New Delhi: When Hindustan Aeronautics Limited (HAL) was left out of the Rafale deal, questions were raised about its capabilities, and the agreement was seen by many as the death knell for the Indian defence PSU.

However, the company has defied all expectations, with its market capitalisation, or total worth, in the Indian stock market growing by 280 percent in the past five years.

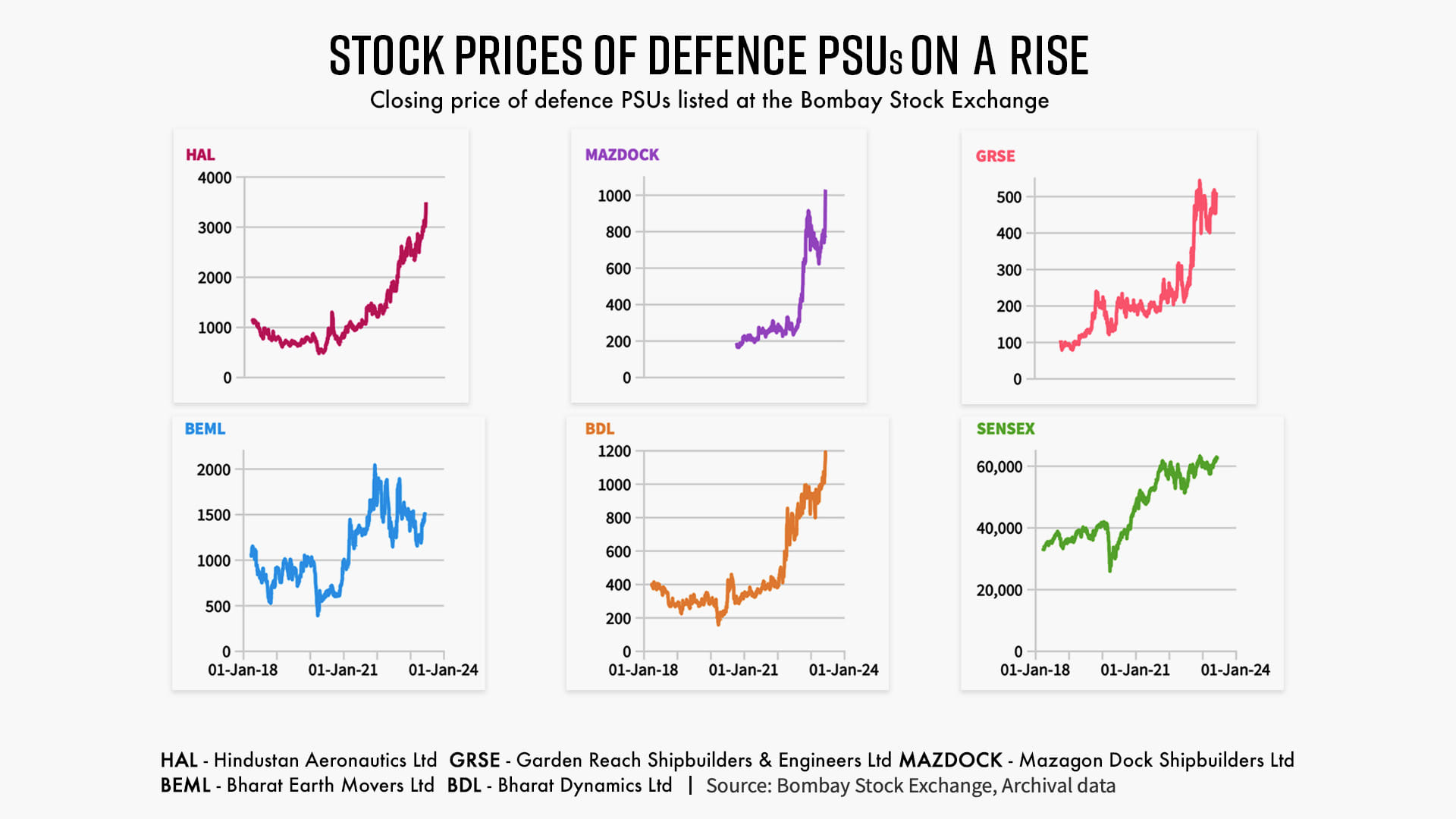

In 2018, when the company was listed on the Indian stock market, its total market capitalisation was $3.87 billion, which remained more or less the same until 2020.

By 2021, its market capitalisation had jumped to $5.44 billion and almost doubled in 2022 to $10.22 billion. In the first half of 2023 alone, its market cap has jumped to $14.76 billion — or about Rs 1.18 lakh crore (as of 8 June 2023) — a rise of 280%, nearly all of it in just the last two-and-a-half years.

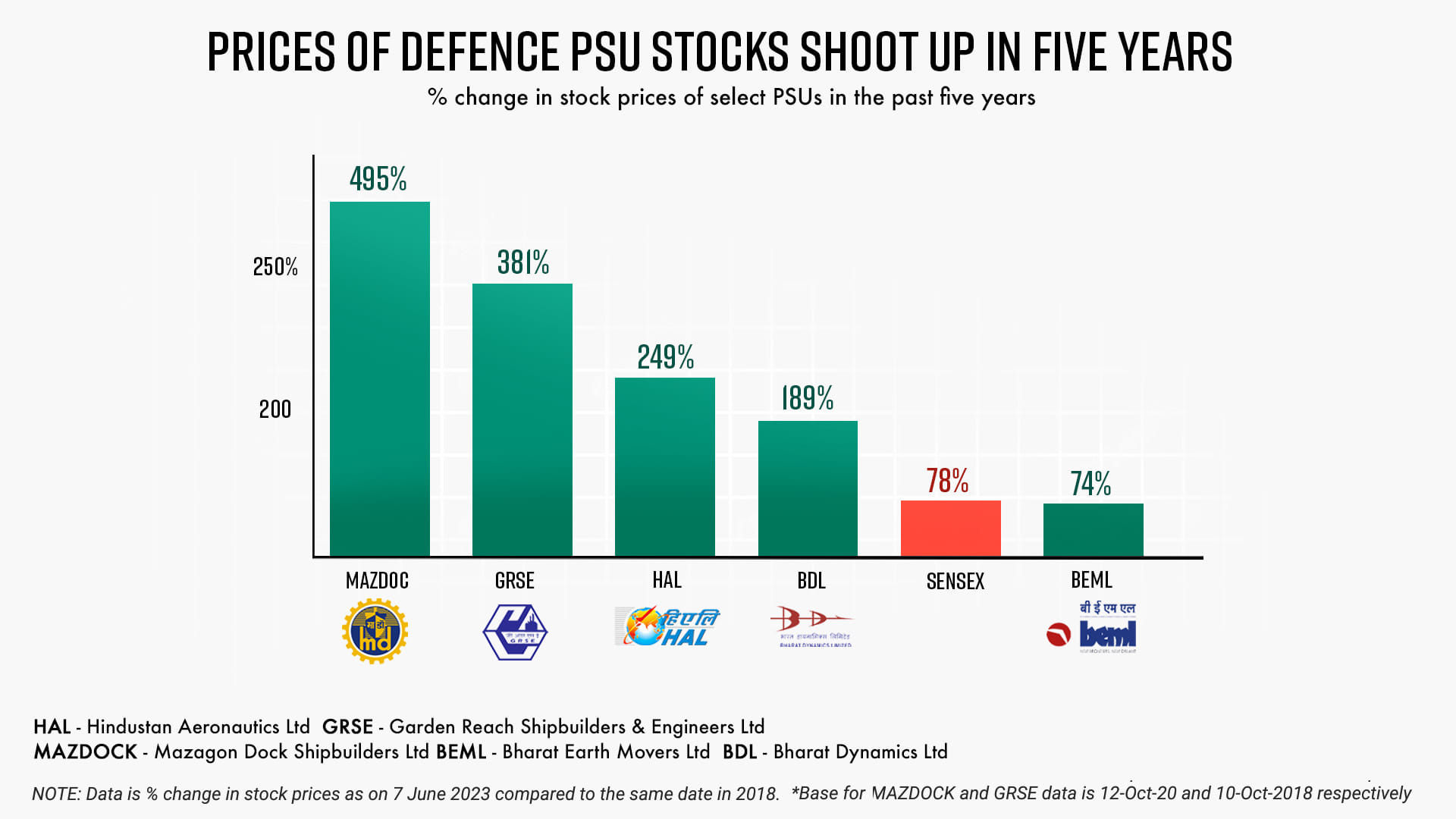

This is also reflected in HAL’s stock prices. The price of a HAL share has jumped from Rs 998 on 7 June 2018 to Rs 3,489 on 7 June 2023 — a rise of nearly 250 percent. In other words, if a person had invested Rs 1 lakh in HAL five years ago, that investment would be worth Rs 3.49 lakh today.

For comparison, the BSE SENSEX (index of top 30 well established companies) has jumped by around 78 percent in the past five years.

And it’s not just HAL. Other major defence PSUs too are following the streak.

Mazagon Dock Shipbuilders, a marine engineering public sector undertaking (PSU) listed on the stock market in 2020, has witnessed its stock price shooting up from Rs 173 in October 2020 to Rs 1,030 in June 2023, an almost 500 percent jump in prices. An investment worth Rs 1 lakh in 2020 in this company would be worth Rs 6 lakh in 2023.

Similarly, each Rs 1 lakh invested in Garden Reach Shipbuilders and Engineers Limited (GRSE), another marine engineering company, in 2018, would be worth Rs 4.8 lakh today. A Rs 1 lakh investment in 2018 in Bharat Earth Movers Limited India (BEML), which manufactures heavy trucks and wagons, would be worth Rs 2.9 lakh today.

Also read: Modi govt proposes to sell up to 3.5% stake in state-run HAL through ‘offer for sale’

HAL compared to PSUs

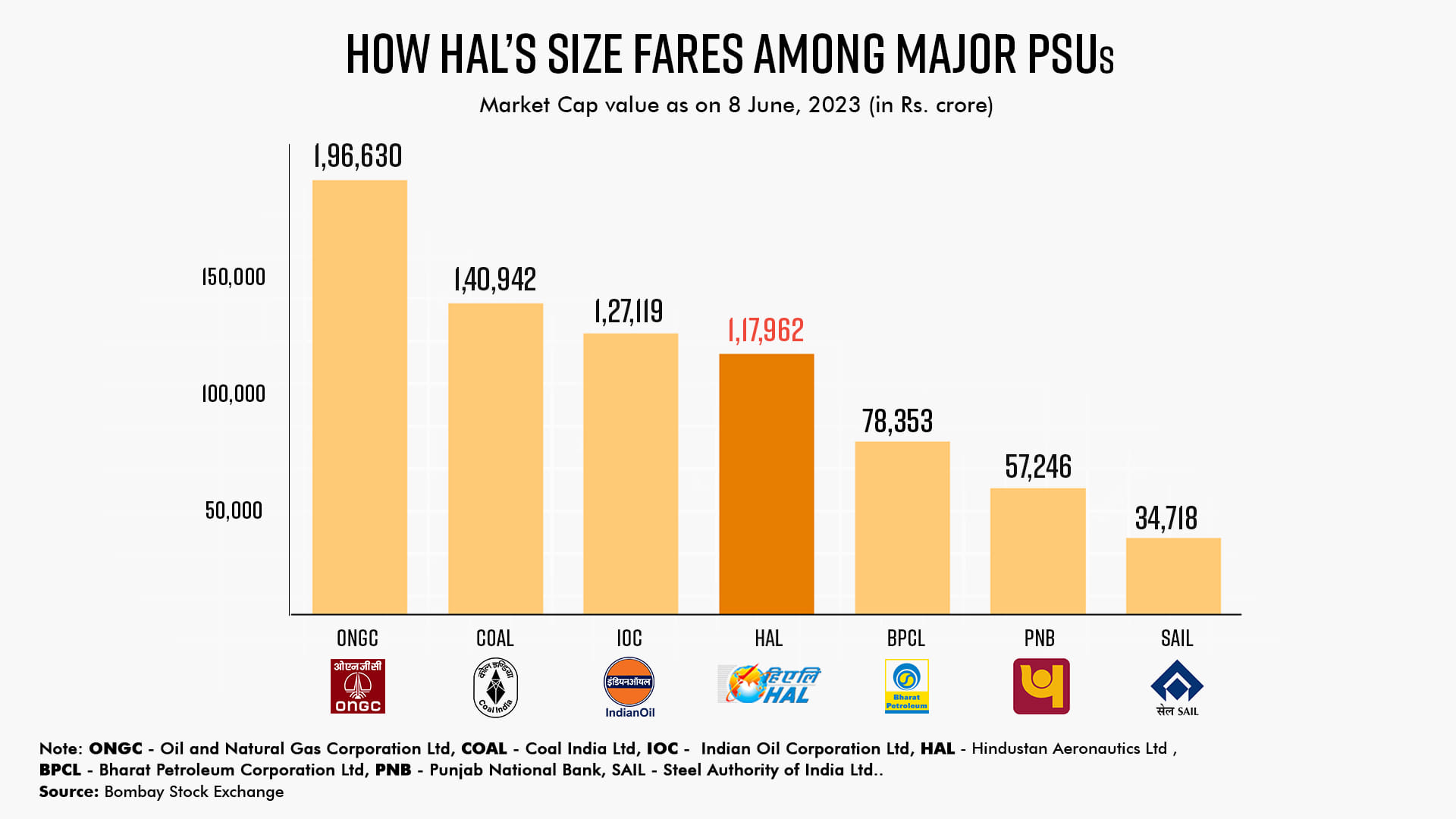

BSE SENSEX data shows that, as of 8 June 2023, HAL’s market cap was Rs 1.18 lakh crore. This is almost three times the market value of Steel Authority of India Ltd or SAIL (Rs 34,700 crore), nearly twice as much as that of Punjab National Bank (Rs 57,200 crore), and almost 1.5 times that of Bharat Petroleum (Rs 78,300 crore).

Even among the bigger PSUs, HAL doesn’t look that tiny. It’s almost 60 percent the size of Oil and Natural Gas Corporation (ONGC) of India, almost 80 percent the size of Coal India Limited, and about 90% the size of Indian Oil Corporation Limited.

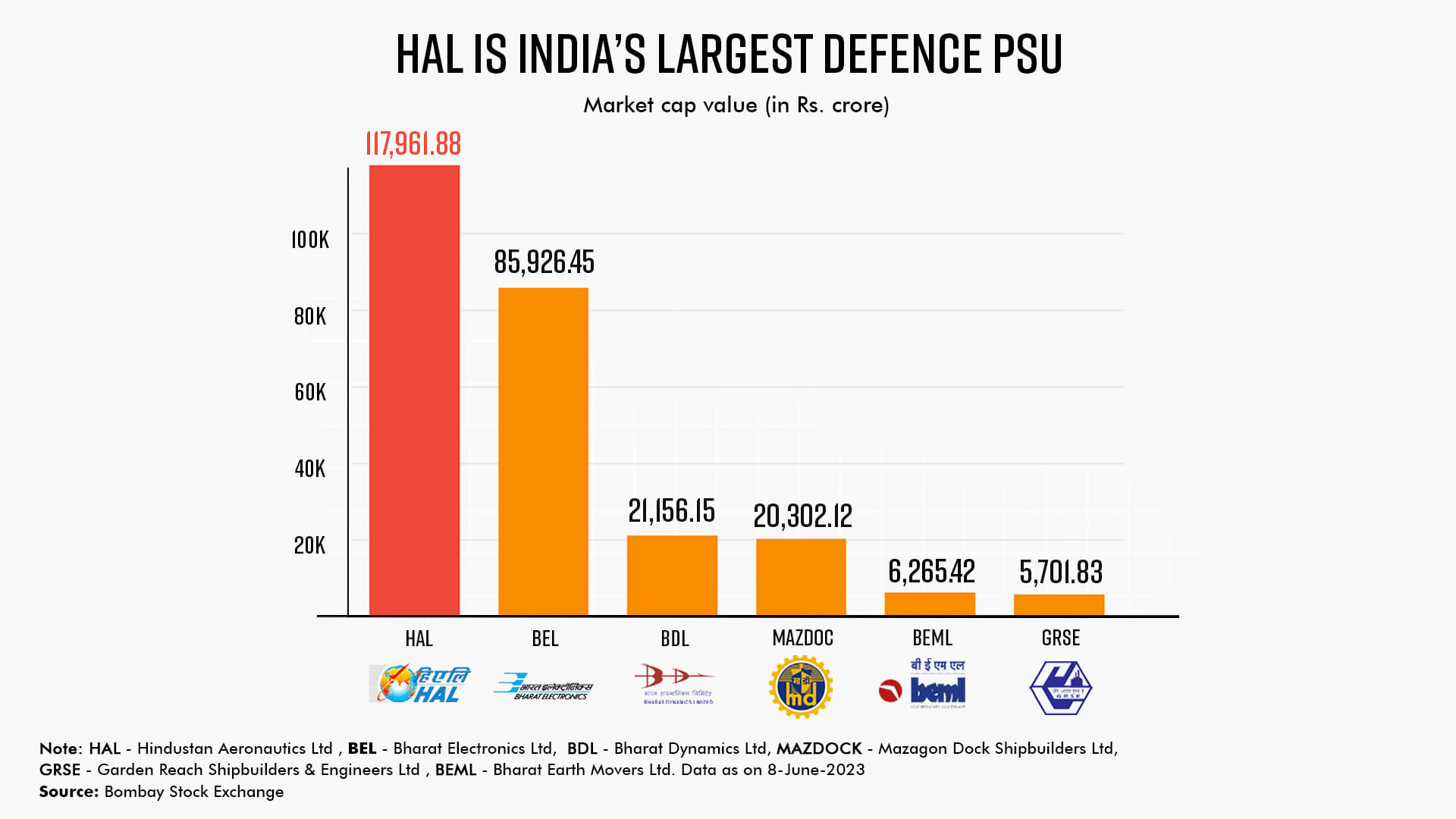

In terms of market cap, HAL is also India’s biggest defence sector PSU, followed by Bharat Electronics Ltd (Rs 85,900 crore), Bharat Dynamics Ltd (Rs 21,000 crore), Mazagon Dock Shipbuilders Limited (Rs 20,000 crore), BEML (Rs 6,260 crore), and GRSE (Rs 5,700 crore).

So how did it get so big?

One of the primary reasons for the increase in defence stock pricing is the growing focus of the government on domestic manufacturing rather than imports.

The defence ministry has come out with multiple negative import lists, which restrict the import of several items in a planned manner. Over the next decade, India will manufacture tanks as well as all kinds of fighter aircraft, transport planes, specialised vehicles, artillery guns and small arms.

The government has earmarked 75 percent of the armed forces’ capital procurement budget this fiscal year for domestic industry, up from 68 per cent in 2022-23.

This means the armed forces will have to prioritise Indian entities or joint ventures based here when placing orders for procurement. The 75 percent would translate to approximately Rs 1 lakh crore.

Over the next decade, orders worth nearly $100 billion are likely to be made by the Indian military, most of which will go to Indian companies.

India has also started exporting defence equipment to over 90 countries, and it hit a record high of nearly Rs 16,000 crore in 2022-23.

HAL has also bagged big contracts, which include those for 83 Tejas aircraft. According to media reports, it has a pending order of about Rs 83,000 crore and another for around Rs 50,000 crore in the pipeline.

Inputs from Snehesh Alex Philip

(Edited by Smriti Sinha)

Also read: ALH ditching off Mumbai coast gave Navy record a salty wash. HAL, Services must fix fatal flaws