Mumbai: India’s biggest mortgage lender agreed to buy one of the country’s most valuable banks to create an almost $190-billion behemoth to ride a boom in home loans and consumer spending in the world’s fastest-growing major economy.

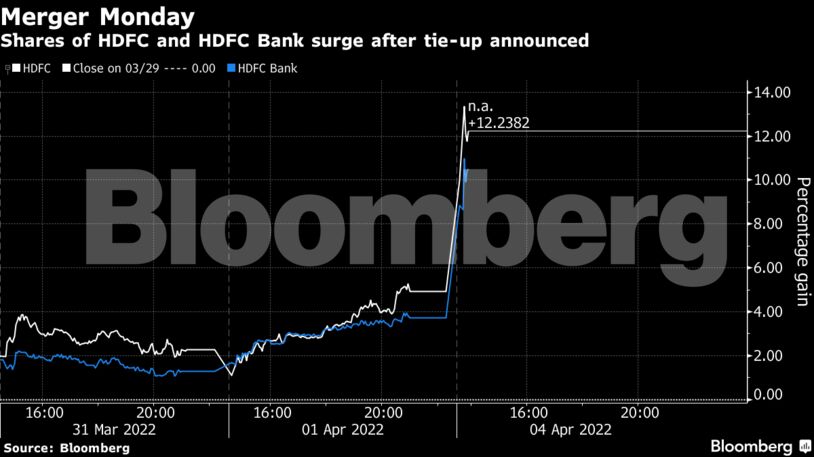

Housing Development Finance Corp., which issues mortgages to more than half the home buyers in a country of 1.4 billion people, will hold 41% of HDFC Bank Ltd., a bank it helped found 28 years ago. Shares of the two Mumbai-based companies surged on the announcement, among one of the biggest M&A deals this year.

The transaction, which will create one of India’s largest financial services entities, follows a proposal by the banking regulator for large non-banking finance companies to convert into banks to avoid a repetition of the nation’s massive shadow lending crisis in 2018. India’s emergence from the pandemic and an improvement in the labor market has helped boost consumer demand and improve lenders’ retail portfolios.

“We think the proposed merger may reduce HDFC Bank’s exposure to unsecured loans and bolster its capital base, further supporting its sector-leading asset quality and capital position which are key credit strengths among the banking peers,” said Bloomberg Intelligence analyst Rena Kwok. Despte HDFC Bank’s low unsecured loans exposure, it had been growing its credit cards and personal loans aggressively to improve interest margins, she said.

Shares in HDFC soared as much as 20% after the announcement, while HDFC Bank jumped 14% in Mumbai. HDFC has 6.23 trillion rupees ($82.3 billion) in assets and a $66 billion market capitalization as of Monday. The bank has 19.38 trillion rupees in assets and a market cap of about $120 billion.

‘Right decision’

“Fundamentally it’s a right decision,” said Amit Kumar Gupta, a New Delhi based fund manager with Adroit Financial Services Pvt. Ltd. “Foreign institutional investors were not able to buy into HDFC Bank because of the 74% limit. So this is a way to allow more FIIs come into the HDFC Bank.”

Once the deal is complete, HDFC Bank will be 100% owned by public shareholders and HDFC shareholder will get 42 shares of HDFC Bank for 25 shares held.

Once the deal is complete, HDFC Bank will be 100% owned by public shareholders and HDFC shareholder will get 42 shares of HDFC Bank for 25 shares held.

“I think it’s a good thing for the Indian banking system” for a large non-banking finance firm to merge with a big bank, Duvvuri Subbarao, former governor of the Reserve Bank of India, said on Bloomberg TV on Monday. “India wants to upsize its banks to a global scale and it will be a good thing for Indian banking, especially private sector banks.” –Bloomberg

Also read: HDFC Bank surges 3.25 per cent after RBI lifts restrictions from the bank’s new digital launches