New Delhi: The Reserve Bank of India’s Monetary Policy Committee (MPC) bucked government and growth-related pressures Friday, deciding to keep the benchmark repo rate unchanged at 6.5 percent for the 11th consecutive time. The MPC, however, significantly revised downwards its growth projections for the year to 6.6 percent from the 7.2 percent it had predicted in October.

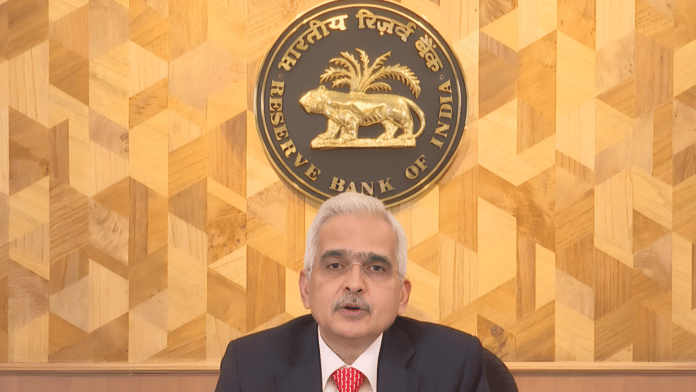

Announcing the decisions after a meeting of the committee, RBI governor Shaktikanta Das said, “The MPC took note of the recent slowdown in the growth momentum, which translates into a downward revision in the growth forecast for the current year.”

“Going forward into the second half of this year and the next year, the MPC assessed the growth outlook to be resilient, but warranting close monitoring.”

Notably, the governor said that the decision to keep the repo rate unchanged was not a unanimous one, with two members calling for a rate cut. This signals growing division within the six members of the MPC. Just one member dissented from the majority opinion in the October meeting.

The MPC also hiked its forecast of inflation for the year to 4.8 percent from 4.5 percent predicted in its October meeting.

The governor noted that inflation surged to 6.2 percent in October, higher than the RBI’s upper tolerance bound of 6 percent, and that food inflation is likely to remain elevated in the third quarter (October to December 2024).

Food prices will start easing only in the January-March 2025 quarter, Das said, “backed by a seasonal correction in vegetable prices, kharif harvest arrivals, likely good rabi output and adequate cereal buffer stocks”.

The MPC’s decision to keep the repo rate unchanged comes at a time when growth in the economy has been slowing—coming in at 6.7 percent in the first quarter (Q1) and 5.4 percent in Q2, both substantially lower than earlier predicted—and several Union ministers, such as Commerce Minister Piyush Goyal and Finance Minister Nirmala Sitharaman, have spoken publicly about the need for lower interest rates to boost growth.

Das, however, has consistently said that inflation still remains a concern and that the RBI will not take its eyes off it until it reaches the target level of 4 percent. This was largely the sentiment he reiterated Friday.

“High inflation reduces the disposable income in the hands of consumers and dents private consumption, which negatively impacts the real GDP growth,” Das said. “The increasing incidence of adverse weather events, heightened geopolitical uncertainties and financial market volatility pose upside risks to inflation. The MPC believes that only with durable price stability can strong foundations be secured for high growth.”

Also Read: India hits back in WTO over allegations that it supports domestic farmers more than permitted

Increased liquidity and more loans for farmers

The MPC took two other significant decisions: one on increasing liquidity in the system and the other to help farmers avail higher collateral-free loans to mitigate higher input costs.

To ease liquidity, the MPC decided to reduce the Cash Reserve Ratio (CRR) for all banks to 4 percent from 4.5 percent.

This would be carried out in two tranches over the course of this month. The CRR is the proportion of bank deposits that must be kept with the RBI in the form of reserves. The lower this ratio, the more the banks have at their disposal to lend out, and thereby increase liquidity.

Das said the CRR cut would release an additional Rs 1.16 lakh crore to the banking system.

“While being cognisant of the incoming growth inflation mix, prudence and practicality required the RBI to address the issue of declining core liquidity,” said Rajeev Radhakrishnan, chief investment officer in the fixed income vertical of SBI Mutual Fund.

“The CRR cut by 50 basis points provides adequate signalling with respect to the direction of monetary policy going forward.”

The other significant decision taken by the MPC was to do with collateral-free loans to farmers.

“The limit for collateral-free agriculture loans was last revised in 2019,” Das explained.

“Taking into account the rise in agricultural input costs and overall inflation, it has been decided to increase the limit for collateral-free agriculture loans from Rs 1.6 lakh to Rs 2 lakh per borrower. This will further enhance credit availability for small and marginal farmers,” he added.

Also Read: Real wages grew just 0.01% over the last 5 years and contracted in Haryana & UP, Ind-Ra report finds

Defensive on using forex reserves to stabilise the rupee

The RBI governor also denied reports that it was excessively intervening in the currency markets.

ThePrint reported last month on how the RBI had been using its foreign exchange reserves—by both buying and selling US dollars—to control the rupee exchange rate. The data showed the central bank sold $26 billion of its reserves to slow the rupee’s slide in October.

Several economists and traders have also pointed out that all evidence pointed to central bank interventions in the currency market.

However, Das asserted Friday that the RBI exchange rate policy has remained consistent over the years and is market-determined.

“Foreign exchange reserves are deployed judiciously to mitigate undue volatility, maintain market confidence, anchor expectations and preserve overall financial stability,” Das said. “These interventions focus on smoothening excessive and disruptive volatility rather than targeting any specific exchange rate level or band.

(Edited by Sanya Mathur)

Also Read: Shaktikanta Das has handled govt better than rockstar RBI chiefs. The real test is now

The Opposition political parties have always belittled Mr. Das as a stooge of the BJP. But truth is, he has his own mind and does not buckle under pressure.

Right now, he is considered as amongst the best central bank chiefs in the world.