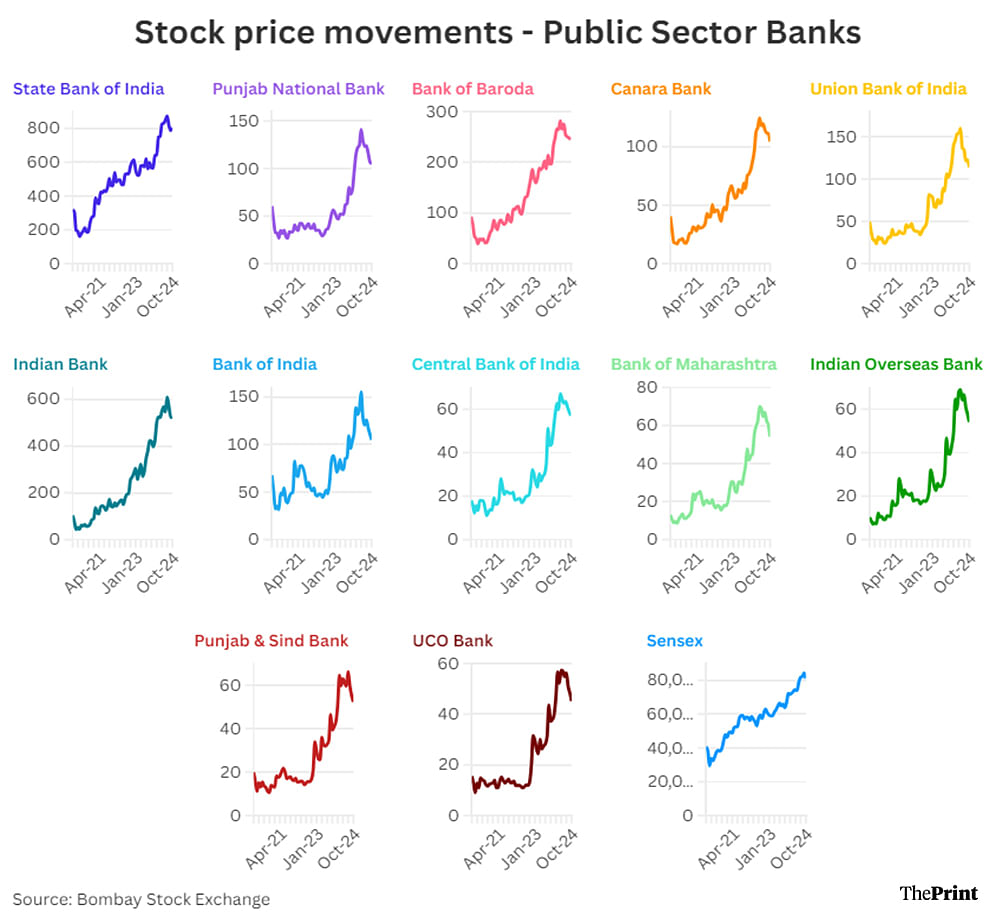

New Delhi: The overly buoyant sentiments and “narratives” that drove up the stock prices of public sector banks to dizzying heights over the past few years seem to be ebbing now as investors face the reality of falling profitability in the banking sector.

Several stocks have fallen more than 20 percent over the past few months only, while others have fallen more than 30 percent.

An analysis of the Bombay Stock Exchange (BSE) data showed that 12 public sector banks in India have seen their stock prices jump an average of nearly 270 percent between January 2020 and April 2024. The Indian Overseas Bank (567 percent), Bank of Maharashtra (437 percent), and Indian Bank (430 percent) have seen their valuations grow far more than the average.

ThePrint reported on the excessive overvaluation of India’s stock market earlier this year and how ‘irrational exuberance and fanciful narratives’ — buoyed by India’s strong growth story and the government’s capex push — have been driving it.

Stock market analysts ThePrint spoke to said the ebullient sentiments extended to the stocks of public sector banks. The trend is now waning as issues specific to the banking sector rein in the strong growth in profitability witnessed by it in the past.

Low deposit growth adds to pain in banking stocks

Of the 12 public sector banks, the Bank of India’s stock price fell the most over the past few months — nearly 32.5 percent from its peak in April this year.

Bank of Maharashtra has seen a 23 percent fall in its stock price since its peak in April 2024, followed by Indian Overseas Bank, whose stock price has fallen nearly 22 percent since May 2024.

Earlier this month, Mumbai-based fund management firm Carnelian Asset Management & Advisors wrote a letter to its investors on the dangers of narratives in the stock market, with public sector banks being one of the affected sectors.

“As a narrative gathers steam, it can go far and wide, reaching a level of contagion,” the letter said. “At this point, the intrinsic values and market prices diverge, thereby, making an investment opportunity either too lucrative or too expensive. Hence, avoiding this becomes very important.”

A senior research analyst at Carnelian, Kunal Shah, told ThePrint that this narrative has now come up against the real-world problems of maintaining profitability.

“Recently, the reason for stock corrections among banking stocks, and, in particular, PSU banks, is that net interest margins, which were at their peak, and credit costs, which were at their lowest levels, are both converging to the mean,” Shah said. “So, despite seeing loan growth, there is not much profitability growth.”

The net interest margin is the difference between the interest rate banks charge on loans they give out and the interest rate they have to pay customers for their deposits. The wider this gap, the higher the banks’ profitability. Conversely, the lower the gap, the lower the profitability.

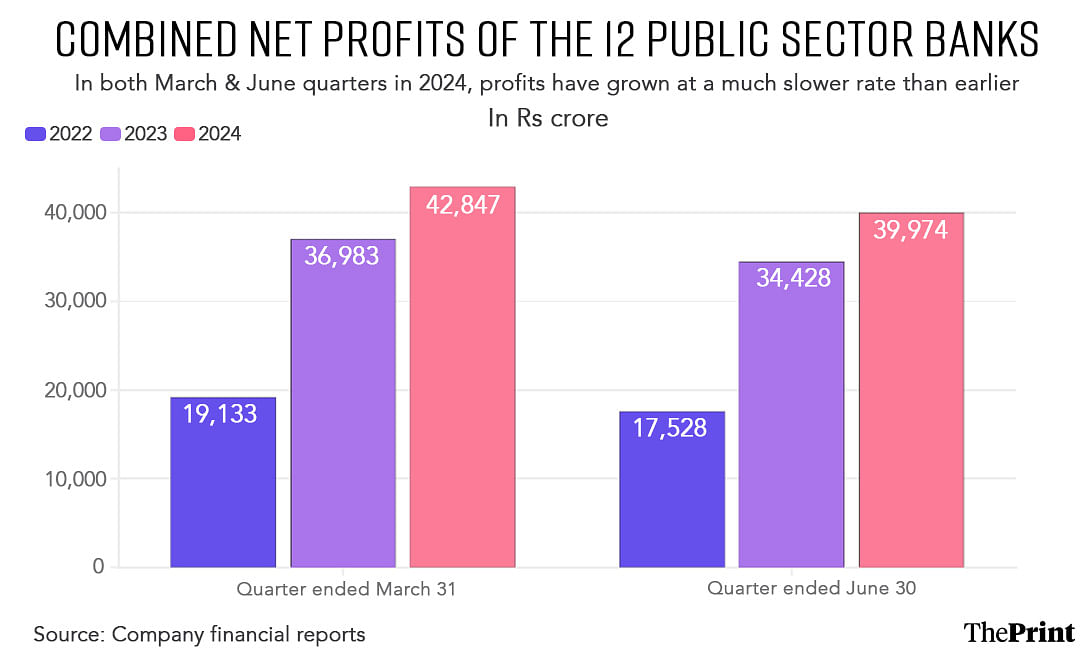

The latest financial statements of the public sector banks showed profit growth had been quite strong in the March and June quarters of 2023, which likely added to investors’ enthusiasm for the stocks of these companies. For instance, the combined net profits of the public sector banks had grown 93 percent and 96 percent, respectively, in the March 2023 and June 2023 quarters.

Also Read: Individuals, businesses are increasingly defaulting on microloans. Both lenders & borrowers at fault

Government hype backfires on investors

Another factor behind the skyrocketing prices of bank stocks has been the hyping up of the sector by government agencies and politicians, even Prime Minister Narendra Modi.

For example, the government platform MyGov, in June this year, posted an X thread on the “unbelievable comeback” of the public sector banks.

Citing that thread, Modi, at the time, wrote, “Insightful data on how there has been a transformation in the banking sector and how PSU banks are powering it.”

Investors influenced by such statements are now facing problems as the rate of growth in profit of the public sector banks has slowed dramatically over the most recent quarters. While profits grew in the March 2024 and June 2024 quarters, the growth rate was much slower than earlier — 16 percent for each quarter.

However, statements made by prominent figures have already caused some damage. In a now-deleted X post in September this year, former Indian cricketer Virender Sehwag said that one of his staffers invested in the public sector bank stocks that the thread reposted by Modi mentioned, only to subsequently find the prices of stocks fall by 20 percent over the next three months.

“One of my staff had got around 1 crore after selling his ancestral land,” Sehwag wrote. “For 80 lakh, he bought (stocks of) 3 of the 4 mentioned PSU banks in this thread — Canara Bank, Bank of Baroda and Union Bank — a day after this tweet from our Hon PM. He is an ardent fan of Hon PM.”

However, three months after buying the stock, Sehwag said the prices fell by 20 percent even as the overall stock market hit all-time highs.

“What would experts advice (sic) him as he is in a panic as he has put in a major portion of his net worth here,” Sehwag concluded.

Stock market analysts ThePrint has spoken to have confirmed that that was likely not an isolated incident. They said politicians and financial influences or ‘finfluencers‘ on social media are prone to influence investors, especially those new in the market.

‘Banks are now valued accurately, worst is over’

V.K. Vijayakumar, the chief investment strategist at Kochi-based investment services firm Geojit Financial Services, told ThePrint that the banking stocks, following the recent fall, are currently not overvalued — an assessment Shah agreed with.

“The banking stocks as a segment are very attractively valued currently in a market that is overvalued,” Vijayakumar said. “The reason is there is a struggle for deposits. Money is moving to mutual funds — (behind it are) particularly, the newbies, who have come to the market post-pandemic. Banks are finding it difficult to match their deposit growth with the credit growth they are seeing.”

With that said, Shah added that he believes that most of the worst for the public sector bank stocks is over since their deposit growth has been inching up, and that will show itself in the books of account in the next quarter or so.

“There is nothing structurally wrong with the PSU banks,” he said. “It is an issue with the whole banking sector. The valuations for PSU banks are now comfortable. Downside should be minimum from hereon.”

(Edited by Madhurita Goswami)

Also Read: Personal income tax now over 30% of govt’s tax revenue, significantly higher than corporate tax