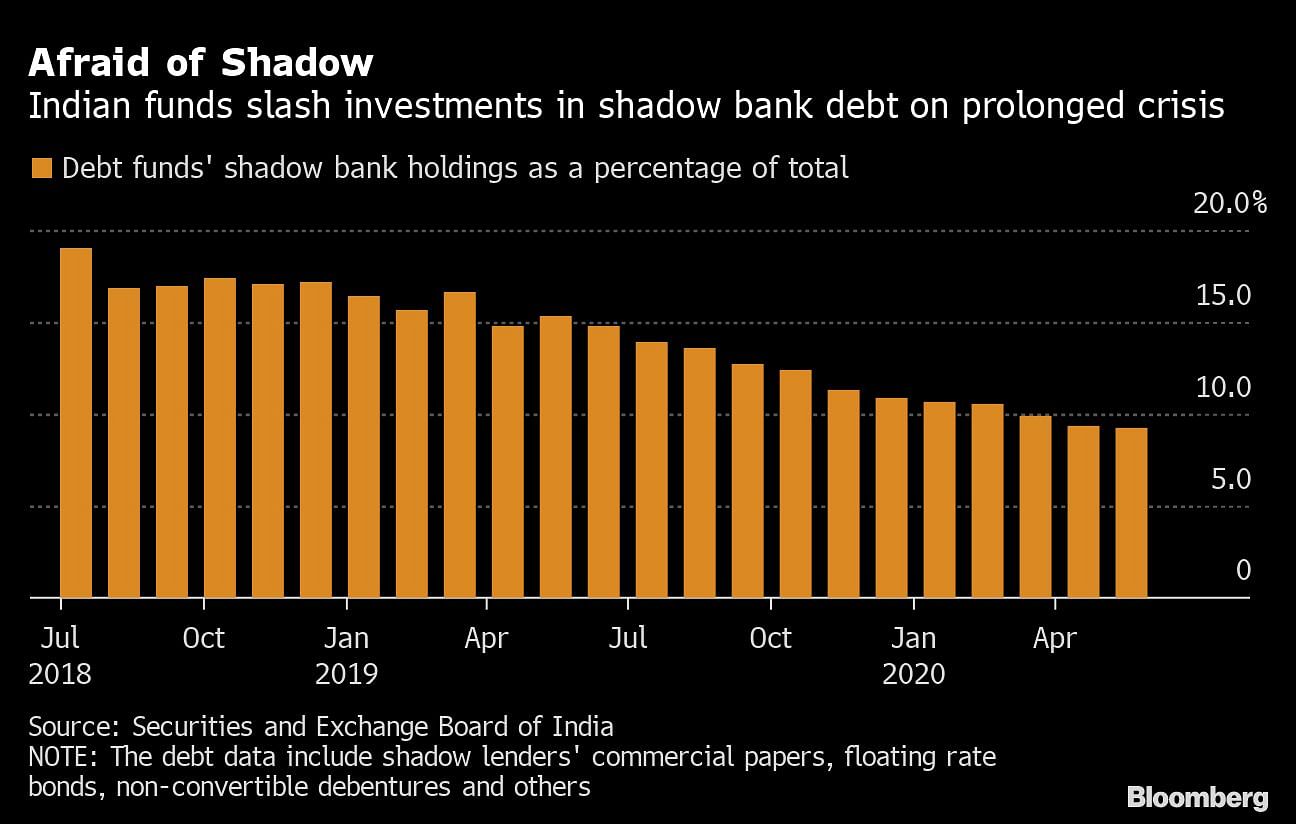

Mumbai: Indian mutual funds have halved their holdings of debt sold by shadow lenders in the two-year period to June after defaults by some major financiers, data from the Securities and Exchange Board of India show. Shadow banks are important lenders to smaller businesses, and policymakers have rolled out measures to support the financiers in recent months, helping to bring down their borrowing costs. It remains to be seen, however, if those initiatives will be enough, with asset managers wary of their bonds and the pandemic threatening to increase their bad debt loads. – Bloomberg

Also read: SEBI and Franklin Templeton fight over investment rules after funds collapse