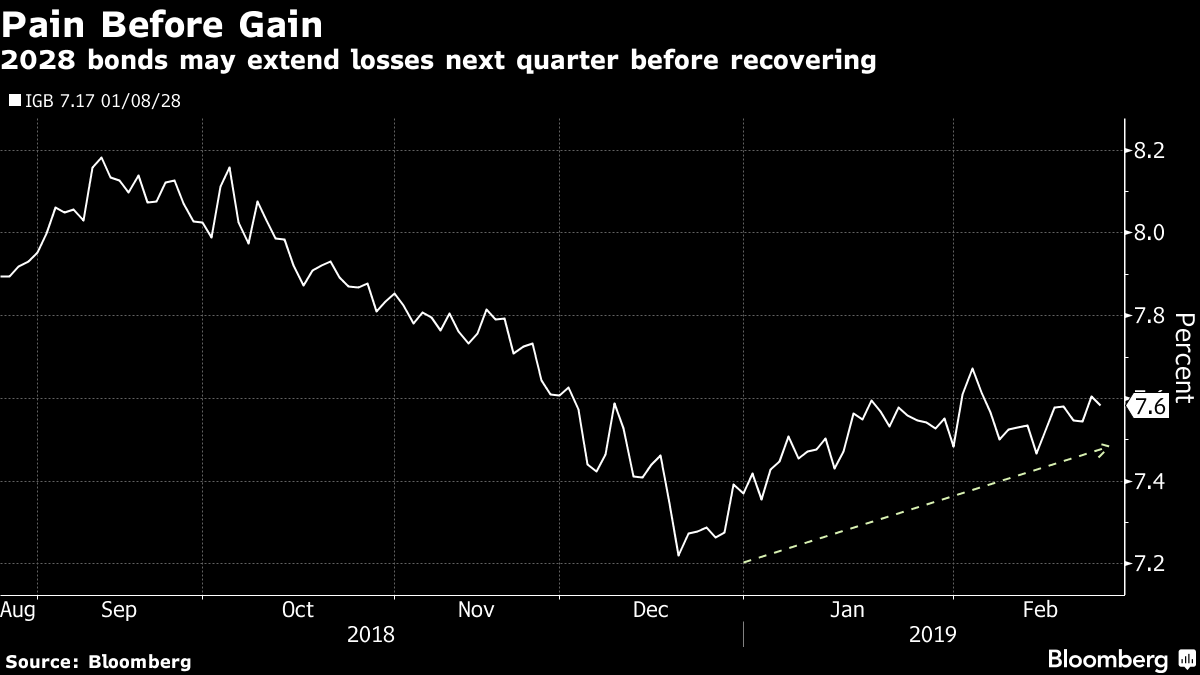

For now, concerns about India’s planned record debt sale, uncertainty about upcoming elections and higher oil prices will pressure bonds. Yields may climb as high as 7.75 percent in the next quarter before falling as some of these worries start to fade, said Gambhir, who in June correctly predicted the RBI would buy bonds to halt a yearlong selloff.

New RBI chief Shaktikanta Das has flagged growth concerns and kept the door open for more rate cuts after a surprise reduction this month, minutes from the latest policy meeting showed. Das pointed to a slowdown in consumer inflation to 2.05 percent in January — well below the medium-term target of 4 percent — to justify the decision.

“You are looking at a situation where growth is weakening at the margin” and inflation is likely to remain below the RBI’s target next year, Gambhir, who’s been tracking the debt market for 24 years and now runs an advisory firm, said in an interview.

Five-year debt “looks the most exciting” as the bulk of the central bank’s purchases are in the shorter-end of the yield curve, he said. The yield for these securities may drop to 6.75 percent by end-December, from 7.06 percent at present, he said.

The yield on 2028 debt has climbed 22 basis points so far this year, as foreigners pulled $738 million from rupee debt, the most among Asian markets tracked by Bloomberg.- Bloomberg

Also read: RBI governor says he’ll meet CEOs of both public & private sector banks on 21 February