New Delhi: The Narendra Modi government is confident of garnering over Rs 1 lakh crore from the listing of Life Insurance Corporation of India (LIC) in the current fiscal, and feels it is on course to achieve its disinvestment target for the year, ThePrint has learnt.

The Government of India will dilute 10 per cent stake in the country’s largest life insurance company as part of the listing process, a senior Ministry of Finance official told ThePrint, adding that it is gearing up for the “largest listing of a state owned entity”.

The Modi government has budgeted to collect Rs 1.75 lakh crore from disinvestment proceeds this year and a successful listing of LIC will contribute to meeting more than half of the target.

LIC’s total valuation is expected to exceed Rs 10 lakh crore, far exceeding the market capitalisation of many of the government’s state-owned firms.

For instance, the market capitalisation of the largest state-owned firm, Oil and Natural Gas Corporation (ONGC), is Rs 1.45 lakh crore. Among state-owned financial institutions, the country’s largest bank, the State Bank of India, has a market capitalisation of around Rs 3.83 lakh crore. The market capitalisation of all other state-owned banks is less than Rs 1 lakh crore.

The government’s intent to list LIC was first mentioned in the 2020-21 budget speech of Finance Minister Nirmala Sitharaman. However, the pandemic slowed down the process, delaying the listing to the end of the current fiscal.

Also read: BPCL privatisation process slows down due to pandemic, focus on LIC IPO

Prep for LIC listing

The government has taken the initial preparatory steps for LIC’s listing. It has made amendments to the LIC Act through Finance Act 2021 to facilitate higher share of profits to shareholders in line with the practice followed by other insurance companies.

The amendments also allow the government to bring down its stake in the life insurer to 51 per cent, but this is only an enabling provision.

To be sure, the government will have to bring down its stake in the insurer to 75 per cent in the next couple of years to adhere to the capital markets regulator’s minimum shareholding provisions.

The process of determining the valuation of the insurance company is also going on.

Insurance company valuations are based on the embedded value or the present value of future profits to shareholders. This is because life insurance policies are issued over a long duration of around 20-25 years necessitating the need to determine the future value over the entire duration of the policy.

Milliman Advisors LLP India was appointed in December last year for determining the embedded value of LIC.

Earlier this month, LIC’s IPO received the cabinet nod. The government also floated a request for proposal to appoint book running lead managers, legal advisors, among others to prepare for the IPO.

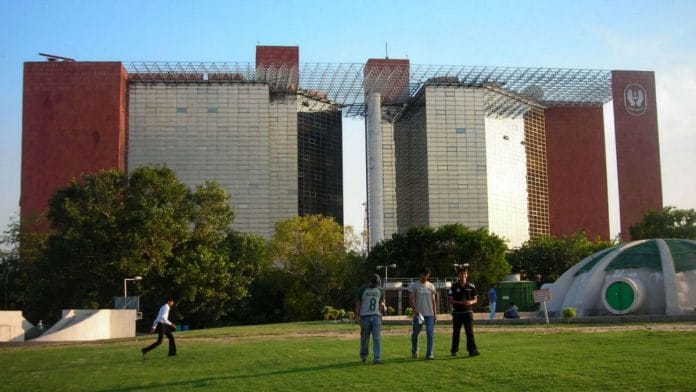

LIC, one of India’s oldest insurance companies and the only state-owned life insurer, has a 68 per cent market share. The corporation was set up in 1956 and its assets are around Rs 32 lakh crore as of 2020-21.

Becoming a publicly traded company will mean the insurance company will have to increase the level of its disclosures in line with the requirements for a listed company.

The other two state-owned insurance firms that are listed on the stock exchanges are in the general insurance space.

Also read: Govt confident of privatising Air India, BPCL by first half of 2021-22 — divestment secretary