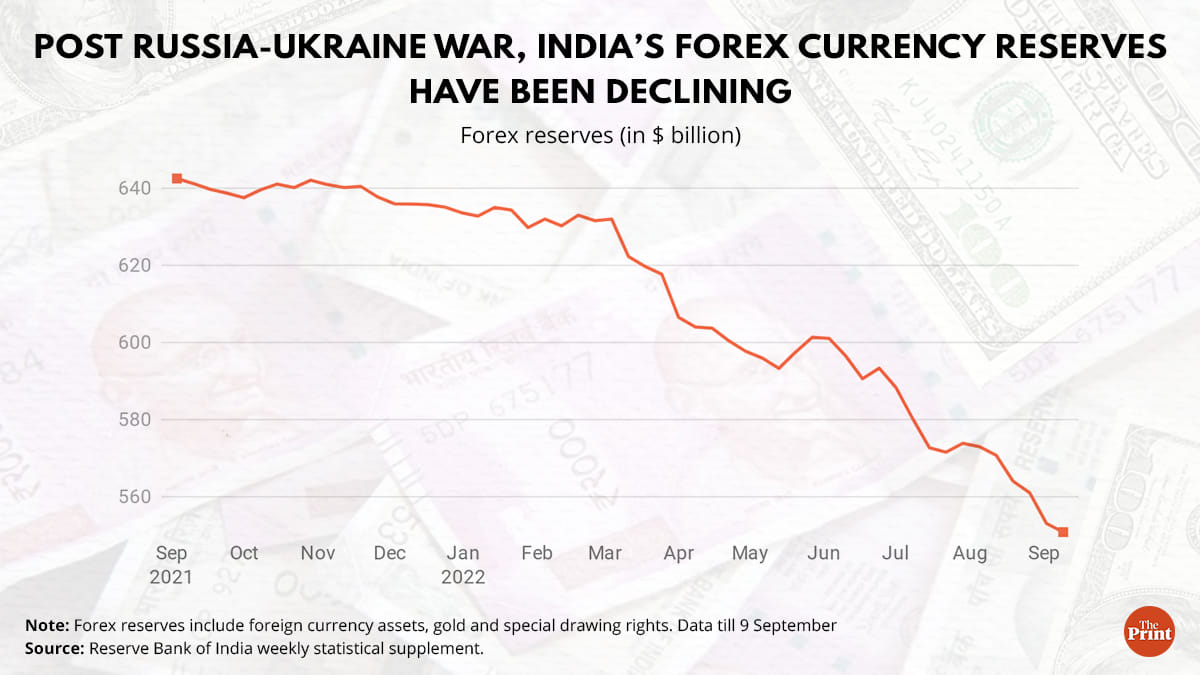

New Delhi: India’s foreign currency reserves have been sliding relentlessly since the Russia-Ukraine war broke out in February. According to the Reserve Bank of India’s (RBI’s) weekly statistical supplement, India’s forex reserves stood at $550.8 billion as of 9 September, the lowest since 2020, when it was $580 billion.

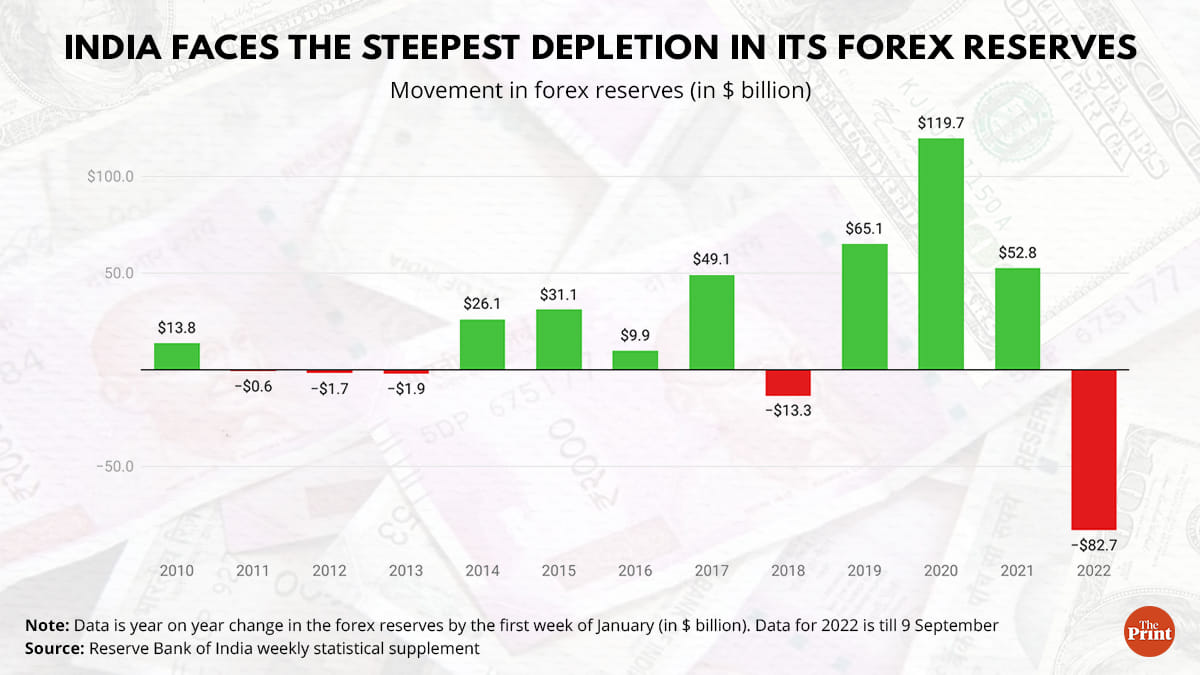

In the first week of January, India had forex reserves worth $633 billion, which means a fall of over $82 billion so far in the calendar year — the steepest in the past decade.

Of the $82 billion that has been wiped out in seven months, nearly half of the loss was reported in the past three months. India’s forex reserves depleted by $12.7 billion in June, by $14.4 billion in July and by $20 billion in August, according to RBI data. Since the first week of June, India’s forex plunged by about $47 billion — around $3.6 billion per week.

Depleting at this rate, the forex reserve plunge in 2022 could possibly be India’s biggest one since the Global Financial Crisis (GFC) of 2007-08. Last month in its bulletin, the RBI had mentioned that during the GFC, forex reserves plunged by around $70 billion.

In their analysis, RBI economists had estimated that by the end of July, India’s forex reserves had depleted by $56 billion, but mentioned that out of this, $20 billion was swap sale — which essentially means that this will return to the RBI. Hence, at present, the real plunge could be a little over $63 billion, if the sell-swaps are excluded.

Steepest depletion in a decade

This depletion, compared to the past 10 years, is likely the steepest India has ever witnessed. There have been instances of India’s forex reserves depleting by the end of the calendar year — 2011 ($0.6 billion), 2012 ($1.7 billion), 2013 ($1.8 billion) and 2018 ($13.28 billion) — but they were marginal in terms of size.

In the remaining years, India had been reporting a rise in its forex reserves, with 2020 — the year the Covid-19 pandemic hit the world — being the most gainful year. That year India’s foreign currency assets rose by about $119 billion (to $580 billion by 2020-end from $461 billion by end of 2019). By the end of 2021, it grew by $52 billion to settle at $633 billion. On 3 September last year, India had seen its forex touch a record high of $642.45 billion.

Also Read: Rupee’s fall to 80/dollar will impact twin deficits. But here’s why you shouldn’t panic

Why has this happened?

The depletion in foreign currency means that the RBI has been selling dollars to tackle the falling value of the rupee, which in July reached an all-time low of Rs 80 per dollar.

One of the biggest reasons why this has happened is that the US Federal Reserve, America’s central bank, increased the key interest rates to check record high inflation rates. This year, the US Fed has increased the lending rate on four occasions so far — to 2.25-2.5 per cent in August from 0.25-0.5 per cent in March.

Through the hikes in lending rate, the US Fed looks to contract the purchasing power of the people using dollars as the currency. Resultantly, foreign portfolio investors in India have withdrawn more than $39 billion in the past one year, according to an analysis by the Economic Times.

A study conducted by Saurabh Nath, Vikram Rajput and Goplakrishnan S. of the RBI’s Financial Markets Operations Department, showed that during the GFC of 2008, India’s forex depletion had gone down by $70 billion. By the time their research was published (12 August), India’s forex reserves had already gone down by $56 billion.

The crux of the study, however, was that the currency volatility expectations from the rupee — compared to previous economic shocks — had come down. Currency volatility is a measure of the frequency and extent of changes in the value of currency of one country vis-à-vis another country’s currency.

The authors ascribed that during the 2008 crisis, the decline in forex was more than 22 per cent of India’s total forex reserves, which is just 6 per cent this time, simply because the country holds a lot more dollars now than it did 14 years ago ($282 billion). “The Reserve Bank has been able to achieve its intervention objectives with progressively lesser percentage drawdown in foreign exchange reserves,” the authors wrote.

Economist Radhika Pandey, a consultant at the National Institute of Public Finance and Policy (NIPFP), also believes that the situation is not too bad right now.

“Given the volatile global backdrop, capital flows would swing between inflows and outflows. As of now, the fall in reserves is not alarming. Reserves adequacy ratio remains comfortable. We are much better placed than the taper tantrum episode of 2014. But at the same time if the dollar continues to remain strong, the RBI would have to allow the rupee to slide,” she said.

(Edited by Tony Rai)

Also Read: Why RBI’s hoarding of forex reserves over currency concerns will be counter-productive