New Delhi: While private sector investment picked up in the April-June quarter of this financial year, this was concentrated in the transport sector, especially aviation, an analysis by the Bank of Baroda’s economic research unit found.

This has meant the bulk of private investment in the quarter hasn’t led to the creation of new business in India, since all of the country’s orders for new aeroplanes go to foreign companies based abroad.

Looked at another way, as the report pointed out, the real boost from this higher private investment in India would go to foreign companies.

Separately, a report released by the Ministry of Finance Thursday found that private sector investment — as measured by new project announcements — grew strongly in the financial year 2022-23.

The Bank of Baroda (BoB) research report, released on 4 June, said that there seems to be a “U-shaped recovery” in new project announcements in the April-June 2023 period, which is the first quarter of the financial year 2023-24.

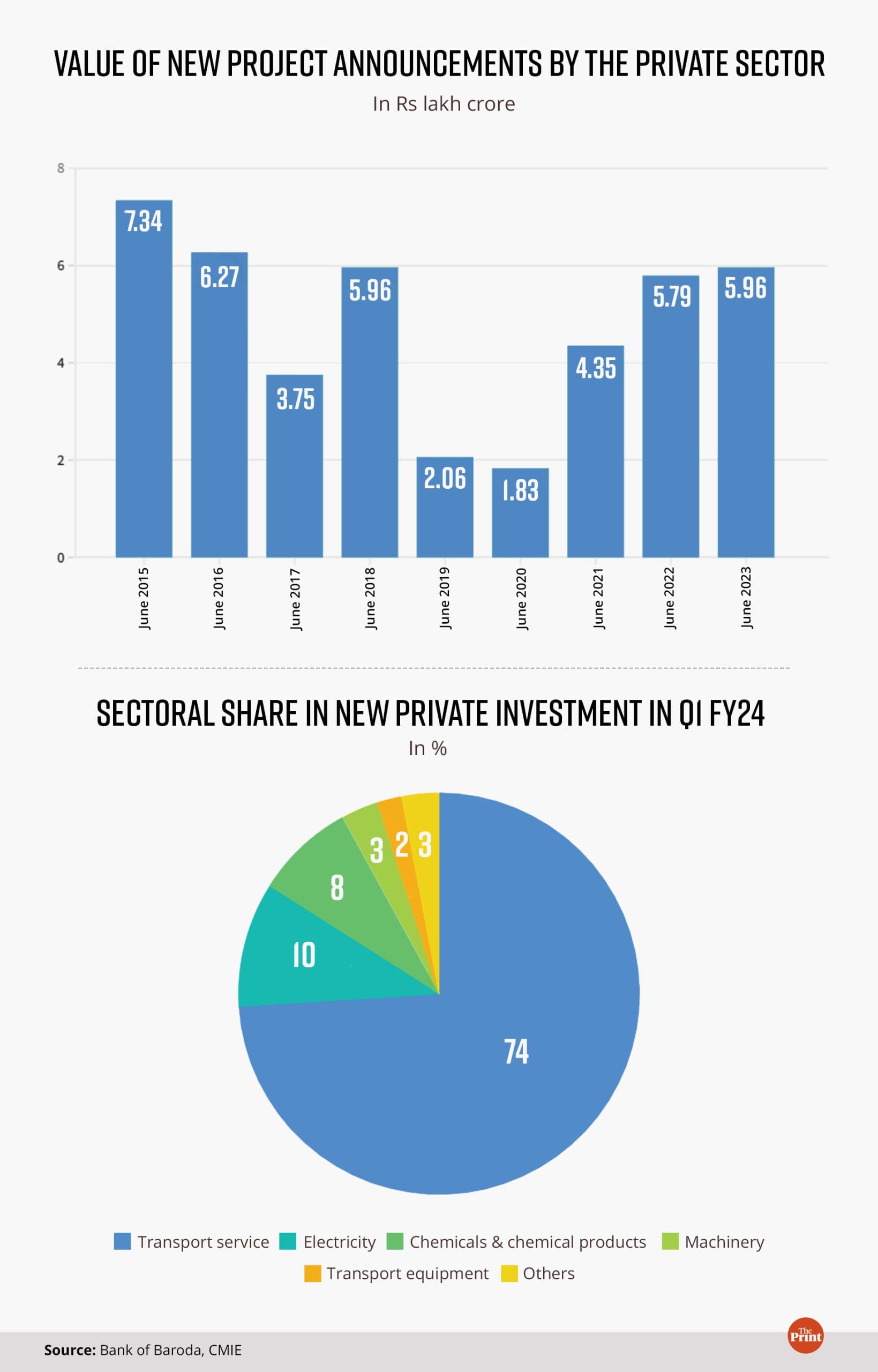

“This is encouraging as these announcements had declined in 2019 and 2020,” the report said. “The revival witnessed in 2021 continued in 2022 and 2023, though admittedly the level is still lower than what it was in 2016 and 2017.”

The data presented in the BoB report show that new projects worth Rs 5.96 lakh crore were announced in the first quarter of the current financial year, up from Rs 5.79 lakh crore in the first quarter of the previous financial year. This has taken private investment to the same level it was in the first quarter of 2018-19.

Also Read: India is using Chinese yuan to pay for 10% of its Russian oil imports, rest in rupee and dirham

Airlines — the dominant contributor

“A closer look at the new investment announcements for Q1 FY24 of Rs 5.96 lakh crore reveals that there has tended to be a high-level concentration in the transport sector,” the BoB report said. “Of this, it is the airline industry which has contributed to these investment announcements.”

The transport industry accounted for 74 per cent of all new project announcements in the first quarter. The share of the power sector was 10 per cent, followed by the chemicals sector at 8 per cent, the machinery sector (3 per cent), and the auto sector (2 per cent).

“Therefore, the announcements are definitely not broad-based and are restricted to a handful of sectors,” the report added.

“The other significant part of these announcements is that the airline industry has dominated the landscape for a considerably long period with a share between 20 and 30 per cent in the last 10 years,” the report said.

It pointed out that investments in the airline industry are “unique” in that they involve the purchase of planes that are imported. So, while this does add to the assets of the sector, it doesn’t translate into benefits for ancillary sectors.

“While it (plane orders) does add to the capital stock of the country, it would not be generating backward linkages with other sectors and, hence, other related industries may not benefit much from such purchases,” the report pointed out.

“The boost is more for the global manufacturers of these aircraft,” it added.

Private sector borrowing

The limited scope of the investment activity is backed up by the data on private-sector borrowing. The reasoning is clear — companies borrow to invest. If they are not borrowing, they do not plan to invest.

“The total amount of funds raised (from the bond market) was impressive at Rs 2.33 lakh crore against Rs 0.97 lakh crore in the last year,” the report said.

“However, almost 89 per cent of the funds mobilised was from the financial sector… Hence, there were limited funds raised by non-finance companies,” it added.

Financial sector borrowing — mostly by non-banking financial companies (NBFCs) — is done to fund further lending and so doesn’t immediately translate into investment in new assets.

The available data on borrowings from banks in the first two months of the financial year confirm this trend. The report said that credit growth was driven by agriculture, services, and personal loans.

“Industry has again lagged with growth of 6 per cent against 8.8 per cent last year,” the report said.

“Therefore, there are again fewer signs of credit being used by industry for investment purposes, and it does appear that most of the loans are for working capital purposes,” it added.

The finance ministry report said that, according to the CMIE Capex database, new private investment proposals grew 78 per cent in 2022-23 compared with the previous year.

“Additionally, as per Axis Bank Research, financial data for a consistent set of listed companies indicate broad-based private capex (capital expenditure) growth of 22 per cent in FY23,” it added.

The government’s report also cited the Reserve Bank of India’s Order Books, Inventories and Capacity Utilisation Survey, which showed that capacity utilisation for the manufacturing sector increased from 74 per cent in the second quarter to 74.3 per cent in the third quarter (October-December 2022).

“Higher capacity utilisation along with double-digit growth in non-food bank credit in FY23 signals positive intent of the private sector to undertake fresh investment soon,” the report said.

(Edited by Richa Mishra)

Also Read: India received 3rd highest FDI in the world in 2022, report by UN body finds